Are you gearing up for a career in Claims Support Specialist? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Claims Support Specialist and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

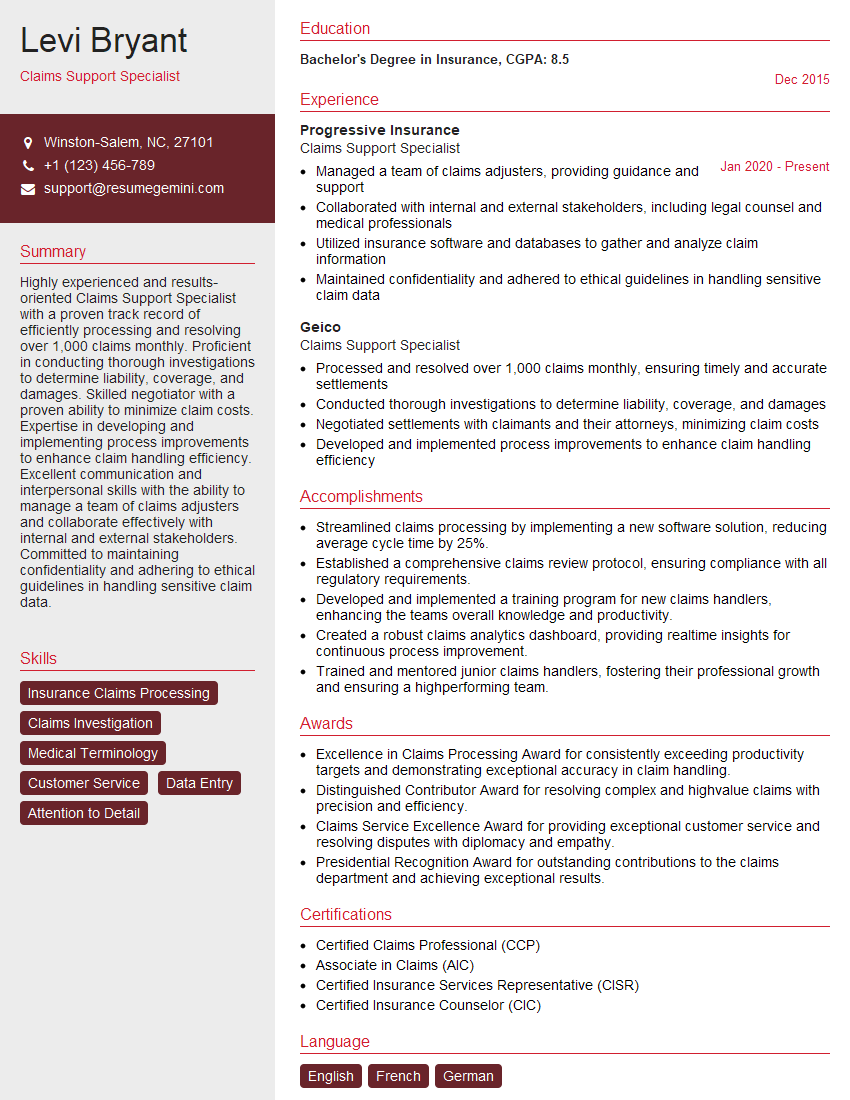

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Support Specialist

1. Walk me through the process of handling an incoming claim from the initial report to the final settlement.

As a Claims Support Specialist, I would adhere to the following process:

- Claim Intake: Receive and register the claim, verify coverage, and assign a claim number.

- Assessment and Investigation: Gather and review relevant documentation, contact the claimant to obtain details, and conduct necessary investigations.

- Claim Adjustment: Determine liability, calculate damages, negotiate settlements, and issue payment.

- Claim Closure: Finalize settlement, close the claim, and maintain records for future reference.

2. What are the different types of claims you have handled and what were the challenges associated with each?

Auto Claims

- Challenges: Determining fault, assessing property damage, negotiating with multiple parties.

Homeowners’ Claims

- Challenges: Coverage disputes, complex property damage, coordinating repairs.

Commercial Liability Claims

- Challenges: High-stakes litigation, managing large claims, handling sensitive information.

3. How do you stay up-to-date with changes in claims legislation and regulations?

I actively monitor industry publications, attend seminars and webinars, and engage in online forums to stay informed about:

- Legal updates and court rulings that impact claims handling.

- Regulatory changes related to insurance coverage and claim settlement.

- Best practices and emerging trends in claims management.

4. What are the key performance indicators (KPIs) you track to measure your effectiveness as a Claims Support Specialist?

- Claim Cycle Time: Average time to process and settle claims.

- Customer Satisfaction: Feedback from claimants on their experience.

- Claims Accuracy: Percentage of claims processed with no errors.

- Compliance: Adherence to all relevant laws and regulations.

5. How do you prioritize tasks and manage your workload in a high-volume claims environment?

I prioritize tasks based on urgency, impact, and deadlines. I use a combination of techniques to manage my workload effectively:

- Prioritization Matrix: Categorizing tasks based on importance and urgency.

- Delegation: Assigning appropriate tasks to support staff when possible.

- Time Management: Blocking off time for specific tasks and minimizing distractions.

- Automation: Utilizing tools to streamline repetitive processes and free up time.

6. What is your experience in using claims management software?

I have extensive experience with various claims management software systems, including:

- InsuranceCore: Policy administration, claims processing, and reporting.

- Guidewire ClaimCenter: Comprehensive end-to-end claims management.

- Mitratech PolicyMaster: Claims workflow automation and document management.

I am proficient in using these systems to track claims, manage communications, process payments, and generate reports.

7. How do you ensure the confidentiality of sensitive claimant information?

I strictly adhere to all regulations and company policies regarding data privacy and confidentiality. I follow these practices:

- Secure Access: Only authorized personnel have access to claimant information.

- Encryption: Sensitive data is encrypted during transmission and storage.

- Limited Sharing: I only share claimant information on a need-to-know basis.

- Regular Audits: I conduct regular audits to ensure compliance with confidentiality standards.

8. Describe a situation where you had to deal with a difficult claimant. How did you handle it?

In one instance, I encountered a claimant who was highly emotional and demanding. I remained calm and professional, and followed these steps:

- Active Listening: I allowed the claimant to express their concerns without interrupting.

- Empathy: I acknowledged their frustration and expressed my understanding of their situation.

- Communication: I clearly explained the process and answered their questions honestly.

- Negotiation: I worked with the claimant to find a mutually acceptable resolution that met their needs.

Through active listening and empathetic communication, I was able to resolve the issue and maintain a positive relationship with the claimant.

9. What are your strengths and weaknesses as a Claims Support Specialist?

Strengths:

- Excellent communication and interpersonal skills

- Strong attention to detail and accuracy

- Proficient in claims management software

- Ability to prioritize and manage a heavy workload

Weaknesses:

- New to the specific policies and procedures of this organization

- Limited experience in handling complex or high-value claims

10. Why are you interested in working at our company, and what can you bring to our team?

I am drawn to your company’s commitment to customer satisfaction and innovation in the claims industry. I believe my skills and experience in claims support would be a valuable asset to your team:

- Proven ability to handle a high volume of claims with accuracy and efficiency

- Dedication to providing exceptional customer service and resolving claims promptly

- Strong work ethic, reliability, and a willingness to go the extra mile

- Enthusiasm for the insurance industry and a desire to continue learning and growing

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Support Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Support Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Claims Support Specialist is a crucial member of an insurance team, providing administrative and technical support to adjusters and other claims professionals. Their core responsibilities include:

1. Claims Processing and Documentation

Processing claims, ensuring accuracy and completeness of documentation.

- Reviewing and analyzing claims to determine eligibility and coverage.

- Collecting and organizing supporting documents, such as medical records and repair estimates.

2. Communication and Customer Service

Communicating with policyholders, claimants, healthcare providers, and repair shops.

- Answering inquiries, providing claim status updates, and resolving issues.

- Negotiating settlements and ensuring customer satisfaction.

3. Data Entry and System Management

Entering claim data accurately and efficiently; maintaining and updating claim files.

- Utilizing insurance software and databases to process claims.

- Retrieving and organizing claim-related information.

4. Policy and Procedure Compliance

Understanding and adhering to insurance policies, procedures, and regulations.

- Ensuring claims are processed in accordance with company guidelines.

- Staying updated on industry best practices and regulatory changes.

Interview Tips

By preparing effectively for your interview for a Claims Support Specialist position, you can demonstrate your qualifications and enthusiasm for the role.

1. Research the Role and Company

Thoroughly research the job description and the insurance company’s website.

- Understand the specific responsibilities and expectations of the role.

- Learn about the company’s culture, values, and industry reputation.

2. Highlight Relevant Skills and Experience

Showcase your relevant skills and experience, such as:

- Claims processing, data entry, and communication abilities.

- Knowledge of insurance policies and procedures.

- Experience in using insurance software and databases.

3. Prepare for Common Interview Questions

Anticipate common interview questions and prepare thoughtful responses.

- Tell us about your experience in claims processing.

- How do you prioritize and manage multiple tasks in a fast-paced environment?

- What strategies do you use to provide excellent customer service?

4. Practice Your Answers

Practice answering interview questions out loud to enhance your delivery and confidence.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Quantify your accomplishments with specific data whenever possible.

5. Dress Professionally and Arrive on Time

First impressions matter; dress professionally and arrive on time for your interview.

- Choose attire that is appropriate for an office setting.

- Plan your route in advance to avoid any delays.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claims Support Specialist interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.