Are you gearing up for a career in Retirement Officer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Retirement Officer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

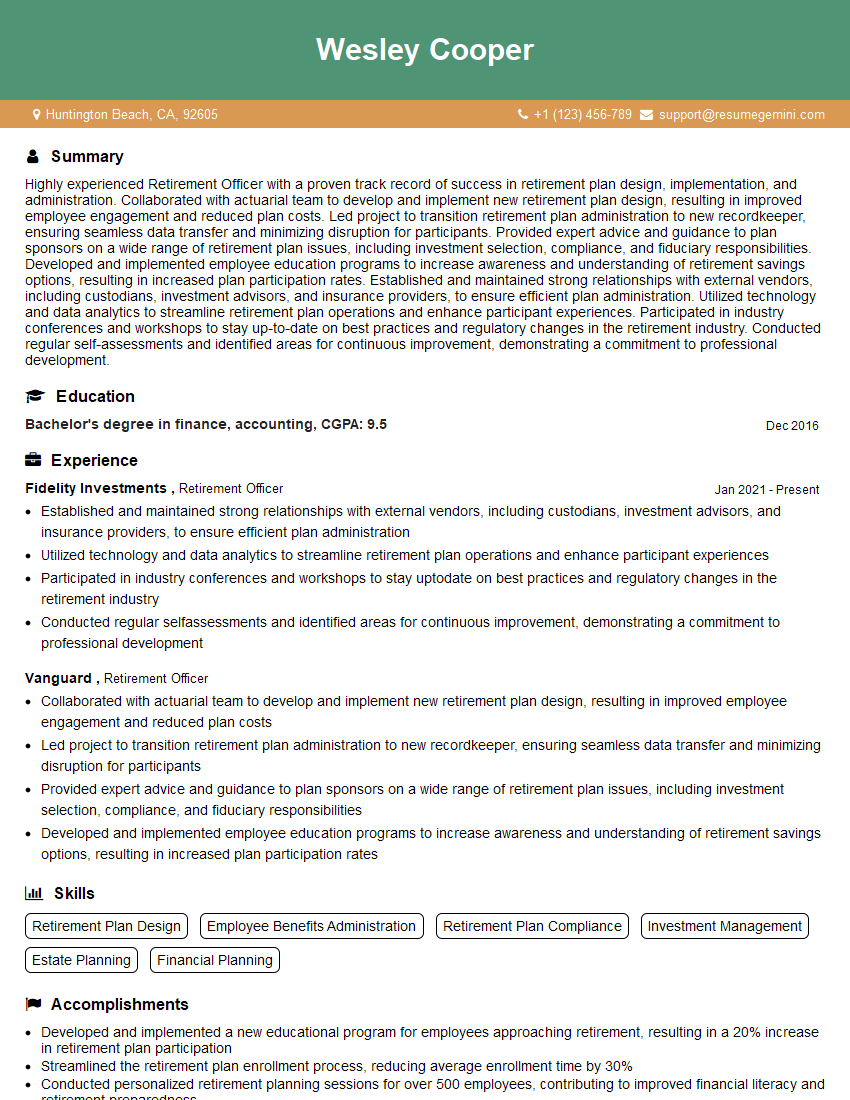

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Retirement Officer

1. Explain the process involved in processing a retirement claim?

The process involved in processing a retirement claim typically includes the following steps:

- The employee submits a retirement claim to the plan administrator.

- The plan administrator reviews the claim to ensure that the employee meets the eligibility requirements for retirement.

- The plan administrator calculates the amount of the employee’s retirement benefit.

- The plan administrator sends the employee a notice of the retirement benefit amount.

- The employee has a period of time to review the notice and appeal the decision if they believe it is incorrect.

- If the employee does not appeal the decision, the plan administrator begins paying the retirement benefit.

2. What are the different types of retirement benefits that are available?

Defined Benefit Plans

- Provide a guaranteed monthly benefit for life.

- The benefit amount is based on a formula that considers factors such as years of service and salary.

Defined Contribution Plans

- Provide a lump sum of money at retirement.

- The employee is responsible for managing the investments in the plan.

Hybrid Plans

- Combine elements of both defined benefit and defined contribution plans.

3. What are the factors that affect the amount of a retirement benefit?

- Age at retirement

- Years of service

- Salary history

- Investment performance

- Plan design

- Tax laws

4. What are the tax implications of retirement benefits?

Retirement benefits are taxed differently depending on the type of plan from which they are received.

Defined Benefit Plans

- Benefits are taxed as ordinary income when they are received.

Defined Contribution Plans

- Contributions are made on a pre-tax basis.

- Earnings on investments in the plan are also tax-deferred.

- Withdrawals from the plan are taxed as ordinary income.

5. What are the different ways to receive retirement benefits?

- Monthly annuity

- Lump sum

- Combination of annuity and lump sum

6. What are the advantages and disadvantages of each method of receiving retirement benefits?

Monthly Annuity

Advantages:- Provides a guaranteed income for life.

- Can help to protect against the risk of outliving your assets.

- May not be as flexible as other options.

- Can be subject to inflation.

Lump Sum

Advantages:- Provides flexibility to invest the money as you wish.

- Can be used to generate income or to pay for expenses.

- May run out of money if you live longer than expected.

- Can be subject to market risk.

7. What are the factors to consider when choosing a method of receiving retirement benefits?

- Age

- Health

- Financial situation

- Investment goals

- Risk tolerance

8. What are the different types of investment options available in retirement plans?

- Stocks

- Bonds

- Mutual funds

- Exchange-traded funds (ETFs)

- Target-date funds

9. What are the advantages and disadvantages of each type of investment option?

Stocks

Advantages:- Potential for high returns

- Risk of loss

- Volatility

Bonds

Advantages:- Provide a steady stream of income

- Less risk than stocks

- Lower potential returns than stocks

- Interest rate risk

Mutual Funds

Advantages:- Diversification

- Professional management

- Fees

- Tracking error

10. How do you stay up-to-date on the latest developments in retirement planning?

- Attend conferences and webinars.

- Read industry publications.

- Talk to other retirement professionals.

- Take continuing education courses.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Retirement Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Retirement Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Retirement Officers play a crucial role in assisting individuals as they transition into retirement. Their primary responsibilities include:

1. Retirement Planning

Provide personalized retirement planning advice to clients considering retirement.

- Assess retirement goals, financial situation, and risk tolerance.

- Create tailored retirement plans outlining investment strategies, income projections, and tax implications.

2. Retirement Account Management

Manage and administer retirement accounts such as 401(k)s, IRAs, and annuities.

- Handle account contributions, rollovers, and distributions.

- Monitor investment performance and make adjustments as necessary.

3. Investment Advisory

Provide investment guidance and recommendations based on clients’ risk tolerance and financial goals.

- Research and analyze different investment options.

- Recommend investment strategies that align with clients’ long-term retirement objectives.

4. Client Education and Communication

Educate clients on retirement-related topics, such as Social Security benefits, Medicare, and estate planning.

- Conduct retirement seminars and webinars.

- Provide ongoing support and guidance to clients throughout their retirement journey.

Interview Tips

To ace an interview for a Retirement Officer position, consider the following preparation tips and hacks:

1. Research the Company and Industry

Demonstrate your understanding of the company’s mission, values, and services. Familiarize yourself with industry trends and regulations relevant to retirement planning.

2. Practice Your Retirement Planning Skills

- Create a mock retirement plan for yourself or a hypothetical client. This will help you showcase your problem-solving and analytical abilities.

- Stay up-to-date on investment strategies and retirement planning tools.

3. Highlight Your Client-Service Skills

Emphasize your ability to build strong relationships and provide personalized advice. Share examples of how you have successfully assisted clients in achieving their retirement goals.

4. Prepare for Common Interview Questions

- Tell me about your experience in retirement planning.

- How do you assess a client’s retirement goals and risk tolerance?

- What investment strategies do you recommend for different retirement time frames?

5. Dress Professionally and Arrive on Time

First impressions matter. Dress appropriately and arrive punctually for your interview. This demonstrates your respect for the interviewer and the job opportunity.

6. Ask Thoughtful Questions

At the end of the interview, ask thoughtful questions that demonstrate your interest in the position and the company. This shows that you’re engaged and eager to learn more.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Retirement Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!