Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Regulatory Compliance Officer interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Regulatory Compliance Officer so you can tailor your answers to impress potential employers.

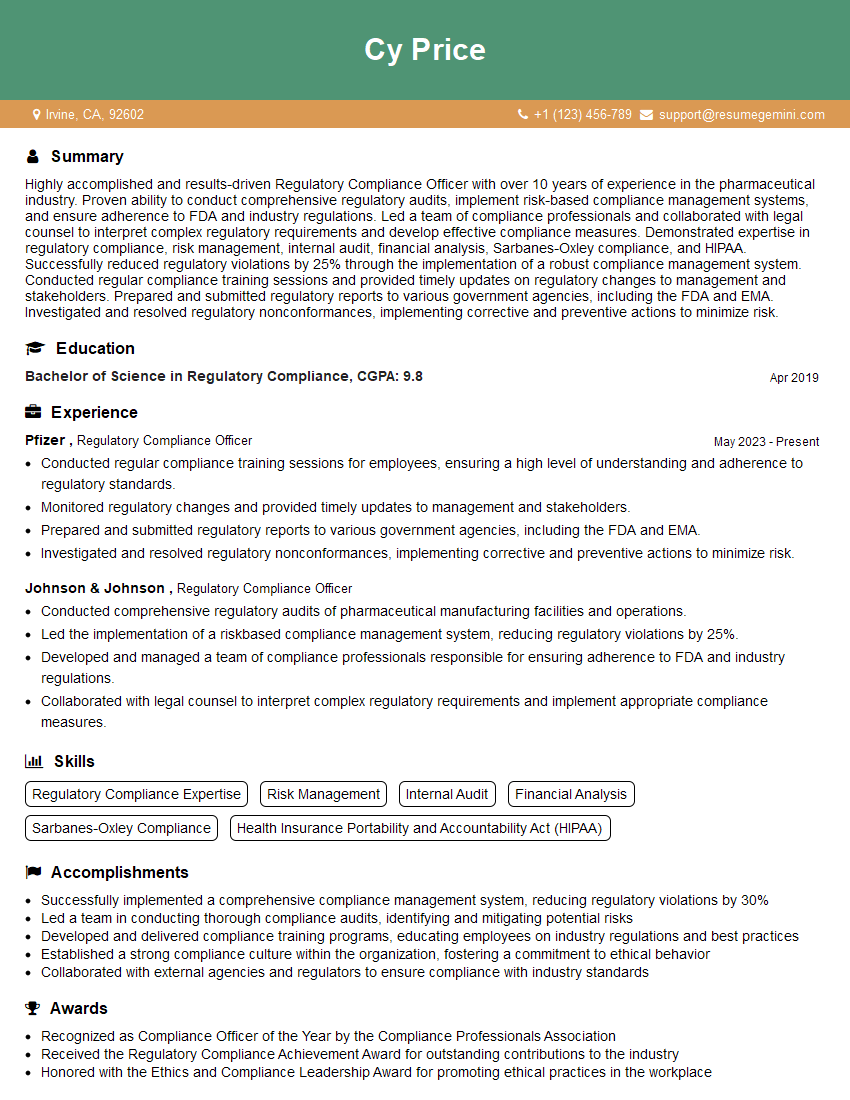

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Regulatory Compliance Officer

1. Can you define regulatory compliance?

Regulatory compliance refers to an organization’s adherence to relevant laws, regulations, ethical standards, industry best practices, and internal policies that govern its operations.

2. What are the key elements of an effective regulatory compliance program?

Roles and Responsibilities

- Clearly define the roles and responsibilities of all stakeholders involved in compliance.

- Establish a designated compliance officer to oversee the program.

Risk Assessment

- Identify and assess potential compliance risks for the organization.

- Prioritize risks based on their likelihood and impact.

Policies and Procedures

- Develop and implement comprehensive policies and procedures to address identified compliance risks.

- Ensure that policies are clear, concise, and easily accessible to all employees.

Training and Education

- Provide regular training and education to employees on applicable laws, regulations, and internal compliance requirements.

- Test employee understanding of compliance policies and procedures.

Monitoring and Auditing

- Establish a process for monitoring compliance with policies and procedures.

- Conduct regular audits to assess compliance effectiveness and identify areas for improvement.

Corrective Action

- Define and implement processes for investigating and addressing compliance violations.

- Take appropriate disciplinary actions and implement corrective measures to prevent future violations.

3. How do you stay up-to-date on regulatory changes?

To stay up-to-date on regulatory changes, I subscribe to industry publications, newsletters, and regulatory alerts. I also attend industry conferences, webinars, and training programs to enhance my knowledge and understanding of regulatory requirements.

4. What is the difference between internal and external compliance audits?

- Internal audits are conducted by an organization’s internal audit function or external auditors hired by the organization to assess compliance with laws, regulations, and internal policies. They are typically more comprehensive and focused on identifying and mitigating compliance risks.

- External audits are conducted by regulatory agencies or third-party auditors to assess an organization’s compliance with external regulations and standards. They are usually more targeted and specific in scope.

5. What is your experience in developing and implementing compliance training programs?

In my previous role, I was responsible for developing and implementing a comprehensive compliance training program for over 500 employees. The program covered a wide range of topics, including anti-money laundering, anti-bribery and corruption, conflict of interest, and data privacy. I used a variety of training methods, such as online modules, in-person workshops, and job aids, to ensure that employees understood their compliance obligations.

6. How do you measure the effectiveness of a compliance program?

- Compliance audits: Conduct regular compliance audits to assess the effectiveness of the program.

- Employee feedback: Collect feedback from employees through surveys or focus groups to gauge their understanding of compliance requirements and their commitment to compliance.

- Compliance reporting: Track and report on compliance incidents, investigations, and corrective actions to identify trends and areas for improvement.

- Regulatory inspections: Analyze the results of regulatory inspections to identify areas where the program can be strengthened.

- Industry benchmarks: Compare the organization’s compliance performance to industry benchmarks and best practices.

7. What are the challenges of working as a Regulatory Compliance Officer?

- Keeping up with regulatory changes: The regulatory landscape is constantly changing, so it can be challenging to stay up-to-date on all the latest requirements.

- Balancing compliance with business objectives: It is important to ensure that compliance efforts do not hinder the organization’s ability to achieve its business goals.

- Communicating effectively with stakeholders: Compliance officers need to be able to communicate effectively with a wide range of stakeholders, including employees, managers, executives, regulators, and external auditors.

- Managing risk: Compliance officers play a key role in managing compliance risk for the organization. This can be a complex and challenging task, especially for organizations that operate in highly regulated industries.

8. What are the skills and qualifications required to be an effective Regulatory Compliance Officer?

- Deep understanding of relevant laws, regulations, and industry best practices.

- Strong analytical and problem-solving skills.

- Excellent communication and interpersonal skills.

- Ability to work independently and as part of a team.

- Strong attention to detail and accuracy.

9. How do you stay informed about emerging regulatory trends?

I regularly monitor reputable sources, such as regulatory agency websites, industry publications, and online resources, to stay informed about emerging regulatory trends. I also attend industry conferences and events to network with other compliance professionals and learn about the latest developments in the field.

10. What is your approach to building a strong compliance culture within an organization?

- Leadership buy-in: Secure support and commitment from senior management to create a culture of compliance throughout the organization.

- Effective communication: Communicate compliance expectations and requirements clearly and regularly to all employees.

- Training and education: Provide comprehensive training and education programs to ensure that employees understand their compliance obligations and how to comply with them.

- Encourage reporting: Establish clear and accessible channels for employees to report compliance concerns or suspected violations.

- Recognition and rewards: Acknowledge and reward employees for their commitment to compliance.

- Discipline and consequences: Address compliance violations promptly and fairly to reinforce the importance of compliance.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Regulatory Compliance Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Regulatory Compliance Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Regulatory Compliance Officers are tasked with important functions within organizations, they must have thorough knowledge of laws and regulations, this enables them to mitigate risks, maintain integrity of the company, and build strong relationships with stakeholders.1. Compliance Monitoring and Auditing

Regulating compliance involves mapping and auditing the company’s processes and activities, to establish the level of adherence to regulatory standards.

- Creating and implementing compliance policies and procedures

- Conducting regular audits and inspections

2. Risk Assessment and Management

A key aspect involves assessing and managing any risks that could lead to legal or ethical violations. This includes conducting thorough risk assessments.

- Identifying and evaluating potential risks

- Developing strategies to mitigate risks

3. Education and Training

Compliance officers are responsible for educating employees, making them aware of the company’s ethical standards, policies, and laws that govern their conduct.

- Conducting training and awareness programs

- Providing guidance on ethical decision-making

4. Reporting and Communication

Informing management of compliance status, assuring them of the company’s adherence to laws is part of the role.

- Reporting on compliance activities

- Communicating with stakeholders about compliance issues

Interview Tips

Proper Interview Preparation can be highly instrumental for achieving success, it involves understanding the job, the company, and your own strengths and capabilities.

1. Research the Company and the Position

Before the interview, you must familiarize yourself with the company’s industry, mission, values and culture.

- Check the company’s website and social media pages

- Read industry news and articles

2. Practice Common Interview Questions

Prepare for common interview questions, such as “Tell me about yourself” and “Why are you interested in this position?”

- Write out your answers and practice saying them out loud

- Use the STAR method (Situation, Task, Action, Result) to structure your answers

3. Highlight Your Skills and Experience

Tailor your resume and cover letter so that they highlight the skills and experience that that aligns with the job description.

- Use keywords from the job description

- Quantify your accomplishments whenever possible

4. Be Professional and Enthusiastic

It is essential to be professional and enthusiastic throughout the interview. This includes dressing appropriately, arriving on time, and making eye contact.

- Be prepared to ask questions about the company and the position

- Thank the interviewer for their time

5. Dress Appropriately

Dress professionally for the interview, this shows that you respect the interviewer and the company.

- For men, a suit or dress pants and a button-down shirt is appropriate

- For women, a dress, skirt and blouse, or pantsuit can work well

Next Step:

Now that you’re armed with the knowledge of Regulatory Compliance Officer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Regulatory Compliance Officer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini