Are you gearing up for an interview for a Institutional Asset Manager position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Institutional Asset Manager and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

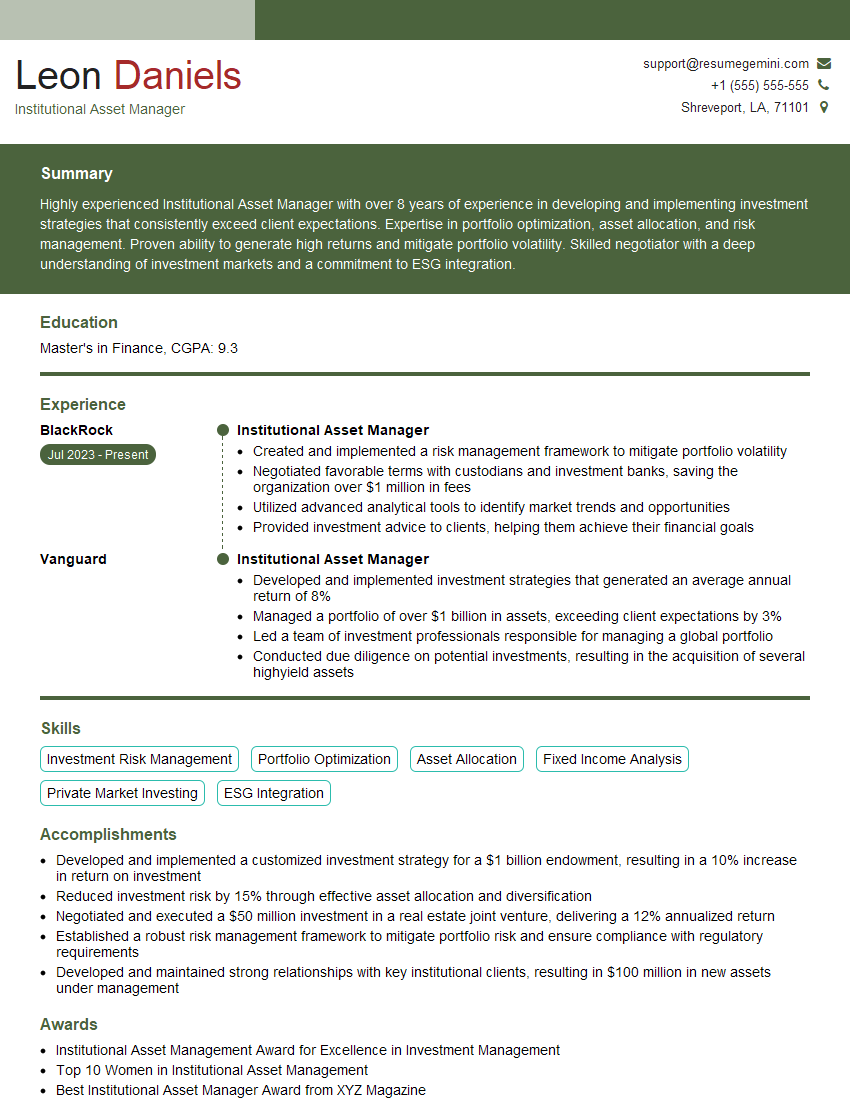

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Institutional Asset Manager

1. Walk me through your investment process for a new institutional client.

In the first step I establish client’s investment objectives, constraints and time horizon. Then I conduct a thorough due diligence on the client’s investment portfolio, including an analysis of their risk tolerance, return expectations, and liquidity needs. This helps me to understand the client’s investment goals and constraints, and to tailor my recommendations accordingly.

Next I develop an investment strategy that is aligned with the client’s objectives. This typically involves selecting a mix of asset classes and individual investments that are designed to meet the client’s return and risk targets. I also consider the client’s tax situation and investment horizon when making these decisions.

Once the investment strategy is in place, I implement it through a combination of direct investments and fund of funds. I also monitor the portfolio’s performance on a regular basis and make adjustments as needed.

2. What are the key quantitative metrics you use to evaluate the performance of an investment portfolio?

Return metrics

- Annualized return

- Total return

- Return on investment (ROI)

- Sharpe ratio

- Sortino ratio

Risk metrics

- Standard deviation

- Variance

- Beta

- R-squared

- Maximum drawdown

- Value at Risk (VaR)

Correlation metrics

- Pearson correlation coefficient

- Spearman rank correlation coefficient

- Kendall tau correlation coefficient

3. How do you incorporate ESG factors into your investment process?

ESG investing involves considering environmental, social, and governance (ESG) factors when making investment decisions. I incorporate ESG factors into my investment process in the following ways:

- I use ESG data and research to identify companies that are leaders in ESG performance.

- I integrate ESG factors into my investment analysis and due diligence process.

- I engage with companies on ESG issues and advocate for positive change.

- I invest in companies that are committed to sustainable practices and positive social impact.

4. What are your views on the current market environment and how are you positioning your clients’ portfolios?

The current market environment is characterized by a number of factors, including rising interest rates, inflation, and geopolitical uncertainty. Given these uncertainties, I am taking a cautious approach to investing and recommending a diversified portfolio of assets that is designed to provide both growth and income.

Specifically, I am overweighting quality companies with strong fundamentals and reasonable valuations. I am also investing in a mix of asset classes, including stocks, bonds, and real assets. I believe that this diversified approach will help my clients to achieve their investment goals in the current market environment.

5. How do you manage risk in your investment portfolios?

I manage risk in my investment portfolios through a combination of diversification, asset allocation, and hedging strategies. I also use a variety of risk management tools, such as stop-loss orders and position sizing, to help me to manage risk.

I believe that risk management is an essential part of the investment process. By taking a disciplined approach to risk management, I can help my clients to protect their capital and achieve their investment goals.

6. How do you communicate with your clients about their investments?

I communicate with my clients about their investments on a regular basis. I provide them with monthly performance updates, and I also meet with them in person or by video conference to discuss their investment goals and objectives.

I believe that open and transparent communication is essential for building strong relationships with my clients. By keeping them informed about their investments, I can help them to make informed decisions and achieve their financial goals.

7. What are your thoughts on the use of alternative investments in institutional portfolios?

Alternative investments can play a valuable role in institutional portfolios. They can provide diversification, enhance returns, and reduce risk. However, it is important to carefully evaluate alternative investments before investing in them.

Some of the most common alternative investments include private equity, hedge funds, and real estate. Each type of alternative investment has its own unique risks and returns. It is important to understand these risks and returns before investing in any alternative investment.

8. What is your experience with using financial modeling and data analysis in your investment process?

I have extensive experience with using financial modeling and data analysis in my investment process. I use financial models to help me evaluate the potential returns and risks of different investment opportunities. I also use data analysis to identify trends and patterns in the market.

I believe that financial modeling and data analysis are essential tools for investment managers. They can help me to make informed investment decisions and achieve my clients’ financial goals.

9. How do you stay up-to-date on the latest investment trends and research?

I stay up-to-date on the latest investment trends and research by reading industry publications, attending conferences, and networking with other investment professionals. I also subscribe to a number of financial news and research services.

I believe that it is important to stay current on the latest investment trends and research in order to make informed investment decisions. This helps me to provide my clients with the best possible investment advice.

10. What are your career goals and how do you see this role fitting into your long-term plans?

My career goal is to become a portfolio manager and manage a large pool of institutional assets. I believe that this role is a great opportunity for me to learn and grow as an investment professional. I am confident that I have the skills and experience necessary to be successful in this role.

In the long term, I hope to start my own investment firm. I believe that this role will give me the experience and knowledge necessary to be successful in this endeavor.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Institutional Asset Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Institutional Asset Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Institutional Asset Manager plays a pivotal role in managing and growing the financial assets of institutional investors, including pension funds, endowments, foundations, and insurance companies.

1. Investment Strategy Development

Develop and implement investment strategies aligned with clients’ risk tolerance, return objectives, and liquidity needs.

- Conduct thorough market research and analysis to identify investment opportunities.

- Design and manage diversified portfolios across various asset classes, such as stocks, bonds, real estate, and private equity.

2. Portfolio Management

Manage and monitor investment portfolios to ensure they meet performance goals and adhere to investment guidelines.

- Monitor market conditions and economic trends to make timely investment adjustments.

- Conduct regular performance reviews and provide clients with comprehensive reporting.

3. Risk Management

Identify, assess, and manage investment risks to protect clients’ assets.

- Develop and implement risk management policies and procedures.

- Monitor portfolio risk levels and take appropriate action to mitigate risks.

4. Client Communication and Relationship Management

Communicate with clients regularly to provide updates on portfolio performance, investment decisions, and market outlook.

- Build strong relationships with clients by understanding their unique needs and objectives.

- Provide ongoing support and guidance to help clients achieve their investment goals.

Interview Tips

To Ace your Institutional Asset Manager Interview, follow these tips.

1. Research the Company and Industry

Demonstrate your knowledge of the asset management industry and the specific firm you’re interviewing with.

- Review the company’s website, annual reports, and press releases to understand their investment philosophy, portfolio performance, and client base.

- Follow industry news and trends to show your interest and engagement in the field.

2. Highlight Your Investment Expertise

Showcase your analytical skills, investment knowledge, and experience in managing portfolios for institutional clients.

- Quantify your investment successes by providing specific examples of how you have helped clients achieve their financial goals.

- Discuss your experience in developing and implementing investment strategies that meet different risk-return profiles.

3. Demonstrate Your Risk Management Skills

Emphasize your ability to identify, assess, and manage investment risks.

- Explain your understanding of different risk management techniques and how you have applied them in practice.

- Discuss how you have proactively monitored and mitigated investment risks to protect client assets.

4. Emphasize Your Communication and Relationship Management Abilities

Highlight your communication skills and ability to build strong relationships with clients.

- Provide examples of how you have effectively communicated complex investment concepts to non-financial clients.

- Discuss your experience in building and maintaining long-term relationships with institutional investors.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Institutional Asset Manager, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Institutional Asset Manager positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.