Are you gearing up for an interview for a Claims Service Representative position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Claims Service Representative and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

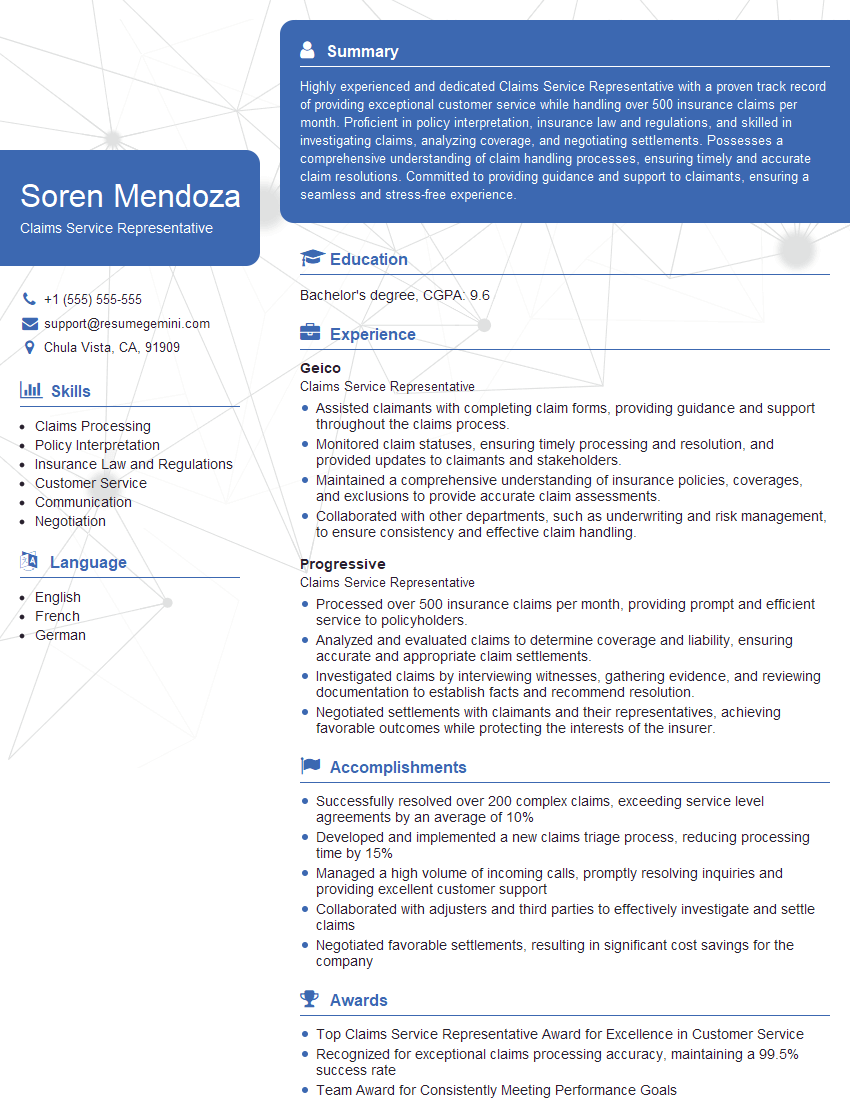

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Service Representative

1. What are the various types of insurance claims an insurance company typically processes?

- Property Damage Claims (e.g., home, car, business)

- Liability Claims (e.g., bodily injury, property damage to others)

- Health Insurance Claims (e.g., medical expenses, prescription drugs)

- Disability Insurance Claims (e.g., loss of income due to illness or injury)

- Life Insurance Claims (e.g., death benefit)

2. What is the difference between a deductible and a co-payment?

Deductible

- Fixed amount the insured pays before insurance coverage begins

- Paid once per policy period

- Lower deductibles typically result in higher premiums

Co-Payment

- Fixed amount the insured pays at the time of service

- Paid every time a covered service is used

- Lower co-payments typically result in higher premiums

3. Explain the concept of subrogation and provide an example.

Subrogation is the right of an insurance company to pursue recovery against a third party who is responsible for causing a loss that the insurance company has paid for.

- Example: If an insured’s car is damaged in an accident caused by another driver, the insurance company may pay for the repairs and then seek reimbursement from the at-fault driver.

4. Describe the role of an independent adjuster in the claims process.

An independent adjuster is a licensed professional who is hired by the insurance company to investigate and evaluate claims.

- Conducts interviews with the insured and witnesses

- Reviews documentation and other evidence

- Assesses the extent of the loss

- Negotiates settlements with the insured

5. What are some of the common challenges faced by Claims Service Representatives?

- Dealing with upset or distressed claimants

- Interpreting complex insurance policies

- Determining the extent of coverage

- Negotiating settlements

- Managing multiple claims simultaneously

6. What is the importance of maintaining confidentiality in the claims process?

Maintaining confidentiality is essential to protect the privacy of claimants and ensure trust in the insurance process.

- Claims Service Representatives must comply with privacy laws and regulations

- Information about claims should only be shared with authorized individuals

- Breaches of confidentiality can damage the reputation of the insurance company

7. How do you stay up-to-date on changes in the insurance industry and claims regulations?

- Attend industry conferences and workshops

- Read trade publications and newsletters

- Participate in online forums and discussion groups

- Obtain professional certifications and designations

- Network with other insurance professionals

8. What are your strengths and weaknesses as a Claims Service Representative?

Strengths

- Strong communication and interpersonal skills

- Ability to remain calm and collected under pressure

- Excellent problem-solving abilities

- Knowledge of insurance policies and regulations

- Experience in claims investigation and settlement

Weaknesses

- Lack of experience in a specific area of insurance (e.g., auto, home)

- Need to improve time management skills

- Difficulty dealing with angry or aggressive claimants

9. Why are you interested in this Claims Service Representative position?

I am interested in this Claims Service Representative position because I am passionate about helping people. I believe that my skills and experience would make me a valuable asset to your team and enable me to make a positive impact on the lives of your customers.

- I have a strong understanding of insurance policies and regulations.

- I am experienced in claims investigation and settlement.

- I am committed to providing excellent customer service.

- I am confident that I can quickly learn and adapt to the specific requirements of your company and position.

10. What are your salary expectations for this role?

My salary expectations are in line with the market rate for similar positions in this industry and region. I am confident that my skills and experience will bring value to your organization and justify my desired salary.

- I am open to discussing my expectations further and negotiating a mutually acceptable compensation package.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Service Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Service Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claims Service Representatives are responsible for handling a variety of tasks related to insurance claims. Their primary duties include:

1. Claims Processing

Assessing claims, determining coverage, and calculating payouts.

- Evaluating claims to ensure they are valid and complete.

- Determining the extent of coverage under the policy.

- Calculating the amount of the settlement or payout.

2. Customer Service

Providing excellent customer service to claimants throughout the claims process.

- Answering questions and providing information about the claims process.

- Keeping claimants updated on the status of their claims.

- Resolving complaints and ensuring customer satisfaction.

3. Communication and Documentation

Communicating effectively with claimants, insurance companies, and other parties involved in the claims process.

- Writing clear and concise letters, emails, and reports.

- Documenting all interactions with claimants and other parties.

- Maintaining accurate and up-to-date records.

4. Investigation and Subrogation

Investigating claims to determine the cause and extent of damages.

- Interviewing witnesses and gathering evidence.

- Determining liability and fault.

- Pursuing subrogation claims to recover costs from responsible parties.

Interview Tips

Preparing for a Claims Service Representative interview can be challenging, but there are several steps you can take to increase your chances of success. Here are some tips:

1. Research the Company and Position

Take the time to learn about the insurance company and the specific role you are applying for. This will help you understand the company’s culture, values, and expectations.

- Visit the company’s website to learn about their mission, products, and services.

- Read industry news and articles to stay up-to-date on current trends and issues in the insurance industry.

2. Practice Your Answers to Common Interview Questions

There are several common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?” Prepare your answers to these questions in advance so that you can deliver them confidently and concisely.

- Use the STAR method to answer behavioral questions. This method involves describing the Situation, Task, Action, and Result of a specific experience that demonstrates your skills and abilities.

- Quantify your accomplishments whenever possible. For example, instead of saying “I improved customer satisfaction,” say “I improved customer satisfaction by 15% over a six-month period.”

3. Highlight Your Relevant Skills and Experience

Make sure to emphasize your skills and experience that are most relevant to the Claims Service Representative position. For example, if you have experience in customer service, claims processing, or investigation, be sure to highlight these skills in your resume and cover letter.

- Tailor your resume and cover letter to each specific job you apply for. Highlight the skills and experience that are most relevant to the position.

- Be prepared to talk about your experience in detail during the interview. Use specific examples to demonstrate your skills and abilities.

4. Dress Professionally and Be on Time

First impressions matter, so it is important to dress professionally for your interview. You should also arrive on time for your interview. Punctuality shows that you are respectful of the interviewer’s time.

- Choose an outfit that is clean, pressed, and appropriate for a business setting.

- Arrive at the interview location 10-15 minutes early so that you have time to relax and prepare yourself.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claims Service Representative interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!