Feeling lost in a sea of interview questions? Landed that dream interview for Securities Teller but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Securities Teller interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

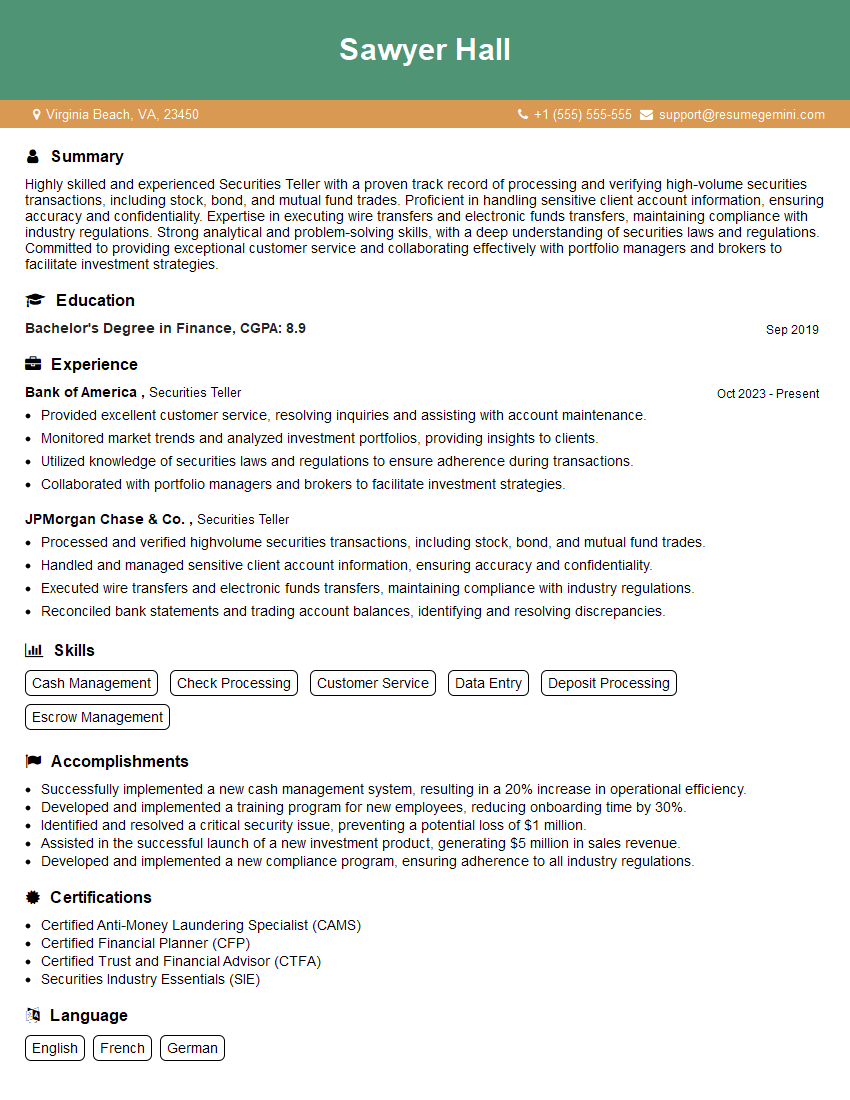

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Securities Teller

1. What are the different types of securities that you have handled in your previous role?

I have handled a wide range of securities in my previous role as a Securities Teller, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). I am also familiar with the different types of orders that can be placed for these securities, such as market orders, limit orders, and stop orders.

2. How do you process a customer’s request to buy or sell securities?

Step 1: Verify the customer’s identity and account information

- I will ask the customer to provide their identification, such as a driver’s license or passport.

- I will also verify the customer’s account information, such as their account number and account balance.

Step 2: Obtain the customer’s trade instructions

- I will ask the customer what type of security they would like to buy or sell.

- I will also ask the customer how many shares or bonds they would like to buy or sell.

- I will ask the customer what price they would like to buy or sell the security at.

Step 3: Place the trade order

- I will enter the customer’s trade instructions into the trading system.

- The trading system will then send the order to the appropriate exchange or market.

Step 4: Confirm the trade with the customer

- Once the trade has been executed, I will confirm the details of the trade with the customer.

- I will provide the customer with a trade confirmation statement.

3. What are the different types of documentation that you are required to maintain as a Securities Teller?

- Customer account records

- Trade confirmation statements

- Daily trade blotter

- Monthly account statements

- Quarterly and annual reports

4. What are the different types of fraud that you are aware of that can occur in the securities industry?

- Identity theft

- Account hacking

- Unauthorized trading

- Ponzi schemes

- Insider trading

5. What are the different types of laws and regulations that govern the securities industry?

- The Securities Act of 1933

- The Securities Exchange Act of 1934

- The Investment Company Act of 1940

- The Investment Advisers Act of 1940

- The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010

6. What are the different types of professional development opportunities that you have taken advantage of in your career?

- I have attended industry conferences and seminars.

- I have read books and articles about the securities industry.

- I have taken online courses and webinars.

- I have shadowed more experienced Securities Tellers.

7. What are your career goals for the next 5 years?

- I would like to become a Senior Securities Teller.

- I would like to learn more about the different areas of the securities industry.

- I would like to eventually become a Branch Manager.

8. What are your strengths as a Securities Teller?

- I am accurate and efficient in my work.

- I am able to learn new things quickly.

- I am able to work independently and as part of a team.

- I am able to handle stress and pressure.

9. What are your weaknesses as a Securities Teller?

- I am sometimes too detail-oriented.

- I can be a bit of a perfectionist.

- I am not always the best at delegating tasks.

10. Is there anything else that you would like to add?

- I am excited about the opportunity to work as a Securities Teller at your company.

- I believe that my skills and experience would be a valuable asset to your team.

- I am confident that I can be successful in this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Securities Teller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Securities Teller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Securities Tellers play a crucial role in the financial industry, handling various transactions involving securities.

1. Process Security Transfers

They execute secure transfers of stocks, bonds, and other financial instruments between customers’ accounts.

- Verify transfer requests, ensuring accuracy of details.

- Update account balances and maintain accurate records.

2. Facilitate Securities Payments

Tellers handle financial transactions related to securities, including dividend payments, interest payments, and redemptions.

- Calculate and process payments accurately and timely.

- Communicate with customers regarding payment arrangements.

3. Customer Service and Sales

Securities Tellers provide excellent customer service, resolving queries and assisting with specific requests.

- Respond to customer inquiries promptly and effectively.

- Cross-sell and promote securities-related products.

4. Compliance and Security

Tellers ensure compliance with regulations and maintain strict security measures while handling sensitive financial information.

- Adhere to all KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements.

- Safeguard confidential customer data and protect against fraud.

Interview Tips

Preparing for an interview for a Securities Teller position is crucial. Consider these tips to ace your interview:

1. Research the Company and Position

Thoroughly research the financial institution and the specific role to understand their operations, culture, and expectations.

- Visit the company’s website and social media pages.

- Read industry news and articles to stay informed about current trends.

2. Highlight Relevant Skills and Experience

Emphasize your proficiency in key skills required for the role, such as:

- Securities processing and transfer.

- Financial transaction handling.

- Excellent customer service.

Provide specific examples from your past experiences to demonstrate your abilities.

3. Prepare Questions for the Interviewers

Asking thoughtful questions during the interview shows your engagement and interest in the position.

- Inquire about the company’s growth plans and strategies.

- Ask for details about the training and development opportunities available.

4. Dress Professionally and Act Confidently

First impressions matter. Dress appropriately for a financial institution and maintain a professional demeanor throughout the interview.

- Choose formal or business casual attire.

- Practice maintaining eye contact and speaking clearly.

5. Follow Up Promptly

After the interview, send a thank-you note to the interviewers within 24 hours.

- Express your gratitude for their time and consideration.

- Reiterate your interest in the position and highlight any additional qualifications.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Securities Teller, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Securities Teller positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.