Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Claims Service Adjustor interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Claims Service Adjustor so you can tailor your answers to impress potential employers.

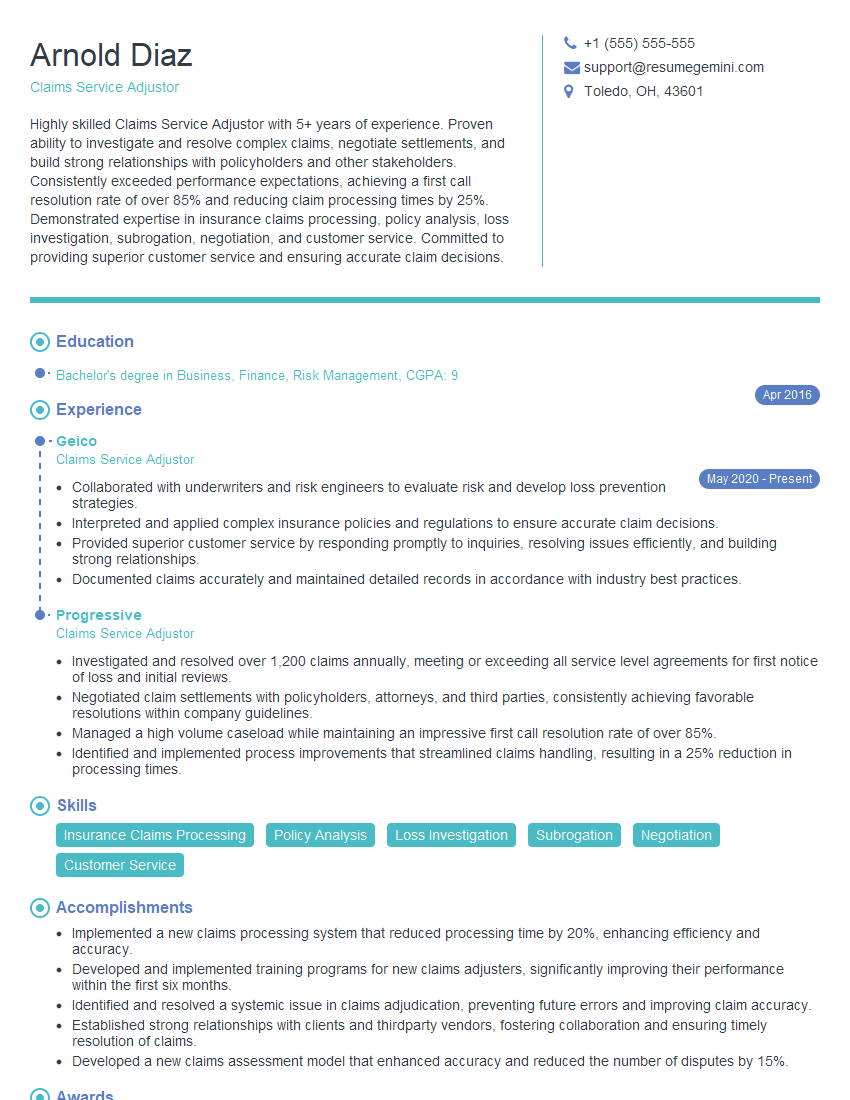

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Service Adjustor

1. Explain the process of investigating and assessing a property damage claim?

- Gather information from the claimant

- Inspect the damaged property

- Review relevant documents, such as the insurance policy and the claim

- Estimate the cost of repairs or replacement

- Determine the cause of the damage

- Make a decision on whether to approve or deny the claim

2. What are the most common types of property damage claims you have handled?

Automobile damage claims

- Collision damage

- Comprehensive damage

- Uninsured/underinsured motorist damage

Homeowners insurance claims

- Wind damage

- Hail damage

- Fire damage

- Water damage

Commercial property insurance claims

- Fire damage

- Water damage

- Theft damage

- Vandalism damage

3. What is the most challenging property damage claim you have ever handled?

Describe the claim in detail, including the challenges you faced and how you overcame them. Explain the outcome of the claim and what you learned from the experience.

4. What are the key factors you consider when evaluating a property damage claim?

- The cause of the damage

- The extent of the damage

- The value of the property

- The terms of the insurance policy

- The claimant’s financial situation

5. How do you communicate with claimants?

Describe your communication style and how you build rapport with claimants. Explain how you handle difficult conversations and how you keep claimants informed throughout the claims process.

6. What is your experience with using insurance software?

List the specific software programs you have used and describe your proficiency with each one. Explain how you use software to manage claims, investigate losses, and assess damages.

7. What are your strengths and weaknesses as a Claims Service Adjustor?

Highlight your strengths, such as your investigative skills, your ability to communicate with claimants, and your knowledge of insurance policies. Be honest about your weaknesses and explain how you are working to improve them.

8. What are your career goals?

Explain your short-term and long-term career goals. Discuss how this position fits into your career plan and how you plan to contribute to the company.

9. Why are you interested in working for our company?

Research the company and learn about its culture and values. Explain how your skills and experience align with the company’s needs and how you can contribute to its success.

10. Do you have any questions for me?

This is your opportunity to ask the interviewer questions about the position, the company, or the industry. Prepare thoughtful questions that show your interest in the job and your knowledge of the field.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Service Adjustor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Service Adjustor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claims Service Adjustors play a crucial role in the insurance industry, handling claims efficiently and providing excellent customer service. Key responsibilities include:

1. Investigating and Assessing Claims

Conducting thorough investigations into insurance claims, examining policy details, and gathering evidence to determine coverage and liability.

- Interviewing policyholders, witnesses, and other parties involved in claims.

- Analyzing medical records, property damage reports, and other relevant documents.

2. Evaluating Damages and Estimating Costs

Inspecting damaged property, assessing the extent of the loss, and estimating repair or replacement costs.

- Working with contractors, repair shops, and other experts to obtain accurate repair estimates.

- Negotiating settlements with policyholders and third parties to ensure fair compensation.

3. Processing and Approving Claims

Reviewing claim documentation, determining eligibility, and making decisions on coverage and payout amounts.

- Authorizing repairs, issuing payments, and resolving disputes.

- Ensuring compliance with insurance policies and regulations.

4. Providing Customer Service and Support

Communicating with policyholders, answering inquiries, and providing support throughout the claims process.

- Explaining coverage details, policy conditions, and settlement options.

- Resolving complaints and ensuring customer satisfaction.

Interview Tips

To ace an interview for a Claims Service Adjustor position, consider the following tips:

1. Research the Role and Company

Thoroughly research the specific job requirements and the company’s insurance practices. Understand the industry and its regulations, as well as the company’s claims handling process.

- Review the job description and company website.

- Read industry news and publications.

2. Highlight Transferable Skills

Even if you don’t have direct claims adjusting experience, emphasize transferable skills that are essential in this role. These include analytical thinking, problem-solving, negotiation, and customer service.

- Provide examples from previous roles where you demonstrated these skills.

- Quantify your accomplishments whenever possible.

3. Practice Answering Common Interview Questions

Prepare for common interview questions by practicing your responses. This will help you present yourself confidently and articulate your qualifications.

- Research typical interview questions for Claims Service Adjustors.

- Use the “STAR” method (Situation, Task, Action, Result) to structure your answers.

4. Demonstrate a Positive and Professional Attitude

During the interview, maintain a positive and professional attitude. Dress appropriately, arrive on time, and be respectful of the interviewer.

- Make eye contact, show enthusiasm, and be eager to learn.

- Ask thoughtful questions to demonstrate your interest in the role and the company.

5. Follow Up and Seek Feedback

After the interview, follow up with a thank-you note to express your appreciation. Consider asking for feedback on your performance to identify areas for improvement.

- Send a personalized thank-you email within 24 hours of the interview.

- Request feedback to show your willingness to develop and learn.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claims Service Adjustor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.