Are you gearing up for an interview for a Claim Inspector position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Claim Inspector and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

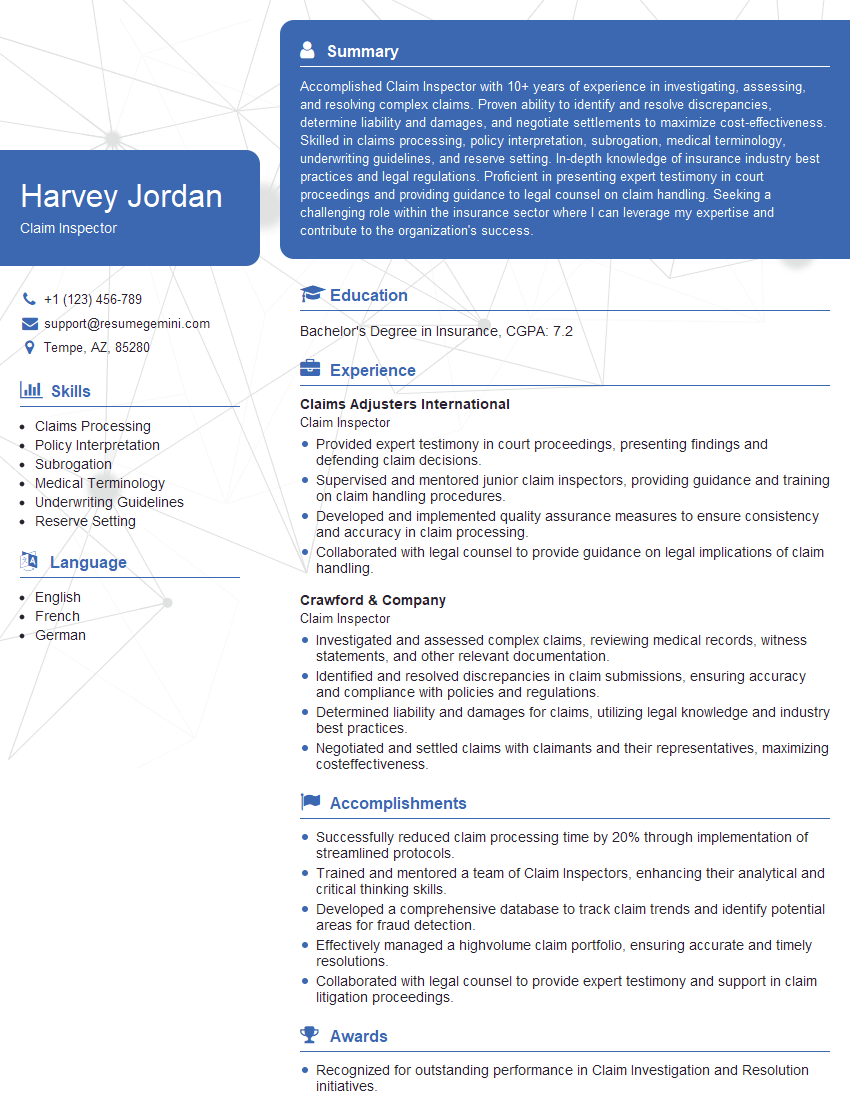

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claim Inspector

1. Explain the different types of insurance claims you have handled and the processes involved in each?

- Provided a detailed explanation of the different types of insurance claims handled including auto, property, liability, and workers’ compensation.

- Outlined the processes involved in each type of claim, such as investigation, documentation, and settlement.

- Emphasized the importance of understanding the terms and conditions of each policy to ensure accurate and fair claim processing.

2. Describe your experience in assessing and evaluating the validity of insurance claims?

Underwriting and Policy Analysis

- Explained the process of reviewing and evaluating insurance policies to determine coverage and potential liability.

- Described the techniques used to assess the validity of claims, including reviewing policy language, investigating evidence, and interviewing claimants.

Claims Investigation

- Outlined the steps taken to investigate claims, such as conducting interviews, gathering evidence, and consulting with experts.

- Emphasized the importance of maintaining objectivity and impartiality during the investigation process.

3. How do you stay up to date with the latest changes and developments in insurance claims handling?

- Mentioned attending industry conferences, workshops, and training programs to stay abreast of new regulations and best practices.

- Discussed the importance of reading industry publications, articles, and journals to stay informed about emerging trends and legal developments.

4. What strategies do you use to resolve complex or disputed insurance claims?

- Emphasized the importance of open communication and negotiation with claimants and their representatives.

- Outlined the use of alternative dispute resolution methods, such as mediation and arbitration, to facilitate settlement.

- Discussed the ability to analyze complex policy language and legal precedents to support decision-making.

5. How do you prioritize and manage your workload effectively, especially when dealing with multiple claims simultaneously?

- Described the use of a structured workflow system to organize and track claims.

- Explained the application of triage techniques to identify and prioritize high-impact claims.

- Mentioned the importance of collaboration with colleagues and supervisors to ensure effective workload management.

6. What measures do you take to ensure accuracy and quality in your claims handling process?

- Outlined the use of checklists and documentation to maintain accuracy in data entry and processing.

- Emphasized the importance of regular self-audits and peer reviews to identify areas for improvement.

7. How do you handle challenging claimants or situations where emotions are running high?

- Discussed the importance of active listening and empathy in dealing with challenging claimants.

- Outlined the use of communication techniques to defuse tense situations and maintain professionalism.

8. What are the ethical considerations you take into account when handling insurance claims?

- Explained the adherence to ethical principles such as confidentiality, fairness, and transparency.

- Discussed the importance of avoiding conflicts of interest and maintaining objectivity in decision-making.

9. How do you leverage technology to improve your claims handling efficiency?

- Mentioned the use of claim management software to automate tasks, streamline communication, and facilitate data analysis.

- Discussed the integration of artificial intelligence and machine learning to enhance claims processing and fraud detection.

10. If presented with a claim that raises red flags for potential fraud, what steps would you take?

- Outlined the process of thoroughly investigating the claim, gathering supporting evidence, and consulting with experts.

- Explained the importance of documenting all findings and communicating with the appropriate authorities if fraud is suspected.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claim Inspector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claim Inspector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claim Inspectors are responsible for reviewing and evaluating insurance claims ensuring accuracy and compliance with company policies and regulations. They investigate claims, gather and analyze evidence, and determine the validity and amount of the claim. Their responsibilities include:

1. Claim Adjudication

Review insurance claims thoroughly to determine coverage and liability.

- Assess the validity of claims based on policy terms and conditions.

- Determine the extent of coverage and applicable deductibles or co-pays.

2. Investigation

Investigate claims by gathering evidence, including medical records, police reports, and witness statements.

- Interview claimants, witnesses, and medical professionals to ascertain the facts.

- Analyze evidence to determine the cause and extent of the loss.

3. Calculation and Settlement

Calculate claim payouts based on evidence and policy coverage, ensuring fair and reasonable settlements.

- Negotiate claim settlements with claimants and their representatives.

- Authorize payments and issue claim checks to settle valid claims.

4. Reporting and Documentation

Prepare detailed claim reports and documentation, including investigation summaries and settlement recommendations.

- Maintain accurate and organized claim files for audit and review purposes.

- Communicate claim status and findings to policyholders, claimants, and other stakeholders.

Interview Tips

To ace a Claim Inspector interview, candidates should focus on demonstrating their technical skills, attention to detail, critical thinking abilities, and customer service orientation. Here are some interview preparation tips:

1. Research the Company and Role

Familiarize yourself with the insurance company’s products and services, as well as the specific responsibilities and qualifications of the Claim Inspector role.

- Visit the company website and read industry news to gain insights.

- Review the job description and identify keywords that align with your skills.

2. Highlight Your Technical Expertise

Showcase your proficiency in insurance claim processing systems, investigation techniques, and relevant regulations.

- Quantify your experience and provide specific examples of successful claim investigations and settlements.

- Discuss your knowledge of insurance policies and how you interpret and apply them in your work.

3. Emphasize Your Analytical and Problem-Solving Skills

Demonstrate your ability to analyze complex claim scenarios, identify patterns, and make sound judgments.

- Explain how you approach claim investigations and the steps you take to gather and evaluate evidence.

- Provide examples of claims where you used your critical thinking skills to resolve discrepancies and determine liability.

4. Showcase Your Customer Service Orientation

Highlight your ability to interact effectively with policyholders, claimants, and other stakeholders.

- Emphasize your empathy and understanding of the emotional aspects of claims.

- Share examples of how you have provided excellent customer service by resolving concerns and building rapport.

5. Be Prepared to Discuss Claims Fraud Detection

Demonstrate your knowledge of common fraud indicators and your experience in detecting and investigating fraudulent claims.

- Explain your understanding of the red flags that signal potential fraud.

- Provide examples of claims where you suspected fraud and how you pursued investigations to uncover it.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claim Inspector interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.