Are you gearing up for an interview for a Claims Coordinator position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Claims Coordinator and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

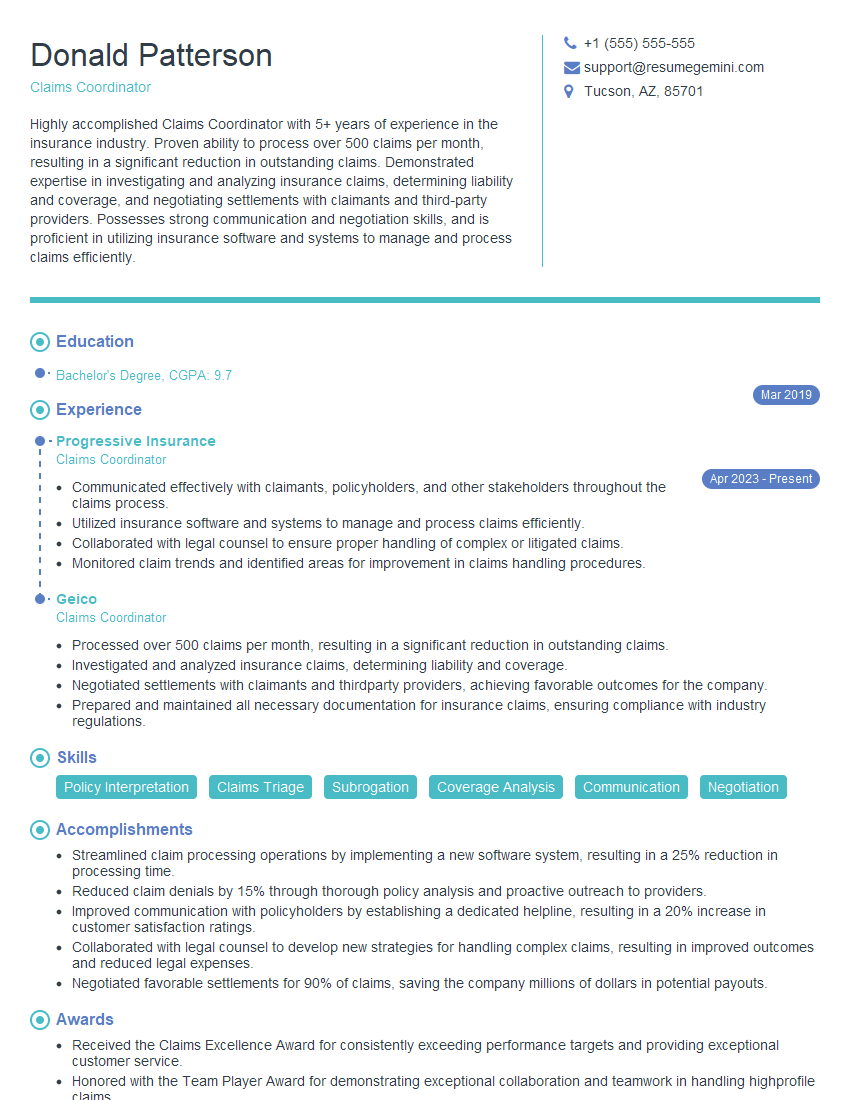

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Coordinator

1. What is the difference between a deductible and a copay?

A deductible is a fixed amount that you must pay out-of-pocket before your insurance starts to cover the costs of your medical care. A copay is a fixed amount that you pay each time you visit a doctor or other healthcare provider.

2. What is the process for filing a claim with an insurance company?

Receiving and reviewing claim forms

- Review the claim form to ensure that all required information is included.

- Verify the patient’s eligibility for benefits.

Processing the claim

- Determine the benefits that apply to the services provided.

- Calculate the amount of payment that is due to the provider.

- Issue a payment to the provider.

Following up on claims

- Monitor the status of claims to ensure that they are processed promptly.

- Respond to any inquiries from the provider or the patient.

3. What are some of the most common reasons why claims are denied?

Some of the most common reasons why claims are denied include:

- The services provided were not covered by the patient’s insurance policy.

- The claim was submitted incorrectly or incompletely.

- The patient was not eligible for benefits at the time the services were provided.

- The provider was not authorized to provide the services.

4. What is your experience with using claims processing software?

I have experience using a variety of claims processing software, including [Software 1], [Software 2], and [Software 3]. I am proficient in using these software programs to enter and process claims, track the status of claims, and generate reports.

5. What are your strengths and weaknesses as a Claims Coordinator?

Strengths

- Strong attention to detail

- Excellent communication and interpersonal skills

- Proficient in the use of claims processing software

- Ability to work independently and as part of a team

Weaknesses

- I am still relatively new to the insurance industry.

- I am not yet familiar with all of the different types of insurance policies.

6. What is your understanding of the Affordable Care Act (ACA)?

The ACA, also known as Obamacare, is a health care reform law that was enacted in 2010. The ACA has made a number of changes to the way health insurance is regulated in the United States, including:

- Requiring most Americans to have health insurance.

- Prohibiting insurance companies from denying coverage to people with pre-existing conditions.

- Providing subsidies to help people afford health insurance.

7. What are some of the challenges that you have faced in your previous role as a Claims Coordinator?

Some of the challenges that I have faced in my previous role as a Claims Coordinator include:

- Processing large volumes of claims in a timely and accurate manner.

- Dealing with difficult customers and resolving their complaints.

- Staying up-to-date on changes in insurance regulations.

8. What are your salary expectations for this position?

My salary expectations for this position are between $50,000 and $60,000 per year.

9. What is your availability to start work?

I am available to start work immediately.

10. Do you have any questions for me?

I do not have any questions for you at this time.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Coordinator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Coordinator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claims Coordinators are responsible for ensuring that insurance claims are processed accurately and efficiently. They work with policyholders, insurance providers, and other stakeholders to gather information, assess claims, and process payments.

1. Processing Claims

Claims Coordinators are responsible for processing claims in accordance with company policies and procedures. This includes:

- Receiving and reviewing claims from policyholders

- Investigating and assessing claims to determine coverage and liability

- Negotiating with policyholders and claimants to reach a fair settlement

- Preparing and sending out claim payments

2. Communicating with Policyholders and Claimants

Claims Coordinators must be able to communicate effectively with policyholders and claimants. This involves:

- Explaining the claims process to policyholders and claimants

- Answering questions about the claims process and claim status

- Negotiating settlements with policyholders and claimants

- Providing excellent customer service

3. Maintaining Records

Claims Coordinators are responsible for maintaining accurate and complete records of all claims processed. This includes:

- Filing claims in accordance with company policies and procedures

- Tracking the status of claims

- Preparing reports on claims activity

- Maintaining a secure and confidential claims database

4. Other Duties

Claims Coordinators may also be responsible for:

- Assisting with fraud investigations

- Training new claims coordinators

- Participating in claims-related projects

- Staying up-to-date on changes in the insurance industry

Interview Tips

Preparing for a Claims Coordinator interview can be overwhelming, but by following these tips, you can increase your chances of success.

1. Research the Company and Position

Before you go to your interview, take some time to research the company and the position. This will help you understand the company’s culture, values, and expectations. It will also help you prepare for the specific questions you may be asked.

- Visit the company’s website to learn about their history, mission, and values.

- Read the job description carefully and identify the key skills and experience required.

- Check out the company’s social media pages to get a sense of their culture.

2. Practice Your Answers

One of the best ways to prepare for an interview is to practice your answers to common interview questions. This will help you feel more confident and prepared on the day of the interview.

- Prepare a list of common interview questions such as “Tell me about yourself” and “Why are you interested in this position?”

- Practice your answers to these questions in front of a mirror or with a friend.

- Be sure to practice speaking clearly and concisely.

3. Dress Professionally

First impressions matter, so it is important to dress professionally for your interview. This means wearing a suit or business casual attire.

- Make sure your clothes are clean and pressed.

- Choose clothes that fit you well and that are comfortable to wear.

- Avoid wearing revealing or too casual clothing.

4. Be on Time

Punctuality is important for any job interview, but it is especially important for a Claims Coordinator interview. This is because insurance companies are typically very busy, and they need to know that you are reliable and can handle a fast-paced environment.

- Plan your route to the interview in advance so that you can avoid getting lost or delayed.

- Aim to arrive at the interview 10-15 minutes early so that you have time to check in and prepare.

- If you are running late, be sure to call the interviewer and let them know.

5. Be Yourself

The most important thing is to be yourself in your interview. This means being honest about your skills and experience, and showing your personality. Insurance companies are looking for people who are professional, reliable, and have a positive attitude.

- Don’t try to be someone you’re not.

- Be confident in your abilities and show the interviewer why you are the best person for the job.

- Be enthusiastic and positive, and let your personality shine through.

Next Step:

Now that you’re armed with the knowledge of Claims Coordinator interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Claims Coordinator positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini