Are you gearing up for a career in Compliance Specialist? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Compliance Specialist and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

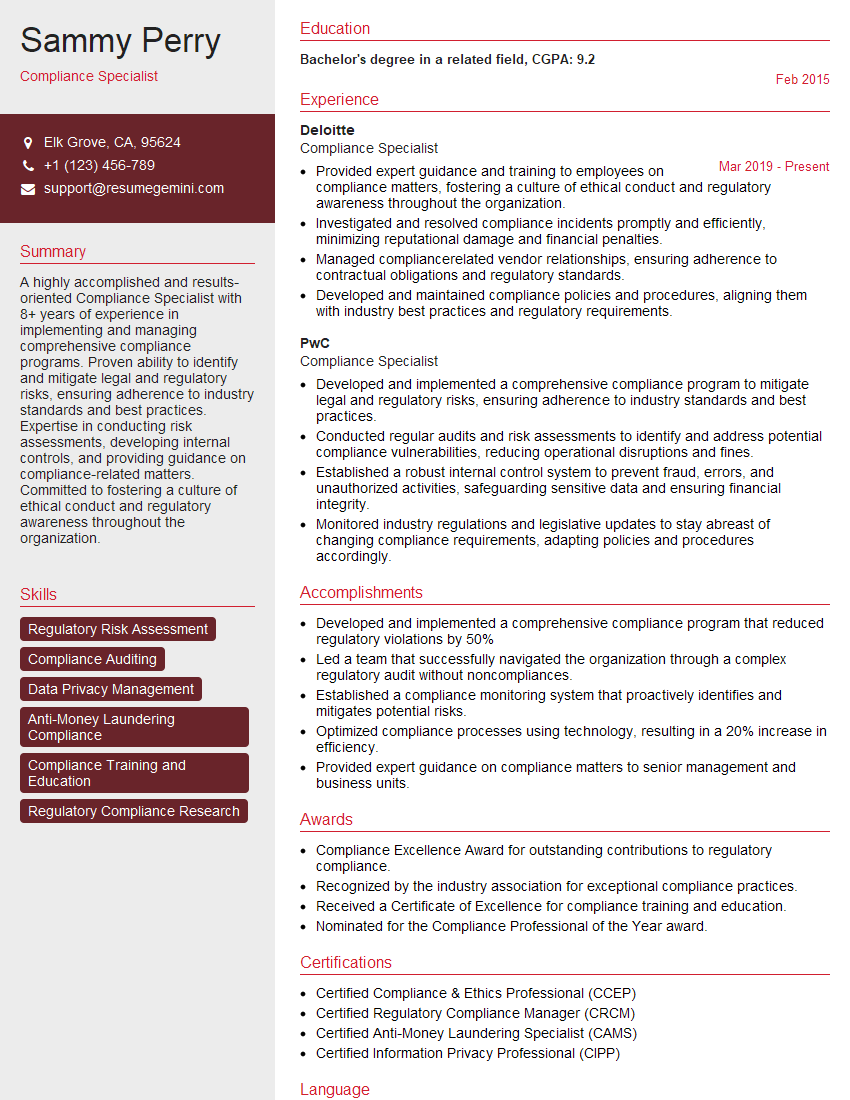

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Compliance Specialist

1. Describe the key responsibilities of a Compliance Specialist in the financial services industry.

As a Compliance Specialist in financial services, I would be responsible for ensuring that the company adheres to all applicable laws, regulations, and industry standards. This would involve:

- Developing and implementing compliance policies and procedures

- Monitoring and auditing compliance activities

- Investigating and resolving compliance issues

- Training employees on compliance requirements

- Liaising with regulators and other stakeholders

2. Explain the difference between internal and external compliance.

Internal Compliance

- Ensuring that the company complies with its own internal policies and procedures

- Monitoring and auditing internal operations to identify and mitigate risks

- Developing and implementing training programs to educate employees on compliance requirements

External Compliance

- Ensuring that the company complies with all applicable laws, regulations, and industry standards

- Monitoring and auditing external activities to identify and mitigate risks

- Liaising with regulators and other stakeholders to ensure compliance

3. Describe the role of the Compliance Specialist in risk management.

The Compliance Specialist plays a vital role in risk management by identifying, assessing, and mitigating compliance risks. This involves:

- Conducting risk assessments to identify potential compliance risks

- Developing and implementing strategies to mitigate compliance risks

- Monitoring and auditing compliance activities to identify and address any emerging risks

- Reporting compliance risks to senior management and the board of directors

4. Explain the importance of ethics and integrity in the financial services industry.

Ethics and integrity are essential in the financial services industry because they help to ensure that companies operate in a fair, honest, and transparent manner. This is important for protecting investors, consumers, and the integrity of the financial system. Compliance Specialists play a vital role in promoting ethics and integrity by:

- Developing and implementing ethics and compliance policies

- Training employees on ethical and compliance requirements

- Investigating and resolving ethical and compliance issues

- Promoting a culture of ethics and integrity within the organization

5. Describe a situation where you successfully resolved a compliance issue.

In my previous role as a Compliance Specialist, I was responsible for investigating a potential insider trading violation. I conducted a thorough investigation, which included interviewing employees, reviewing trading records, and analyzing data. I was able to determine that there was no evidence of insider trading, and I closed the investigation with no further action.

6. How do you stay up-to-date on the latest compliance requirements?

I stay up-to-date on the latest compliance requirements by:

- Attending industry conferences and webinars

- Reading trade publications and industry blogs

- Participating in online forums and discussion groups

- Networking with other compliance professionals

7. What are the most important qualities of a successful Compliance Specialist?

The most important qualities of a successful Compliance Specialist include:

- Strong knowledge of compliance laws and regulations

- Excellent analytical and problem-solving skills

- Strong communication and interpersonal skills

- Ability to work independently and as part of a team

- High ethical standards and integrity

8. What are your career goals as a Compliance Specialist?

My career goals as a Compliance Specialist are to:

- Continue to develop my knowledge of compliance laws and regulations

- Become a subject matter expert in a specific area of compliance

- Lead a team of compliance professionals

- Make a significant contribution to the compliance field

9. Why are you interested in this position?

I am interested in this position because it is a great opportunity to use my compliance skills and experience to make a positive contribution to your company. I am particularly interested in your company’s commitment to compliance and ethics, and I believe that my skills and experience would be a valuable asset to your team.

10. What are your salary expectations?

My salary expectations are commensurate with my experience and qualifications. I am open to discussing a salary range that is competitive with the market rate for similar positions.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Compliance Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Compliance Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Compliance Specialist is responsible for ensuring that a company operates in compliance with all applicable laws, regulations, and industry standards. This role requires a deep understanding of the regulatory environment and the ability to interpret and apply complex legal and technical requirements.

1. Develop and implement compliance programs

Compliance Specialists develop and implement compliance programs that are tailored to the specific needs of their organization. These programs typically include policies and procedures that address areas such as financial reporting, anti-money laundering, and data privacy.

- Assess the organization’s compliance risks.

- Develop and implement policies and procedures to mitigate these risks.

2. Monitor and audit compliance

Compliance Specialists monitor and audit their organization’s compliance with applicable laws and regulations. This involves reviewing internal controls, conducting risk assessments, and investigating potential violations.

- Conduct internal audits.

- Review and analyze data to identify potential compliance issues.

- Investigate potential violations of laws and regulations.

3. Train and educate employees on compliance

Compliance Specialists train and educate employees on compliance requirements. This helps to ensure that employees are aware of their compliance obligations and that they understand the importance of compliance.

- Develop and deliver training programs on compliance topics.

- Provide ongoing compliance support to employees.

4. Report on compliance activities

Compliance Specialists report on their compliance activities to management and other stakeholders. This helps to ensure that management is aware of the organization’s compliance status and that it is taking appropriate steps to mitigate compliance risks.

- Prepare compliance reports for management and other stakeholders.

- Provide updates on compliance activities to the board of directors.

Interview Tips

To prepare for an interview for a Compliance Specialist position, you should:

1. Research the company and the industry

This will help you to understand the company’s compliance risks and the regulatory environment in which it operates.

- Visit the company’s website and read its latest financial reports.

- Review industry news and publications to stay up-to-date on current trends and developments.

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as:

- Why are you interested in a career in compliance?

- What are your strengths and weaknesses as a Compliance Specialist?

- How would you handle a situation where you identified a potential violation of the law?

By practicing your answers to these questions, you can increase your confidence and deliver more polished responses during the interview.

3. Be prepared to discuss your knowledge of the regulatory environment

The interviewer will likely ask you questions about your knowledge of the regulatory environment in which the company operates. Be prepared to discuss the key laws and regulations that apply to the company and how you would ensure compliance with these requirements.

- Review the company’s compliance policies and procedures.

- Stay up-to-date on changes in the regulatory environment.

4. Be able to demonstrate your communication and interpersonal skills

Compliance Specialists must be able to communicate effectively with a variety of stakeholders, including management, employees, and regulators. Be prepared to discuss your communication and interpersonal skills and how you would use these skills to build relationships and promote compliance.

- Provide examples of how you have successfully communicated complex compliance issues to different audiences.

- Discuss your experience working with regulators and other external stakeholders.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Compliance Specialist, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Compliance Specialist positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.