Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Vice President, Fixed Income interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Vice President, Fixed Income so you can tailor your answers to impress potential employers.

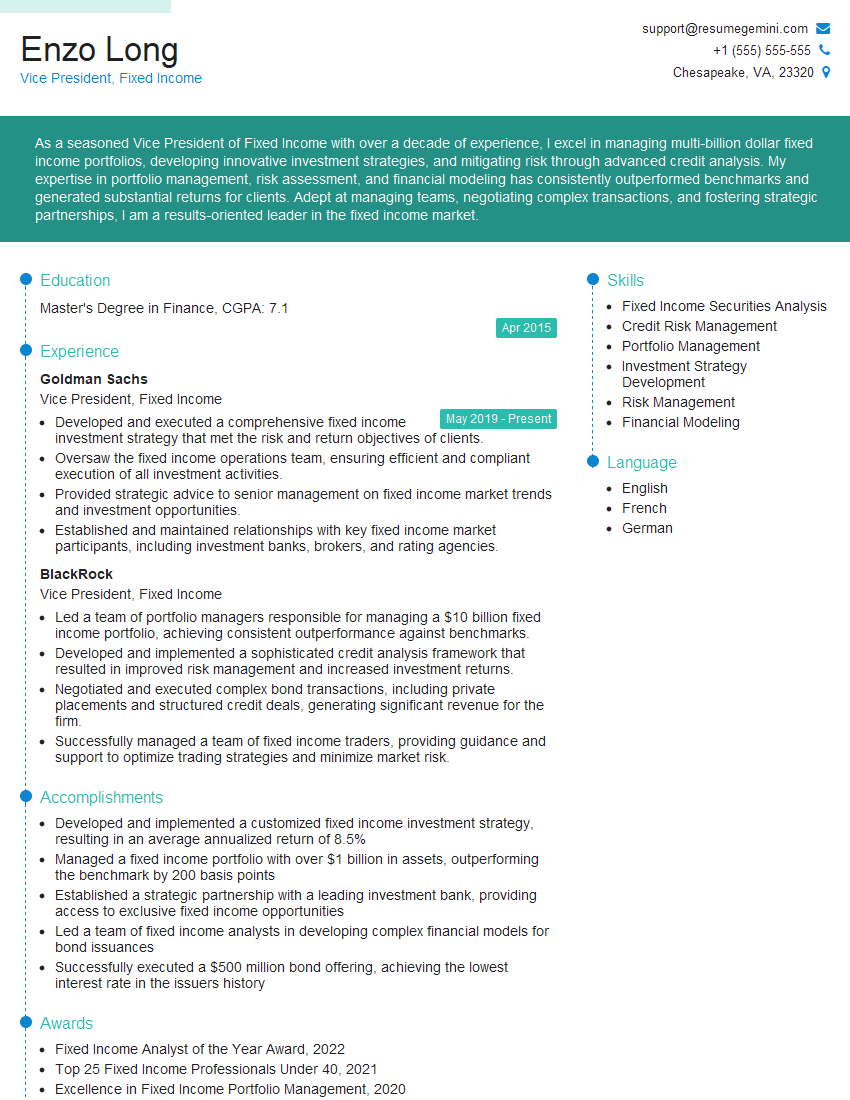

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Vice President, Fixed Income

1. Describe the key considerations for managing a fixed income portfolio during periods of rising interest rates?

Sample Answer: * Interest Rate Sensitivity: Assess the duration and convexity of the portfolio to manage interest rate risk. * Credit Risk: Evaluate the creditworthiness of issuers to minimize defaults and downgrades. * Yield Curve Positioning: Adjust the portfolio’s maturity profile to take advantage of yield curve shifts. * Investment Grade Flexibility: Increase exposure to higher-rated bonds to reduce interest rate volatility. * High-Yield Opportunities: Explore opportunities in high-yield bonds with lower interest rate sensitivity. * Active Management: Implement strategies such as barbell positioning and laddering to mitigate interest rate fluctuations.

2. Explain the process for valuing fixed income securities and discuss the various factors that affect their pricing.

Market Factors

- Interest rates

- Inflation expectations

- Economic conditions

Bond Factors

- Coupon rate

- Maturity

- Credit quality

Valuation Methods

- Present Value Analysis

- Yield-to-Maturity (YTM)

- Modified Duration

3. Describe the different types of fixed income instruments and how they can be used to meet specific investment objectives.

Types of Fixed Income Instruments: * Bonds * Notes * Certificates of Deposit (CDs) * Commercial Paper * Money Market Instruments Investment Objectives: * Income: Bonds with high coupon rates and short maturities * Growth: Bonds with lower coupon rates and longer maturities * Preservation: Money market instruments and short-term CDs * Diversification: Diversify across different issuers, sectors, and maturities

4. Discuss the role of credit analysis in fixed income investing and explain how you evaluate the creditworthiness of an issuer.

- Financial Analysis: Analyze financial statements to assess profitability, solvency, and liquidity.

- Industry Analysis: Understand the issuer’s industry dynamics, competitive environment, and growth potential.

- Management Analysis: Evaluate the competence and experience of the management team.

- Credit Rating Agencies: Consider ratings from reputable agencies, but conduct independent analysis to form a comprehensive view.

5. Explain the concept of yield curve management and discuss how it can be used to enhance portfolio returns.

- Bullish Yield Curve: Interest rates expected to rise; invest in shorter-term bonds to lock in lower rates.

- Flat Yield Curve: Interest rates expected to remain stable; invest in intermediate-term bonds to balance risk and return.

- Bearish Yield Curve: Interest rates expected to fall; invest in longer-term bonds to benefit from potential capital appreciation.

6. How do you approach risk management in fixed income investing?

- Diversification: Diversify across issuers, sectors, maturities, and credit ratings.

- Duration Management: Manage interest rate risk by adjusting the portfolio’s duration.

- Credit Risk Management: Monitor issuer creditworthiness and implement strategies to mitigate default risk.

- Stress Testing: Conduct simulations to assess the portfolio’s resilience under various market conditions.

7. Describe the different types of fixed income investment vehicles and explain their advantages and disadvantages.

Types of Fixed Income Vehicles: * Mutual Funds: Diversified portfolios of bonds managed by professional fund managers. * ETFs: Exchange-traded funds that track fixed income indices. * Closed-End Funds: Fixed income funds that are not continuously available for redemption. * Structured Products: Complex investments that combine fixed income and other asset classes. Advantages and Disadvantages: * Mutual Funds: Diversification, professional management; may have higher expenses. * ETFs: Intraday liquidity, low expenses; may lack diversification. * Closed-End Funds: Fixed number of shares, potential for discounts or premiums to NAV. * Structured Products: Enhanced returns or income; complex and may involve higher risk.

8. Discuss the challenges and opportunities in the current fixed income market environment.

Challenges

- Low interest rates

- Rising inflation

- Geopolitical uncertainty

Opportunities

- High-yield bonds

- Emerging market bonds

- Diversification strategies

9. Describe your experience in fixed income trading and explain how you have successfully navigated different market conditions.

- Experiences in trading various fixed income instruments

- Key market insights and successful trading strategies

- Handling of market volatility and risk management

- Quantifiable results achieved

10. How do you stay abreast of the latest developments and trends in the fixed income market?

- Industry publications and research reports

- Conferences and networking events

- Data analysis and market surveillance tools

- Consultation with industry experts

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Vice President, Fixed Income.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Vice President, Fixed Income‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Vice President of Fixed Income plays a critical role in managing and overseeing the investment activities of the company’s fixed income portfolio. Key responsibilities include:

1. Portfolio Management

Develop and implement investment strategies for fixed income portfolios, including bonds, notes, and other debt instruments

- Analyze market trends and economic data to make informed investment decisions

- Manage risk by diversifying investments and implementing hedging strategies

2. Fund Raising

Raise capital from investors to fund fixed income investments

- Develop marketing materials and present to potential investors

- Build and maintain relationships with investors

3. Team Management

Lead and manage a team of fixed income analysts and portfolio managers

- Provide guidance and support to team members

- Evaluate and provide performance feedback

4. Reporting

Report on portfolio performance to investors and senior management

- Prepare and present regular reports on investment strategies and results

- Respond to investor inquiries and provide updates on market conditions

Interview Tips

To ace the interview for the Vice President of Fixed Income position, here are some tips:

1. Research the Company and Position

Thoroughly research the company’s fixed income investment strategies, market positioning, and recent performance. Understand the scope and responsibilities of the Vice President role.

- Visit the company’s website and read its financial reports.

- Follow the company on social media and industry publications.

2. Highlight Your Experience and Skills

Emphasize your experience in fixed income portfolio management, fund raising, and team leadership. Quantify your accomplishments and provide specific examples of your success.

- Example: “In my previous role, I managed a fixed income portfolio of over $1 billion and achieved an annual return of 8%, consistently outperforming the benchmark.”

3. Demonstrate Your Knowledge of the Fixed Income Market

Show your expertise in the fixed income market by discussing your understanding of market trends, economic factors, and investment strategies. Share your insights and provide analysis on current market conditions.

- Example: “I believe that the rising interest rate environment will present both challenges and opportunities for fixed income investors. I have developed a strategy to navigate this environment by investing in high-quality bonds with short durations.”

4. Prepare for Behavioral Questions

Be prepared to answer behavioral questions that assess your leadership style, problem-solving abilities, and teamwork skills. Use the STAR method (Situation, Task, Action, Result) to structure your responses.

- Example: “Tell me about a time you faced a difficult challenge. How did you handle it and what was the outcome?”

5. Ask Thoughtful Questions

Ask thoughtful questions to demonstrate your interest in the position and the company. This shows that you are engaged and have taken the time to prepare for the interview.

- Example: “I am curious about the company’s plans for expanding its fixed income product offerings. Can you share more about this strategy?”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Vice President, Fixed Income interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!