Are you gearing up for an interview for a Property Claims Adjuster position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Property Claims Adjuster and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

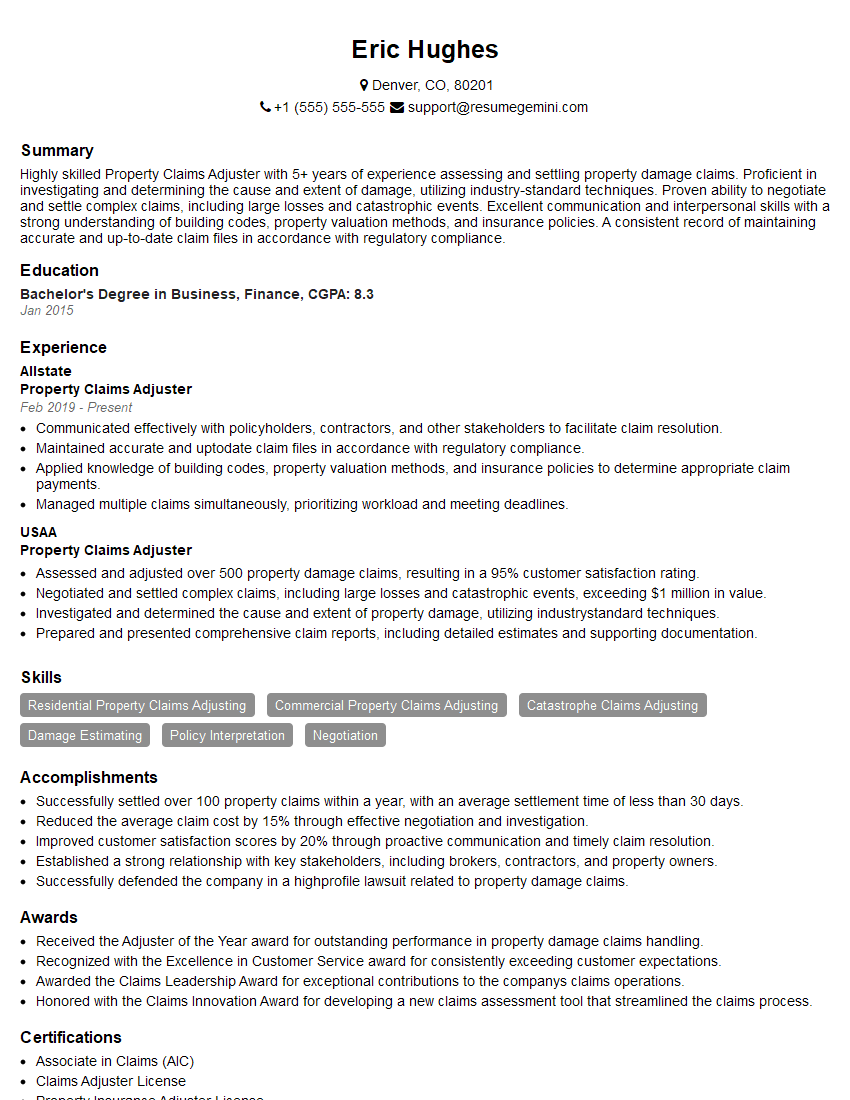

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Property Claims Adjuster

1. What is the first step you take when investigating a property claim?

When investigating a property claim, the first step is to gather as much information as possible to determine the cause and extent of the loss. This includes interviewing the policyholder, witnesses, and any other relevant parties; inspecting the damaged property; and reviewing any documentation related to the claim, such as the policy, police reports, and repair estimates.

2. What are the different types of property insurance claims?

Property Damage

- Dwelling coverage

- Other structures coverage

- Personal property coverage

Liability

- Bodily injury liability

- Property damage liability

3. What are the most common causes of property damage claims?

The most common causes of property damage claims are:

- Weather events (e.g., hurricanes, tornadoes, hail, earthquakes)

- Fire

- Theft

- Vandalism

- Water damage

4. What are the key elements of a property claims investigation?

The key elements of a property claims investigation include:

- Determining the cause and origin of the loss

- Estimating the extent of the damage

- Identifying the responsible parties

- Determining the amount of coverage available

- Recommending a settlement amount

5. What are the different types of property claims settlements?

The different types of property claims settlements include:

- Cash settlements

- Repair or replacement settlements

- Structured settlements

6. What are the most challenging aspects of property claims adjusting?

Some of the most challenging aspects of property claims adjusting include:

- Dealing with difficult policyholders

- Determining the cause and origin of the loss

- Estimating the extent of the damage

- Negotiating settlements

7. What are the most rewarding aspects of property claims adjusting?

Some of the most rewarding aspects of property claims adjusting include:

- Helping policyholders recover from their losses

- Solving complex problems

- Making a difference in people’s lives

8. What are the key qualities of a successful property claims adjuster?

Some of the key qualities of a successful property claims adjuster include:

- Strong communication skills

- Excellent negotiation skills

- Analytical skills

- Problem-solving skills

- Attention to detail

9. What are the career advancement opportunities for property claims adjusters?

Property claims adjusters can advance their careers in a number of ways, including:

- Becoming a senior adjuster

- Becoming a claims manager

- Becoming a claims director

- Opening their own independent adjusting firm

10. What is the role of technology in property claims adjusting?

Technology plays an increasingly important role in property claims adjusting. Some of the ways that technology is used in property claims adjusting include:

- Estimating damages

- Communicating with policyholders

- Managing claims

- Preventing fraud

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Property Claims Adjuster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Property Claims Adjuster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Property Claims Adjusters are responsible for investigating and settling claims related to property damage or loss. They work with policyholders, insurance companies, and other parties to assess the extent of the damage, determine the cause of the loss, and negotiate a fair settlement.

1. Investigating Claims

Property Claims Adjusters typically begin by visiting the site of the damage to assess the extent of the loss. They may also interview the policyholder, witnesses, and other parties involved in the incident. They will gather evidence, such as photographs, estimates, and receipts, to support their findings.

2. Determining the Cause of Loss

Property Claims Adjusters must determine the cause of the loss to determine if it is covered by the policy. They will review the policy language and investigate the circumstances surrounding the incident to make this determination.

3. Negotiating Settlements

Once the cause of loss has been determined, Property Claims Adjusters will negotiate a fair settlement with the policyholder. They will consider the extent of the damage, the policy coverage, and the policyholder’s financial situation.

4. Communicating with Policyholders

Property Claims Adjusters must be able to communicate effectively with policyholders throughout the claims process. They will explain the claims process, answer questions, and keep policyholders updated on the status of their claim.

Interview Tips

Preparing for a Property Claims Adjuster interview can help you make a positive impression on the hiring manager and increase your chances of getting the job. Here are some tips to help you prepare:

1. Research the Company and the Position

Take some time to learn about the insurance company and the specific Property Claims Adjuster position you are applying for. This will help you understand the company’s culture, values, and the specific requirements of the job.

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. Practice your answers to these questions so that you can deliver them confidently and concisely.

3. Be Prepared to Talk About Your Experience

The interviewer will want to know about your experience as a Property Claims Adjuster. Be prepared to discuss your skills and abilities, and how they have helped you to be successful in your previous roles.

4. Dress Professionally and Arrive on Time

First impressions matter, so it is important to dress professionally and arrive for your interview on time. This will show the interviewer that you are serious about the position and that you respect their time.

Example Outline:

Why are you interested in this position?

- Discuss your interest in the insurance industry and claims adjusting.

- Explain how your skills and experience align with the requirements of the job.

Tell me about your experience as a Property Claims Adjuster.

- Describe your responsibilities and accomplishments in your previous role.

- Quantify your results whenever possible, using specific examples.

What are your strengths and weaknesses?

- Identify your strengths and weaknesses relevant to the job.

- Provide specific examples to support your claims.

Why should we hire you?

- Summarize your qualifications and how they make you the best candidate for the job.

- Express your enthusiasm for the position and the company.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Property Claims Adjuster interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.