Feeling lost in a sea of interview questions? Landed that dream interview for Currency Counter but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Currency Counter interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

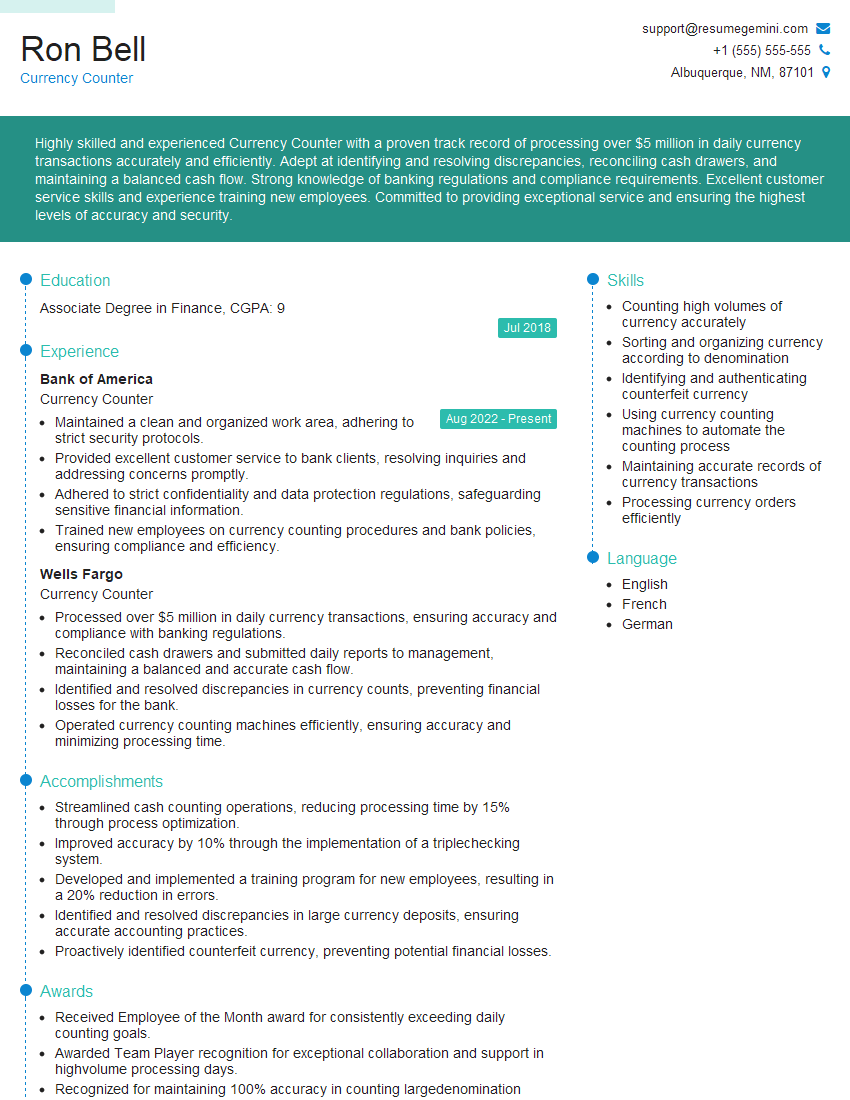

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Currency Counter

1. Describe your experience in handling different types of currency counting machines.

- Highlight your proficiency in operating various currency counting machines, including high-speed note sorters, counterfeit detectors, and bundling machines.

- Discuss your familiarity with their features, maintenance procedures, and troubleshooting techniques.

2. Explain the importance of proper cash handling procedures and how you ensure compliance.

Security Measures

- Emphasize the importance of securing sensitive financial information and preventing fraud.

- Describe your knowledge of security protocols, such as access control, CCTV monitoring, and tamper-proof seals.

Accuracy and Efficiency

- Highlight your meticulous attention to detail and ability to handle large volumes of cash accurately.

- Discuss your knowledge of counting techniques, such as manual counting, batching, and random sampling.

3. How do you prioritize tasks in a fast-paced and demanding environment?

- Explain your ability to manage multiple tasks effectively and prioritize urgent requests.

- Discuss your strategies for staying organized, delegating responsibilities, and meeting deadlines.

4. Describe your experience in identifying and handling counterfeit currency.

- Demonstrate your knowledge of counterfeit detection techniques, including visual inspection, UV light verification, and magnetic ink detection.

- Discuss your familiarity with security features on different currencies and your ability to recognize suspicious banknotes.

5. How do you maintain a clean and efficient work environment?

- Emphasize your understanding of the importance of hygiene and safety in a cash handling environment.

- Describe your daily cleaning and maintenance routine, including machine upkeep, surface disinfection, and waste disposal.

6. Discuss your experience in handling currency exchange transactions.

- Explain your familiarity with foreign exchange rates and your ability to calculate exchange values accurately.

- Describe your knowledge of currency regulations and your adherence to compliance procedures.

7. How do you stay up-to-date with advancements in currency handling technology?

- Highlight your interest in professional development and your commitment to staying informed about industry trends.

- Discuss your attendance at conferences, workshops, and online training sessions.

8. Describe your experience in managing the cash flow for a large organization.

- Explain your role in managing cash inflows and outflows, forecasting cash needs, and maintaining liquidity.

- Discuss your knowledge of cash management tools, such as bank reconciliations, cash flow statements, and petty cash systems.

9. How do you handle discrepancies in cash counts and maintain accurate records?

- Demonstrate your meticulousness in reconciling cash counts and your ability to identify and resolve discrepancies.

- Discuss your use of reconciliation reports, signed count vouchers, and documentation to ensure accuracy.

10. Describe your experience in training and supervising other currency counters.

- Explain your role in onboarding, training, and evaluating new employees.

- Discuss your ability to communicate effectively, provide guidance, and ensure adherence to company policies.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Currency Counter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Currency Counter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Currency Counters are responsible for counting, sorting, and verifying the authenticity of currency. They play a vital role in ensuring the accuracy and integrity of financial transactions in various settings such as banks, casinos, and retail businesses.

1. Counting and Verifying Currency

The primary responsibility of a Currency Counter is to count and verify the authenticity of currency. They use specialized machines or manual counting techniques to ensure the accuracy of financial transactions.

- Count and verify currency notes and coins to ensure accuracy in cash transactions.

- Detect counterfeit currency using various methods, such as visual inspection, UV light, and magnetic sensitivity.

2. Sorting and Bundling Currency

Once the currency is counted and verified, Currency Counters sort and bundle it into specific denominations and quantities. This facilitates easy storage, handling, and transportation of cash.

- Sort currency notes and coins into specific denominations and bundles according to established procedures.

- Prepare and maintain inventory records of currency processed and stored.

3. Maintaining Records and Reporting

Currency Counters maintain accurate records of all transactions they handle, including the amount of currency counted, verified, sorted, and bundled. They also report any discrepancies or irregularities to supervisors or management.

- Maintain accurate records of currency processed, including denominations, quantities, and serial numbers.

- Report any discrepancies or irregularities in currency handling to the appropriate authorities.

4. Complying with Regulations and Standards

Currency Counters must adhere to strict industry regulations and standards to ensure the integrity and compliance of their work. They follow established procedures to prevent fraud, theft, and errors.

- Follow all established policies, procedures, and regulations related to currency handling and accounting.

- Stay up-to-date on industry best practices and changes in regulations affecting currency counting and verification.

Interview Tips

Preparing for an interview as a Currency Counter requires a combination of technical knowledge, attention to detail, and a strong understanding of the industry. Here are some tips to help you ace the interview:

1. Research the Company and Position

Before the interview, thoroughly research the company you are applying to and the specific Currency Counter position. This will demonstrate your interest and enthusiasm for the role.

- Visit the company’s website to learn about their history, mission, values, and services.

- Review the job description carefully to understand the key responsibilities and requirements.

2. Highlight Your Skills and Experience

Emphasize your technical skills related to currency counting, sorting, and verification. Quantify your experience whenever possible to demonstrate your proficiency.

- Provide specific examples of how you have counted, sorted, and verified currency accurately and efficiently.

- Describe any experience you have with detecting counterfeit currency using various methods.

3. Demonstrate Attention to Detail and Accuracy

Currency Counters must be highly attentive to detail and accurate in their work. Highlight your ability to focus on precision and minimize errors.

- Share examples of how you have maintained accurate records and identified discrepancies in currency handling.

- Explain how you maintain concentration and accuracy even under pressure or in fast-paced environments.

4. Understand Regulations and Compliance

Currency Counters must be familiar with industry regulations and compliance standards. Demonstrating your knowledge of these requirements will show the interviewer your professionalism and commitment to ethical practices.

- Explain your understanding of the importance of complying with anti-money laundering regulations and other relevant laws.

- Describe how you stay up-to-date on industry best practices and changes in regulations.

5. Practice Common Interview Questions

Prepare for common interview questions related to your skills, experience, and motivations. Practicing your answers will help you feel more confident and articulate during the interview.

- Why are you interested in this Currency Counter position?

- How do you ensure accuracy and minimize errors in your work?

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Currency Counter role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.