Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Compliance Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

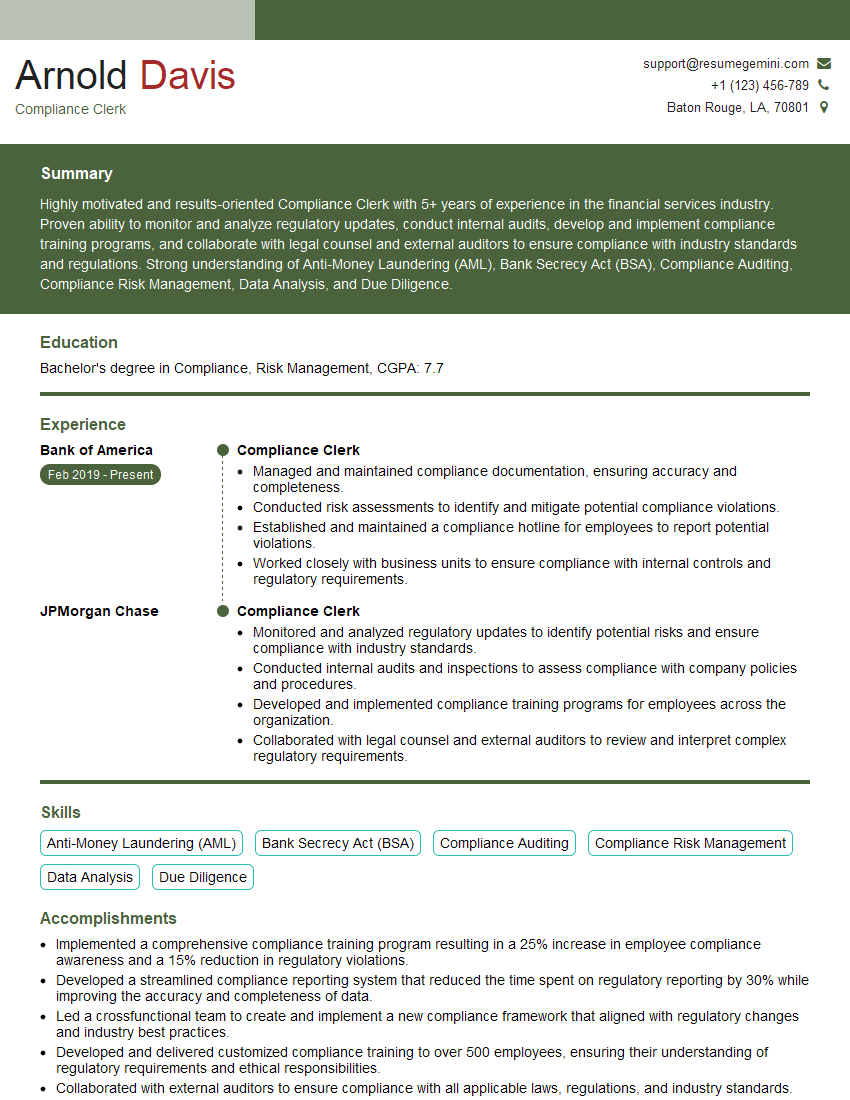

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Compliance Clerk

1. Explain the key responsibilities of a Compliance Clerk?

- Monitoring and tracking compliance with internal policies and external regulations.

- Maintaining detailed records of all compliance activities.

- Providing guidance and training to employees on compliance matters.

- Conducting internal audits and investigations to identify potential compliance risks.

- Reporting and escalating compliance issues to management and relevant authorities.

2. What are the essential skills and qualifications required to excel as a Compliance Clerk?

Technical Skills

- Strong understanding of compliance regulations and laws.

- Proficiency in data management and analysis.

- Excellent communication and interpersonal skills.

- Ability to work independently and as part of a team.

- Attention to detail and accuracy.

Qualifications

- Bachelor’s degree in a related field (e.g., business, finance, legal studies).

- Relevant certifications (e.g., Certified Compliance and Ethics Professional).

- Experience in compliance or related roles.

3. Describe the process you would follow when conducting an internal compliance audit?

- Plan the audit, including scope, objectives, and methodology.

- Review relevant policies, procedures, and documents.

- Conduct interviews with key stakeholders.

- Test controls and processes.

- Document findings and make recommendations.

- Report audit results to management and relevant authorities.

4. Explain the role of technology in compliance management?

- Streamlining data collection and analysis.

- Automating compliance tasks and workflows.

- Improving communication and collaboration among compliance teams.

- Providing real-time visibility into compliance risks and issues.

- Enhancing regulatory reporting and compliance monitoring.

5. What are some common compliance risks faced by organizations today?

- Data breaches and cybersecurity threats.

- Financial fraud and embezzlement.

- Anti-money laundering and terrorist financing.

- Environmental, health, and safety violations.

- Violations of employment laws and regulations.

6. How would you stay up-to-date on regulatory changes and industry best practices in compliance?

- Attending industry conferences and webinars.

- Subscribing to compliance publications and newsletters.

- Participating in professional development programs.

- Networking with other compliance professionals.

- Leveraging online resources and databases.

7. What are the ethical considerations involved in compliance management?

- Maintaining confidentiality and protecting sensitive information.

- Objectivity and impartiality in decision-making.

- Avoiding conflicts of interest.

- Promoting ethical behavior and culture within the organization.

- Balancing compliance requirements with business objectives.

8. How would you handle a situation where an employee violates a compliance policy?

- Document the violation and gather evidence.

- Interview the employee involved.

- Determine the root cause of the violation.

- Take appropriate disciplinary action, as per company policies.

- Implement measures to prevent similar violations in the future.

9. What is your understanding of the Sarbanes-Oxley Act?

- Description of the act and its key provisions.

- Impact on corporate governance and financial reporting.

- Role of the Compliance Clerk in ensuring compliance with Sarbanes-Oxley.

10. How do you maintain a strong working relationship with the Compliance Officer?

- Regular communication and updates.

- Proactive identification and escalation of compliance issues.

- Support and assistance with compliance initiatives.

- Open and honest dialogue on compliance matters.

- Respect for roles and responsibilities.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Compliance Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Compliance Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Compliance Clerks are responsible for creating and maintaining company-wide compliance programs, ensuring that businesses operate in accordance with applicable laws, regulations, and ethical standards. This role requires a deep understanding of compliance regulations, strong attention to detail, and exceptional communication skills.

1. Compliance Monitoring and Reporting

A Compliance Clerk is responsible for monitoring and assessing compliance with all applicable laws, regulations, and industry standards.

- Receive and review compliance-related documents and reports, and analyze for adherence to regulations.

- Conduct internal audits and inspections to ensure compliance with policies and procedures.

- Investigate and analyze compliance incidents, identify root causes, and recommend corrective actions.

- Prepare reports on compliance status and identify areas of potential risk or non-compliance.

2. Policy and Procedure Development

Creating and maintaining compliance policies and procedures is a key responsibility of a Compliance Clerk.

- Develop and implement company-wide compliance policies and procedures to ensure compliance with laws and regulations.

- Conduct research on industry best practices and emerging compliance issues.

- Review and update existing policies and procedures to ensure they are current and effective.

- Provide guidance and training to employees on compliance policies and procedures.

3. Recordkeeping and Documentation

Compliance Clerks are responsible for maintaining accurate and complete records of all compliance-related activities.

- Maintain records of compliance audits, investigations, training, and reporting.

- Manage compliance documentation, including policies, procedures, and training materials.

- Archive and retrieve compliance records as needed for audits or investigations.

- Develop and maintain a system for tracking and managing compliance-related correspondence.

4. Communication and Outreach

Effective communication is essential for Compliance Clerks, who must keep employees, management, and external stakeholders informed about compliance matters.

- Communicate compliance requirements and expectations to employees, contractors, and vendors.

- Conduct training and educational programs on compliance topics.

- Respond to inquiries and complaints regarding compliance matters.

- Represent the company in compliance-related meetings and presentations.

Interview Tips

Preparing for a Compliance Clerk interview requires thorough research and practice. Here are some tips to help candidates ace the interview:

1. Research the Company and Industry

Demonstrating knowledge of the company and the industry shows that you are genuinely interested in the position. Research the company’s website, read industry news, and identify any recent compliance issues or initiatives. This knowledge will help you understand the company’s compliance culture and the challenges you may face in the role.

- Review the company’s website to understand their mission, values, and compliance history.

- Read industry publications and news articles to stay up-to-date on compliance trends.

- Check the company’s social media pages to see how they engage with stakeholders on compliance issues.

2. Practice Your Communication Skills

Compliance Clerks must be able to communicate effectively with a wide range of stakeholders. Practice answering common interview questions and explaining complex compliance concepts in a clear and concise manner. You should also be able to demonstrate your active listening skills and ability to build rapport with others.

- Prepare for questions such as: “How would you explain a complex compliance regulation to a non-technical audience?”

- Record yourself answering interview questions and review your delivery, tone, and body language.

- Practice active listening by summarizing the interviewer’s questions and responding with relevant information.

3. Highlight Your Knowledge of Compliance Regulations

Interviewers will want to know that you have a deep understanding of compliance regulations and best practices. Familiarize yourself with industry-specific compliance requirements and demonstrate your ability to apply them to real-world scenarios. You should also be aware of any recent compliance cases or enforcement actions that may impact the company.

- Review relevant compliance regulations and standards, such as the Sarbanes-Oxley Act, HIPAA, and GDPR.

- Discuss your experience in managing compliance risks and implementing compliance programs.

- Be prepared to answer questions about how you would handle specific compliance challenges.

4. Emphasize Your Organizational and Analytical Skills

Compliance Clerks must be organized and detail-oriented to manage multiple compliance projects effectively. Highlight your ability to prioritize tasks, manage deadlines, and track compliance-related data. You should also be able to analyze compliance information, identify trends, and make recommendations based on your findings.

- Provide examples of how you have implemented and managed compliance programs in previous roles.

- Explain how you use technology and data analysis to improve compliance processes.

- Discuss your experience in identifying and mitigating compliance risks.

5. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview demonstrates your interest in the position and the company. Prepare questions that show you have done your research and that you are eager to learn more about the role and the team. Avoid asking generic questions that can be easily found on the company website.

- Ask about the company’s compliance culture and how the role contributes to it.

- Inquire about the company’s plans for compliance training and development.

- Ask about opportunities for career growth and advancement within the compliance department.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Compliance Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!