Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Check Processor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

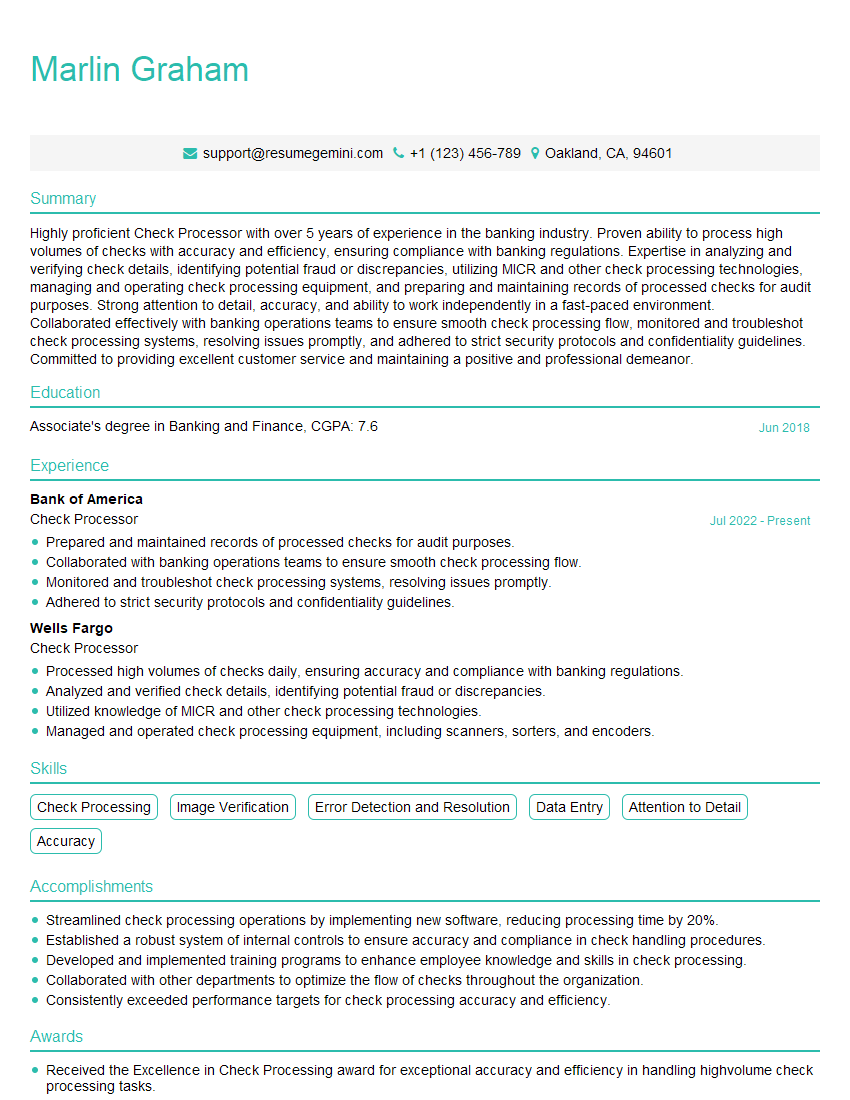

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Check Processor

1. How do you determine if a check is counterfeit?

To determine if a check is counterfeit, I would examine the following factors:

- Paper Stock: Counterfeit checks may use cheap, thin paper that feels different from authentic checks.

- Security Features: Legitimate checks often have watermarks, security threads, and other anti-counterfeiting measures that may be absent from counterfeits.

- Printing Quality: Counterfeits may have blurry or uneven printing, with misaligned text or images.

- Magnetic Ink Character Recognition (MICR): The MICR line at the bottom of the check should be crisp and clear. Counterfeits may have smudged or distorted characters.

- Check Number and Sequence: I would verify that the check number and sequence match the bank’s records to ensure it’s not a stolen or forged check.

2. What steps do you take to ensure accuracy in check processing?

Attention to Detail:

- I meticulously review each check for completeness, including the amount, date, payee, and signature.

- I ensure that the amounts match both the check itself and any accompanying documentation.

Verification Processes:

- I cross-reference checks against account records to identify any potential discrepancies or fraudulent activity.

- I verify account numbers and ensure that funds are available to cover the check amount.

3. How would you handle a situation where a customer disputes the validity of a processed check?

In such a scenario, I would:

- Communicate with the Customer: I would promptly contact the customer to obtain their concerns and gather any supporting documentation.

- Investigate the Claim: I would thoroughly review the check in question, compare it to the original image, and examine any relevant account records.

- Resolve the Dispute: Based on my findings, I would either confirm the validity of the check or work with the customer to resolve the issue amicably.

4. How do you stay up to date with the latest banking regulations and best practices in check processing?

To ensure compliance and efficiency, I:

- Attend Industry Events and Trainings: I participate in workshops, seminars, and conferences to gain knowledge about regulatory updates and industry best practices.

- Research and Study: I regularly read industry publications, consult with experts, and stay informed on regulatory changes.

- Network with Colleagues: I maintain connections with other professionals in the field to exchange insights and stay abreast of emerging trends.

5. Describe your experience in using check processing software.

Throughout my career, I have extensively used check processing software, including [Software Name]. My responsibilities involved:

- Inputting and Validating Check Data: I accurately entered and verified check information, such as amounts, dates, and account numbers.

- Reconciling Processed Checks: I reconciled processed checks with corresponding account records to ensure accuracy and completeness.

- Managing Exceptions: I identified and resolved exceptions, such as missing signatures or insufficient funds, promptly.

6. How do you prioritize your workload and meet deadlines while maintaining accuracy?

To manage my workload effectively, I:

- Prioritize Tasks: I assess the importance and urgency of tasks, focusing on completing critical tasks first.

- Time Management: I allocate specific time slots for different tasks, ensuring that I have sufficient time to complete each task accurately.

- Automation: I utilize automation tools and software to streamline processes and reduce manual effort, allowing me to focus on complex tasks.

- Delegation: When necessary, I delegate tasks to colleagues to ensure timely completion while maintaining quality standards.

7. How do you handle high-volume check processing and ensure efficiency?

To handle high-volume check processing efficiently, I employ the following strategies:

- Batch Processing: I group similar checks into batches to streamline input and processing.

- Automated Sorting: I use automated sorting machines to quickly and accurately sort checks based on pre-defined criteria.

- Optimized Workspace: I maintain an organized workstation and utilize ergonomic equipment to maximize productivity.

- Teamwork: I collaborate with colleagues to distribute workload and expedite processing.

8. Describe your understanding of the Check Clearing for the 21st Century Act (Check 21).

Check 21 is a significant legislation that transformed check processing by:

- Allowing for Check Truncation: Banks can now capture and transmit check images electronically, eliminating the need for physical checks to be exchanged.

- Establishing Legal Equivalency: Electronic check images have the same legal status as original paper checks.

- Reducing Processing Time and Costs: Check truncation streamlines processing, reduces transportation costs, and improves efficiency.

9. How do you stay motivated and maintain a positive attitude in a repetitive work environment?

To stay motivated and positive in a repetitive work environment, I:

- Set Personal Goals: I establish performance targets to challenge myself and maintain a sense of accomplishment.

- Seek Recognition: I acknowledge my accomplishments and seek recognition from others to boost my morale.

- Maintain a Positive Mindset: I focus on the importance and impact of my work, reminding myself that I am contributing to the financial system.

- Engage with Colleagues: I socialize and collaborate with colleagues to create a supportive and enjoyable work atmosphere.

10. Why are you interested in working as a Check Processor for our company?

I am eager to join your esteemed company as a Check Processor for the following reasons:

- Industry Reputation: Your company’s reputation as a leader in the banking industry is highly regarded.

- Commitment to Excellence: I am impressed by your company’s commitment to delivering exceptional customer service and maintaining high-quality standards.

- Growth Opportunities: I believe that my skills and experience would be a valuable asset to your team, and I am confident that I can contribute to the company’s continued success.

- Personal Career Goals: This role aligns with my long-term career aspirations, and I am excited about the opportunity to learn and grow within your organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Check Processor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Check Processor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Check Processor plays a vital role in ensuring the smooth processing and handling of financial transactions via checks. Here are the key responsibilities involved:

1. Check Processing

Check Processors are responsible for receiving checks from various sources, such as banks, businesses, and individuals. They verify the checks’ authenticity, accuracy, and completeness.

- Validate check details, including account numbers, amounts, and signatures.

- Encode checks into electronic format using optical character recognition (OCR) or other scanning devices.

- Sort and batch checks based on specific criteria for further processing.

2. Data Entry

Check Processors may also be responsible for entering check data into a computerized system. This includes capturing information such as account numbers, amounts, and transaction codes.

- Key in check data accurately and efficiently into designated systems.

- Verify and reconcile data for accuracy and completeness.

- Resolve discrepancies and errors in data entry.

3. Account Maintenance

Some Check Processors may also assist with opening and maintaining customer accounts. They may verify customer information, process account transactions, and respond to customer inquiries.

- Verify customer identification and collect necessary documentation.

- Open new customer accounts and process account updates.

- Provide accurate and timely responses to customer inquiries.

4. Quality Control

Check Processors play a crucial role in maintaining the accuracy and integrity of check processing operations. They are responsible for ensuring that all checks are processed correctly and in compliance with established procedures.

- Monitor and review check processing operations for errors and discrepancies.

- Identify and resolve any issues that may arise during check processing.

- Maintain high standards of accuracy and efficiency in all aspects of check processing.

Interview Tips

Preparing thoroughly for an interview can significantly increase your chances of success. Here are some tips to help you ace your Check Processor interview:

1. Research the Company and Position

Before the interview, take the time to learn about the company, its values, and the specific requirements of the Check Processor position. This will demonstrate your interest and enthusiasm for the opportunity.

- Visit the company’s website to gather information about their business, products, and services.

- Review the job description thoroughly to understand the key responsibilities and qualifications.

- Research industry trends and best practices related to check processing.

2. Highlight Your Skills and Experience

During the interview, emphasize your relevant skills and experience that align with the key responsibilities of a Check Processor. Use specific examples to illustrate your abilities.

- Showcase your proficiency in data entry and attention to detail.

- Provide examples of your experience in check processing or similar financial transactions.

- Discuss your skills in customer service and problem-solving.

3. Practice Answering Common Interview Questions

It’s helpful to anticipate common interview questions and prepare thoughtful answers. Practicing your responses will boost your confidence and help you articulate your strengths effectively.

- Prepare answers to questions about your experience, skills, and motivation.

- Research typical behavioral interview questions and develop examples from your work history.

- Consider questions you may have for the interviewer to show your engagement.

4. Dress Professionally and Arrive on Time

First impressions matter, so make sure to dress professionally for the interview. Arrive on time to demonstrate your punctuality and respect for the interviewer’s schedule.

- Choose business attire that is clean, pressed, and appropriate for an office setting.

- Plan your route and allow ample time for travel to avoid being late.

- Be courteous and respectful to everyone you encounter during the interview process.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Check Processor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!