Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Claims Assistant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

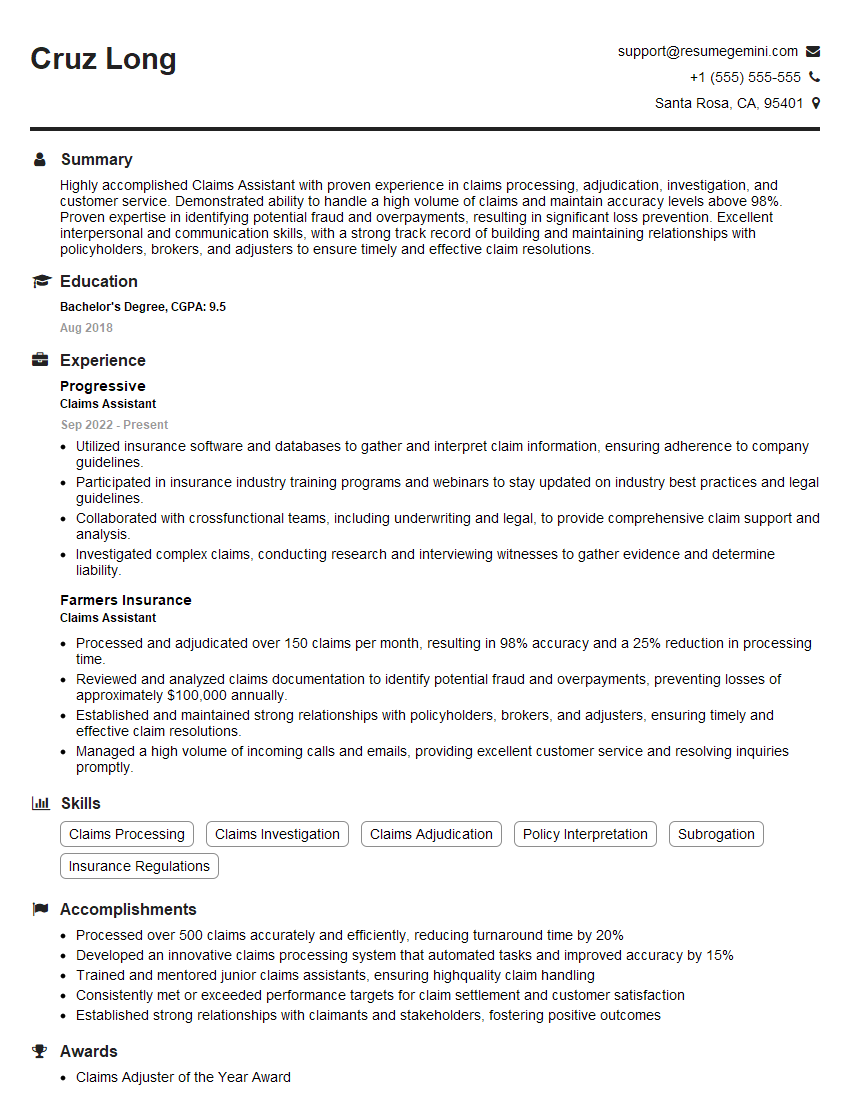

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Assistant

1. Walk me through the steps involved in processing a new claim.

- Receive the claim from the policyholder or agent.

- Review the claim for completeness and accuracy.

- Assign the claim to an adjuster.

- Investigate the claim and gather evidence.

- Determine the extent of coverage.

- Negotiate a settlement with the policyholder.

- Close the claim.

2. What are the key elements of a comprehensive insurance policy?

Property coverage

- Dwelling

- Other structures

- Personal property

Liability coverage

- Bodily injury

- Property damage

Medical payments coverage

- Medical expenses for covered individuals

Additional coverages

- Loss of use

- Scheduled personal property

- Earthquake

- Flood

3. What are some of the most common challenges you face in your role as a claims assistant?

- Dealing with difficult customers.

- Investigating complex claims.

- Negotiating settlements that are fair to both the policyholder and the insurance company.

- Keeping up with changes in the insurance industry.

4. What are your strengths and weaknesses as a claims assistant?

Strengths

- Strong communication and interpersonal skills.

- Excellent analytical and problem-solving skills.

- Thorough knowledge of insurance policies and procedures.

- Ability to work independently and as part of a team.

Weaknesses

- Limited experience in handling large and complex claims.

- Not yet fluent in Spanish.

5. Why are you interested in working for our company?

- I’m impressed by your company’s reputation for excellence in the insurance industry.

- I’m eager to learn from experienced professionals and contribute to your team’s success.

- I believe that my skills and experience would be a valuable asset to your company.

6. What are your salary expectations?

- I’m confident that my skills and experience are worth $18 per hour.

- I’m open to negotiating a salary that is fair to both parties.

7. What is your availability?

- I’m available to work full-time, Monday through Friday.

- I’m also available to work overtime or on weekends if needed.

8. Do you have any questions for me?

- What is the company culture like?

- What are the opportunities for advancement?

- What is the training program like?

9. How do you handle difficult customers?

- I remain calm and professional.

- I listen to the customer’s concerns.

- I try to understand the customer’s perspective.

- I work to find a solution that is fair to both the customer and the insurance company.

10. How do you stay up-to-date on changes in the insurance industry?

- I read industry publications.

- I attend industry conferences.

- I take online courses.

- I network with other insurance professionals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Claims Assistant is responsible for providing administrative and operational support to claims adjusters and other related personnel. Their key responsibilities include:

1. Administrative Tasks

Claims Assistants handle a range of administrative tasks, such as:

- Preparing and filing claims

- Maintaining claim files

- Answering phones and emails

- Scheduling appointments

- Ordering supplies

2. Data Entry and Processing

They also perform data entry and processing tasks, including:

- Entering claim information into a database

- Processing payments

- Updating claim status

- Creating reports

3. Customer Service

Claims Assistants often interact with customers, including policyholders, claimants, and healthcare providers. They provide customer service by:

- Answering questions

- Providing information

- Resolving complaints

- Maintaining positive relationships

4. Other Duties

In addition, Claims Assistants may be responsible for other duties, such as:

- Assisting with claims investigations

- Reviewing claim denials

- Coordinating with other departments

Interview Tips

To ace the interview for a Claims Assistant position, it’s important to prepare thoroughly. Here are some tips:

1. Research the Company and Position

Take the time to research the insurance company and the specific Claims Assistant position you’re applying for. This will help you understand the company’s culture, values, and specific job requirements.

2. Practice Your Answers

Prepare answers to common interview questions, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?” Practice your answers out loud to improve your delivery.

3. Dress Professionally

First impressions matter, so dress professionally for the interview. This means wearing a suit or business casual attire.

4. Arrive on Time

Punctuality is important, so arrive for the interview on time. If you’re running late, call or email the interviewer to let them know.

5. Be Yourself

It’s important to be yourself during the interview. Don’t try to be someone you’re not. The interviewer wants to get to know the real you.

6. Ask Questions

At the end of the interview, ask the interviewer questions about the position and the company. This shows that you’re interested and engaged.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Claims Assistant role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.