Feeling lost in a sea of interview questions? Landed that dream interview for Personal Banking Representative but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Personal Banking Representative interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

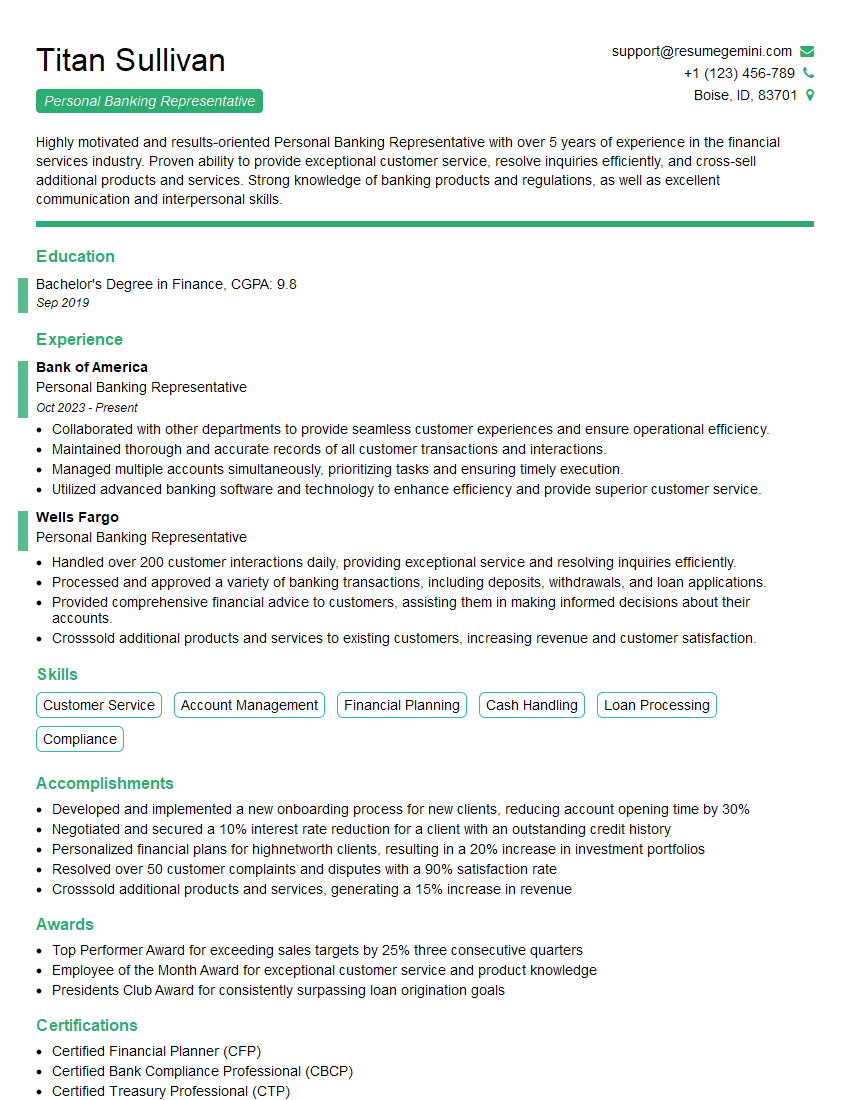

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Personal Banking Representative

1. Describe the key responsibilities of a Personal Banking Representative.

As a Personal Banking Representative, I would be responsible for providing exceptional customer service, assisting clients with their financial needs, and building strong relationships with them. My key responsibilities would include:

- Greeting and welcoming customers

- Opening and managing accounts

- Processing transactions

- Providing financial advice and guidance

- Resolving customer queries and complaints

- Cross-selling and up-selling products

- Meeting sales targets

2. What is your understanding of the financial products and services that you would be offering to clients?

I have a comprehensive understanding of the financial products and services typically offered by Personal Banking Representatives, including:

- Checking and savings accounts

- Credit cards

- Loans (personal, auto, mortgage)

- Investments (mutual funds, stocks, bonds)

- Insurance (life, health, disability)

- Retirement planning

3. How do you plan to build rapport and trust with customers?

Building rapport and trust is crucial in my role as a Personal Banking Representative. I would employ the following strategies:

- Active listening and empathy

- Understanding customers’ financial needs and goals

- Providing tailored and personalized advice

- Being honest and transparent

- Following up and staying in touch

- Going the extra mile

4. How do you stay up-to-date with industry trends and regulations?

To stay up-to-date with industry trends and regulations, I would:

- Attend industry conferences and workshops

- Read industry publications and blogs

- Take online courses and certifications

- Network with other professionals

- Follow regulatory updates

5. How do you handle difficult customers?

Dealing with difficult customers is part of the job. I would approach such situations with:

- Patience and empathy

- Active listening and understanding their concerns

- Remaining calm and professional

- Offering solutions and alternatives

- Escalating the issue to a supervisor if necessary

6. How do you prioritize tasks and manage your time effectively?

With a high volume of tasks, I would prioritize and manage my time effectively using:

- To-do lists and task management tools

- Setting priorities and delegating tasks

- Time blocking and scheduling appointments

- Seeking assistance from colleagues

- Continuously evaluating and adjusting my workflow

7. What is your knowledge of financial regulations, and how do you ensure compliance?

I have a strong knowledge of financial regulations and am committed to ensuring compliance. I would:

- Stay up-to-date with regulatory changes

- Receive regular compliance training

- Follow established policies and procedures

- Report any suspicious transactions or activities

- Maintain accurate and complete records

8. How would you approach a customer who is dissatisfied with a product or service?

In such situations, I would:

- Acknowledge their dissatisfaction and apologize for any inconvenience

- Actively listen and understand their concerns

- Offer solutions or alternatives to resolve the issue

- Follow up to ensure their satisfaction

- Document the interaction and any actions taken

9. What strategies do you use to cross-sell and up-sell products and services?

To generate additional revenue, I would use the following strategies:

- Identify customer needs and recommend suitable products

- Provide value-added services and bundle products

- Offer incentives and promotions

- Build strong relationships and trust

- Stay informed about new products and services

10. How do you evaluate your performance and identify areas for improvement?

Regular self-evaluation is crucial. I would:

- Track my sales and customer satisfaction metrics

- Receive feedback from customers and colleagues

- Review industry benchmarks and best practices

- Set personal development goals

- Continuously seek opportunities for growth

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Personal Banking Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Personal Banking Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Personal Banking Representatives are the backbone of banks. They are responsible for meeting with customers, opening accounts, answering questions, and providing financial advice. They also handle transactions such as deposits, withdrawals, and transfers.

1. Provide excellent customer service

Personal Banking Representatives must be friendly, helpful, and knowledgeable. They must be able to build relationships with customers and make them feel comfortable doing business with the bank. They must also be able to resolve customer issues quickly and efficiently.

2. Open accounts and process transactions

Personal Banking Representatives are responsible for opening new accounts, such as checking, savings, and money market accounts. They must also be able to process transactions such as deposits, withdrawals, and transfers. They must be accurate and efficient in their work.

3. Answer customer questions and provide financial advice

Personal Banking Representatives must be able to answer customer questions about banking products and services. They must also be able to provide financial advice to customers, such as how to budget their money or save for retirement.

4. Sell bank products and services

Personal Banking Representatives are also responsible for selling bank products and services, such as loans, credit cards, and insurance. They must be able to explain the benefits of these products and persuade customers to purchase them.

Interview Tips

Interviewing for a Personal Banking Representative position can be competitive. To increase your chances of success, follow these tips:

1. Do your research

Before your interview, take some time to learn about the bank you are interviewing with. Visit their website, read their annual report, and check out their social media pages. This will help you understand the bank’s culture and values, and it will make you more knowledgeable about the position you are applying for.

2. Practice your answers to common interview questions

There are some common interview questions that you are likely to be asked, such as “Why do you want to work for our bank?” and “What are your strengths and weaknesses?” Take some time to practice your answers to these questions so that you can deliver them confidently and clearly.

3. Dress professionally

First impressions matter, so make sure you dress professionally for your interview. This means wearing a suit or business casual attire. You should also be well-groomed and have a neat and clean appearance.

4. Be on time

Punctuality is important, so make sure you arrive for your interview on time. If you are running late, call the interviewer to let them know.

5. Be yourself

The most important thing is to be yourself during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Be honest and authentic, and let your personality shine through.

Next Step:

Now that you’re armed with the knowledge of Personal Banking Representative interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Personal Banking Representative positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini