Feeling lost in a sea of interview questions? Landed that dream interview for Broker but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Broker interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

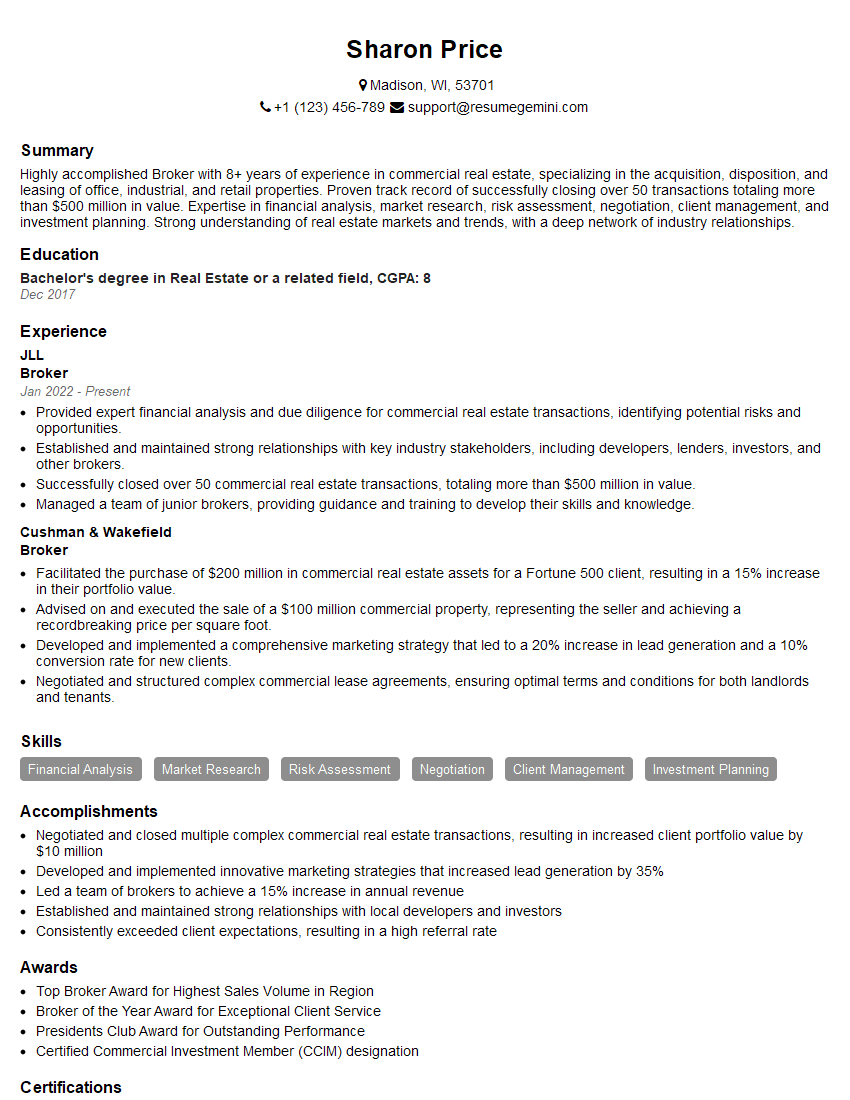

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Broker

1. What are the key responsibilities of a Broker?

As a Broker, my responsibilities would encompass:

- Acting as an intermediary between buyers and sellers, facilitating the exchange of goods and services.

- Matching the needs of clients with suitable financial products or services.

- Providing expert advice and guidance to clients on financial matters.

- Negotiating the best possible terms and conditions for clients.

- Executing trades on behalf of clients.

2. Describe the different types of brokerage firms and their specialties.

- Full-service brokerage firms offer a wide range of financial services, including investment advice, portfolio management, and financial planning.

- Discount brokerage firms provide basic trading services at a lower cost.

- Online brokerage firms allow clients to trade online without the need for a broker.

- Independent brokerage firms are not affiliated with any particular financial institution.

3. What are the key factors to consider when choosing a brokerage firm?

When choosing a brokerage firm, it is important to consider the following factors:

- Fees and commissions: Different brokerage firms charge different fees for their services.

- Services offered: Some brokerage firms offer a wider range of services than others.

- Experience and reputation: It is important to choose a brokerage firm with a good track record and reputation.

- Customer service: The brokerage firm should provide excellent customer service.

- Online trading platform: If you plan to trade online, you should choose a brokerage firm with a user-friendly online trading platform.

4. What are the different types of financial instruments that a Broker can trade?

As a Broker, I have experience trading various types of financial instruments, including:

- Stocks: Stocks represent ownership in a company.

- Bonds: Bonds are loans that investors make to companies or governments.

- Mutual funds: Mutual funds are baskets of stocks or bonds that are managed by a professional.

- ETFs: ETFs are exchange-traded funds that track the performance of a particular index or sector.

- Options: Options give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date.

- Futures: Futures are contracts to buy or sell an underlying asset at a specified price on a future date.

5. What are the different trading strategies that a Broker can use?

As a Broker, I am familiar with a variety of trading strategies, including:

- Day trading: Day traders buy and sell stocks within the same trading day.

- Swing trading: Swing traders hold stocks for a few days or weeks.

- Trend trading: Trend traders follow the trend of the market.

- Value investing: Value investors buy stocks that are trading at a discount to their intrinsic value.

- Growth investing: Growth investors buy stocks that are expected to grow at a faster rate than the market.

6. What is the importance of risk management in trading?

Risk management is essential in trading to protect capital and minimize losses.

- Identify potential risks

- Assess the probability of the risks occurring

- Develop strategies to mitigate the risks

- Monitor the risks and make adjustments as needed

7. What are the qualities and skills that successful Brokers possess?

Successful Brokers possess the following qualities and skills:

- Communication skills: Brokers must be able to communicate clearly and effectively with clients.

- Analytical skills: Brokers must be able to analyze financial data and make sound investment decisions.

- Interpersonal skills: Brokers must be able to build rapport with clients and understand their financial needs.

- Negotiation skills: Brokers must be able to negotiate the best possible terms for their clients.

- Market knowledge: Brokers must have a deep understanding of the financial markets.

8. What are the challenges facing the brokerage industry?

The brokerage industry faces a number of challenges, including:

- Competition: The brokerage industry is a competitive industry.

- Regulation: The brokerage industry is heavily regulated.

- Technology: The brokerage industry is constantly evolving due to advances in technology.

- Economic conditions: The brokerage industry is affected by economic conditions.

9. How do you stay up-to-date on the latest trends in the financial markets?

I stay up-to-date on the latest trends in the financial markets through a variety of methods, including:

- Reading financial news and analysis

- Attending conferences and webinars

- Taking continuing education courses

- Networking with other professionals in the industry

10. What is your investment philosophy?

My investment philosophy is based on the following principles:

- Long-term investing: I believe in investing for the long term.

- Diversification: I believe in diversifying my investments across a variety of asset classes.

- Value investing: I believe in buying stocks that are trading at a discount to their intrinsic value.

- Risk management: I believe in managing risk carefully.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Broker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Broker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Brokers play a crucial role in facilitating financial transactions and providing advisory services. Their primary responsibilities include:

1. Transaction Management

Brokers act as intermediaries between buyers and sellers in various financial markets, including stocks, bonds, commodities, and real estate. They execute trades, negotiate prices, and ensure the smooth settlement of transactions.

- Understanding and analyzing market trends and fluctuations.

- Matching buyers and sellers based on their requirements.

- Negotiating prices, quantities, and delivery terms.

- Finalizing and documenting transactions.

2. Market Analysis and Research

Brokers stay abreast of economic and financial market developments. They conduct research to identify investment opportunities, assess the risks associated with different assets, and make recommendations to their clients.

- Monitoring economic indicators, company news, and industry trends.

- Using analytical tools and models to evaluate asset performance.

- Identifying potential investments that align with clients’ financial goals and risk tolerance.

3. Consulting and Advisory Services

Brokers provide expert advice and guidance to their clients on financial planning, investment strategies, and risk management. They help clients make informed decisions based on their individual circumstances and objectives.

- Assessing clients’ financial needs and goals.

- Developing and implementing customized investment portfolios.

- Providing ongoing advice on investment performance and risk management.

4. Relationship Management

Brokers foster long-term relationships with their clients. They are responsive to client inquiries, provide regular updates, and build trust through ethical and transparent practices.

- Maintaining open lines of communication with clients.

- Addressing client concerns and resolving issues promptly.

- Providing personalized service and tailoring advice to meet individual client needs.

Interview Tips

To ace the interview for a Broker position, candidates should prepare thoroughly and showcase their knowledge, skills, and experience.

1. Research the Company and Role

Demonstrate your interest by researching the company’s history, industry, and specific role you are applying for. Understand the company’s values, goals, and the responsibilities associated with the position.

2. Practice Common Interview Questions

Prepare for common interview questions such as:

- Tell us about your experience in the brokerage industry.

- Describe a complex transaction you managed and how you ensured a successful outcome.

- How do you stay up-to-date on market trends and financial regulations?

- Provide an example of how you provided valuable advice to a client.

3. Highlight Your Technical Skills

Emphasize your proficiency in financial software, analytical tools, and industry-specific knowledge. Showcase your ability to interpret financial data, analyze market conditions, and make sound investment recommendations.

4. Showcase Your Relationship-Building Abilities

Brokers are essentially relationship managers. Highlight your interpersonal skills, ability to build rapport, and maintain long-lasting relationships with clients. Share examples of how you have effectively managed client expectations and resolved any issues.

5. Ask Thoughtful Questions

Asking intelligent questions not only demonstrates your interest but also allows you to gather more information about the company and the role. Prepare thoughtful questions that align with your research and show your understanding of the industry.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Broker interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.