Feeling lost in a sea of interview questions? Landed that dream interview for Customs Brokerage Agent but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Customs Brokerage Agent interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

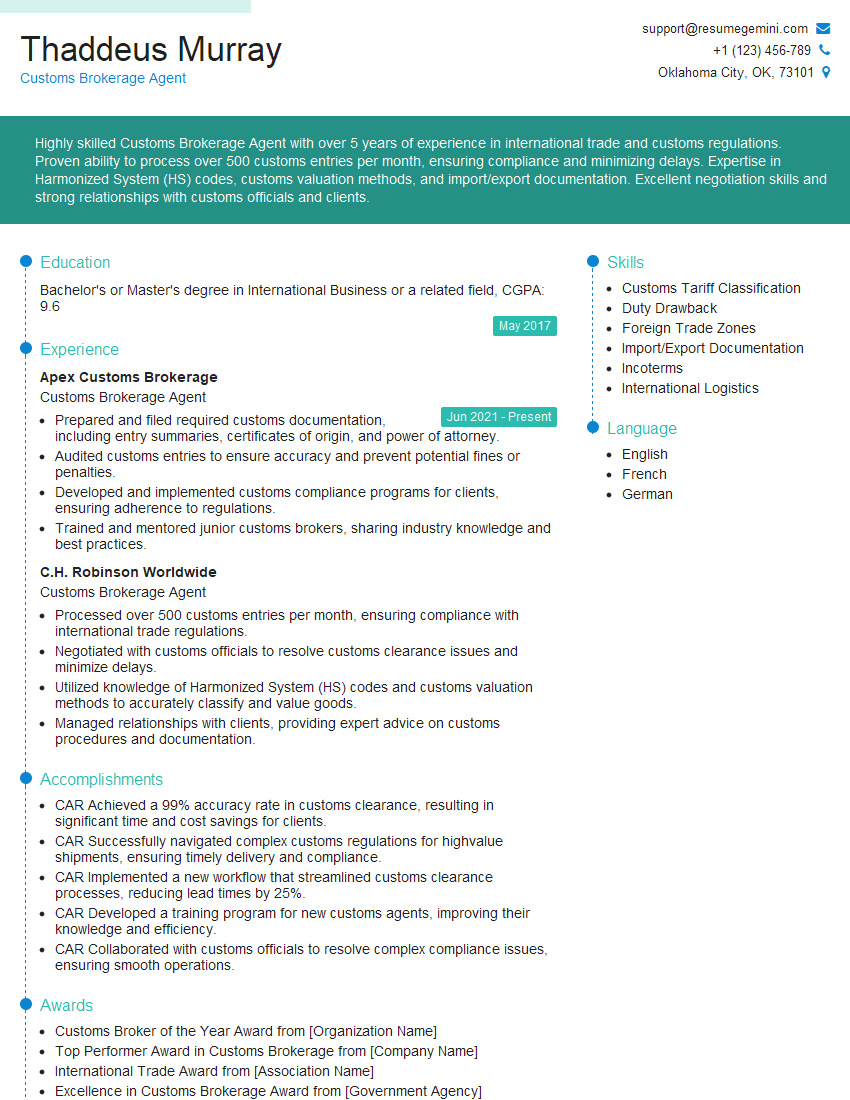

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Customs Brokerage Agent

1. Explain the essential steps involved in the customs clearance process for an imported shipment.

- Review the shipping documents and ensure they are complete and accurate.

- Determine the applicable duty rates and taxes for the goods being imported.

- Prepare and submit the necessary customs entry forms, including the Bill of Lading, Commercial Invoice, and Packing List.

- Arrange for the examination of the goods by customs officials, if required.

- Pay the applicable duties and taxes.

- Release the goods to the importer.

2. Discuss the different types of bonded warehouses and explain their uses.

Public Bonded Warehouses

- Owned and operated by the government

- Used to store goods that have not yet cleared customs

- Goods can be stored indefinitely without paying duties or taxes

Private Bonded Warehouses

- Owned and operated by private companies

- Used to store goods that have cleared customs but have not yet been released to the importer

- Goods can be stored for a limited time without paying duties or taxes

Foreign Trade Zones (FTZs)

- Designated areas within the United States that are treated as being outside the country for customs purposes

- Goods can be stored, manipulated, and manufactured in FTZs without paying duties or taxes until they are released into the United States

3. What are the key differences between a Customs Broker and a Freight Forwarder?

- Customs Brokers are licensed by the government to clear goods through customs

- Freight Forwarders are not licensed by the government and can only arrange for the transportation of goods

- Customs Brokers can provide advice on customs regulations and can assist with the preparation of customs entry forms

- Freight Forwarders cannot provide advice on customs regulations and cannot assist with the preparation of customs entry forms

4. Explain the importance of Harmonized System (HS) codes and how they are used in the customs clearance process.

- HS codes are used to classify goods for customs purposes

- HS codes are used to determine the applicable duty rates and taxes

- HS codes are used to track the movement of goods across borders

- HS codes are used to facilitate the exchange of trade data between countries

5. Describe the role of the Importer of Record (IOR) in the customs clearance process.

- The IOR is the person or entity that is legally responsible for the importation of goods

- The IOR is responsible for ensuring that the goods are properly cleared through customs

- The IOR is liable for the payment of any duties or taxes that are due

6. What are the consequences of failing to declare all goods on a customs declaration?

- Penalties may be assessed

- Goods may be seized

- Importer may be prosecuted

7. What are the different types of Preferential Trade Agreements (PTAs) and how can they benefit importers?

- PTAs are agreements between two or more countries that provide for reduced or eliminated tariffs on goods traded between the countries

- There are many different types of PTAs, including free trade agreements, preferential trade agreements, and economic partnership agreements

- Importers can benefit from PTAs by reducing or eliminating the duties and taxes that they pay on imported goods

8. Explain the concept of De Minimis Value and how it affects the customs clearance process.

- De Minimis Value is the value below which goods are not subject to duties or taxes

- The De Minimis Value varies from country to country

- Goods that are below the De Minimis Value can be cleared through customs without the need for a formal customs entry

9. What are the steps involved in filing a protest against a customs decision?

- File a protest with the Customs Service within 90 days of the decision

- State the reason for the protest

- Provide evidence to support the protest

- Pay a protest fee

- The Customs Service will review the protest and make a decision

10. Describe the role of technology in the customs clearance process.

- Technology is playing an increasingly important role in the customs clearance process

- Technology can be used to automate many of the tasks that are involved in the customs clearance process

- Technology can help to improve the efficiency and accuracy of the customs clearance process

- Technology can help to reduce the costs of the customs clearance process

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Customs Brokerage Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Customs Brokerage Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Customs Brokerage Agents are responsible for facilitating the import and export of goods across international borders. Their key duties include:

1. Preparing and Filing Customs Documents

Accurately completing and submitting import and export declarations, entry summaries, and other required documentation.

- Ensuring compliance with customs regulations and procedures.

- Calculating and paying duties, taxes, and other fees.

2. Classifying Goods

Correctly identifying and classifying goods according to the Harmonized System (HS) codes to determine appropriate customs treatment and duty rates.

- Interpreting and applying customs regulations and rulings.

- Resolving classification disputes with customs authorities.

3. Advising Clients

Providing expert advice to clients on customs regulations, duty rates, and import/export procedures.

- Assisting clients in developing compliant customs strategies.

- Keeping clients informed of changes in customs laws and regulations.

4. Managing Relationships

Building and maintaining strong relationships with customs officials, freight forwarders, and other industry professionals.

- Representing clients’ interests before customs authorities.

- Negotiating and resolving disputes.

Interview Tips

Preparing thoroughly for a Customs Brokerage Agent interview is crucial for success. Here are some valuable tips to help you ace the interview:

1. Research the Company

Familiarize yourself with the company’s history, services, and industry reputation. Understanding the company’s culture and values will demonstrate your interest and enthusiasm for the role.

- Visit the company’s website and LinkedIn page.

- Read industry news and articles about the company.

2. Study Customs Regulations and Procedures

Customs regulations are constantly evolving, so staying up-to-date is essential. Thoroughly research the Harmonized System (HS) codes, customs entry processes, and any relevant trade agreements.

- Review the U.S. Customs and Border Protection (CBP) website.

- Attend industry seminars and webinars.

3. Showcase Your Industry Experience

Highlight your previous experience in customs brokerage or a related field. Quantify your accomplishments and provide specific examples that demonstrate your skills in customs compliance, classification, and client advisory.

- Emphasize any experience with specific customs software or technologies.

- Discuss challenges you have faced and how you overcame them.

4. Prepare for Behavioral Questions

Behavioral questions are commonly used to assess your soft skills and fit for the role. Be prepared to provide thoughtful answers that demonstrate your teamwork, problem-solving, and communication abilities.

- Review common behavioral interview questions.

- Prepare examples from your previous experience that align with the company’s values.

5. Dress Professionally and Arrive Early

First impressions matter. Dress professionally in business attire and arrive for your interview on time. Being well-prepared and making a positive impression can greatly enhance your chances of success.

- Consider the company’s dress code and industry norms.

- Allow ample time for travel and unforeseen delays.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Customs Brokerage Agent interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.