Feeling lost in a sea of interview questions? Landed that dream interview for Senior Investment Analyst but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Senior Investment Analyst interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

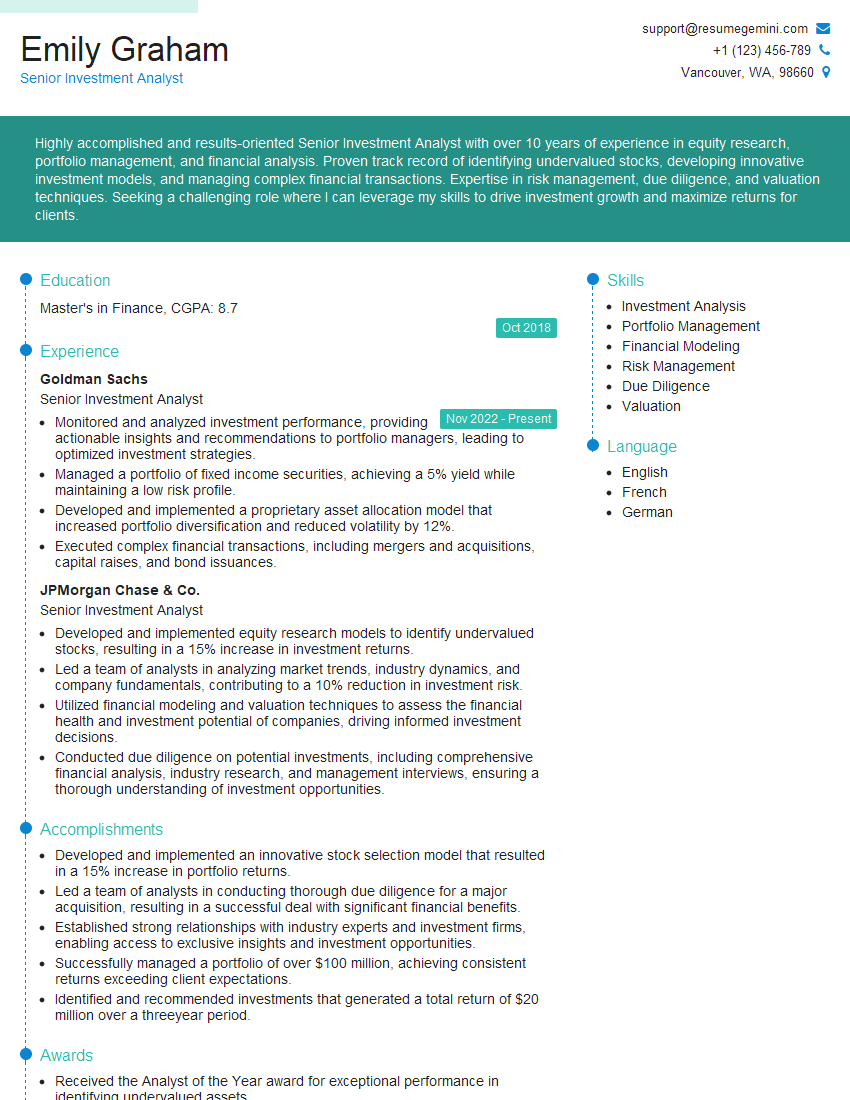

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Senior Investment Analyst

1. Describe your process for evaluating the financial performance of a company?

Answer: – Begin by assessing the company’s financial statements, including the balance sheet, income statement, and statement of cash flows. – Analyze key financial ratios, such as gross profit margin, operating margin, and return on equity. – Examine the company’s revenue and earnings trends over time. – Review the company’s competitive landscape and industry outlook. – Consider the company’s management team and their track record. – Conduct due diligence and interviews with key stakeholders.

2. How do you approach the valuation of growth companies with limited financial history?

Discounted Cash Flow Analysis

- Estimate future cash flows based on growth projections and industry benchmarks.

- Apply an appropriate discount rate to reflect the risk and uncertainty associated with the company’s growth trajectory.

Transaction Comparable Analysis

- Identify comparable companies with similar growth profiles and financial characteristics.

- Utilize multiples such as revenue multiples or EBITDA multiples to derive a valuation range.

Venture Capital Method

- Consider the company’s stage of development and potential exit scenarios (e.g., IPO, acquisition).

- Apply a pre-money valuation based on industry averages or recent funding rounds.

3. Explain your understanding of the capital asset pricing model (CAPM) and how you apply it in your investment analysis?

Answer: – CAPM is a model that estimates the expected return of an asset based on its systemic risk (beta). – I use CAPM to compare the expected return of an investment to the risk-free rate and the expected return of the market portfolio. – This allows me to assess whether an investment is fairly priced or over/undervalued. – I adjust the beta for the specific investment’s characteristics and industry dynamics. – I also consider other factors, such as the company’s financial health and competitive advantage, alongside CAPM analysis.

4. Discuss the ethical considerations you take into account when making investment decisions?

Answer: – I prioritize fiduciary responsibility and act solely in the best interests of my clients. – I adhere to all applicable laws and regulations, including anti-money laundering and insider trading rules. – I disclose any potential conflicts of interest and avoid situations where my personal interests could influence my investment decisions. – I consider the environmental, social, and governance (ESG) impact of my investments. – I am committed to ethical investing and believe that long-term success is built on trust and integrity.

5. How do you stay up-to-date with the latest financial research and market trends?

Answer: – I regularly read industry publications, attend conferences, and participate in webinars. – I subscribe to financial news and data providers to track market movements and company announcements. – I network with other investment professionals and experts in the field. – I conduct my own research and analysis, utilizing financial databases and modeling tools. – I stay informed about economic, political, and regulatory developments that may impact the financial markets.

6. Tell me about a successful investment you made, how did you identify the opportunity?

Answer: – I identified an undervalued company in the technology sector. – The company had a strong management team, a competitive product offering, and a growing market. – I conducted thorough due diligence, including financial analysis and industry research. – I believed the company had the potential for significant growth and return on investment. – I presented my analysis to my investment committee and recommended an investment.

7. Share an example of a time when you made an incorrect investment decision. What did you learn from that experience?

Answer: – I once invested in a company that I believed had a promising new product. – However, the product did not gain traction in the market as expected. – I did not adequately consider the competitive landscape and potential risks. – I learned the importance of thorough research, including market testing and understanding the company’s execution capabilities. – I also learned the value of diversifying my investments to mitigate individual investment risks.

8. How do you handle pressure and manage risk in your role?

Answer: – I maintain a calm and analytical approach under pressure. – I rely on data and research to inform my decisions rather than making impulsive choices. – I continuously assess and manage risks, implementing strategies to mitigate potential losses. – I seek input from colleagues and consult with experts when necessary. – I prioritize my responsibilities and delegate tasks effectively to manage my workload.

9. How do you stay motivated and continue to develop professionally?

Answer: – I am passionate about investing and enjoy the challenges and opportunities it presents. – I set personal and professional development goals to continuously enhance my skills. – I pursue certifications and engage in ongoing education to stay abreast of industry advancements. – I seek mentorship and guidance from experienced professionals. – I attend industry events and conferences to connect with peers and learn from experts.

10. Why are you interested in this role and our company?

Answer: – I am eager to join your reputable company and contribute my expertise to your investment team. – Your firm’s commitment to ethical investing and long-term value creation aligns with my investment philosophy. – The role of Senior Investment Analyst offers me the opportunity to leverage my skills in financial analysis, portfolio management, and risk assessment. – I believe my experience and passion for investing would make me a valuable asset to your organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Senior Investment Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Senior Investment Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Investment Analysis and Recommendation

Conduct thorough financial analysis and valuation of potential investment opportunities.

- Develop investment models and projections to assess risk and return.

- Recommend investment strategies and asset allocation decisions to clients.

2. Market Research and Monitoring

Monitor and analyze economic, industry, and company trends to identify investment opportunities.

- Gather and interpret market data, financial statements, and industry reports.

- Stay abreast of regulatory changes and market developments.

3. Portfolio Management

Manage and monitor client portfolios in accordance with investment objectives.

- Execute trades, allocate assets, and adjust portfolio holdings.

- Monitor portfolio performance and provide regular updates to clients.

4. Client Communication and Reporting

Communicate investment recommendations, portfolio performance, and market insights to clients.

- Prepare investment presentations and reports for clients.

- Field client inquiries and provide sound financial advice.

5. Team Collaboration and Mentorship

Collaborate with other analysts, portfolio managers, and investment professionals.

- Provide guidance and support to junior analysts.

- Share knowledge and contribute to firm-wide investment strategies.

Interview Tips

1. Research the Company and Industry

Learn about the investment firm, its investment philosophy, and specific industry expertise.

- Research the industry landscape and key investment trends.

- Identify the firm’s strengths, weaknesses, and competitive advantages.

2. Prepare Case Studies and Examples

Highlight your analytical skills by preparing case studies or examples of successful investment decisions.

- Demonstrate your ability to analyze financial data, identify investment opportunities, and make sound recommendations.

- Quantify your results whenever possible to showcase your impact on client portfolios.

3. Practice Behavioral Interview Questions

Prepare for behavioral interview questions that assess your teamwork, communication skills, and problem-solving abilities.

- Use the STAR method (Situation, Task, Action, Result) to answer behavioral questions effectively.

- Focus on specific examples that highlight your relevant skills and experiences.

4. Ask Thoughtful Questions

Asking thoughtful questions at the end of the interview shows your interest in the position and the firm.

- Ask about the firm’s investment process, risk management strategies, and growth plans.

- Inquire about the opportunities for professional development and career advancement.

5. Follow Up and Thank the Interviewers

Send a thank-you note to each interviewer within 24 hours of the interview.

- Reiterate your interest in the position and thank them for their time.

- If appropriate, address any specific points or questions that arose during the interview.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Senior Investment Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!