Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Operational Risk Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

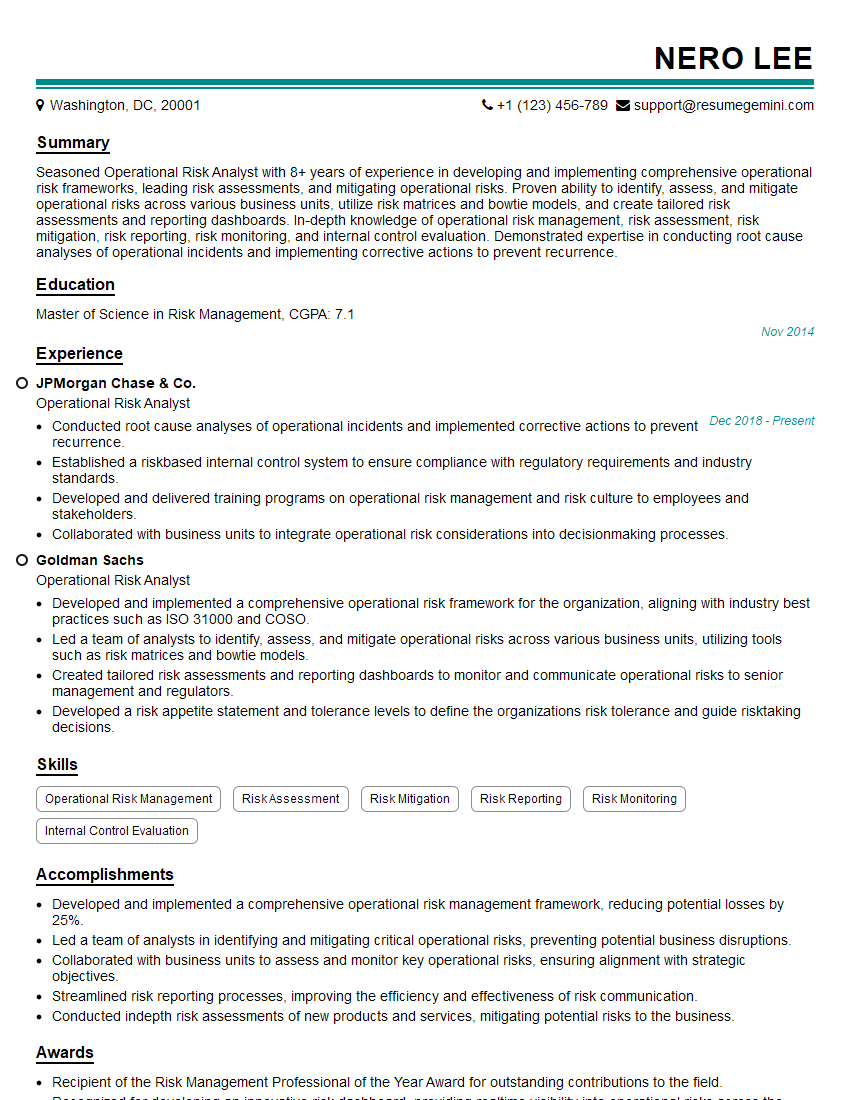

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Operational Risk Analyst

1. Explain the key components of an operational risk management framework?

- Risk Identification: Identifying potential operational risks that may impact the organization.

- Risk Assessment: Evaluating the likelihood and impact of identified risks to determine their significance.

- Risk Mitigation: Developing and implementing strategies to reduce or eliminate identified risks.

- Risk Monitoring: Continuously monitoring and assessing risks to ensure the effectiveness of mitigation strategies.

- Risk Reporting: Communicating risk information to relevant stakeholders, including management and regulators.

2. What are the different approaches to operational risk quantification?

Quantitative Approaches

- Value-at-Risk (VaR): Calculates the potential loss over a specific time period and confidence level.

- Expected Shortfall (ES): Measures the average loss in the worst-case scenarios within a given confidence level.

Qualitative Approaches

- Risk Rating: Assigns a risk score based on the likelihood and impact of a risk.

- Scenario Analysis: Evaluates the potential impact of hypothetical risk events.

3. How would you assess the effectiveness of an operational risk management program?

- Reviewing risk assessment and mitigation plans.

- Conducting audits and reviewing incident reports.

- Monitoring compliance with risk management policies and procedures.

- Analyzing the frequency and severity of operational incidents.

- Seeking feedback from stakeholders on the effectiveness of the program.

4. What are the challenges in managing operational risk in the financial services industry?

- Complexity and interconnectedness of financial systems.

- Rapid technological advancements introducing new risks.

- Regulatory requirements and compliance obligations.

- Limited availability of historical data for certain risks.

- Cultural and organizational factors influencing risk-taking behavior.

5. Describe the Basel Committee’s principles for operational risk management.

- Establish a sound risk culture.

- Identify and assess operational risks.

- Develop and implement a risk management strategy.

- Monitor and control operational risks.

- Measure and report operational risks.

6. How do you stay up-to-date on emerging operational risks and best practices?

- Attending industry conferences and webinars.

- Reading research papers and publications.

- Networking with other professionals in the field.

- Subscribing to industry newsletters and alerts.

- Participating in training programs and certifications.

7. What are the ethical considerations in operational risk management?

- Confidentiality and privacy of sensitive information.

- Transparency and disclosure of risks to stakeholders.

- Fairness and objectivity in risk assessment and mitigation.

- Balancing risk management with business objectives.

- Accountability for risk-taking decisions.

8. Describe the role of technology in operational risk management.

- Automating risk identification and assessment processes.

- Providing data and analytics for risk monitoring and reporting.

- Developing risk management software and tools.

- Enhancing communication and collaboration among risk professionals.

- Improving compliance through automated controls and audit trails.

9. What are the potential consequences of inadequate operational risk management?

- Financial losses and operational disruptions.

- Reputational damage and loss of customer trust.

- Legal and regulatory penalties.

- Loss of market share and competitive advantage.

- Increased cost of capital and insurance premiums.

10. How would you assess the risk of a new product or service?

- Identify potential operational risks associated with the product or service.

- Evaluate the likelihood and impact of each risk.

- Consider the organization’s risk appetite and tolerance.

- Develop mitigation strategies to address the identified risks.

- Monitor and review the risks and mitigation strategies over time.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Operational Risk Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Operational Risk Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Operational Risk Analysts are accountable for identifying and evaluating potential risks an organization may encounter in day-to-day operations. They must assess, manage, and mitigate those risks to ensure compliance within the operational framework.

1. Risk Identification and Assessment

Performing comprehensive analyses of business operations and processes to proactively identify inherent risks; assign proper methodologies to assess risk severity

2. Control Implementation and Monitoring

Creating and monitoring effective operational controls like policies and procedures to mitigate identified risks; proposing changes and improvements to enhance control effectiveness

3. Regulatory Compliance and Reporting

Collaborating with legal and compliance teams to remain updated on regulatory requirements; developing and implementing risk management policies to meet regulatory standards

4. Communication and Training

Providing clear and concise risk management training to staff; conducting presentations and creating documentation to educate stakeholders about operational risks and mitigation measures

Interview Tips

Preparing for an Operational Risk Analyst interview requires thorough research on the role and industry-specific best practices. Here are some key tips to help you ace the interview:

1. Research the Company and Role

Take the time to study the company’s website, annual reports, and industry news to understand their business model, risk appetite, and regulatory landscape

2. Practice Your Technical Skills

Brush up on risk assessment techniques, control evaluation methodologies, and regulatory compliance requirements relevant to the industry

3. Be Ready to Discuss Case Studies

Prepare examples of successful risk mitigation initiatives you’ve led or contributed to, highlighting your problem-solving and analytical abilities

4. Emphasize Communication and Collaboration

Showcase your ability to communicate complex risk concepts clearly to stakeholders from diverse backgrounds, demonstrating your teamwork and interpersonal skills

5. Prepare Questions to Ask

Asking thoughtful questions about the company’s risk management strategy and the role’s responsibilities demonstrates your engagement and interest in the position

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Operational Risk Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!