Are you gearing up for a career in Field Automobile Adjuster (Field Auto Adjuster)? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Field Automobile Adjuster (Field Auto Adjuster) and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

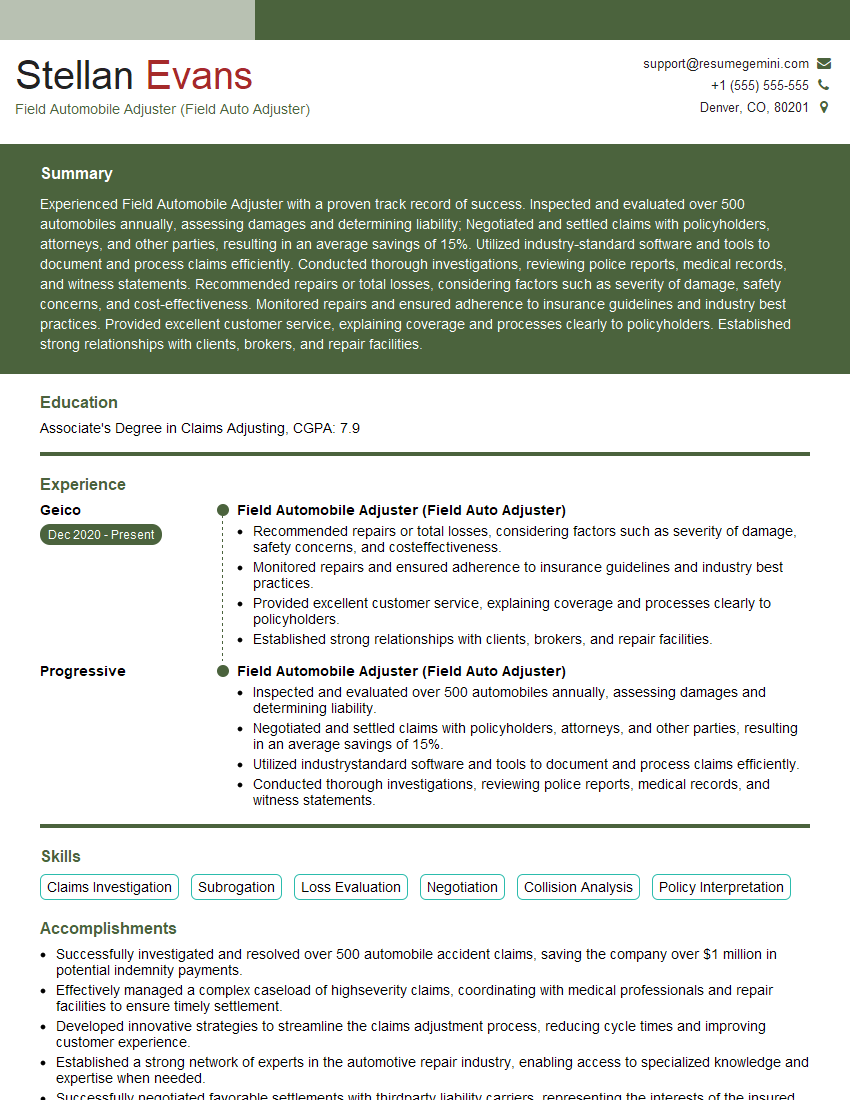

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Field Automobile Adjuster (Field Auto Adjuster)

1. Can you describe the key responsibilities of a Field Automobile Adjuster?

- Investigating automobile accidents and assessing the extent of damages.

- Interviewing claimants, witnesses, and other parties involved in the accident.

- Taking photographs and gathering physical evidence to support the claim.

- Estimating the cost of repairs or total loss.

- Negotiating settlements with claimants and insurance companies.

2. What are the essential skills that a Field Automobile Adjuster should possess?

Technical Skills

- Knowledge of automobile construction and repair.

- Proficiency in using adjusting software and estimating tools.

- Understanding of insurance policies and coverage.

Soft Skills

- Strong communication and interpersonal skills.

- Ability to work independently and manage multiple tasks.

- Attention to detail and accuracy.

3. How do you determine the fair market value of a damaged vehicle?

- Research comparable vehicles in the local market.

- Consider the age, mileage, condition, and features of the vehicle.

- Consult with independent appraisers or industry experts if necessary.

- Utilize online valuation tools or databases to support the estimated value.

4. What is the difference between a partial loss and a total loss?

- Partial Loss: Damage is less than the actual cash value of the vehicle and repairs can be made.

- Total Loss: Damage exceeds the actual cash value of the vehicle or repairs are not feasible.

5. How do you handle disputes with claimants who disagree with your assessment?

- Explain the basis for your assessment clearly and provide supporting evidence.

- Listen to the claimant’s concerns and try to understand their perspective.

- Be willing to negotiate and compromise within reason.

- If necessary, involve management or a supervisor in the discussion.

6. What is your experience with subrogation?

Explain the process of recovering funds from at-fault parties and highlight any successful subrogation cases.

7. How do you stay up-to-date with changes in the auto insurance industry?

- Attend industry conferences and webinars.

- Read trade publications and articles.

- Network with other adjusters and insurance professionals.

- Obtain professional certifications or designations.

8. What are some of the challenges you have faced as a Field Automobile Adjuster? How did you overcome them?

Discuss specific situations where you encountered obstacles, problem-solved, and achieved successful outcomes.

9. How do you prioritize your workload and manage your time effectively?

- Use a scheduling system to plan and organize assignments.

- Prioritize claims based on urgency and complexity.

- Delegate tasks to others when possible.

- Learn to say no to non-essential tasks or requests.

10. What are your strengths and weaknesses as a Field Automobile Adjuster?

Highlight your core competencies, such as negotiation abilities, technical expertise, and customer service skills. Acknowledge areas for improvement and demonstrate a willingness to learn and grow.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Field Automobile Adjuster (Field Auto Adjuster).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Field Automobile Adjuster (Field Auto Adjuster)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Field Automobile Adjusters, also known as Field Auto Adjusters, play a crucial role in the insurance industry by investigating and settling automobile claims. They work directly with policyholders, witnesses, and other parties involved in auto accidents to gather information, assess damages, and determine liability.

1. Investigate Automobile Accidents

Field Auto Adjusters investigate automobile accidents by visiting the scene, taking photographs, and gathering witness statements. They interview drivers, passengers, and any other individuals involved in the accident to obtain a clear understanding of how the accident occurred.

2. Assess Damages

Field Auto Adjusters assess the damages sustained by vehicles and property. They inspect the vehicles, take measurements, and consult with repair shops to estimate the cost of repairs or replacement. They also document any injuries sustained by individuals involved in the accident.

3. Determine Liability

Field Auto Adjusters determine liability for automobile accidents based on the evidence gathered during their investigation. They review police reports, witness statements, and other relevant documents to identify the party or parties responsible for the accident.

4. Negotiate Settlements

Field Auto Adjusters negotiate settlements with policyholders and other parties involved in the accident. They work with policyholders to ensure that they receive fair compensation for their damages, while also protecting the insurance company’s financial interests.

Interview Tips

Preparing for an interview for a Field Automobile Adjuster position requires a combination of technical knowledge, communication skills, and a professional demeanor. Here are some tips to help candidates ace the interview:

1. Research the Company and Position

Research the insurance company and the specific Field Automobile Adjuster position. This will give you a good understanding of the company’s culture, values, and the specific responsibilities of the role.

- Visit the company’s website to learn about their history, mission statement, and products/services.

- Review the job description carefully to identify the key requirements and qualifications.

2. Highlight Your Technical Expertise

In the interview, emphasize your technical expertise in automobile insurance and claims handling. Explain your experience with investigating accidents, assessing damages, determining liability, and negotiating settlements.

- Share specific examples of complex claims you have handled successfully.

- Discuss your knowledge of industry regulations and best practices.

3. Demonstrate Your Communication Skills

Field Automobile Adjusters need excellent communication skills to effectively interact with policyholders, witnesses, and other parties involved in accidents. Highlight your ability to communicate clearly, build rapport, and negotiate effectively.

- Provide examples of challenging conversations you have had with clients or other stakeholders.

- Emphasize your ability to listen attentively and respond empathetically.

4. Present a Professional Demeanor

Dress professionally and arrive on time for the interview. Be polite and respectful to the interviewer and maintain eye contact throughout the conversation. Show enthusiasm for the position and the insurance industry.

- Prepare thoughtful questions to ask the interviewer about the company and the role.

- Thank the interviewer for their time and consideration, regardless of the outcome of the interview.

Next Step:

Now that you’re armed with the knowledge of Field Automobile Adjuster (Field Auto Adjuster) interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Field Automobile Adjuster (Field Auto Adjuster) positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini