Are you gearing up for a career in Claim Specialist? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Claim Specialist and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

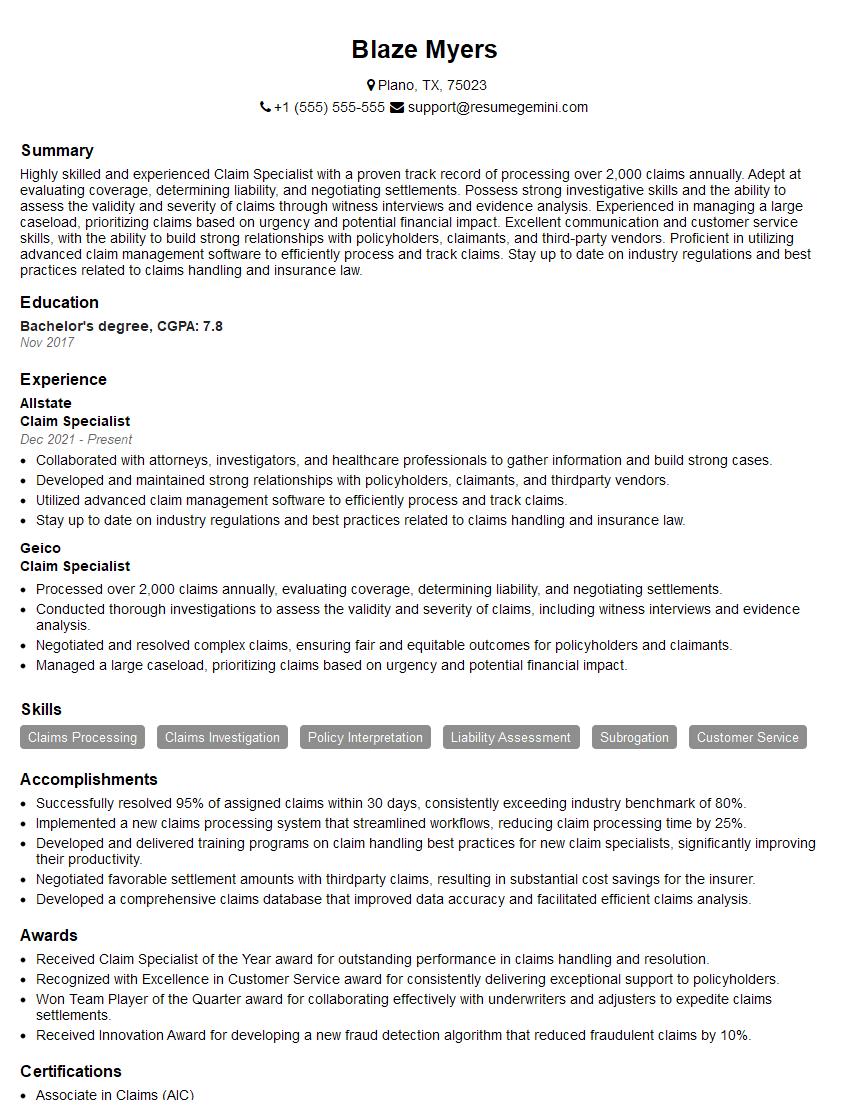

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claim Specialist

1. Describe the key components of a health insurance claim form?

The key components of a health insurance claim form are:

- Patient information: This includes the patient’s name, address, date of birth, and Social Security number.

- Provider information: This includes the provider’s name, address, and contact information.

- Procedure information: This includes the date of service, the procedure code, and the diagnosis code.

- Charges: This includes the amount of the charges for the procedure.

- Payment information: This includes the amount of the payment made by the patient and the amount of the payment made by the insurance company.

2. Explain the process of how a claim is processed by an insurance company?

The process of how a claim is processed by an insurance company is as follows:

The claim is received by the insurance company.

- The claim is reviewed for completeness and accuracy.

- The claim is processed to determine the amount of the benefits that the patient is eligible for.

- The benefits are paid to the patient or to the provider.

The claim is denied.

- The claim is reviewed for completeness and accuracy.

- The claim is processed to determine if the patient is eligible for benefits.

- The claim is denied if the patient is not eligible for benefits.

3. What are the most common reasons for a claim to be denied?

The most common reasons for a claim to be denied are:

- The claim is not covered by the patient’s insurance policy.

- The claim is not submitted in a timely manner.

- The claim is not supported by the necessary documentation.

- The claim is fraudulent.

4. What are the steps you would take to resolve a denied claim?

The steps I would take to resolve a denied claim are as follows:

- Review the denial letter to determine the reason for the denial.

- Gather the necessary documentation to support the claim.

- Submit an appeal to the insurance company.

- Follow up with the insurance company to track the status of the appeal.

5. What are the key elements of a successful appeal?

The key elements of a successful appeal are as follows:

- A clear and concise explanation of the reason for the appeal.

- The supporting documentation that is required to support the appeal.

- A timely submission of the appeal.

6. What are the most common types of fraud that you have encountered in your work as a claim specialist?

The most common types of fraud that I have encountered in my work as a claim specialist are:

- Upcoding: This is when a provider bills for a higher level of service than was actually provided.

- Unbundling: This is when a provider bills for each individual component of a procedure, rather than billing for the procedure as a whole.

- Duplicate billing: This is when a provider bills for the same procedure multiple times.

- False claims: This is when a provider bills for services that were not actually provided.

7. What are the steps you would take to investigate a suspected case of fraud?

The steps I would take to investigate a suspected case of fraud are as follows:

- Review the claim for any inconsistencies.

- Contact the provider to verify the services that were provided.

- Contact the patient to verify that the services were actually received.

- Refer the case to the appropriate authorities for further investigation.

8. What are the key challenges that you have faced in your work as a claim specialist?

The key challenges that I have faced in my work as a claim specialist are:

- The volume of claims that need to be processed.

- The complexity of the claims process.

- The need to keep up with the ever-changing regulations.

- The need to manage the expectations of patients and providers.

9. What are the key skills and qualities that you possess that make you a successful claim specialist?

The key skills and qualities that I possess that make me a successful claim specialist are:

- Excellent communication and interpersonal skills.

- Strong attention to detail.

- Ability to work independently and as part of a team.

- Knowledge of the claims process and the relevant regulations.

- Ability to manage multiple priorities and meet deadlines.

10. What are your career goals?

My career goals are to continue to develop my skills and knowledge in the claims field. I would like to eventually move into a management role where I can lead and mentor a team of claim specialists. I am also interested in becoming more involved in the development and implementation of new claims processing systems.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claim Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claim Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claim Specialists play a pivotal role in insurance companies, serving as the primary point of contact for policyholders and claimants. They are responsible for investigating, assessing, and processing claims to ensure fair and timely compensation.

1. Investigating Claims

Claims Specialists thoroughly investigate claims reported by policyholders. They analyze documentation, interview witnesses, consult with experts, and conduct site inspections to gather evidence and determine the extent of damages or losses.

- Review claim forms, medical records, and other supporting documentation

- Contact policyholders, witnesses, and healthcare providers to gather information

- Conduct thorough investigations to determine liability and coverage

2. Assessing Claims

Claims Specialists evaluate the validity of claims and assess the appropriate compensation amount. They consider factors such as policy terms, coverage limits, and applicable laws to calculate fair settlements.

- Analyze policy provisions and coverage limits

- Calculate reserves and loss estimates

- Determine appropriate settlement amounts

3. Processing Claims

Claims Specialists handle the administrative and procedural aspects of claim processing. They prepare claim forms, communicate with policyholders and claimants, and ensure compliance with company policies and regulations.

- Process claim payments and issue checks

- Maintain records and documentation

- Communicate regularly with policyholders and claimants

4. Customer Service

Claims Specialists provide exceptional customer service by promptly responding to inquiries, addressing concerns, and ensuring policyholder satisfaction. They build relationships with policyholders and work to resolve disputes amicably.

- Answer policyholder questions and address concerns

- Resolve disputes and complaints effectively

- Maintain positive relationships with policyholders

Interview Tips

Preparing thoroughly for your interview will boost your confidence and chances of success. Here are some valuable tips to help you ace the interview and land the Claim Specialist position.

1. Research the Company and Industry

Research the insurance company you’re applying to and gain insights into their products, services, and company culture. Familiarize yourself with the industry’s trends and regulations to demonstrate your knowledge and interest.

- Visit the company’s website and social media pages

- Read industry publications and articles

- attend industry events or webinars

2. Practice Common Interview Questions

Anticipate common interview questions and prepare thoughtful answers that showcase your skills and experience. Practice articulating your strengths, weaknesses, and why you’re the ideal candidate for the role.

- Tell me about yourself and why you’re interested in claims handling.

- Describe your experience in investigating and assessing claims.

- Explain how you handle challenging or complex claims.

3. Highlight Your Soft Skills

Claims Specialists need strong interpersonal, communication, and problem-solving skills. Emphasize your ability to build rapport with customers, resolve conflicts, and think critically under pressure.

- Provide examples of how you defused tense situations with customers.

- Share your strategies for gathering and analyzing information effectively.

- Explain how you handle high-volume workloads and prioritize tasks.

4. Showcase Your Technical Expertise

Demonstrate your proficiency in claim handling software and industry-specific tools. Highlight your understanding of insurance policies and coverage, as well as your ability to interpret legal documents and regulations.

- List the claim handling software you’re familiar with.

- Explain your knowledge of insurance principles and concepts.

- Provide examples of how you’ve successfully navigated complex legal issues.

5. Dress Professionally and Arrive on Time

First impressions matter. Dress appropriately for the interview and arrive on time to show respect for the interviewer’s time. Maintain a positive and enthusiastic attitude throughout the interview.

- Choose business formal or business casual attire.

- Be punctual and arrive 10-15 minutes early.

- Smile, make eye contact, and greet the interviewer warmly.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Claim Specialist role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.