Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Compliance Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

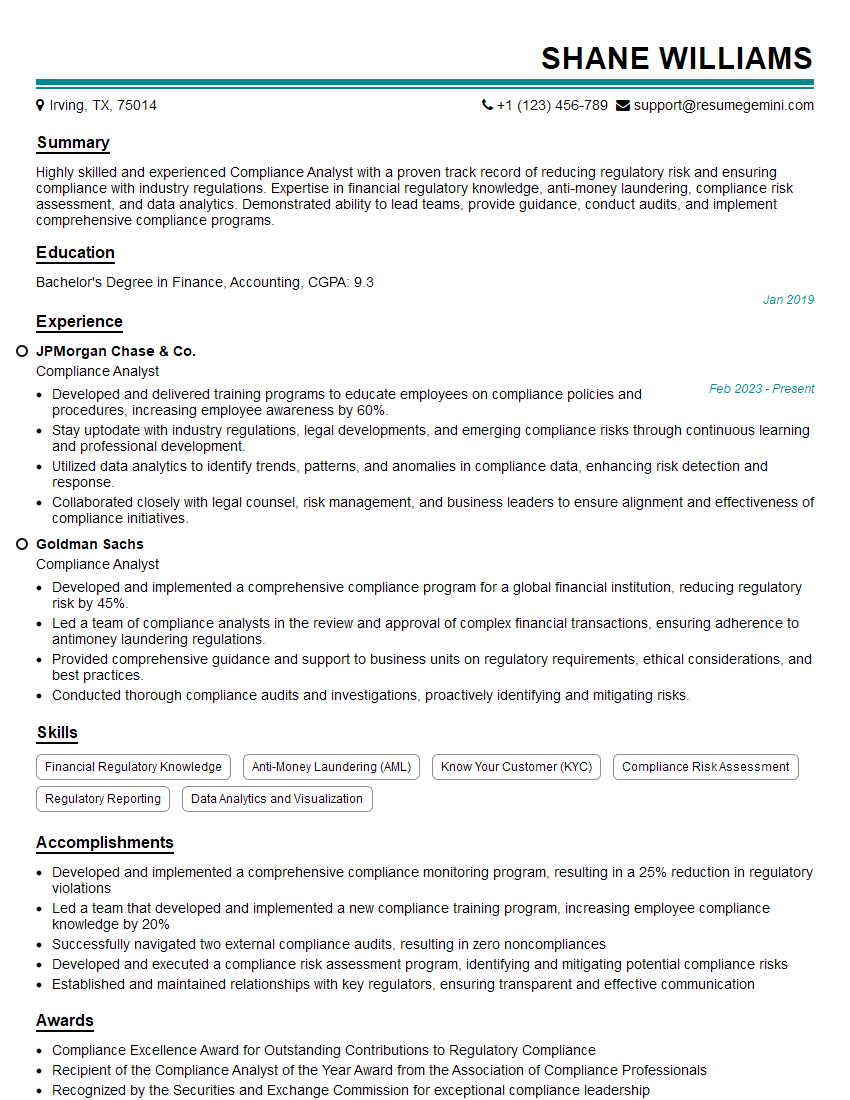

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Compliance Analyst

1. What are the key regulatory frameworks that you are familiar with?

As a Compliance Analyst, I am well-versed in various regulatory frameworks, including:

- Sarbanes-Oxley Act (SOX)

- Dodd-Frank Wall Street Reform and Consumer Protection Act

- Bank Secrecy Act (BSA)

- Anti-Money Laundering (AML) regulations

- Health Insurance Portability and Accountability Act (HIPAA)

- General Data Protection Regulation (GDPR)

2. Describe the risk assessment process involved in compliance monitoring.

Identifying and Evaluating Risks

- Conduct thorough reviews of applicable laws, regulations, and internal policies

- Analyze potential vulnerabilities and impact on business operations

- Prioritize risks based on likelihood and severity

Monitoring and Mitigation

- Establish monitoring systems to track compliance adherence

- Implement controls and procedures to mitigate identified risks

- Regularly review and update risk assessments as regulations and business practices evolve

3. Explain the concept of “materiality” in financial reporting.

Materiality refers to the significance of an omission or misstatement in financial statements that could influence the economic decisions of users. When assessing materiality, I consider:

- Nature of the item and its impact on financial position or results

- Relative size to other financial statement elements

- Qualitative factors such as regulatory requirements or industry standards

4. Describe the role of internal controls in ensuring compliance.

Internal controls are crucial for achieving compliance objectives. Their effectiveness relies on:

- Establishing clear policies and procedures

- Implementing segregation of duties and authorization limits

- Conducting regular audits and reviews

- Enforcing appropriate disciplinary actions for compliance violations

5. Discuss the importance of stakeholder engagement in compliance.

Engaging stakeholders in the compliance process is essential for:

- Raising awareness of compliance requirements

- Obtaining input and feedback on policies and procedures

- Securing buy-in and support for compliance initiatives

- Ensuring that compliance is integrated into daily operations

6. Describe your experience using data analytics to enhance compliance monitoring.

I have utilized data analytics to enhance compliance monitoring through:

- Developing dashboards and reports to track key compliance indicators

- Performing trend analysis and risk identification

- Automating compliance monitoring processes to improve efficiency and accuracy

- Integrating data from multiple sources to gain a comprehensive view of compliance risks

7. Explain the process for investigating and reporting compliance violations.

- Receiving or identifying the allegation

- Conducting a thorough investigation, gathering evidence and interviewing involved parties

- Evaluating the evidence to determine the nature and severity of the violation

- Preparing a detailed report summarizing the investigation findings and recommendations

- Reporting the violation to appropriate authorities, if necessary

8. Discuss the ethical considerations and challenges involved in compliance work.

Compliance work poses ethical challenges, such as:

- Balancing the need for confidentiality with transparency

- Maintaining independence and objectivity

- Dealing with conflicts of interest

To address these challenges, I adhere to ethical principles, including:

- Integrity and honesty

- Confidentiality and privacy

- Objectivity and impartiality

- Respect for the law

9. Describe a time when you had to balance multiple compliance priorities.

In my previous role, I managed a large portfolio of compliance projects with varying deadlines. To prioritize effectively, I:

- Assessed the risks and potential impact of each project

- Consulted with stakeholders and colleagues to gather input

- Developed a comprehensive project plan and timeline

- Regularly monitored progress and adjusted priorities as needed

10. Discuss the latest trends and developments in compliance.

Compliance is constantly evolving, with new regulations and technologies emerging. Recent trends include:

- Increased focus on data privacy and cybersecurity

- Expansion of whistleblower protection laws

- Advancements in artificial intelligence and its impact on compliance

- Growing importance of regulatory technology (RegTech)

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Compliance Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Compliance Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Compliance Analysts ensure organizations adhere to laws, regulations, and company policies. They play a crucial role in mitigating risks and maintaining compliance across various aspects of business operations.

1. Regulatory Monitoring and Analysis

Monitor and analyze regulatory changes and updates.

- Review and interpret laws, regulations, industry standards, and internal policies.

- Identify potential risks and areas of non-compliance.

2. Compliance Risk Management

Assess and manage compliance risks facing the organization.

- Conduct risk assessments and develop mitigation plans.

- Implement controls and procedures to reduce compliance risks.

3. Internal Audit and Reporting

Conduct internal audits to evaluate compliance with regulations and policies.

- Review financial statements, contracts, and business processes.

- Report audit findings to senior management and regulatory bodies.

4. Compliance Training and Education

Provide training and education to employees on compliance requirements.

- Develop and deliver training materials and programs.

- Monitor employee understanding and knowledge of compliance regulations.

Interview Tips

Preparing well for a Compliance Analyst interview can significantly improve your chances of success. Here are some tips to help you ace the interview:

1. Research the Organization

Familiarize yourself with the organization’s industry, size, regulatory environment, and recent compliance initiatives.

- Visit the company website and review its annual reports and public disclosures.

- Follow the organization on social media and industry publications.

2. Highlight Relevant Experience and Skills

Emphasize your experience in compliance risk management, regulatory monitoring, and internal audit. Highlight your ability to identify and mitigate compliance risks.

- Provide specific examples of compliance projects you have worked on.

- Quantify your accomplishments and demonstrate your impact on compliance.

3. Prepare for Behavioral Questions

Behavioral questions assess your soft skills and work style. Be ready to provide examples of your problem-solving, teamwork, and communication abilities.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Focus on highlighting your ability to handle ethical dilemmas and maintain a high level of integrity.

4. Practice Common Interview Questions

Anticipate common interview questions and prepare thoughtful responses. Practice answering these questions out loud to improve your delivery and confidence.

- “Why are you interested in compliance?”

- “What is your understanding of the latest regulatory changes in the industry?”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Compliance Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!