Are you gearing up for a career in Claims Account Manager? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Claims Account Manager and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

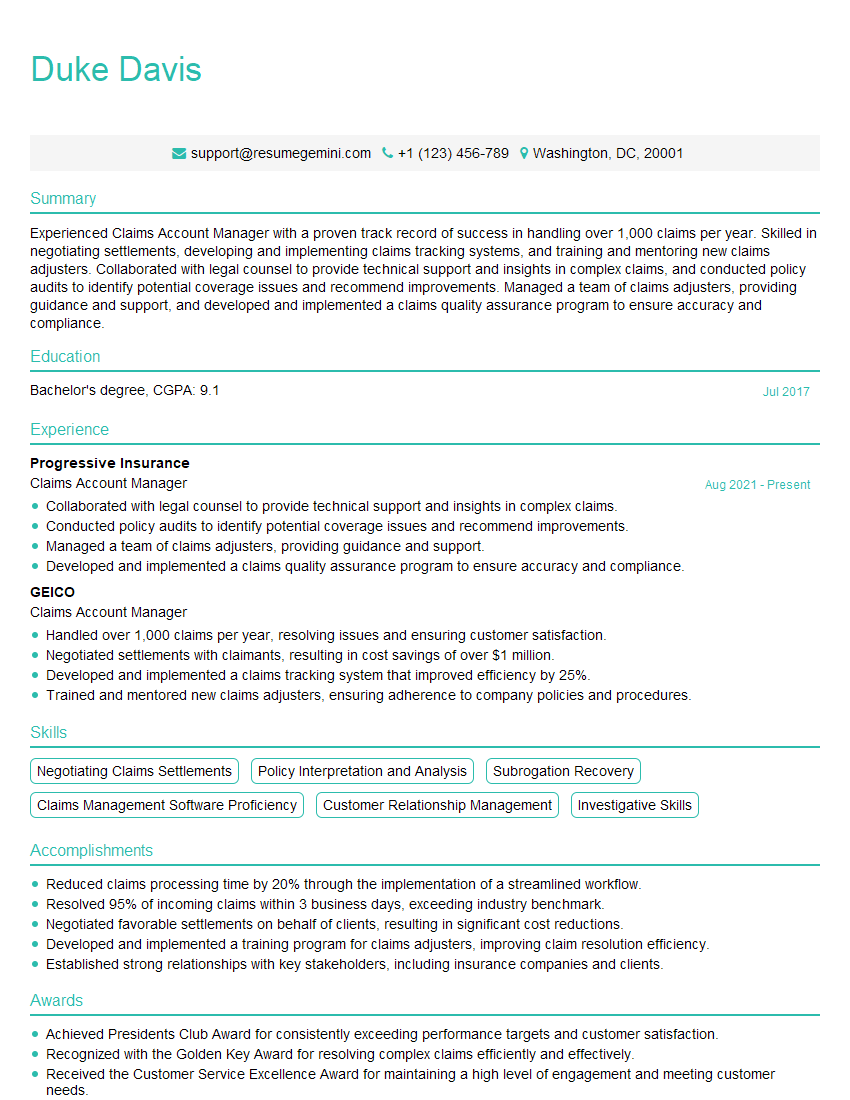

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Account Manager

1. Describe your experience in handling complex insurance claims?

- Handled complex claims involving multiple parties, coverage disputes, subrogation, and legal implications.

- Conducted thorough investigations, analyzed relevant documents, interviewed stakeholders, and negotiated settlements to resolve complex issues.

2. How do you prioritize and manage a high volume of claims inflow?

- Utilized triage systems to assess claim severity and prioritize urgent cases.

- Delegated responsibilities effectively to ensure efficient handling of claims.

- Employed technology tools to streamline processes and increase productivity.

3. Explain how you communicate effectively with policyholders, brokers, and adjusters regarding claim status and resolution?

- Provided clear and concise updates on claim status and resolution throughout the process.

- Maintained regular communication with policyholders and brokers to address concerns and build relationships.

- Utilized a variety of communication channels such as phone, email, and online platforms to ensure accessibility.

4. How do you stay informed about changes in insurance regulations and best practices?

- Attended industry conferences and workshops to stay abreast of regulatory updates.

- Subscribed to insurance publications and online resources to keep up with best practices.

- Consulted with legal counsel and industry experts to ensure compliance and maximize claim outcomes.

5. Describe your experience in negotiating claim settlements?

- Assessed liability, damages, and legal precedents to determine fair and reasonable settlement amounts.

- Engaged in negotiations with claimants, their attorneys, and third-party stakeholders to reach mutually acceptable agreements.

- Secured settlements that minimized financial exposure for the insurer while maintaining positive relationships with policyholders.

6. How do you handle disputes that arise during the claims process?

- Investigated the facts and arguments presented by disputing parties.

- Mediated between policyholders and claimants to facilitate resolution.

- Escalated unresolved disputes to management or legal counsel for guidance and support.

7. Explain how you protect sensitive customer information while handling claims?

- Adhered to strict confidentiality policies and data security protocols.

- Encrypted sensitive data and limited access to authorized personnel.

- Trained and supervised staff on data protection best practices.

8. How do you measure and improve the efficiency of your claims handling process?

- Tracked key performance indicators such as average claim closure time and customer satisfaction.

- Identified bottlenecks and implemented process improvements to streamline operations.

- Incorporated automation and technology solutions to increase efficiency.

9. Describe your experience in managing a team of claims adjusters?

- Provided clear direction, training, and support to adjusters.

- Delegated responsibilities and empowered adjusters to make informed decisions.

- Evaluated adjuster performance and provided feedback for continuous improvement.

10. How do you prioritize customer satisfaction while handling claims?

- Emphasized empathy and understanding in all interactions with customers.

- Responded promptly to inquiries and resolved issues effectively.

- Gathered customer feedback to identify areas for improvement and enhance the claims experience.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Account Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Account Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claims Account Managers are responsible for managing the claims process for their clients. They work with clients to ensure that claims are filed and processed correctly, and that clients receive the benefits they are entitled to. Claims Account Managers also work with insurance companies to negotiate settlements and ensure that clients receive fair compensation.

1. Manage the claims process

Claims Account Managers are responsible for managing the entire claims process, from initial intake to final settlement. They work with clients to gather information about their claims, file claims with insurance companies, and track the progress of claims. They also work with insurance companies to negotiate settlements and ensure that clients receive the benefits they are entitled to.

- Gather information from clients about their claims

- File claims with insurance companies

- Track the progress of claims

- Negotiate settlements with insurance companies

- Ensure that clients receive the benefits they are entitled to

2. Work with clients

Claims Account Managers work closely with clients to ensure that their claims are filed and processed correctly. They provide clients with information about the claims process, answer their questions, and help them to understand their rights. They also work with clients to develop strategies for maximizing their recovery.

- Provide clients with information about the claims process

- Answer clients’ questions

- Help clients to understand their rights

- Develop strategies for maximizing clients’ recovery

3. Work with insurance companies

Claims Account Managers work with insurance companies to negotiate settlements and ensure that clients receive fair compensation. They have a strong understanding of insurance policies and claims procedures. They also have strong negotiation skills and are able to advocate for their clients’ interests.

- Negotiate settlements with insurance companies

- Ensure that clients receive fair compensation

- Have a strong understanding of insurance policies and claims procedures

- Have strong negotiation skills

- Advocate for their clients’ interests

4. Stay up-to-date on changes in the insurance industry

The insurance industry is constantly changing. Claims Account Managers must stay up-to-date on changes in the law, regulations, and insurance policies. They must also be aware of new technologies and trends that can impact the claims process.

- Stay up-to-date on changes in the law

- Stay up-to-date on changes in regulations

- Stay up-to-date on changes in insurance policies

- Be aware of new technologies and trends that can impact the claims process

Interview Tips

Interviewing for a Claims Account Manager position can be challenging, but there are a few things you can do to prepare and increase your chances of success.

1. Research the company and the position

Before you go on an interview, it is important to do your research. Learn as much as you can about the company, the position, and the industry. This will help you to answer questions intelligently and show the interviewer that you are serious about the opportunity.

- Visit the company’s website

- Read articles about the company and the industry

- Talk to people who work in the industry

- Prepare questions to ask the interviewer

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked. It is important to practice your answers to these questions so that you can deliver them confidently and concisely.

- Tell me about yourself

- Why are you interested in this position?

- What are your strengths and weaknesses?

- What is your experience with claims management?

- How do you handle difficult clients?

3. Dress professionally and arrive on time

First impressions matter. Make sure to dress professionally and arrive on time for your interview. This shows the interviewer that you are respectful of their time and that you are serious about the opportunity.

- Wear a suit or business casual attire

- Be punctual

- Make eye contact and smile

4. Be prepared to talk about your experience and skills

The interviewer will want to know about your experience and skills. Be prepared to talk about your experience in claims management, your customer service skills, and your negotiation skills.

- Highlight your experience in claims management

- Describe your customer service skills

- Discuss your negotiation skills

- Provide examples of your work

5. Be confident and enthusiastic

Confidence is key in any interview. Be confident in your abilities and enthusiastic about the opportunity. This will show the interviewer that you are passionate about the work and that you are eager to join the team.

- Make eye contact

- Speak clearly and confidently

- Be positive and enthusiastic

- Ask questions

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claims Account Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!