Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Business Opportunity and Property Investment Broker position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

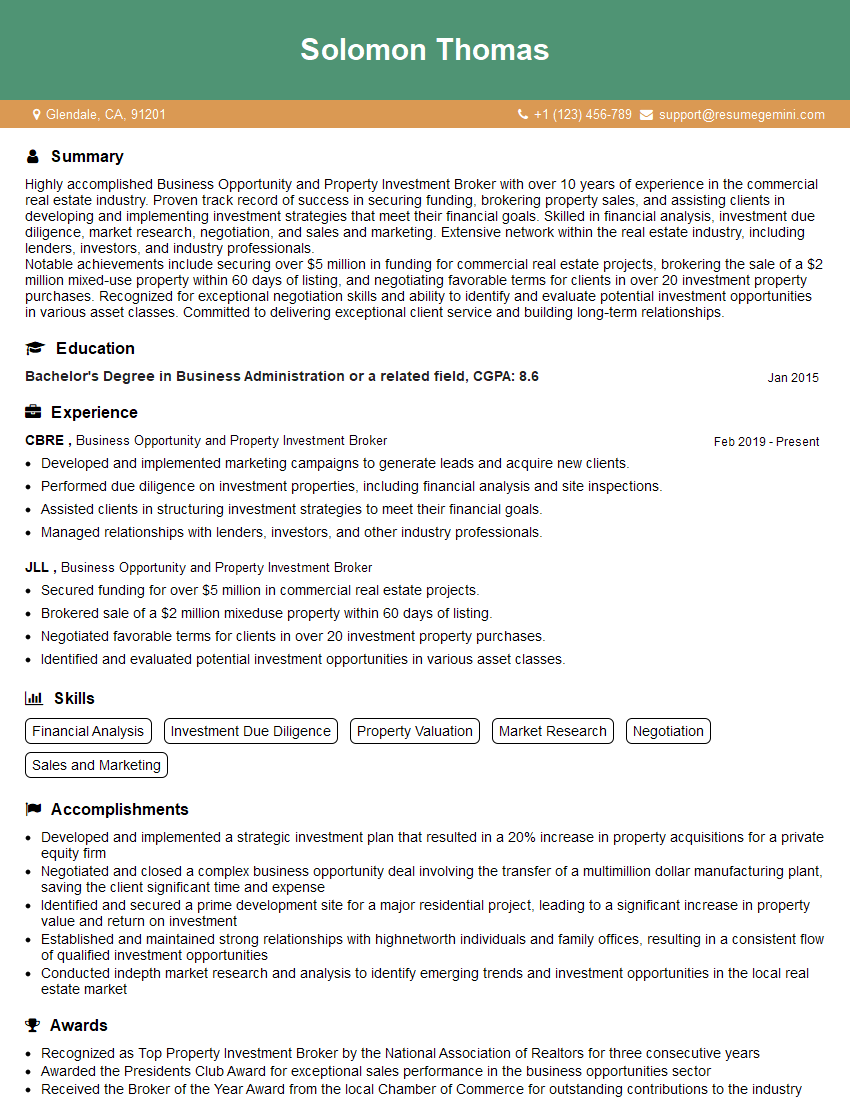

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Business Opportunity and Property Investment Broker

1. What are the key factors you consider when evaluating a business opportunity or property investment for a client?

- Financial performance: Analyze historical financials, including revenue, expenses, and profitability, to assess the financial health and growth potential of the business.

- Market analysis: Research industry trends, competitive landscape, and target market to understand the demand and potential for success.

- Operational efficiency: Evaluate the business’s operations, including staffing, supply chain, and infrastructure, to identify areas for improvement and cost optimization.

- Legal compliance: Ensure that the business is compliant with all applicable laws, regulations, and licensing requirements.

- Growth potential: Assess the business’s potential for future growth, considering factors such as market expansion, product innovation, and customer acquisition strategies.

2. How do you identify potential investors for a business opportunity or property investment?

- Network and referrals: Utilize existing relationships and seek referrals from industry professionals, clients, and colleagues.

- Online platforms: Leverage online platforms such as LinkedIn, industry forums, and investment websites to connect with potential investors.

- Targeted marketing: Develop targeted marketing campaigns through email, social media, and search engine optimization to reach specific investor demographics.

- Joint ventures and partnerships: Seek opportunities to collaborate with other brokers, financial advisors, and real estate agents to expand your reach and identify potential investors.

- Attend industry events: Participate in conferences, trade shows, and networking events to meet potential investors and promote investment opportunities.

3. What are the ethical considerations and legal responsibilities involved in business opportunity and property investment brokerage?

- Disclosure: Providing accurate and complete information about the investment to potential investors.

- Conflict of interest: Avoiding situations where personal interests conflict with the interests of clients.

- Fiduciary duty: Acting in the best interests of clients and putting their financial well-being above personal gain.

- Licensing and compliance: Adhering to all applicable state and federal licensing and regulatory requirements.

- Professional conduct: Maintaining a high level of professionalism and integrity in all interactions with clients, investors, and industry partners.

4. How do you stay up-to-date on market trends and industry best practices in business opportunity and property investment brokerage?

- Continuing education: Attend industry conferences, workshops, and online courses to enhance knowledge and skills.

- Industry publications: Subscribe to industry magazines, journals, and online resources to stay informed about market news and emerging trends.

- Networking and collaboration: Engage with industry professionals, thought leaders, and peers to exchange ideas and learn from their experiences.

- Research and analysis: Conduct in-depth research and analysis of market data, economic indicators, and investment trends to stay ahead of the curve.

- Market immersion: Actively participate in the market by visiting properties, attending industry events, and interacting with potential investors and clients.

5. How do you build and maintain strong relationships with clients and investors?

- Exceptional communication: Maintain regular communication, provide timely updates, and respond promptly to inquiries to build trust and loyalty.

- Personalized service: Tailor services to meet the specific needs and goals of each client and investor, demonstrating a genuine understanding of their objectives.

- Transparency and integrity: Foster trust by being transparent, honest, and reliable in all interactions.

- Value-added services: Provide value beyond the transaction, such as market insights, investment advice, and support throughout the investment journey.

- Networking and social events: Host social events and networking opportunities to connect with clients and investors on a personal level and build relationships.

6. What are your strategies for sourcing and screening potential business opportunities and property investments?

- Market research: Conduct thorough market research to identify emerging industries, growth sectors, and areas with high investment potential.

- Networking and referrals: Leverage relationships with industry professionals, business owners, and investors to uncover potential opportunities.

- Online platforms: Utilize online databases, listing services, and industry-specific websites to search for and identify investment opportunities.

- Cold calling and outreach: Reach out to potential investment targets directly through cold calling, email campaigns, and social media outreach.

- Screening and due diligence: Conduct rigorous screening of potential opportunities, including financial analysis, legal review, and site visits to assess their viability and potential returns.

7. How do you handle objections and negotiate effectively with potential clients and investors?

- Active listening: Listen attentively to objections, acknowledge their concerns, and seek to understand their underlying motivations.

- Empathy and understanding: Demonstrate empathy and try to see things from the client’s perspective to build rapport and trust.

- Address concerns directly: Address the objections head-on, providing clear and factual information to counter concerns and provide solutions.

- Value proposition: Clearly articulate the value proposition of the investment opportunity, highlighting its benefits and potential returns.

- Negotiation skills: Be prepared to negotiate terms and conditions that are mutually beneficial, while maintaining a strong position in protecting your client’s interests.

8. What are your thoughts on the current real estate market and its impact on business opportunities and property investments?

- Market trends: Discuss current trends in the real estate market, such as interest rates, inflation, and supply and demand dynamics.

- Impact on business opportunities: Analyze how market conditions are affecting the availability, pricing, and viability of business opportunities in different sectors.

- Investment strategies: Provide insights into investment strategies that are best suited for the current market environment, considering factors such as risk tolerance, return expectations, and market volatility.

- Emerging opportunities: Identify potential opportunities that may arise from changing market conditions, such as distressed assets, undervalued properties, or emerging growth sectors.

- Long-term outlook: Share your perspective on the long-term outlook for the real estate market and how it could impact business opportunities and property investments.

9. Describe your experience in conducting financial analysis and due diligence for business opportunities and property investments.

- Financial modeling: Proficiency in financial modeling techniques to evaluate cash flow, profitability, and return on investment.

- Valuation methods: Expertise in various property and business valuation methods, such as income capitalization, comparable sales, and discounted cash flow.

- Due diligence: Experience in conducting thorough due diligence investigations, including legal, financial, and environmental reviews to assess investment risks and potential.

- Report writing: Ability to prepare comprehensive financial analysis and due diligence reports that clearly communicate key findings and investment recommendations.

- Industry knowledge: In-depth understanding of industry-specific metrics, financial ratios, and valuation methodologies to provide accurate and reliable analysis.

10. Share a successful case study of a business opportunity or property investment that you brokered.

- Project overview: Provide a brief description of the business opportunity or property investment involved.

- Challenges faced: Outline the specific challenges faced during the brokerage process, such as market conditions, competition, or investor concerns.

- Solutions implemented: Describe the innovative solutions or strategies employed to overcome the challenges.

- Results achieved: Quantify the financial or strategic benefits achieved for the client or investor, highlighting the value added through your brokerage services.

- Lessons learned: Share any valuable lessons learned from the experience that could contribute to future success.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Business Opportunity and Property Investment Broker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Business Opportunity and Property Investment Broker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Business Opportunity and Property Investment Brokers play a vital role in connecting investors with suitable investment options. Their responsibilities include:

1. Market Research and Analysis

Conduct thorough market research to identify emerging opportunities in business and property investment.

- Analyze market trends, economic indicators, and industry forecasts.

- Evaluate potential investment properties and businesses, assessing their financial viability, growth potential, and exit strategies.

2. Client Acquisition and Qualification

Develop and implement strategies to attract potential investors and clients.

- Network with business owners, entrepreneurs, and investors.

- Attend industry events and conferences.

- Conduct webinars and seminars on investment opportunities.

- Qualify clients to ensure their investment goals, risk tolerance, and financial capabilities align with available investment opportunities.

3. Investment Presentation and Negotiation

Effectively present investment opportunities to potential investors, highlighting their value proposition and potential returns.

- Prepare detailed investment proposals and financial models.

- Negotiate investment terms with clients, including purchase prices, equity stakes, and profit sharing arrangements.

- Facilitate due diligence processes and provide support throughout the investment closing process.

4. Portfolio Management and Exit Strategies

Monitor and manage client investment portfolios to ensure their alignment with investment goals and market conditions.

- Provide ongoing investment advice and support.

- Identify potential exit strategies for investments, such as sale, merger, or refinancing.

- Assist clients with executing exit strategies to maximize returns and minimize risks.

Interview Tips

Preparing thoroughly for an interview is crucial. Here are some tips to help you ace your interview for a Business Opportunity and Property Investment Broker role:

1. Research the Company and Industry

Demonstrate your knowledge of the company and the investment industry by researching their website, annual reports, and industry publications.

- Identify their core business areas, investment strategies, and recent performance.

- Understand the current market trends and investment climate.

2. Prepare for Common Interview Questions

Anticipate common interview questions and prepare thoughtful answers that showcase your skills, experience, and passion for the industry.

- Tell me about your experience in business opportunity and property investment brokerage.

- Describe a successful investment you have brokered and the strategies you used.

- How do you identify and evaluate potential investment opportunities?

3. Highlight Your Networking Skills

Emphasize your ability to build and maintain strong relationships with potential investors, business owners, and other professionals in the industry.

- Provide examples of successful networking events or strategies you have used.

- Share your experience in identifying and qualifying potential clients.

- Discuss your experience in developing and presenting financial models and investment proposals.

- Explain how you monitor and manage investment portfolios and advise clients on financial matters.

4. Demonstrate Your Financial Acumen

Highlight your understanding of financial concepts, including investment analysis, portfolio management, and exit strategies.

5. Be Confident and Enthusiastic

Project confidence and enthusiasm during the interview. Convey your passion for the industry and your ability to succeed in this role.

- Express your belief in the company and their investment strategies.

- Articulate your goals and ambitions within the organization.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Business Opportunity and Property Investment Broker role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.