Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Claims Auditor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

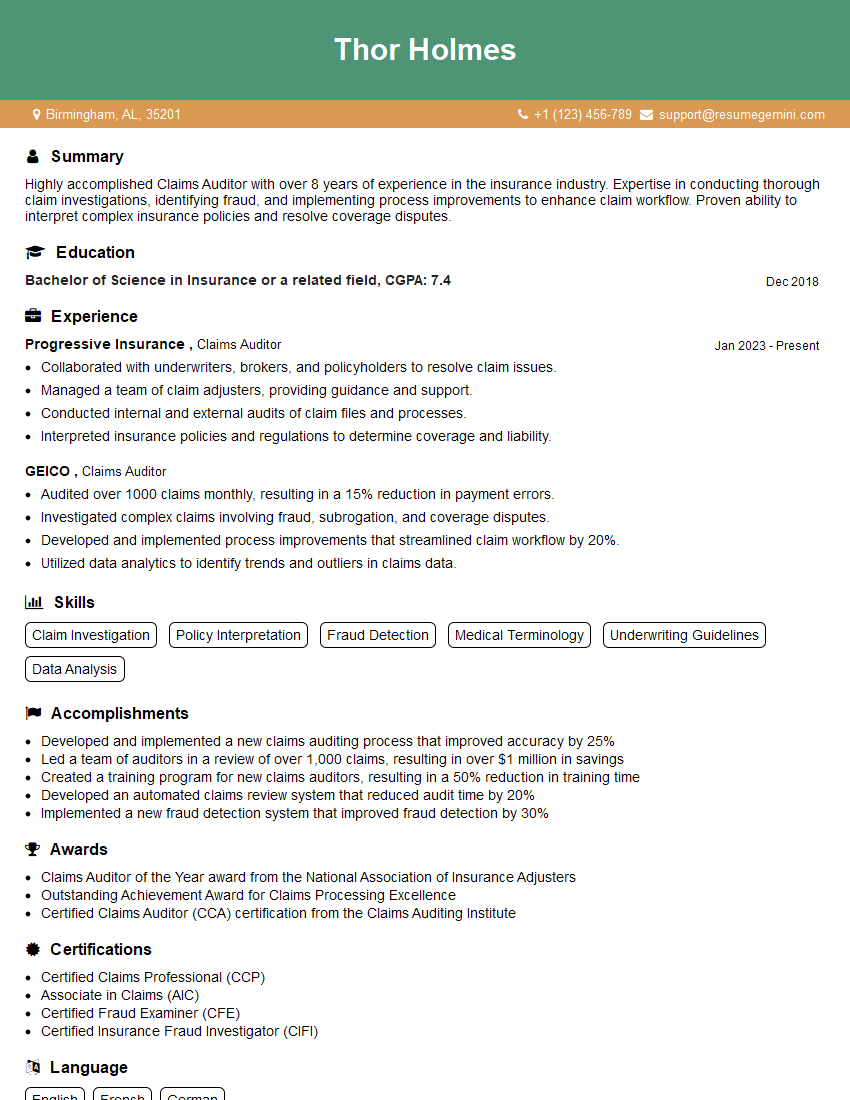

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Auditor

1. What are the key responsibilities of a Claims Auditor?

As a Claims Auditor, I would be responsible for:

- Investigating and evaluating insurance claims

- Assessing the validity of claims and determining the appropriate payment

- Reviewing insurance policies and contracts to ensure compliance

- Communicating with policyholders, claimants, and other stakeholders

- Maintaining accurate records and reporting on claims activity

2. What are the different types of insurance claims that you have experience auditing?

I have experience auditing a wide range of insurance claims, including:

Property damage claims

- Homeowners insurance claims

- Commercial property insurance claims

- Auto insurance claims

Liability claims

- General liability claims

- Product liability claims

- Medical malpractice claims

Workers’ compensation claims

- Lost time claims

- Medical only claims

- Death claims

3. What are the most common types of fraud that you have encountered in your work?

The most common types of fraud that I have encountered in my work include:

- Exaggerated or fabricated claims

- Duplicate claims

- Staged accidents

- Insurance policy fraud

- Provider fraud

4. What are the steps involved in auditing an insurance claim?

The steps involved in auditing an insurance claim typically include:

- Reviewing the claim file

- Interviewing the policyholder and/or claimant

- Inspecting the damaged property or scene of the accident

- Reviewing medical records and other relevant documentation

- Assessing the validity of the claim and determining the appropriate payment

5. What are the ethical considerations that you must keep in mind when auditing insurance claims?

When auditing insurance claims, it is important to keep the following ethical considerations in mind:

- Confidentiality

- Objectivity

- Fairness

- Integrity

- Professionalism

6. How do you stay up-to-date on the latest changes in insurance regulations and laws?

I stay up-to-date on the latest changes in insurance regulations and laws by:

- Reading industry publications

- Attending seminars and conferences

- Taking continuing education courses

- Networking with other claims professionals

7. What is your experience with using insurance claims software?

I have experience using a variety of insurance claims software, including:

- ClaimCenter

- Guidewire

- ISO Claims Manager

- Mitratech

- PolicyWorks

8. What are your strengths and weaknesses as a Claims Auditor?

My strengths as a Claims Auditor include:

- Strong analytical skills

- Excellent attention to detail

- Ability to work independently and as part of a team

- Good communication and interpersonal skills

My weaknesses as a Claims Auditor include:

- I am relatively new to the insurance industry

- I can sometimes be too detail-oriented

- I am not always comfortable working under tight deadlines

9. What are your career goals?

My career goals are to:

- Continue to develop my skills and knowledge as a Claims Auditor

- Become a manager or supervisor in the claims department

- Eventually become a claims executive

10. What are your salary expectations?

My salary expectations are in the range of $50,000 to $60,000 per year.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Auditor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Auditor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claims Auditors are responsible for verifying and processing insurance claims, ensuring accuracy and compliance with policies and regulations.

1. Claims Processing

Reviewing and analyzing insurance claims to determine their validity and coverage.

- Investigating claim details, contacting claimants, and gathering necessary documentation.

- Applying knowledge of insurance policies, regulations, and industry practices.

2. Claims Adjudication

Making decisions on claims approvals, denials, or payments based on the assessment of evidence.

- Calculating claim amounts, including medical expenses, lost wages, and property damage.

- Negotiating claim settlements and ensuring fair and equitable outcomes.

3. Compliance and Fraud Detection

Ensuring compliance with insurance regulations and identifying potential fraudulent claims.

- Reviewing claims for accuracy, completeness, and adherence to guidelines.

- Investigating suspicious claims and collaborating with investigators to detect and prevent fraud.

4. Reporting and Analysis

Preparing reports on claims activities and presenting findings to management.

- Identifying trends and patterns in claims data to improve processes and reduce risk.

- Providing insights and recommendations for enhancing claims management strategies.

Interview Tips

To effectively prepare for a Claims Auditor interview, consider the following tips:

1. Research the Company and Industry

Understand the insurance company’s business, products, and market position.

- Read the company’s website, annual reports, and industry news articles.

- Research the company’s claims philosophy and approach to customer service.

2. Highlight Relevant Skills and Experience

Demonstrate your strong analytical, investigative, and communication skills.

- Emphasize your experience in claims processing, adjudication, compliance, and reporting.

- Provide specific examples of your contributions to efficiency, accuracy, and fraud detection.

3. Prepare for Technical Questions

Expect questions on insurance policies, regulations, and claims handling procedures.

- Review insurance terminology, coverage types, and claim investigation techniques.

- Practice resolving complex claim scenarios and explaining your decision-making process.

4. Showcase Your Communication and Interpersonal Skills

Strong communication and interpersonal skills are crucial for effectively interacting with claimants, adjusters, and supervisors.

- Demonstrate your ability to build rapport, resolve conflicts, and provide clear explanations.

- Highlight your experience in negotiating and collaborating with diverse stakeholders.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claims Auditor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.