Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Auto Claims Adjuster position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

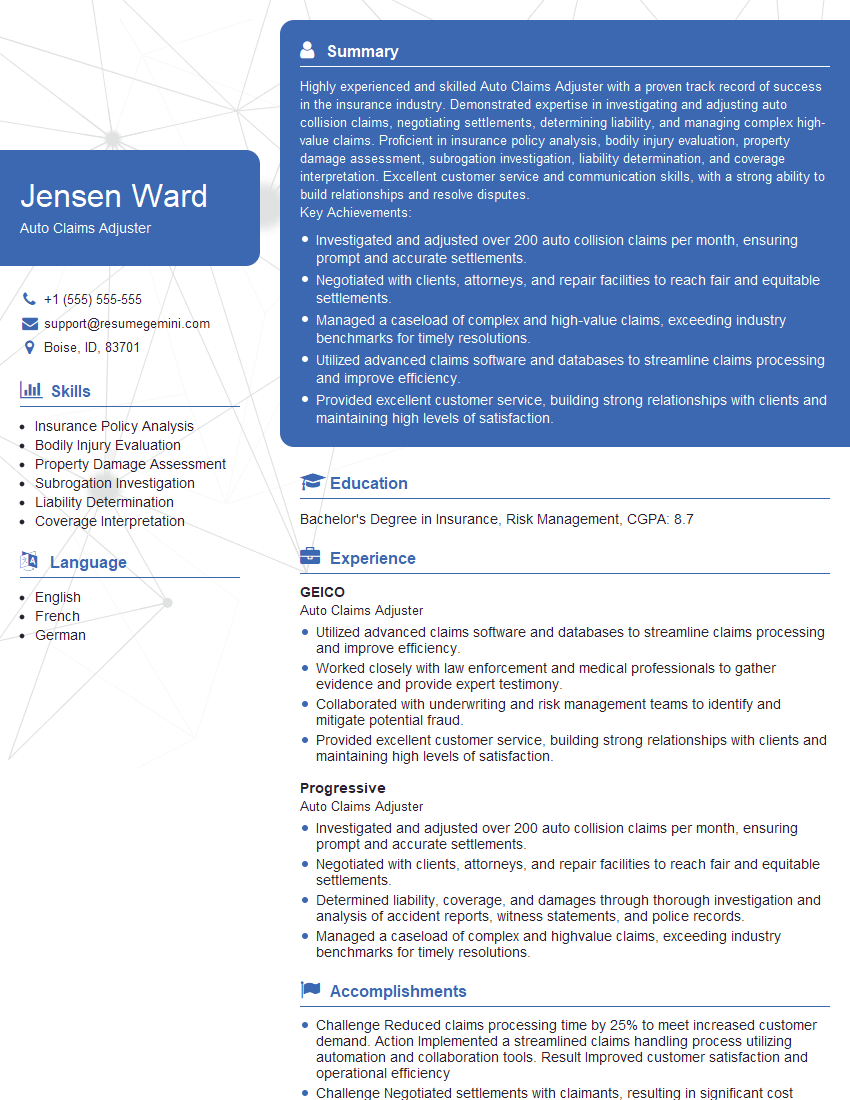

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Auto Claims Adjuster

1. Describe the steps involved in handling a total loss claim.

- Acknowledge the claim and gather information from the policyholder.

- Inspect the vehicle to assess the damage and determine if it is a total loss.

- Calculate the actual cash value (ACV) of the vehicle.

- Negotiate a settlement with the policyholder and issue payment.

- Salvage the vehicle if possible.

2. How do you calculate the actual cash value (ACV) of a vehicle?

Depreciation

- Determine the vehicle’s current market value.

- Deduct any depreciation based on the vehicle’s age, mileage, and condition.

Sales tax and license fees

- Add any applicable sales tax and license fees to the depreciated value.

3. What factors do you consider when negotiating a settlement with a policyholder?

- The ACV of the vehicle.

- The policyholder’s coverage limits.

- The policyholder’s financial situation.

- The policyholder’s expectations.

4. How do you handle disputes with policyholders?

- Listen to the policyholder’s concerns and try to understand their perspective.

- Explain the company’s policies and procedures.

- Negotiate a settlement that is fair to both the policyholder and the company.

- If necessary, escalate the dispute to a supervisor or manager.

5. What are the most common types of auto insurance fraud?

- Staged accidents.

- Inflated repair estimates.

- False or exaggerated claims.

- Identity theft.

6. How do you detect and investigate auto insurance fraud?

- Reviewing claim documents for inconsistencies.

- Interviewing the policyholder and other parties involved in the claim.

- Conducting background checks and verifying employment information.

- Working with law enforcement and other investigative agencies.

7. What are the key differences between first-party and third-party auto insurance claims?

First-party claims

- Involve damages to the policyholder’s own vehicle.

- Are typically covered under the policyholder’s collision or comprehensive coverage.

Third-party claims

- Involve damages to another person’s property or injuries.

- Are typically covered under the policyholder’s liability coverage.

8. How do you handle subrogation claims?

- Identify the at-fault party and their insurance company.

- File a claim with the at-fault party’s insurance company.

- Negotiate a settlement to recover the costs of the claim.

9. What are the most important qualities of a successful auto claims adjuster?

- Excellent communication and interpersonal skills.

- Strong analytical and problem-solving abilities.

- Knowledge of auto insurance policies and procedures.

- Attention to detail and accuracy.

- Ability to work independently and as part of a team.

10. What are your career goals and how do you see this position helping you achieve them?

- Express interest in the position and the company.

- Explain how the position aligns with your career goals.

- Discuss how you believe your skills and experience will contribute to the team.

- Express enthusiasm for learning and growing within the organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Auto Claims Adjuster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Auto Claims Adjuster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Auto Claims Adjusters are responsible for investigating and settling insurance claims for vehicle accidents. They assess the damage to vehicles, determine fault, and calculate the amount of the settlement.

1. Investigate Claims

Claims adjusters investigate claims by reviewing police reports, interviewing witnesses, and inspecting damaged vehicles.

- Review police reports and other documentation

- Interview witnesses to gather information about the accident

- Inspect damaged vehicles to assess the extent of the damage

2. Determine Fault

Claims adjusters determine fault by reviewing the evidence and applying the laws of the state in which the accident occurred.

- Review the evidence to determine who was at fault for the accident

- Apply the laws of the state in which the accident occurred to determine liability

3. Calculate Settlement Amounts

Claims adjusters calculate settlement amounts by considering the following factors:

- The extent of the damage to the vehicles

- The value of the vehicles

- The amount of the deductible

- The claimant’s policy limits

4. Negotiate Settlements

Claims adjusters negotiate settlements with claimants and their attorneys. They work to reach a fair and reasonable settlement that is acceptable to both parties.

- Negotiate settlements with claimants and their attorneys

- Reach a fair and reasonable settlement that is acceptable to both parties

Interview Tips

Here are some tips to help you ace your interview for an Auto Claims Adjuster position:

1. Research the Company and the Position

Before your interview, take some time to research the insurance company and the specific Auto Claims Adjuster position you are applying for. This will help you understand the company’s culture and the specific requirements of the job.

- Visit the company’s website and read about their mission, values, and products/services.

- Read the job description carefully and make note of the key qualifications and responsibilities.

- Look up the company on Glassdoor or other review websites to get insights from current and former employees.

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you can expect to be asked, such as:

- Tell me about yourself.

- Why are you interested in working as an Auto Claims Adjuster?

- What are your strengths and weaknesses?

- Give me an example of a time when you had to deal with a difficult customer.

- What is your salary expectation?

Take some time to practice your answers to these questions so that you can deliver them confidently and concisely during your interview.

3. Dress Professionally and Arrive on Time

First impressions matter, so make sure to dress professionally for your interview. You should also arrive on time, as this shows that you are respectful of the interviewer’s time.

- Wear a suit or business casual attire.

- Make sure your clothes are clean and pressed.

- Arrive for your interview on time, or even a few minutes early.

4. Be Prepared to Talk About Your Experience

In your interview, you will be asked about your experience and qualifications. Be prepared to talk about your previous claims adjusting experience, as well as any other relevant skills or experience that you have.

- Highlight your experience investigating claims, determining fault, and calculating settlements.

- Discuss any previous experience you have working with customers or negotiating settlements.

- Share examples of your problem-solving and critical thinking skills.

5. Ask Questions

At the end of your interview, you will have the opportunity to ask the interviewer questions. This is your chance to learn more about the company, the position, and the interviewer. Asking thoughtful questions shows that you are engaged and interested in the opportunity.

- Ask about the company’s culture and values.

- Inquire about the specific responsibilities of the Auto Claims Adjuster position.

- Ask about the interviewer’s experience in the insurance industry.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Auto Claims Adjuster, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Auto Claims Adjuster positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.