Are you gearing up for an interview for a Investment Officer position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Investment Officer and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

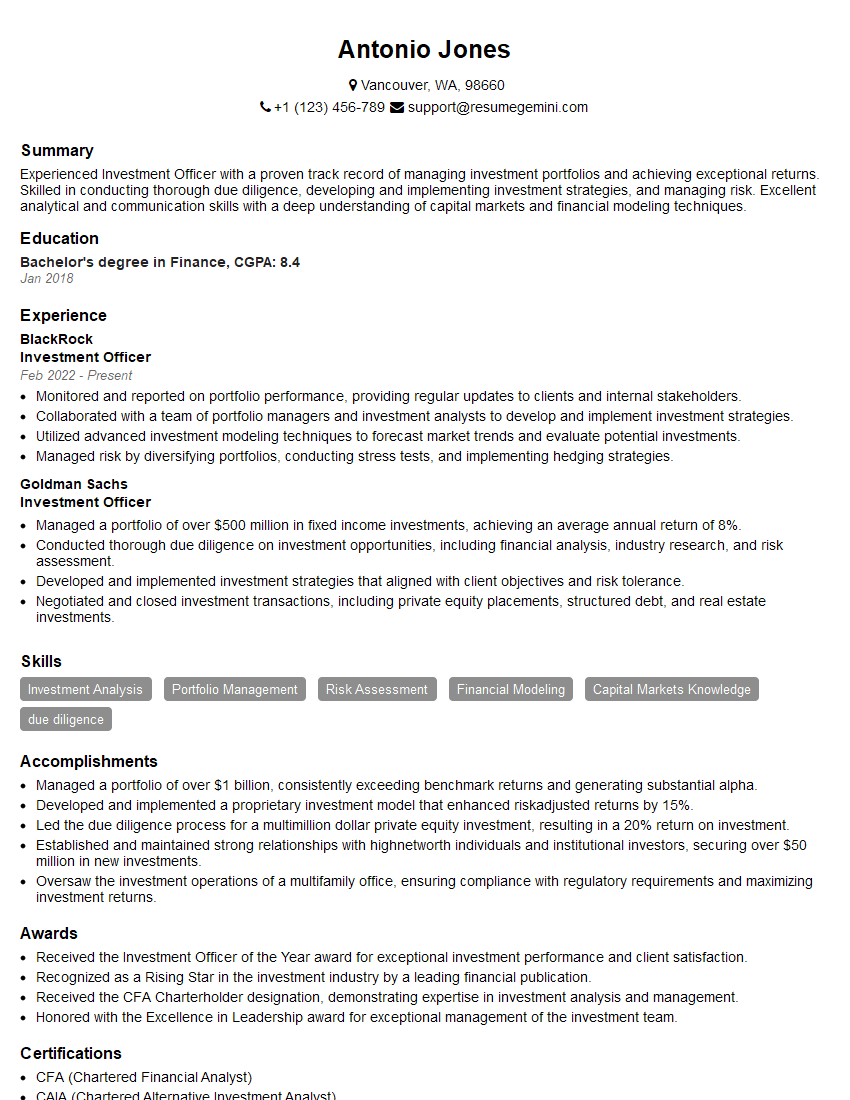

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Investment Officer

1. Walk me through your investment process?

- Sourcing and Screening: Identifying potential investment opportunities through various channels (e.g., industry research, networking, deal flow platforms) and screening them based on pre-defined criteria (e.g., financial performance, growth potential, management team).

- Due Diligence: Conducting thorough analysis of selected opportunities, including financial analysis, market research, and operational assessments, to evaluate their risks and potential returns.

- Investment Structuring: Negotiating and structuring investment agreements that align with the fund’s investment strategy and protect the interests of investors.

- Portfolio Management: Actively managing the investment portfolio, monitoring performance, making adjustments as needed, and providing regular reporting to investors.

- Exit Strategy: Developing and implementing exit strategies to realize gains on investments, such as through trade sales, IPOs, or secondary market transactions.

2. How do you evaluate the performance of your investments?

KPIs and Metrics

- Internal Rate of Return (IRR): Measures the rate of return on an investment over its lifetime.

- Net Asset Value (NAV): Represents the per-share value of the fund’s portfolio.

- Distributions to Investors: Dividends or interest payments made to investors.

Qualitative Factors

- Alignment with Investment Strategy: Assessing whether the investment meets the fund’s objectives and risk tolerance.

- Market Position: Evaluating the investment’s competitive position and industry trends.

- Management Effectiveness: Monitoring the performance and decision-making of the management team.

3. What are the key risk factors you consider when making investment decisions?

- Market Risk: Fluctuations in financial markets that can impact the value of investments.

- Credit Risk: The risk that a borrower may default on a loan or credit obligation.

- Liquidity Risk: The ability to quickly and efficiently convert an investment into cash without significant loss of value.

- Operational Risk: Risks related to the management and operations of the underlying company or asset.

- Regulatory Risk: Changes in laws or regulations that could impact the investment’s performance or viability.

4. Tell me about a time when you had to make a difficult investment decision. What was the process you went through to make that decision?

- Situation: Briefly describe the investment opportunity and the challenges or uncertainties involved.

- Process: Outline the steps taken to gather information, analyze the risks and potential returns, and consult with relevant experts or stakeholders.

- Decision: Explain the rationale behind the decision made, considering both quantitative and qualitative factors.

- Outcome: If applicable, share the results or lessons learned from the decision.

5. How do you stay up-to-date with the latest investment trends and market developments?

- Industry Publications: Reading financial journals, newsletters, and research reports.

- Conferences and Webinars: Attending industry events and listening to expert presentations.

- Networking: Engaging with other investment professionals, fund managers, and industry leaders.

- Continuing Education: Pursuing certifications or taking courses to expand knowledge and skills.

- Market Monitoring: Regularly tracking market news, economic indicators, and company performance.

6. What is your favorite investment strategy and why?

- Explain the strategy: Describe the investment approach, including its underlying principles and target asset classes.

- Benefits and risks: Highlight the potential advantages and disadvantages of the strategy.

- Personal experience: Share examples of successful or challenging investments using this strategy.

7. How do you handle volatility and market downturns in your investment portfolio?

- Risk Management: Describe strategies for managing risk, such as diversification, asset allocation, and stress testing.

- Communication: Explain how you communicate with investors during market fluctuations and periods of uncertainty.

- Investment Adjustments: Discuss potential adjustments or rebalancing strategies to mitigate losses and capitalize on opportunities.

8. What are the ethical considerations you take into account when making investment decisions?

- ESG Factors: Explain how you incorporate environmental, social, and governance (ESG) factors into your investment analysis.

- Conflict of Interest: Describe policies and procedures in place to avoid or manage conflicts of interest.

- Investor Protection: Highlight your commitment to acting in the best interests of investors and ensuring transparency and accountability.

9. Tell me about a time when you had to work effectively with a team to achieve a successful investment outcome.

- Team Dynamics: Describe the roles and responsibilities of team members.

- Communication and Collaboration: Explain how you worked together effectively to share information, make decisions, and coordinate tasks.

- Outcome: Share the specific investment outcome achieved and highlight your contribution to the team’s success.

10. What are your career goals and how do you see this role contributing to them?

- Career Aspirations: State your long-term career goals and describe how they align with the role and responsibilities of this position.

- Skill Development: Explain how the role will provide opportunities to develop your skills and knowledge in specific areas.

- Company Growth: Discuss your interest in contributing to the growth and success of the company and how this role will enable you to do so.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Investment Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Investment Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Investment Officers are financial professionals responsible for managing and growing investment portfolios. They play a crucial role in developing and implementing investment strategies, conducting financial research, and making investment decisions.

1. Investment Research and Analysis

Conduct thorough fundamental and technical analysis of companies, industries, and markets.

- Analyze financial statements, economic data, and industry trends.

- Identify investment opportunities with high growth potential and low risk.

2. Portfolio Management

Develop and implement investment strategies consistent with client goals, risk tolerance, and investment objectives.

- Allocate assets across different classes (e.g., stocks, bonds, real estate).

- Manage risk by diversifying portfolios and hedging positions.

3. Client Relationship Management

Communicate with clients regularly to provide investment updates, performance reports, and financial advice.

- Understand client financial needs, goals, and risk appetite.

- Build long-term relationships based on trust and transparency.

4. Compliance and Reporting

Adhere to all relevant investment regulations and industry best practices.

- Prepare and submit regular reports on portfolio performance and compliance.

- Maintain accurate and up-to-date investment documentation.

Interview Tips

Preparing for an Investment Officer interview requires a combination of technical knowledge, analytical skills, and strong communication abilities. Here are some tips to help you ace your interview:

1. Research the Company and Position

Thoroughly research the company’s investment philosophy, portfolio performance, and industry reputation.

- Review the job description carefully to identify the specific responsibilities and qualifications required.

- Practice answering questions about your understanding of the company and the role.

2. Highlight Your Technical Expertise

Investment Officers need a solid understanding of financial markets, investment strategies, and risk management.

- Demonstrate your proficiency in financial analysis, portfolio optimization, and investment research.

- Use examples from your past experience to showcase your analytical skills and investment decision-making process.

3. Emphasize Communication and Client Management Skills

Investment Officers must be able to effectively communicate investment strategies and performance to clients.

- Discuss your experience in building and maintaining client relationships.

- Provide examples of how you have managed client expectations and resolved investment-related issues.

4. Prepare for Behavioral Questions

Interviewers often ask behavioral questions to assess your problem-solving, teamwork, and decision-making abilities.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Practice answering questions about your experience with market volatility, investment mistakes, and ethical challenges.

5. Be Professional and Confident

Dress professionally, arrive on time, and maintain a positive and confident demeanor throughout the interview.

- Demonstrate your enthusiasm for the investment industry and your desire to learn and grow.

- Be prepared to ask thoughtful questions about the company, the role, and the investment landscape.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Investment Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!