Are you gearing up for an interview for a Corporate Compliance Director position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Corporate Compliance Director and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

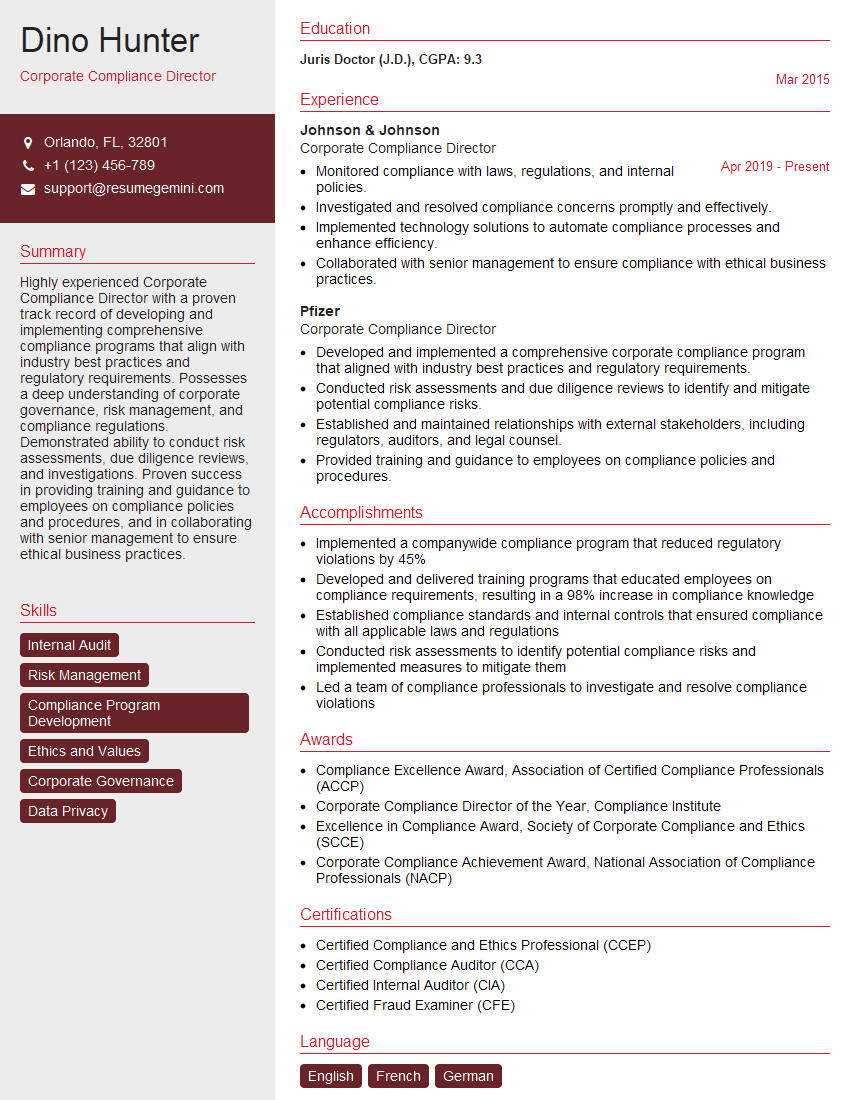

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Corporate Compliance Director

1. What are the key responsibilities of a Corporate Compliance Director?

As a Corporate Compliance Director, I would oversee and manage the organization’s compliance program, ensuring adherence to all applicable laws, regulations, and ethical standards. My responsibilities would include:

- Developing, implementing, and maintaining the compliance program

- Monitoring and auditing compliance with the program

- Investigating and resolving compliance issues

- Providing training and guidance on compliance matters

- Working with internal and external stakeholders to ensure compliance

- Reporting to senior management and the board of directors on compliance matters

2. What are the key challenges facing Corporate Compliance Directors today?

Compliance with Evolving Regulations:

- Keeping up with the constantly changing regulatory landscape

- Understanding and interpreting complex regulations

- Implementing effective compliance measures

Managing Compliance Risk:

- Identifying and assessing compliance risks

- Developing and implementing risk mitigation strategies

- Monitoring and evaluating the effectiveness of risk management measures

Maintaining Ethical Standards:

- Promoting a culture of integrity and ethics within the organization

- Addressing ethical issues and concerns

- Ensuring compliance with ethical standards

Collaboration with Stakeholders:

- Working with internal stakeholders (e.g., employees, management, legal counsel)

- Collaborating with external stakeholders (e.g., regulators, auditors, investors)

- Building and maintaining strong relationships

3. What are the key skills and qualifications required for a Corporate Compliance Director?

Effective Corporate Compliance Directors possess a combination of skills and qualifications, including:

- Deep understanding of compliance laws and regulations

- Strong ethical values and commitment to integrity

- Exceptional communication and interpersonal skills

- Ability to lead and motivate a team

- Experience in developing and implementing compliance programs

- Knowledge of risk management principles

- Ability to work independently and as part of a team

- Excellent analytical and problem-solving skills

4. What are the best practices for developing and implementing a compliance program?

Developing and implementing an effective compliance program involves a systematic approach that includes the following best practices:

- Establish a clear and concise compliance policy

- Conduct a comprehensive risk assessment

- Develop and implement tailored compliance procedures

- Provide comprehensive training and education to employees

- Establish a confidential reporting mechanism

- Monitor and audit compliance regularly

- Investigate and resolve compliance issues promptly

- Continuously improve the compliance program

5. How do you stay up-to-date on compliance laws and regulations?

To ensure my knowledge remains current, I utilize various strategies to stay up-to-date on compliance laws and regulations:

- Attend industry conferences and seminars

- Read legal journals and publications

- Subscribe to compliance-related newsletters

- Network with other compliance professionals

- Utilize online resources and databases

- Seek guidance from legal counsel as needed

6. How do you manage conflicts of interest?

Managing conflicts of interest is essential to maintain the integrity of the compliance program. I employ the following strategies:

- Establish clear conflict of interest policies and procedures

- Provide training to employees on conflict of interest

- Create a system for disclosing and managing conflicts

- Implement measures to mitigate or eliminate conflicts

- Regularly review and update conflict of interest policies

7. How do you investigate compliance issues?

When investigating compliance issues, I follow a structured and thorough approach:

- Gather all relevant information and evidence

- Interview witnesses and gather statements

- Conduct a root cause analysis to identify the underlying causes

- Make recommendations for corrective action

- Follow up to ensure corrective action is implemented

- Document the investigation process and findings

8. How do you build and maintain a culture of compliance within an organization?

Creating and sustaining a culture of compliance requires a comprehensive approach that includes:

- Communicating the importance of compliance to all employees

- Providing regular training and education

- Recognizing and rewarding compliance efforts

- Fostering a speak-up culture

- Leading by example

- Setting clear expectations and holding employees accountable

9. How do you measure the effectiveness of a compliance program?

Evaluating the effectiveness of a compliance program is crucial to ensure it is meeting its objectives. I employ a multi-faceted approach:

- Conduct regular audits and assessments

- Monitor compliance metrics and KPIs

- Review employee feedback

- Assess the number and nature of compliance violations

- Compare performance against industry benchmarks

10. How do you handle regulatory inspections and enforcement actions?

When faced with regulatory inspections or enforcement actions, I take the following steps:

- Cooperate fully with the regulators

- Provide all necessary information and documentation

- Work with legal counsel to navigate the process

- Take immediate action to address any identified deficiencies

- Learn from the experience and make necessary improvements to the compliance program

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Corporate Compliance Director.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Corporate Compliance Director‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Corporate Compliance Director is responsible for developing, implementing, and overseeing the organization’s compliance program. This program is designed to ensure that the organization complies with all applicable laws, regulations, and ethical standards. The Director will work closely with the organization’s management team to identify and assess risks, develop and implement compliance policies and procedures, and monitor compliance with those policies and procedures.

1. Develop and Implement Compliance Program

The Director will be responsible for developing and implementing the organization’s compliance program. This program will include policies and procedures designed to ensure that the organization complies with all applicable laws, regulations, and ethical standards. The Director will also be responsible for training employees on the compliance program and monitoring compliance with the program.

2. Assess Compliance Risks

The Director will be responsible for assessing the organization’s compliance risks. This includes identifying the laws, regulations, and ethical standards that are applicable to the organization, as well as the risks of non-compliance with those laws, regulations, and ethical standards. The Director will also be responsible for developing and implementing strategies to mitigate those risks.

3. Monitor Compliance

The Director will be responsible for monitoring the organization’s compliance with the compliance program. This includes conducting audits and investigations, reviewing reports, and meeting with employees to discuss compliance issues. The Director will also be responsible for taking corrective action when necessary to ensure compliance with the compliance program.

4. Report Compliance Issues

The Director will be responsible for reporting compliance issues to the organization’s management team and board of directors. The Director will also be responsible for working with outside counsel to investigate and resolve compliance issues.

Interview Tips

Preparing for your interview for a Corporate Compliance Director position is essential to making a great impression and increasing your chances of getting the job. Here are some tips to help you ace your interview:

1. Research the Company

Before your interview, take the time to research the company. This will help you understand the company’s culture, values, and business goals. You should also be familiar with the company’s compliance program and any recent compliance issues that the company has faced.

2. Practice Your Answers

Once you have researched the company, take some time to practice your answers to common interview questions. This will help you feel more confident and prepared during your interview. You should also be prepared to discuss your experience with compliance, your knowledge of the law, and your skills in risk assessment and mitigation.

3. Dress Professionally

First impressions matter, so dress professionally for your interview. This means wearing a suit or business casual attire. You should also be well-groomed and have a neat and tidy appearance.

4. Be Yourself

It is important to be yourself during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Be honest and genuine, and let your personality shine through.

5. Ask Questions

At the end of your interview, be sure to ask the interviewer questions. This shows that you are interested in the position and that you are taking the interview seriously. You can ask questions about the company, the position, or the interviewer’s experience.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Corporate Compliance Director interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!