Feeling lost in a sea of interview questions? Landed that dream interview for Underwriting Assistant but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Underwriting Assistant interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

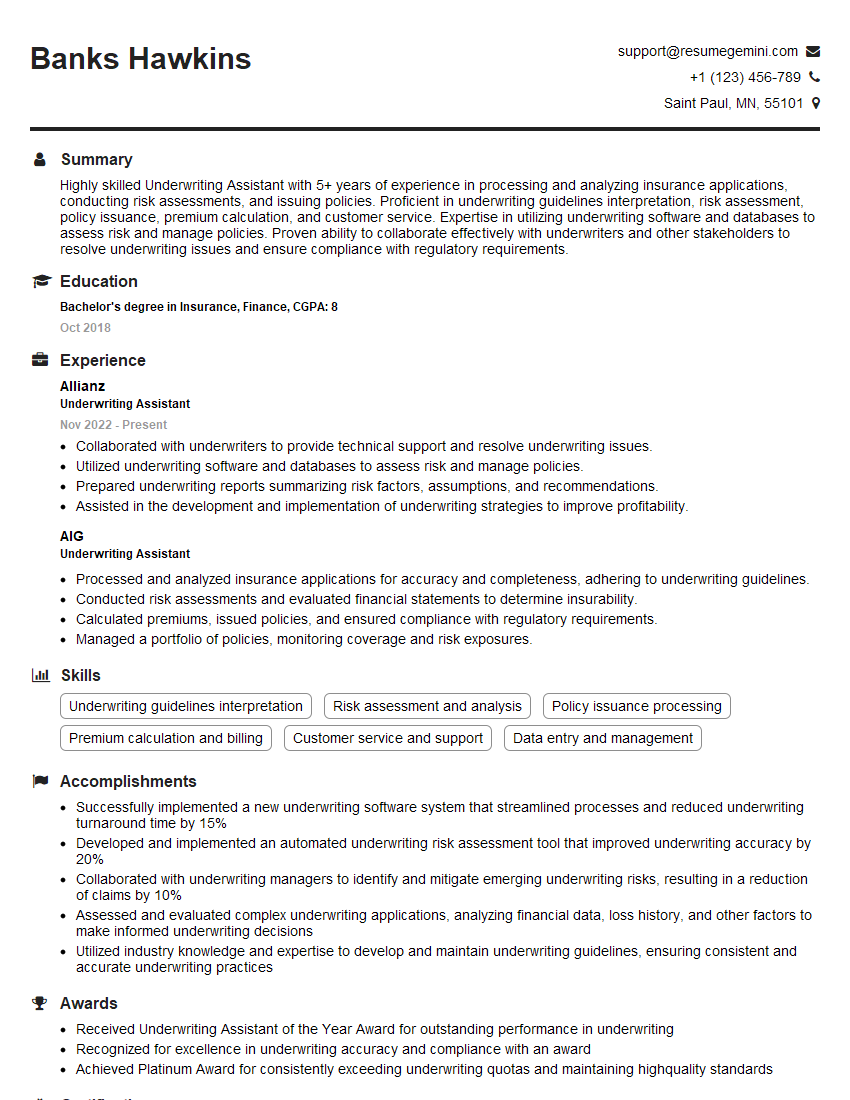

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Underwriting Assistant

1. How would you evaluate a risk for homeowners insurance?

I would consider the following factors when evaluating a risk for homeowners insurance:

- Property condition: This includes the age, condition, and construction of the home, as well as any recent renovations or repairs.

- Location: I would consider the crime rate, weather patterns, and natural disaster risks in the area where the home is located.

- Occupancy: I would determine who lives in the home and how they use it, as this can affect the risk of damage or theft.

- Previous claims history: I would review the homeowner’s previous claims history to assess their risk of future claims.

- Personal liability: I would consider the homeowner’s personal liability risks, such as the risk of someone being injured on their property or the risk of damage to others’ property.

2. What are the different types of underwriting guidelines?

Internal Guidelines

- Developed by the insurance company

- Based on the company’s experience and data

- Used to assess risk and determine eligibility for coverage

External Guidelines

- Developed by regulatory bodies or industry associations

- Provide standardized criteria for underwriting certain types of risks

- Help ensure consistency and fairness in the underwriting process

Model Guidelines

- Developed by independent rating agencies or actuaries

- Provide statistical models to predict risk and set rates

- Used to supplement internal and external guidelines

3. What is the difference between underwriting and pricing?

Underwriting is the process of evaluating and assessing risk, while pricing is the process of determining the premium to be charged for coverage. Underwriting focuses on the individual characteristics of the risk, while pricing considers the overall risk pool and market conditions. Underwriting is a qualitative process, while pricing is a quantitative process.

4. What are the key elements of an insurance contract?

The key elements of an insurance contract include:

- Declarations: This section provides basic information about the policy, such as the policyholder’s name, the insured property, and the coverage limits.

- Insuring agreements: This section outlines the specific risks that are covered by the policy.

- Exclusions: This section lists the risks that are not covered by the policy.

- Conditions: This section describes the duties and responsibilities of the policyholder and the insurer.

- Endorsements: These are amendments to the policy that can add or modify coverage.

5. What is the role of reinsurance in the insurance industry?

Reinsurance is a form of insurance that insurance companies purchase to protect themselves from the risk of large losses. By transferring a portion of their risk to a reinsurer, insurance companies can limit their exposure to catastrophic events and ensure that they have sufficient funds to pay claims. Reinsurance also helps to stabilize insurance rates and make them more affordable for consumers.

6. What are the different types of reinsurance?

- Proportional reinsurance: The reinsurer shares a proportional share of the risk and premium with the ceding insurer.

- Non-proportional reinsurance: The reinsurer only covers losses that exceed a certain threshold, known as the attachment point.

- Facultative reinsurance: The reinsurer provides coverage for specific risks or policies on an individual basis.

- Treaty reinsurance: The reinsurer provides coverage for a specific portfolio of risks or policies on a long-term basis.

7. What are the advantages of using reinsurance?

- Reduced risk: Reinsurance helps to reduce the risk of large losses for insurance companies.

- Increased capacity: Reinsurance allows insurance companies to offer higher coverage limits and take on more risk.

- Stabilized rates: Reinsurance helps to stabilize insurance rates and make them more affordable for consumers.

- Improved solvency: Reinsurance helps to improve the solvency of insurance companies by providing them with a source of additional capital.

8. What are the disadvantages of using reinsurance?

- Increased costs: Reinsurance can increase the cost of insurance for consumers.

- Reduced control: Insurance companies may have to cede some control over their underwriting and claims handling processes to reinsurers.

- Complexity: Reinsurance can be a complex and time-consuming process.

9. Describe your experience with underwriting software.

I have experience with a variety of underwriting software, including:

- InsuranceNow: A cloud-based underwriting platform that provides automated underwriting, risk assessment, and policy issuance.

- Guidewire: A comprehensive insurance software suite that includes modules for underwriting, claims, billing, and policy administration.

- Verisk: A provider of data and analytics for the insurance industry, including underwriting software and risk assessment tools.

I am proficient in using these software programs to perform underwriting tasks, such as:

- Risk assessment: Evaluating risks and determining coverage eligibility.

- Policy issuance: Issuing policies and endorsements.

- Claims processing: Reviewing and approving claims.

- Reporting: Generating reports on underwriting activities and performance.

10. What are your strengths and weaknesses as an Underwriting Assistant?

Strengths

- Attention to detail: I am very detail-oriented and able to identify and resolve potential issues in insurance applications.

- Communication skills: I am able to communicate effectively with customers, agents, and other stakeholders to gather information and provide clear explanations.

- Problem-solving skills: I am able to quickly and efficiently solve problems that arise during the underwriting process.

- Teamwork skills: I am a team player and able to work effectively with others to achieve common goals.

Weaknesses

- Lack of experience with certain types of insurance: I do not have experience with all types of insurance, such as commercial or marine insurance. However, I am eager to learn and develop my skills in these areas.

- Time management: I sometimes struggle to manage my time effectively when dealing with multiple tasks and deadlines.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Underwriting Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Underwriting Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Underwriting Assistants play a vital role in the insurance industry, supporting underwriters in evaluating and approving insurance policies. Their key responsibilities include:

1. Policy Evaluation

Reviewing and analyzing insurance applications to assess the risks involved

- Gathering and verifying information about applicants, including medical history, driving records, and property details

- Assessing the potential for fraud or misrepresentation

2. Underwriting Process

Assisting underwriters in determining the appropriate coverage, premiums, and deductibles for each policy

- Using underwriting guidelines and actuarial data to calculate risks and determine policy terms

- Preparing underwriting reports and recommendations for underwriters’ review

3. Policy Issuance

Processing and issuing insurance policies once they are approved

- Preparing policy documents, including declarations, endorsements, and certificates of insurance

- Ensuring that policies meet all regulatory requirements and company standards

4. Customer Service

Providing excellent customer service to policyholders and brokers

- Answering questions about coverage, premiums, and policy terms

- Processing policy changes, endorsements, and cancellations

Interview Tips

Preparing thoroughly for an Underwriting Assistant interview is crucial for success. Here are some valuable tips to help you ace it:

1. Research the Industry and Company

Familiarize yourself with the insurance industry, different types of insurance policies, and the company you’re applying to. This will demonstrate your passion for the field and knowledge of the company’s operations.

2. Practice Common Interview Questions

Prepare for common interview questions, such as “Tell us about yourself” and “Why are you interested in underwriting?” Practice answering these questions concisely and confidently, highlighting your relevant skills and experience.

3. Showcase Your Attention to Detail

Underwriting Assistants need exceptional attention to detail. During the interview, emphasize your ability to review documents thoroughly, identify errors, and ensure accuracy. Provide specific examples where you demonstrated this skill.

4. Highlight Your Communication Skills

Effective communication is crucial for Underwriting Assistants. In the interview, demonstrate your ability to communicate clearly and professionally with both internal and external stakeholders. Discuss your experience in customer service or other roles that required strong communication skills.

5. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview shows your engagement and interest in the role. Prepare questions about the company’s underwriting process, the team you’ll be working with, or the opportunities for growth within the organization.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Underwriting Assistant role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.