Are you gearing up for an interview for a Lost Charge Card Clerk position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Lost Charge Card Clerk and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

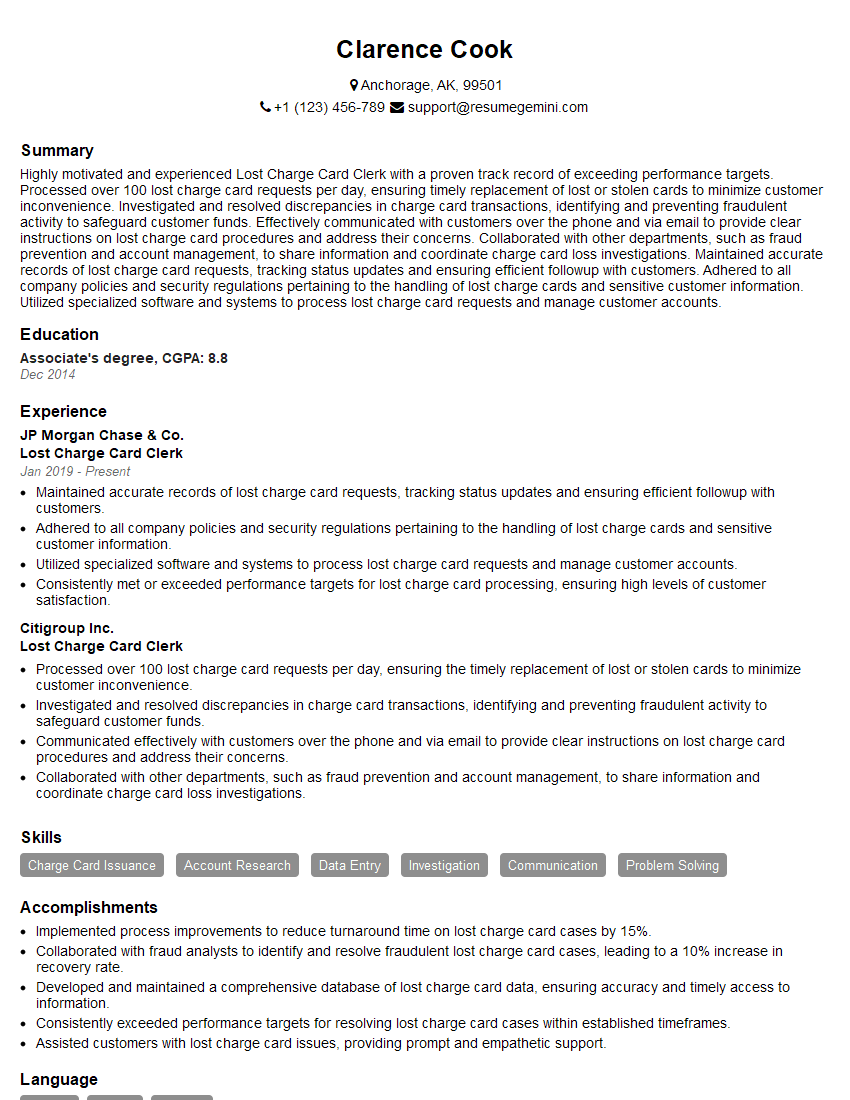

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Lost Charge Card Clerk

1. Describe the process of reporting a lost or stolen charge card.

The process of reporting a lost or stolen charge card involves several steps:

- Contact the credit card issuer immediately to report the card as lost or stolen.

- Provide the issuer with relevant information, such as the card number, account number, and date the card was lost or stolen.

- Follow the issuer’s instructions for canceling the card and requesting a replacement.

- Monitor account statements and report any unauthorized transactions to the issuer promptly.

2. What are the key security measures to prevent fraudulent charge card use?

Key security measures to prevent fraudulent charge card use include:

- Using strong passwords and multi-factor authentication for online accounts.

- Being cautious when sharing personal information online or over the phone.

- Monitoring account statements regularly for unauthorized transactions.

- Using chip-enabled credit cards and contactless payment methods.

- Keeping personal information, such as Social Security number and birthdate, confidential.

3. How do you handle disputes related to lost or stolen charge cards?

When handling disputes related to lost or stolen charge cards:

- Contact the credit card issuer immediately to report the dispute and provide supporting documentation, such as a police report.

- Work with the issuer to investigate the dispute and determine liability.

- Follow the issuer’s dispute resolution process and provide any necessary information.

- Stay informed of the status of the dispute and follow up as needed.

4. What are the common types of fraud associated with charge cards?

Common types of fraud associated with charge cards include:

- Unauthorized use of lost or stolen cards.

- Counterfeit cards created using stolen account information.

- Phishing scams where fraudsters attempt to obtain account information.

- Identity theft resulting in fraudulent charge card applications and usage.

- Card skimming devices used to capture card data at point-of-sale terminals.

5. How do you stay up-to-date with the latest fraud trends and prevention techniques?

To stay up-to-date with the latest fraud trends and prevention techniques:

- Attend industry conferences and workshops.

- Read trade publications and follow industry news.

- Network with other fraud professionals and share best practices.

- Take advantage of training and certification programs offered by credit card issuers and fraud prevention organizations.

- Monitor relevant government and law enforcement websites for updates on fraud trends and prevention.

6. Describe how you would investigate a suspected case of charge card fraud.

When investigating a suspected case of charge card fraud:

- Gather all relevant information, including account statements, transaction details, and contact information for the cardholder.

- Review account activity for any suspicious patterns or anomalies.

- Contact the cardholder to verify transactions and identify any unauthorized activity.

- Work with other departments, such as IT and legal, to gather additional evidence and support.

- Document the investigation findings and communicate the results to the cardholder and relevant stakeholders.

7. What are the potential consequences of not properly handling lost or stolen charge cards?

Failing to properly handle lost or stolen charge cards can have several negative consequences:

- Increased risk of fraud and financial losses.

- Damage to the cardholder’s credit score.

- Legal liability for unauthorized transactions.

- Reputational damage for the organization.

- Loss of customer trust.

8. How do you prioritize and manage multiple lost or stolen charge card cases?

To prioritize and manage multiple lost or stolen charge card cases:

- Establish a clear triage process to identify high-risk cases.

- Assign cases based on severity and urgency.

- Use technology tools to automate tasks and streamline workflows.

- Collaborate with other departments to ensure a coordinated response.

- Monitor case progress and adjust priorities as needed.

9. What are the ethical guidelines that you follow in your work as a Lost Charge Card Clerk?

As a Lost Charge Card Clerk, I adhere to the following ethical guidelines:

- Confidentiality: Maintaining the privacy of cardholder information.

- Integrity: Acting with honesty and fairness in all interactions.

- Objectivity: Avoiding conflicts of interest and bias.

- Professionalism: Conducting myself in a respectful and ethical manner.

- Compliance: Adhering to all applicable laws and regulations.

10. How do you stay motivated and engaged in your role as a Lost Charge Card Clerk?

I stay motivated and engaged in my role as a Lost Charge Card Clerk by:

- Understanding the importance of my work in protecting cardholders from fraud.

- Continuously developing my knowledge of fraud prevention techniques.

- Seeking out opportunities for growth and professional development.

- Building strong relationships with my colleagues and clients.

- Celebrating successes and learning from challenges.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Lost Charge Card Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Lost Charge Card Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Lost Charge Card Clerk is responsible for handling lost or stolen charge cards, ensuring that the accounts are protected and that customers receive prompt assistance.

1. Process Lost or Stolen Charge Card Reports

When a customer reports a lost or stolen charge card, the clerk must take the following steps:

- Verify the customer’s identity and account information.

- Cancel the lost or stolen card and issue a new one.

- Investigate any fraudulent activity on the account.

2. Communicate with Customers

The clerk must be able to communicate effectively with customers, both in person and over the phone.

- Explain the process for reporting a lost or stolen card.

- Answer any questions the customer may have.

- Provide reassurance and support to customers who are victims of fraud.

3. Maintain Records

Maintain accurate records of all lost or stolen charge card reports. This includes tracking the date and time the report was received, the name and contact information of the customer, and the account information associated with the lost or stolen card.

4. Monitor Fraudulent Activity

The clerk must be able to identify and investigate fraudulent activity on charge card accounts.

- Review account statements for unauthorized transactions.

- Contact customers to verify any suspicious transactions.

- Report any fraudulent activity to the appropriate authorities.

Interview Tips

To ace the interview for a Lost Charge Card Clerk position, it is important to be prepared and to highlight your key skills and experience.

1. Research the Company and the Position

Before the interview, take some time to learn more about the company and the specific position you are applying for. This will help you understand the company’s culture and values, and will also give you a better idea of what the job entails.

2. Practice Answering Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. It is helpful to practice answering these questions in advance so that you can deliver confident and thoughtful responses during the interview.

3. Highlight Your Relevant Skills and Experience

In your interview, be sure to highlight the skills and experience that make you a good fit for the position. This includes your customer service skills, your attention to detail, and your ability to work independently.

4. Be Enthusiastic and Professional

First impressions matter, so it is important to be enthusiastic and professional during your interview. Dress appropriately, arrive on time, and be polite and respectful to everyone you meet.

5. Ask Questions

At the end of the interview, be sure to ask the interviewer any questions you have about the position or the company. This shows that you are interested in the opportunity and that you are taking the interview seriously.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Lost Charge Card Clerk interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.