Are you gearing up for an interview for a Insurance Examining Clerk position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Insurance Examining Clerk and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

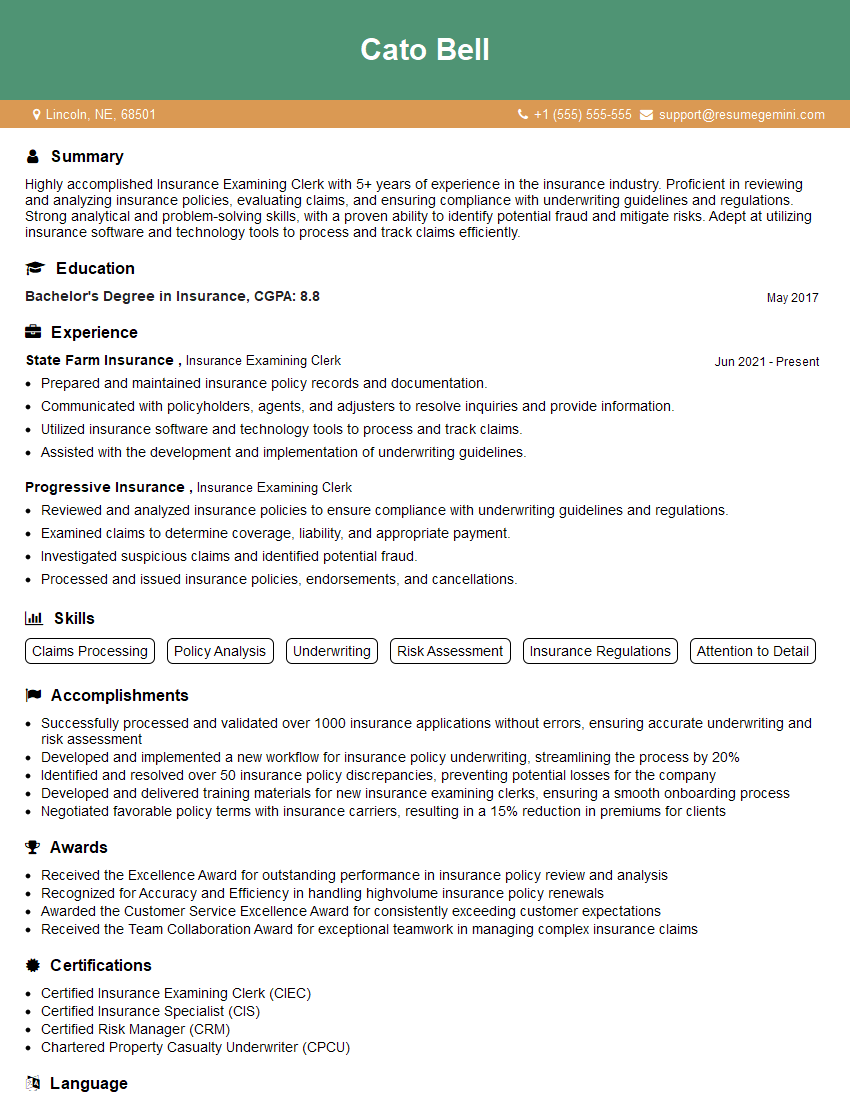

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Examining Clerk

1. Describe the key responsibilities of an Insurance Examining Clerk?

As an Insurance Examining Clerk, I would be responsible for:

- Examining insurance policies and applications for accuracy and completeness.

- Verifying coverage details, calculating premiums, and issuing policies.

- Processing claims, investigating losses, and determining coverage eligibility.

- Maintaining accurate records of insurance policies and claims.

- Providing customer service and assisting policyholders with insurance-related inquiries.

2. What types of insurance policies have you worked with in the past?

- Individual Life Insurance: Provides coverage to individuals in case of death.

- Group Life Insurance: Protects employees of a company in case of death.

- Health Insurance: Covers medical expenses incurred by the insured and their dependents.

- Dental Insurance: Covers dental procedures and treatments.

- Disability Insurance: Provides income replacement to individuals who are unable to work due to illness or injury.

3. What are the different types of claims that you have handled?

- Property Damage Claims: Damage to buildings, vehicles, or other property.

- Liability Claims: Injuries or damages caused to others by the policyholder.

- Health Claims: Expenses related to medical treatment, hospitalization, and prescriptions.

- Disability Claims: Loss of income due to illness or injury.

- Life Insurance Claims: Death benefits to beneficiaries.

4. How do you determine coverage eligibility?

I review the policyholder’s insurance policy to determine the specific terms and conditions of coverage. I also verify the accuracy of the information provided on the claim form, including the date of the loss, the cause of the loss, and the amount of the claim.

5. What are the key factors you consider when evaluating a claim?

When evaluating a claim, I consider the following factors:

- The policyholder’s coverage and eligibility.

- The cause and extent of the loss.

- The amount of the claim.

- Any applicable exclusions or limitations.

- The policyholder’s previous claims history.

6. How do you handle disputed claims?

In the event of a disputed claim, I would:

- Review the policy and all relevant documentation.

- Contact the policyholder to discuss the dispute.

- Gather additional information or evidence to support the claim.

- Consult with my supervisor or other experts as needed.

- Make a decision on the claim based on the evidence and applicable laws and regulations.

7. What software or systems are you proficient in?

- Insurance policy management systems

- Claims processing systems

- Microsoft Office Suite

- Customer relationship management (CRM) software

8. How do you stay up-to-date on changes in insurance regulations?

I regularly attend industry conferences, webinars, and training sessions to stay informed about changes in insurance regulations. I also subscribe to industry publications and newsletters to stay abreast of the latest developments.

9. What are your strengths as an Insurance Examining Clerk?

- Accuracy and attention to detail

- Strong analytical skills

- Excellent communication skills

- Understanding of insurance policies and regulations

- Ability to work independently and as part of a team

10. Why are you interested in working as an Insurance Examining Clerk for our company?

I am interested in working as an Insurance Examining Clerk for your company because I am passionate about the insurance industry and I am confident that my skills and experience would be a valuable asset to your team. I am eager to contribute to the success of your organization and to provide exceptional customer service to your policyholders.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Examining Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Examining Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Examining Clerks serve as the backbone of insurance operations, ensuring meticulous processing of insurance policies, claims, and related documents. Their key responsibilities involve:

1. Policy Processing

Meticulously reviewing and assessing insurance applications, verifying information, and ensuring completeness and accuracy.

- Analyzing risk factors, determining coverage eligibility, and assigning policy terms and premiums.

- Issuing policies, generating documentation, and maintaining records in compliance with company guidelines.

2. Claims Management

Evaluating claims, investigating circumstances, and assessing damages to determine coverage and payouts.

- Calculating claim amounts, processing payments, and ensuring timely settlement of claims.

- Communicating with policyholders, claimants, and other stakeholders to facilitate claim resolution.

3. Customer Service

Providing prompt and accurate customer support, resolving inquiries, and ensuring satisfaction with insurance products and services.

- Answering client questions, providing policy details, and assisting with account management.

- Handling complaints, addressing concerns, and working towards customer retention.

4. Document Management

Organizing, maintaining, and safeguarding insurance-related documents, including policies, claims files, and correspondence.

- Archiving and retrieving records efficiently to support business operations and regulatory compliance.

- Ensuring the confidentiality and integrity of sensitive customer information.

Interview Tips

To ace your Insurance Examining Clerk interview, consider these essential preparation tips:

1. Research the Company and Industry

Familiarize yourself with the insurance company’s products, services, and reputation. Understand the industry trends and regulatory landscape.

- Visit the company’s website, read news articles, and check social media for insights.

- Attend webinars or industry events to stay updated on insurance practices and best practices.

2. Highlight Relevant Skills and Experience

Emphasize your proficiency in policy processing, claims handling, and customer service. Showcase any transferable skills from previous roles.

- Quantify your accomplishments using specific metrics and examples to demonstrate your impact.

- Prepare examples of how you resolved complex claims, provided exceptional customer service, or streamlined processes.

3. Practice Answering Common Interview Questions

Anticipate common interview questions and prepare thoughtful responses. Here are some examples:

- Tell me about your experience in insurance policy processing.

- Describe a challenging claim you handled and how you resolved it.

- How do you prioritize multiple tasks and manage your workload effectively?

- Explain your understanding of insurance regulations and compliance.

4. Dress Professionally and Show Enthusiasm

Make a positive first impression by dressing appropriately and displaying a genuine interest in the opportunity.

- Choose business attire that is neat, clean, and fits well.

- Maintain eye contact, smile, and demonstrate a positive attitude throughout the interview.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance Examining Clerk interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.