Feeling lost in a sea of interview questions? Landed that dream interview for Merchant but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Merchant interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

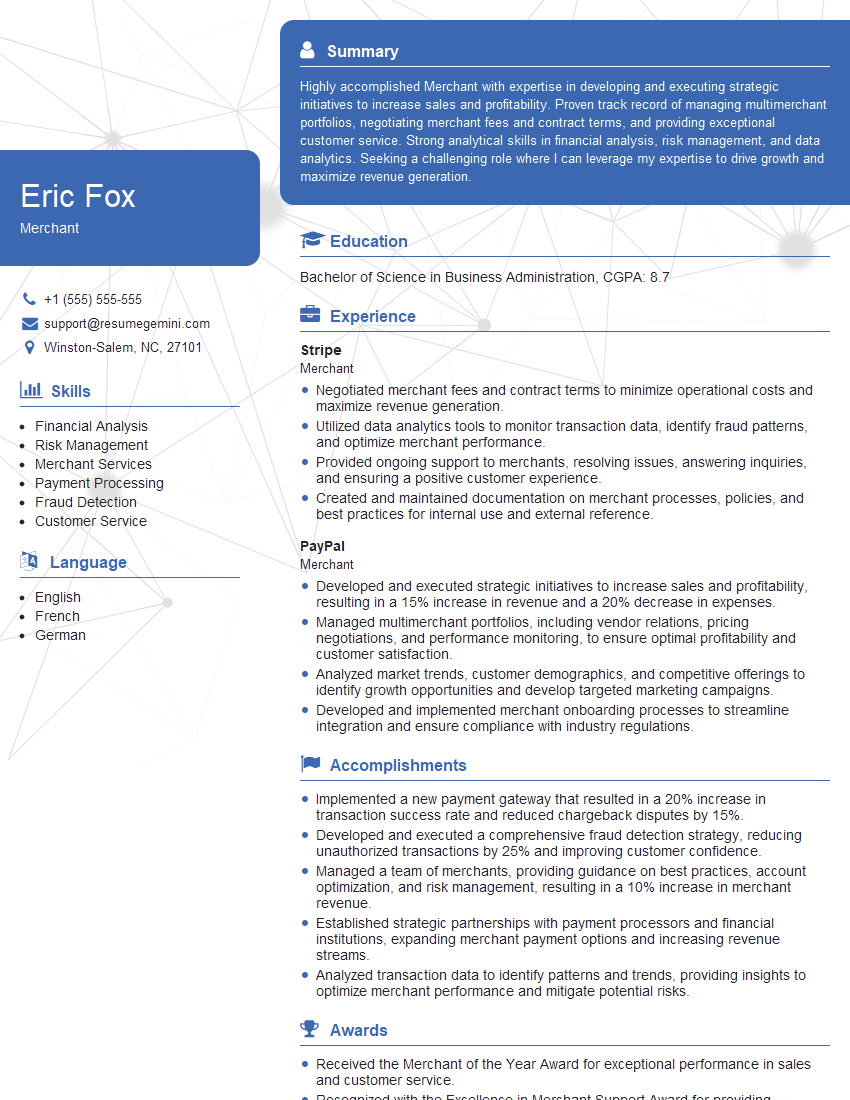

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Merchant

1. Describe the process of generating a customer statement.

The process of generating a customer statement involves several steps:

- Data Collection: Gather customer account data, including transaction history, payments, and outstanding balances.

- Statement Calculation: Calculate the current balance, interest charges, and other relevant details.

- Formatting and Design: Design the statement layout, including customer information, account details, and transaction summaries.

- Data Integration: Integrate data from various sources, such as transaction databases and payment systems.

- Quality Assurance: Review and verify the statement for accuracy and completeness before sending it to the customer.

2. Explain the different types of payment processing systems.

Payment processing systems can be classified into several types:

- Manual Processing: Payments are received and processed manually without automated systems.

- Automated Clearing House (ACH): Electronic transfer of funds between banks accounts.

- Credit and Debit Card Processing: Processing transactions using payment cards such as Visa, Mastercard, and American Express.

- Electronic Wallets: Digital platforms for storing and transferring funds, e.g., PayPal and Apple Pay.

- Mobile Payments: Payments made through mobile devices using NFC, QR codes, or mobile apps.

3. Discuss the key performance indicators (KPIs) for measuring merchant operations.

KPIs for merchant operations include:

- Transaction Volume: Number of transactions processed per period.

- Average Transaction Value: Average value of transactions processed.

- Authorisation Rate: Percentage of transactions approved by payment processors.

- Chargeback Rate: Percentage of transactions disputed by customers.

- Customer Satisfaction: Measurement of customer satisfaction with payment processes.

4. Describe the process of reconciling merchant accounts.

Reconciling merchant accounts involves matching transactions processed by the merchant with corresponding records from the payment processor:

- Data Collection: Gather transaction data from merchant systems and payment processors.

- Transaction Matching: Compare transactions from both sources to identify matches.

- Discrepancy Investigation: Investigate and resolve any unmatched or mismatched transactions.

- Statement Verification: Review and verify the reconciliation statement against expected balances.

- Documentation: Record and document the reconciliation process and findings.

5. Explain the concepts of interchange fees and merchant discounts.

Interchange Fees: Fees paid by merchants to issuers of payment cards when customers make purchases.

Merchant Discounts: Discounts offered by payment processors to merchants based on the volume and type of transactions processed.

6. Discuss the security measures implemented by merchants to protect customer data.

Security measures for merchant data protection include:

- PCI DSS Compliance: Adherence to Payment Card Industry Data Security Standard.

- Encryption: Encrypting sensitive customer data, such as credit card numbers and personal information.

- Tokenization: Replacing sensitive data with unique tokens for secure storage and transmission.

- Fraud Detection and Prevention: Implementing systems to detect and prevent fraudulent transactions.

- Regular Security Audits: Conducting regular audits to identify and address security vulnerabilities.

7. Outline the process for handling merchant disputes.

Merchant dispute process involves:

- Dispute Notification: Receiving and processing dispute notifications from customers or issuers.

- Investigation: Conducting thorough investigations to gather evidence and determine the validity of the dispute.

- Response Preparation: Preparing a response to the dispute, including supporting documentation.

- Negotiation: Engaging in negotiations with the customer or issuer to reach a resolution.

- Resolution: Resolving the dispute and processing any necessary adjustments.

8. Describe the strategies for reducing merchant risk.

Strategies for reducing merchant risk include:

- Fraud Detection and Prevention: Implementing systems to detect and prevent fraudulent transactions.

- Customer Authentication: Verifying customer identity through methods such as OTPs and CVV codes.

- Risk-Based Pricing: Adjusting payment processing fees based on the perceived risk of transactions.

- Compliance with Regulations: Ensuring adherence to industry regulations and standards, such as PCI DSS.

- Partnerships with Fraud Prevention Providers: Collaborating with third-party services to enhance fraud detection capabilities.

9. Discuss the role of chargebacks in merchant operations.

Chargebacks are disputes initiated by customers, resulting in the reversal of transactions:

- Impact on Merchants: Chargebacks can impact merchants’ revenue, reputation, and processing fees.

- Reasons for Chargebacks: Common reasons include unauthorized transactions, product or service issues, and disputes over quality.

- Merchant Liability: Merchants are generally liable for chargebacks unless they can prove otherwise.

10. Explain how merchant acquirers facilitate payment processing.

Merchant acquirers play a crucial role in payment processing:

- Account Provision: Providing merchants with merchant accounts to receive payments.

- Transaction Authorisation: Authorizing and processing customer transactions.

- Settlement: Transferring funds from customers’ accounts to merchants’ accounts.

- Customer Support: Assisting merchants with payment inquiries and disputes.

- Fraud Detection and Prevention: Collaborating with merchants to detect and prevent fraudulent transactions.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Merchant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Merchant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Merchants play a crucial role in the seamless functioning of e-commerce businesses. Here are some core responsibilities involved in this role:

1. Product Management

Ensuring the quality, availability, and pricing of products on online platforms.

- Managing product listings, descriptions, and images.

- Monitor inventory levels and optimizing product availability.

2. Order Processing and Fulfillment

Handling customer orders efficiently and ensuring timely delivery.

- Processing and managing orders from various sales channels.

- Collaborating with shipping carriers for smooth delivery.

3. Customer Service and Support

Providing excellent customer service to resolve queries and build customer relationships.

- Responding to customer inquiries via email, phone, or chat.

- Resolving issues related to orders, products, or delivery.

4. Marketing and Promotions

Implementing strategies to increase product visibility and drive sales.

- Creating and managing marketing campaigns on online platforms.

- Analyzing marketing data to optimize campaigns and improve performance.

Interview Tips

To ace your interview for a Merchant position, consider these valuable tips:

1. Research the Company and Role

Demonstrate your interest and preparation by thoroughly researching the company, its products, and the specific Merchant role.

- Visit the company website and social media pages.

- Read industry news and articles to stay up-to-date.

2. Practice Answering Common Questions

Prepare thoughtful answers to commonly asked interview questions related to your skills, experience, and industry knowledge.

- For example: “Tell me about your experience in managing e-commerce products.” “How do you handle customer complaints and resolve issues effectively?”

3. Highlight Your Skills and Experience

Emphasize your relevant skills and experience that align with the key job responsibilities. Use specific examples and quantify your accomplishments whenever possible.

- For example: “In my previous role, I increased product sales by 25% through effective marketing campaigns and product optimization.”

4. Be Prepared to Discuss Industry Trends

Show that you are up-to-date with the latest industry trends and developments. Discuss how these trends may impact the company and your role.

- For example: “I believe AI and machine learning are transforming the e-commerce industry. I am eager to explore how these technologies can enhance customer experiences and streamline operations.”

5. Ask Thoughtful Questions

Asking intelligent questions at the end of the interview demonstrates your engagement and interest. Prepare questions related to the company, the role, or industry best practices.

- For example: “What are the current strategic priorities for the e-commerce department?” “How does the company approach customer retention and loyalty?”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Merchant interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!