Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Liability Claims Representative position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

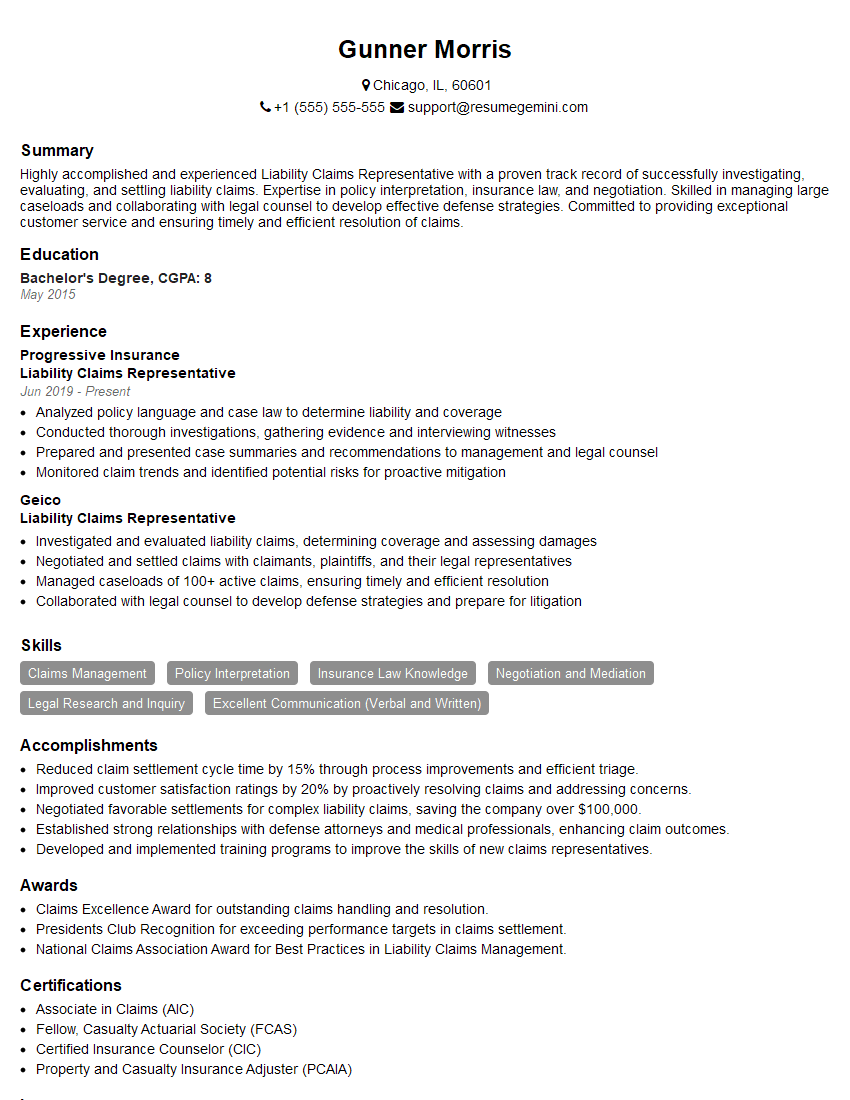

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Liability Claims Representative

1. Explain the process of investigating a liability claim?

- Establish the facts of the case by reviewing the accident report, witness statements, and other relevant documents.

- Determine the extent of the damages, both property and bodily injury.

- Identify the potentially liable parties and their insurance coverage.

- Interview witnesses, gather evidence, and conduct an independent investigation as needed.

- Assess the strengths and weaknesses of the claim to determine the appropriate settlement strategy.

2. What are the key factors that determine the value of a liability claim?

Damages:

- Medical expenses

- Lost wages

- Pain and suffering

- Property damage

Liability:

- Degree of fault

- Insurance coverage

- Legal precedent

Settlement Considerations:

- Cost of defense

- Likelihood of success at trial

- Client’s settlement expectations

3. How do you handle a claim where the liability is disputed?

- Investigate the facts thoroughly to determine the true extent of liability.

- Review relevant case law and legal precedents.

- Consult with experts such as accident reconstructionists or medical professionals.

- Negotiate with the other party’s attorney to reach a fair settlement.

- Prepare for trial if necessary.

4. What are the ethical considerations involved in representing a liability insurance company?

- Duty to the client: Represent the interests of the insurance company while acting in good faith.

- Duty to the claimant: Treat claimants fairly and with respect, even if their claims are denied.

- Duty to the legal system: Uphold the law and avoid engaging in any unethical or dishonest practices.

5. How do you prioritize multiple claims with varying levels of urgency?

- Assess the severity of each claim and the potential financial impact.

- Consider the claimant’s needs and circumstances.

- Manage the workload effectively and delegate tasks as needed.

- Communicate regularly with claimants to keep them informed.

6. Describe the different types of liability insurance policies and their coverage.

- General Liability Insurance: Protects businesses from claims of bodily injury, property damage, and personal injury.

- Commercial Auto Insurance: Covers vehicles used for business purposes, including liability for accidents and injuries.

- Professional Liability Insurance: Protects professionals from claims of negligence and errors and omissions.

- Product Liability Insurance: Covers businesses for claims arising from defective products.

7. What is the role of subrogation in liability claims?

- Allows an insurance company that has paid a claim to pursue reimbursement from the party responsible for the damages.

- Protects the insurance company from paying for damages caused by a third party.

- Encourages responsible behavior by holding the at-fault party accountable.

8. How do you stay updated on changes in liability laws and regulations?

- Attend industry conferences and webinars.

- Read legal publications and journals.

- Network with other professionals in the field.

- Receive continuing education credits.

9. What software or tools do you use to manage liability claims?

- Claim management software

- Policy management systems

- Legal research databases

- Communication tools (email, phone, instant messaging)

10. How do you handle difficult or uncooperative claimants?

- Remain calm and professional.

- Listen to the claimant’s concerns and try to understand their perspective.

- Explain the claim process and provide updates regularly.

- Negotiate in good faith and work towards a fair resolution.

- Seek legal advice if necessary.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Liability Claims Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Liability Claims Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Liability Claims Representatives perform a critical role in the insurance industry, handling the resolution of liability claims for individuals, businesses, and organizations. They collaborate with claimants, policyholders, and other stakeholders to investigate and assess claims.

1. Claim Investigation and Analysis

Conduct thorough investigations into liability claims, gathering and analyzing evidence, such as police reports, medical records, and witness statements.

- Interview claimants, witnesses, and other parties involved in the incident.

- Research applicable laws, regulations, and insurance policies to determine liability and coverage.

2. Claim Evaluation and Settlement

Evaluate the extent of damages and determine appropriate settlement amounts based on legal liability and policy coverage.

- Negotiate settlements with claimants and their legal representatives.

- Prepare and issue settlement agreements and other related documentation.

3. Communication and Customer Service

Maintain clear and regular communication with claimants, policyholders, and other stakeholders throughout the claims process.

- Provide timely updates on the status of claims and respond promptly to inquiries.

- Build and maintain positive relationships with customers and external parties.

4. Documentation and Reporting

Maintain accurate and detailed records of all claim-related activities, including investigation notes, correspondence, and settlement agreements.

- Prepare reports and summaries for management, insurance carriers, and other internal and external stakeholders.

- Participate in internal audits and compliance reviews to ensure adherence to company policies and regulatory requirements.

Interview Tips

To prepare for an interview for a Liability Claims Representative position, you should focus on highlighting your skills and experience in the following areas:

1. Industry Knowledge and Claim Investigation

Demonstrate your understanding of liability insurance principles, claims handling procedures, and relevant laws and regulations.

- Provide examples of how you have successfully investigated and analyzed complex liability claims.

- Emphasize your ability to gather and interpret evidence, interview witnesses, and assess damages.

2. Negotiation and Settlement Skills

Showcase your ability to negotiate fair and equitable settlements while adhering to ethical and legal guidelines.

- Describe your experience in negotiating with claimants, attorneys, and other parties involved in claims.

- Provide examples of successful settlements where you achieved a positive outcome for all parties.

3. Communication and Customer Service

Highlight your strong communication and interpersonal skills, particularly in dealing with sensitive and often emotional situations.

- Emphasize your ability to build rapport with customers, listen actively, and provide clear and empathetic explanations.

- Provide examples of situations where you successfully resolved customer complaints or handled difficult conversations.

4. Attention to Detail and Accuracy

Stress your meticulous attention to detail and ability to maintain highly accurate records and documentation.

- Describe your experience in preparing comprehensive claim files, including investigation reports and settlement agreements.

- Emphasize your ability to adhere to strict confidentiality and privacy guidelines.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Liability Claims Representative interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.