Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Transfer Clerk interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Transfer Clerk so you can tailor your answers to impress potential employers.

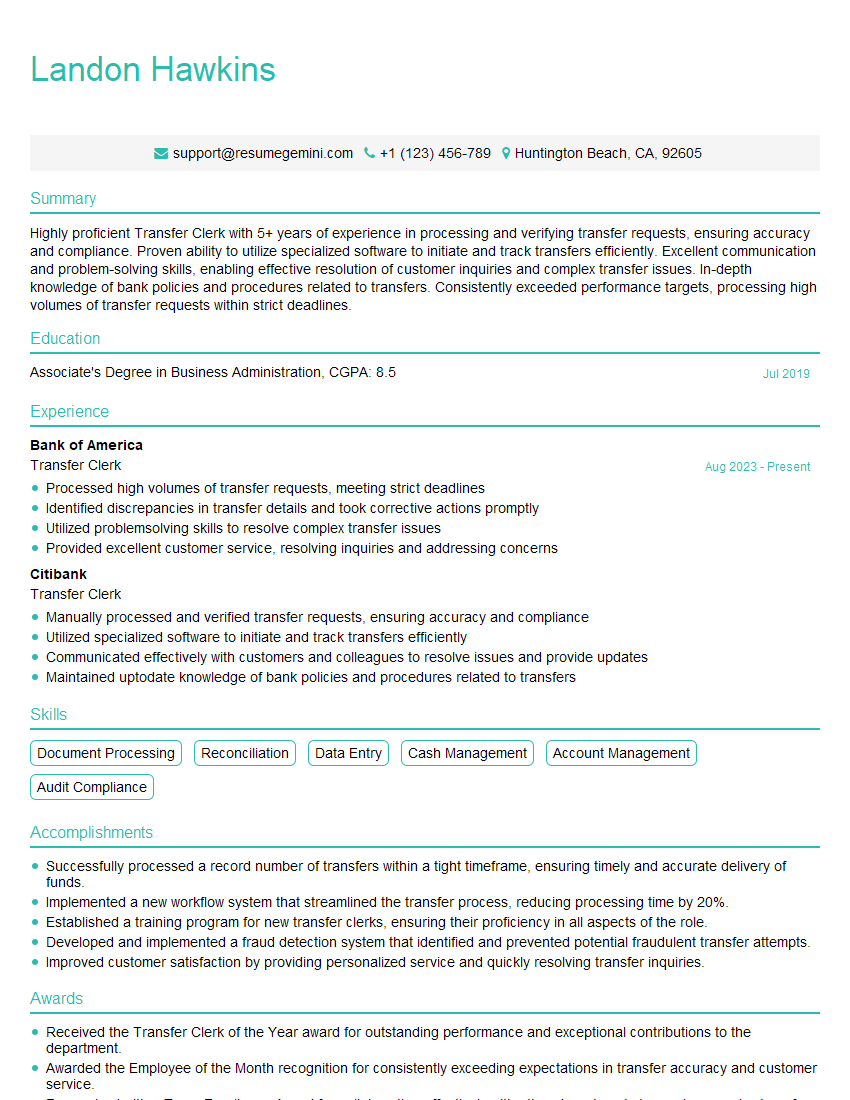

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Transfer Clerk

1. Can you describe the process of transferring funds between accounts?

- Verify the customer’s identity and account information.

- Confirm the amount and destination of the transfer.

- Check the availability of funds in the sender’s account.

- Initiate the transfer through the bank’s system.

- Provide a confirmation to the customer.

2. What are the different types of transfer methods and which one is preferred for international transfers?

Wire Transfer

- Fast and secure.

- Can be used for international and domestic transfers.

- Typically more expensive than other methods.

ACH Transfer

- Electronic transfer through the Automated Clearing House.

- Can take several days to complete.

- Less expensive than wire transfers.

Fedwire

- High-value wire transfer system operated by the Federal Reserve.

- Used for large and time-sensitive international transfers.

- More expensive than other methods.

3. Can you explain the difference between a demand and time draft?

- Demand draft: A sight draft that requires immediate payment upon presentation to the drawee bank.

- Time draft: A draft that specifies a future date on which payment is due.

4. What are the key features of a negotiable instrument?

- Transferable to a third party.

- Unconditional promise to pay a specific sum of money.

- Signed by the maker or drawer.

- Dated and payable on demand or at a fixed future date.

5. Can you describe the process of stop payment on a check?

- Contact the bank immediately.

- Provide the bank with the check number, amount, and date.

- Sign a stop payment order.

- The bank will place a stop on the check and prevent its payment.

6. What are the various types of bank accounts and their key features?

- Checking account: For everyday transactions and withdrawals.

- Savings account: For saving money and earning interest.

- Money market account: Offers higher interest rates and limited access.

- Certificate of deposit (CD): Fixed-term deposit with a higher interest rate.

- Investment account: For investing in stocks, bonds, and mutual funds.

7. How do you handle cash shortages or overages in your daily transactions?

- Immediately report the discrepancy.

- Recount the cash carefully.

- Review transactions and identify potential errors.

- Complete a cash reconciliation form.

- Take corrective action (e.g., adjust records, file a claim).

8. What are the common errors to look for when processing transfer requests?

- Incorrect account numbers.

- Invalid routing numbers.

- Insufficient funds.

- Frozen accounts.

- Signature mismatches.

9. Can you explain the process of reconciling a bank statement?

- Compare the bank statement to the bank account records.

- Identify any discrepancies.

- Investigate the discrepancies and make adjustments as needed.

- Ensure that the bank account balance matches the bank statement balance.

10. What are your strengths and weaknesses as a transfer clerk?

Strengths:

- Excellent attention to detail.

- Proficient in bank procedures and regulations.

- Strong work ethic and commitment to accuracy.

- Ability to handle multiple transactions simultaneously.

Weaknesses:

- Can get overwhelmed during peak times.

- Not always comfortable with handling large cash amounts.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Transfer Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Transfer Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Transfer Clerks have a wide range of responsibilities in a financial institution. Their primary duty is to facilitate secure and accurate transfers of funds between accounts. Let’s explore the key responsibilities of a Transfer Clerk:

1. Fund Transfer Processing

Transfer Clerks are responsible for initiating and processing fund transfers. They verify the source and destination accounts, ensure the accuracy of transfer details, and process the transfers as per the instructions.

2. Verification and Validation

Before processing transfers, Transfer Clerks carefully verify the identities of customers, authenticate signatures, and confirm the legitimacy of transfer requests. They adhere to strict security protocols to prevent fraud and unauthorized transactions.

3. Customer Service and Support

Transfer Clerks serve as the first point of contact for customers who have questions or need assistance with fund transfers. They provide clear and concise information, resolving customer inquiries promptly and efficiently.

4. Account Maintenance

Transfer Clerks maintain accurate and up-to-date account records. They monitor account balances, track transactions, and prepare reports to ensure the integrity of account information.

Interview Tips

To ace the interview for a Transfer Clerk position, candidates should prepare thoroughly and showcase their knowledge and skills. Here’s a comprehensive guide to help candidates stand out during the interview:

1. Research and Practice

Research the specific financial institution and the role of Transfer Clerk. Practice answering common interview questions related to the responsibilities, procedures, and policies of a Transfer Clerk.

2. Highlight Skills and Experience

Emphasize your skills in document verification, attention to detail, and accuracy. Showcase your ability to work under time pressure while maintaining high levels of accuracy.

3. Prepare Examples

Provide specific examples of situations where you demonstrated your abilities in fund transfer processing, customer service, and problem-solving.

4. Demonstrate Industry Knowledge

Show your understanding of banking regulations and best practices related to fund transfers. Mention any certifications or training you have completed to enhance your knowledge.

5. Be Prepared for Technical Questions

Transfer Clerks often use specialized software and systems. Be prepared to answer questions about your experience with these tools and your ability to learn new technologies.

6. Ask Insightful Questions

Asking thoughtful and relevant questions shows your engagement and interest in the position. This also gives you an opportunity to gather more information about the role and the company.

7. Prepare a Strong Closing Statement

Summarize your key strengths, express your enthusiasm for the role, and reiterate how you can contribute to the team. Thank the interviewer for their time and consideration.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Transfer Clerk, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Transfer Clerk positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.