Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Pension Fund Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

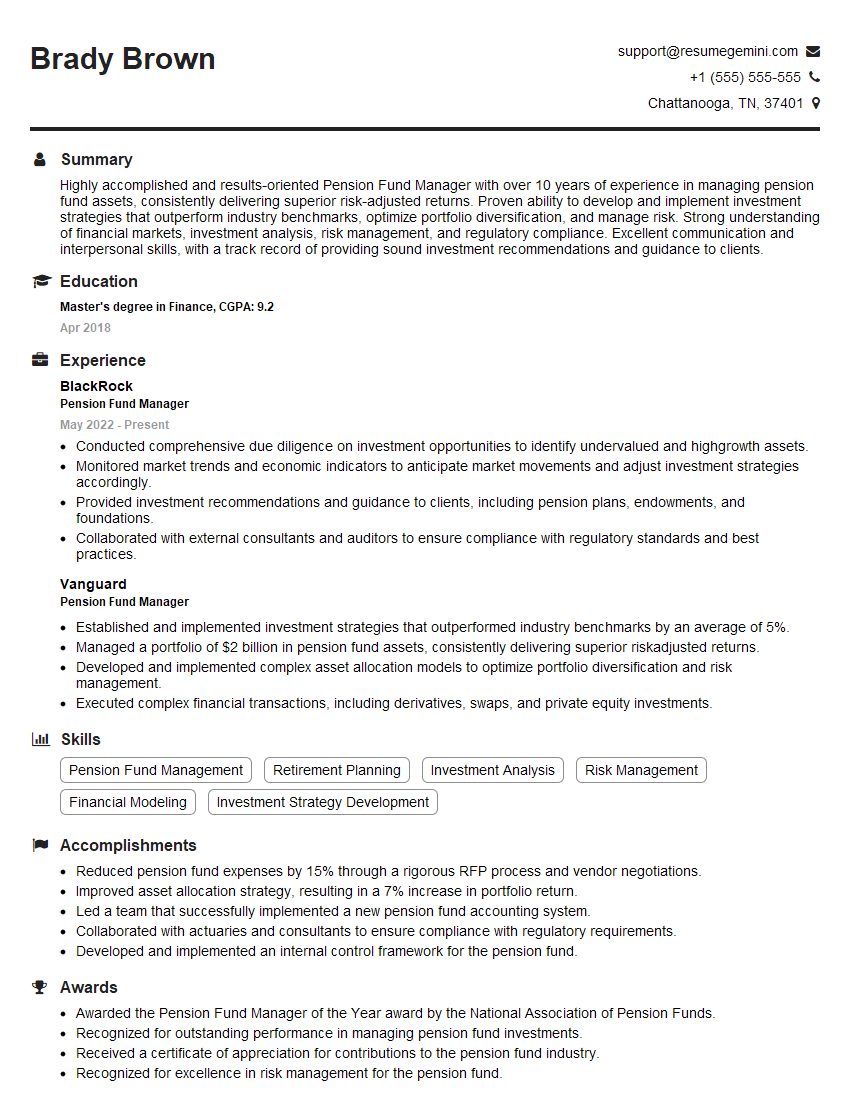

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Pension Fund Manager

1. Explain the primary responsibilities and key performance indicators (KPIs) of a Pension Fund Manager?

- Primary Responsibilities:

- Develop and implement strategic investment plans

- Manage and monitor investment portfolios

- Conduct research and analysis on financial markets and investment opportunities

- Coordinate with custodians, brokers, and other investment professionals

- Ensure compliance with regulatory requirements

- KPIs:

- Investment performance against benchmarks

- Risk management and portfolio volatility

- Asset allocation and diversification

- Client satisfaction and retention

- Compliance with regulations and ethical standards

2. Describe the different investment strategies employed by Pension Fund Managers?

Asset Classes:

- Equities: Stocks of publicly traded companies

- Fixed Income: Bonds and other debt instruments

- Real Estate: Commercial, residential, and land

- Commodities: Gold, oil, and other raw materials

- Private Equity: Investments in non-publicly traded companies

Investment Styles:

- Active Management: Attempting to outperform a benchmark or index

- Passive Management: Tracking a benchmark or index

- Value Investing: Purchasing undervalued assets

- Growth Investing: Purchasing assets with high potential for growth

- Momentum Investing: Following market trends

3. How do you evaluate and select investment opportunities for a pension fund?

- Due Diligence: Conducting thorough research on the investment and its potential risks

- Risk Assessment: Identifying and assessing potential risks associated with the investment

- Return Analysis: Projecting potential returns and comparing them to benchmarks

- Diversification: Ensuring the investment fits the overall risk and return profile of the portfolio

- Investment Strategy: Aligning the investment with the fund’s overall investment strategy

4. How do you manage risk in a pension fund portfolio?

- Asset Allocation: Diversifying across different asset classes to reduce overall risk

- Investment Selection: Selecting investments with appropriate risk profiles

- Hedging Strategies: Using financial instruments to offset risks

- Stress Testing: Simulating market conditions to test portfolio resilience

- Risk Monitoring: Continuously monitoring risks and adjusting portfolio accordingly

5. How do you stay up-to-date on financial markets and best practices in pension fund management?

- Continuous Education: Attending conferences, workshops, and seminars

- Professional Development: Pursuing certifications and designations

- Industry Publications: Reading journals, magazines, and news articles

- Market Research: Conducting research on financial markets and investment strategies

- Networking: Connecting with other professionals in the industry

6. How do you handle conflicts of interest in your role as a Pension Fund Manager?

- Disclosure: Disclosing any potential conflicts of interest

- Transparency: Being transparent about investment decisions and rationale

- Recusal: Removing oneself from decision-making when a conflict arises

- Code of Conduct: Adhering to ethical standards and regulations

- External Oversight: Seeking independent review of investment decisions

7. Describe a challenging situation you faced as a Pension Fund Manager and how you overcame it?

- Situation: Briefly describe the challenging situation

- Actions: Explain the specific actions you took to address the challenge

- Outcome: Describe the positive outcome or lessons learned from the experience

8. How do you measure the effectiveness of your investment decisions?

- Benchmarks: Comparing performance to industry benchmarks or peer groups

- Risk-Adjusted Returns: Measuring returns relative to the level of risk taken

- Time-Weighted Return: Calculating average annualized return over a period of time

- Sharpe Ratio: Assessing the excess return relative to the risk-free rate

- Performance Attribution: Identifying the sources of investment performance

9. What are your thoughts on the future of pension fund management?

- Demographic Shifts: Aging population and impact on pension liabilities

- Technological Advancements: Use of AI and machine learning in investment decision-making

- Sustainability and ESG Investing: Increasing focus on environmental, social, and governance factors

- Regulatory Changes: Evolving regulations and their impact on pension fund management

- Alternative Investment Strategies: Expanding use of private equity, real estate, and other alternative asset classes

10. Why are you interested in working as a Pension Fund Manager for our organization?

- Alignment with Values: Sharing the organization’s values and commitment to providing retirement security

- Expertise and Experience: Demonstrating relevant skills and experience in pension fund management

- Professional Growth: Aspiring to contribute to the organization’s success and grow professionally

- Team Environment: Eager to collaborate with a team of professionals

- Reputation and Market Standing: Respect for the organization’s reputation and market presence

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Pension Fund Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Pension Fund Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Pension Fund Managers bear the responsibility of overseeing and managing pension funds. They play a pivotal role in ensuring the financial stability and retirement security of individuals and groups. The key job responsibilities of a Pension Fund Manager include:

1. Investment Management

Pension Fund Managers are entrusted with the task of investing the fund’s assets. They make strategic decisions regarding asset allocation, selecting investments such as stocks, bonds, real estate, and alternative investments. The goal is to maximize returns while managing risk to achieve the fund’s investment objectives.

- Conduct thorough research and analysis to identify potential investment opportunities.

- Monitor and evaluate investments regularly, making necessary adjustments to the portfolio.

2. Risk Management

Managing risk is a critical aspect of pension fund management. Fund Managers assess and mitigate investment risks, taking into account factors such as market fluctuations, economic conditions, and geopolitical events. The aim is to safeguard the fund’s assets and ensure long-term sustainability.

- Implement risk management strategies to minimize potential losses.

- Stay abreast of regulatory and compliance requirements related to risk management.

3. Financial Reporting and Compliance

Pension Fund Managers play a vital role in financial reporting and ensuring compliance with legal and regulatory requirements. They prepare financial statements, tax returns, and other relevant documents, ensuring transparency and accountability.

- Comply with all applicable laws and regulations governing pension funds.

- Maintain accurate and up-to-date financial records and prepare financial reports.

4. Stakeholder Relations

Pension Fund Managers interact with a range of stakeholders, including fund members, beneficiaries, employers, investment managers, and regulators. They provide information, answer inquiries, and build relationships to ensure the smooth operation of the fund and address the concerns of stakeholders.

- Communicate effectively with stakeholders, building trust and confidence.

- Address customer inquiries and resolve issues promptly and professionally.

Interview Tips

Preparing thoroughly for a pension fund manager interview is essential to showcase your knowledge and skills. Here are some tips to help you ace the interview:

1. Research the Company and Position

Familiarize yourself with the company’s profile, mission, and investment strategies. Research the specific responsibilities and requirements of the position you are applying for. This will demonstrate your genuine interest and understanding of the role.

- Visit the company website, read annual reports, and gather information about their investment philosophy.

- Review the job description thoroughly and identify the key skills and experience required.

2. Highlight Relevant Skills and Experience

Emphasize your skills and experience that are directly relevant to pension fund management. Showcase your expertise in investment analysis, risk management, financial modeling, and regulatory compliance. Provide specific examples of your accomplishments and how you have contributed to the success of previous roles.

- Quantify your results whenever possible, using specific metrics and data to demonstrate the impact of your work.

- Prepare examples of successful investment decisions you have made, including how you analyzed potential risks and returns.

3. Showcase Your Knowledge of the Industry

Demonstrate your understanding of the pension fund industry, including the regulatory landscape, economic trends, and best practices. Display your awareness of current events and developments in the field, as this will indicate your passion and commitment to staying updated.

- Follow industry news and publications to stay informed about the latest developments.

- Attend conferences and webinars to expand your knowledge and network with professionals in the field.

4. Prepare for Common Interview Questions

Anticipate common interview questions and prepare thoughtful responses. Practice answering questions related to your investment philosophy, risk management approach, financial reporting experience, and stakeholder engagement skills.

- Consider using the STAR method to structure your answers, providing specific examples of your experiences.

- For example, for the question “Tell me about a time you faced a significant investment risk,” describe the situation, your analysis of the risk, the steps you took to mitigate it, and the outcome.

5. Dress Professionally and Arrive Punctually

First impressions matter. Dress professionally and arrive for your interview on time. This shows respect for the interviewer and the company, and conveys a sense of professionalism and punctuality.

- Choose attire that is appropriate for a business setting, such as a suit or business casual clothing.

- Plan your route and transportation arrangements to ensure you arrive at the interview location with ample time to spare.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Pension Fund Manager interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.