Are you gearing up for a career in Portfolio Manager? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Portfolio Manager and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

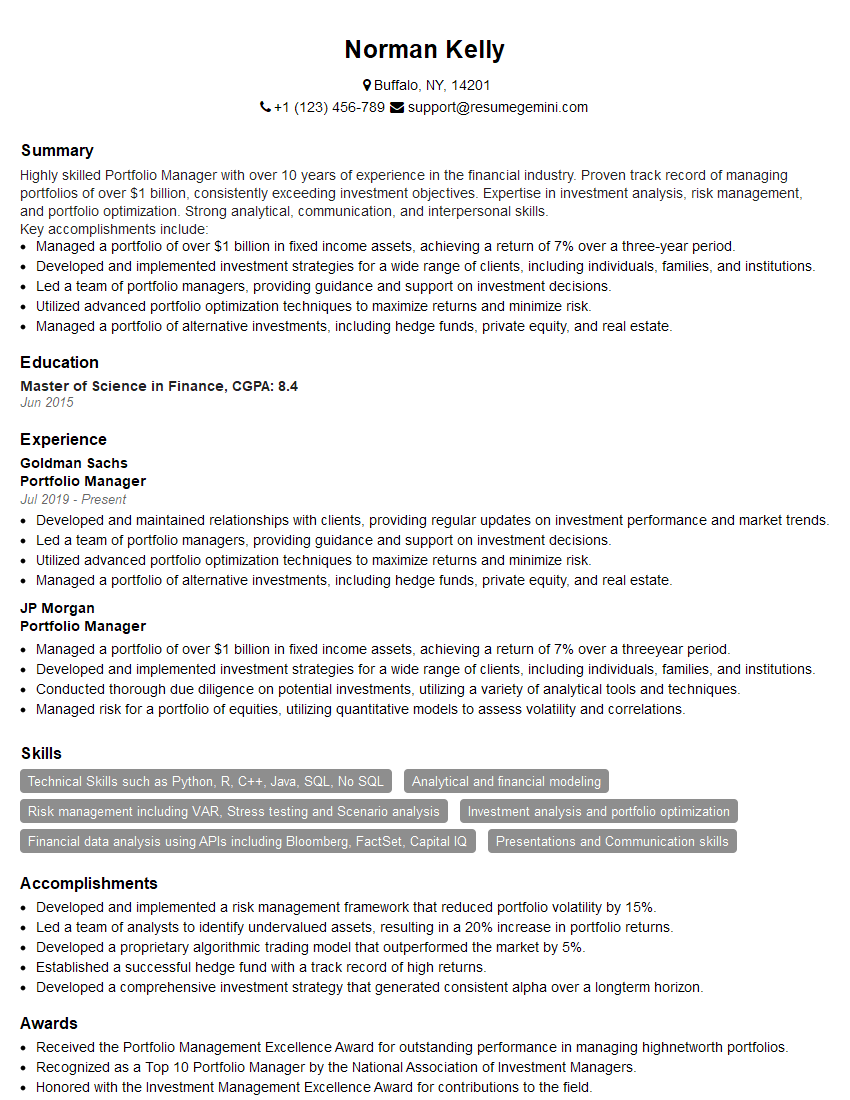

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Portfolio Manager

1. Explain the investment process you follow while managing a portfolio?

As a Portfolio Manager, my investment process involves the following key steps:

- Investment Objectives Definition: Clearly defining the investment goals, risk tolerance, and time horizon of the client.

- Asset Allocation Strategy: Determining the appropriate mix of asset classes (e.g., stocks, bonds, real estate) to achieve the desired risk-return profile.

- Security Selection: Identifying and selecting individual investments within each asset class that meet the portfolio’s objectives and risk parameters.

- Portfolio Construction: Building a diversified portfolio that optimizes return while managing risk.

- Performance Monitoring and Rebalancing: Regularly tracking portfolio performance and making adjustments as necessary to maintain the desired risk-return balance.

2. How do you evaluate the risk and return of a potential investment?

Risk Assessment

- Quantitative Analysis: Using statistical measures such as standard deviation, Sharpe ratio, and beta to assess volatility and risk.

- Qualitative Analysis: Evaluating factors such as management team, industry dynamics, and economic conditions to identify potential risks.

Return Analysis

- Historical Performance: Reviewing past returns to assess potential future performance.

- Earnings Projections: Analyzing company financial statements and industry reports to forecast future earnings and growth potential.

- Valuation Metrics: Using metrics such as P/E ratio, EV/EBITDA, and Price-to-Book to determine whether the investment is fairly valued.

3. Describe your approach to portfolio diversification.

Diversification is crucial for risk management. My approach involves:

- Asset Class Diversification: Allocating investments across various asset classes such as stocks, bonds, real estate, and commodities.

- Sector and Industry Diversification: Diversifying within each asset class by investing in different sectors and industries to reduce concentration risk.

- Investment Style Diversification: Combining different investment styles such as growth, value, and income to capture a wider range of market opportunities.

- Geographic Diversification: Investing in international markets to reduce exposure to a single country’s economic or political risks.

4. How do you manage risk in a volatile market environment?

Managing risk in volatile markets requires a proactive approach:

- Stress Testing: Simulating extreme market conditions to assess the portfolio’s resilience.

- Risk Limits: Establishing clear risk parameters and adhering to them.

- Dynamic Asset Allocation: Adjusting asset allocation strategies in response to changing market conditions.

- Hedging Strategies: Using financial instruments such as options and derivatives to mitigate specific risks.

- Communication with Clients: Keeping clients informed about potential risks and the measures taken to manage them.

5. How do you stay up-to-date on financial trends and market developments?

Keeping abreast of financial trends is essential:

- Industry Research: Subscribing to industry publications, attending conferences, and networking with experts.

- News and Analysis: Monitoring financial news outlets, reading market reports, and utilizing online resources.

- Continuing Education: Pursuing professional certifications and attending workshops to enhance knowledge and skills.

- Market Observations: Analyzing market data, price movements, and economic indicators to identify trends and patterns.

6. How do you determine the appropriate benchmark for a portfolio?

Benchmark selection is crucial for performance evaluation:

- Risk-Return Profile: Selecting a benchmark that aligns with the portfolio’s risk and return objectives.

- Sector and Industry Exposure: Choosing a benchmark that reflects the portfolio’s investment strategy and sector/industry allocation.

- Performance History: Evaluating the benchmark’s historical performance to ensure it is representative of the desired market segment.

- Data Availability: Selecting a benchmark that has reliable and easily accessible data for accurate comparisons.

7. What are the key performance metrics you use to evaluate portfolio performance?

Performance evaluation is multifaceted:

- Return Measures: Absolute return, annualized return, and return on investment (ROI).

- Risk Measures: Standard deviation, beta, and Sharpe ratio.

- Comparison to Benchmark: Tracking excess returns over the selected benchmark.

- Risk-Adjusted Returns: Using measures such as the Sortino ratio and Calmar ratio to assess returns relative to risk.

8. How do you handle difficult clients or challenging situations?

Client management and conflict resolution are essential:

- Communication: Maintaining open and transparent communication with clients.

- Active Listening: Understanding client concerns and addressing them effectively.

- Problem Solving: Collaborating with clients to find mutually agreeable solutions.

- Professionalism: Maintaining composure and professionalism even under pressure.

- Documentation: Documenting client interactions and decisions to maintain transparency and avoid misunderstandings.

9. What are your ethical guidelines as a Portfolio Manager?

Ethical conduct is paramount:

- Fiduciary Duty: Acting in the best interests of clients and prioritizing their financial well-being.

- Compliance: Adhering to all applicable laws and regulations.

- Conflicts of Interest: Avoiding situations that could create conflicts between personal interests and client interests.

- Confidentiality: Maintaining the confidentiality of client information.

- Transparency: Disclosing all relevant information to clients in a clear and understandable manner.

10. Describe a successful investment strategy you have implemented in the past.

Highlighting a successful strategy:

- Background: Provide the context and investment objectives of the strategy.

- Investment Process: Describe the specific investment decision-making process used.

- Performance: Quantify the results achieved, including return, risk, and benchmark comparison.

- Key Learnings: Discuss what insights or lessons were learned from the implementation of the strategy.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Portfolio Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Portfolio Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Portfolio managers are responsible for making investment decisions on behalf of their clients. They develop and implement investment strategies, and monitor the performance of their portfolios. Their key responsibilities include:

1. Investment Research and Analysis

Portfolio managers conduct thorough research and analysis of financial markets, economic conditions, and individual companies. They use this information to identify potential investment opportunities, assess risk levels, and make informed investment decisions.

2. Portfolio Construction and Management

Portfolio managers construct and manage portfolios of investments, such as stocks, bonds, and mutual funds. They allocate assets based on each client’s unique risk tolerance, financial goals, and investment objectives.

3. Risk Management

Portfolio managers identify and assess potential risks to their portfolios. They implement risk management strategies to minimize losses and protect client investments.

4. Performance Evaluation and Reporting

Portfolio managers regularly evaluate the performance of their portfolios and report the results to clients. They provide updates on investment strategies and market conditions, and make recommendations for any necessary adjustments.

Interview Tips

Preparing thoroughly for a portfolio manager interview can significantly increase your chances of success. Here are some tips to help you:

1. Research the Company and Position

Research the company you’re interviewing with and the specific role you’re applying for. This will help you understand their business, investment philosophy, and the responsibilities of the position. Tailoring your answers to the specific requirements of the role will make a positive impression.

2. Practice Common Interview Questions

Practice answering common interview questions to improve your responses and reduce any nerves. Some typical questions for portfolio manager interviews include:

- Tell us about your investment philosophy and how you apply it to portfolio management.

- What is your approach to risk management?

- Provide an example of a successful investment decision you made.

- How do you stay up-to-date on market trends and financial news?

3. Highlight Your Skills and Experience

Emphasize your skills and experience that are relevant to the role of a portfolio manager. Quantify your accomplishments and use specific examples to demonstrate your abilities in investment research, portfolio management, and risk assessment.

4. Show Your Passion for the Industry

Conveying your passion for the investment industry will enhance your interview performance. Share instances where you actively engaged in investment-related activities, such as managing personal investments, participating in financial competitions, or attending industry events.

5. Prepare Questions for the Interviewer

Asking well-thought-out questions at the end of the interview shows interest and engagement. Questions could focus on the company’s investment strategies, their approach to client relationships, or any specific areas of the role that were not discussed in detail.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Portfolio Manager interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.