Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Certified Public Accountant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

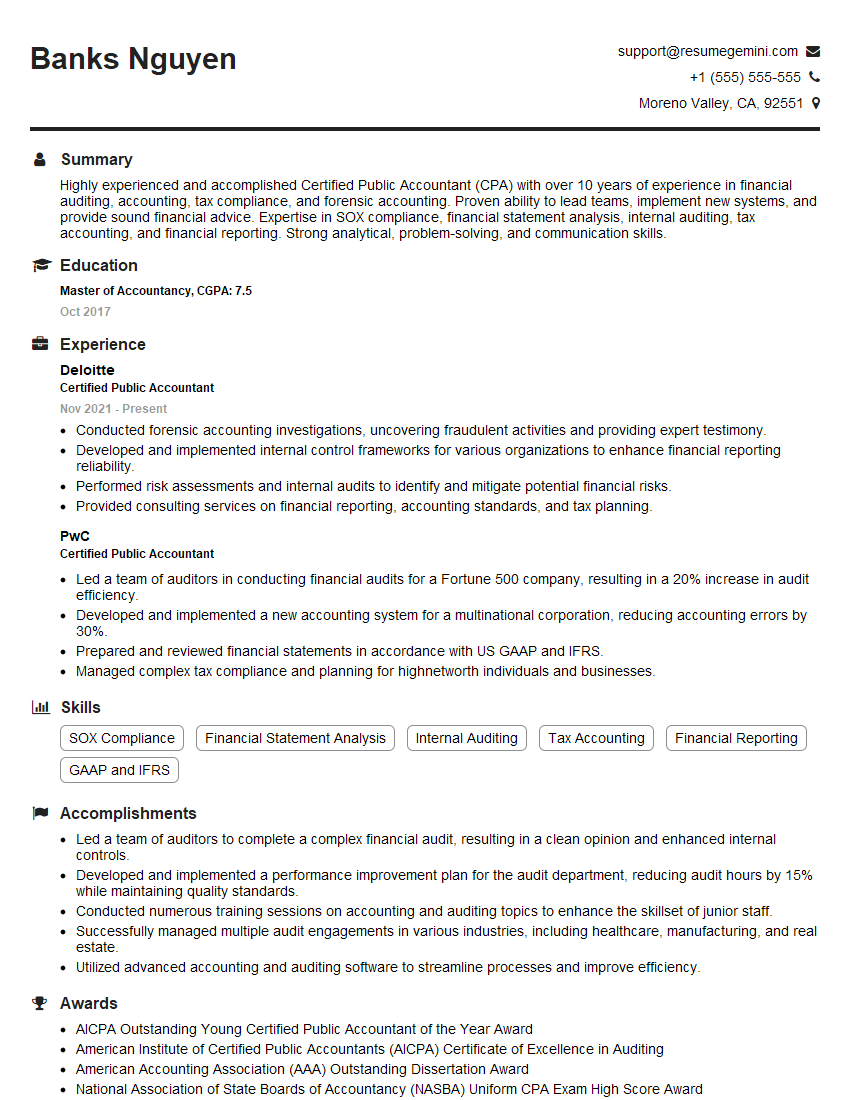

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Certified Public Accountant

1. Explain the concept of materiality in financial reporting?

Materiality refers to the significance or importance of an accounting misstatement or omission. It is a qualitative concept that considers the likelihood and magnitude of an error or omission to influence the economic decisions of users of financial statements. In essence, it helps determine whether the misstatement or omission would be likely to alter the overall perception of the financial performance or position of the company.

- Materiality is judged in relation to the overall financial statements and considers factors such as the nature of the item, its size and nature relative to other items, and the potential impact on the overall presentation of the company’s financial position and performance.

- The assessment of materiality involves both quantitative and qualitative factors and is influenced by professional judgment.

2. Describe the different types of audit opinions and when they are issued?

There are four main types of audit opinions:

Unqualified Opinion

- Issued when the auditor has obtained sufficient appropriate evidence to support the fairness of the financial statements.

- Indicates that the financial statements are fairly presented in all material respects.

Qualified Opinion

- Issued when the auditor has obtained sufficient appropriate evidence, except for a specific matter.

- The specific matter is considered material, but its effect on the financial statements is not pervasive.

Adverse Opinion

- Issued when the auditor, having obtained sufficient appropriate evidence, concludes that misstatements, individually or in the aggregate, are both material and pervasive to the financial statements.

- Indicates that the financial statements are not fairly presented.

Disclaimer of Opinion

- Issued when the auditor has not obtained sufficient appropriate evidence to form an opinion on the fairness of the financial statements.

- Can occur due to factors such as a lack of or restriction on the scope of the audit, or when the financial statements are not prepared in accordance with an applicable financial reporting framework.

3. What are the key internal controls that should be in place for cash receipts and disbursements?

Cash Receipts

- Segregation of duties between those who handle cash and those who record transactions.

- Use of pre-numbered receipts and daily reconciliation of receipts to deposits.

- Regular bank reconciliations to ensure accuracy of cash balances.

- Authorization and approval of all disbursements by authorized personnel.

- Periodic physical counts of cash on hand.

Cash Disbursements

- Segregation of duties between those who authorize payments and those who sign checks.

- Use of a check register to record all disbursements.

- Require supporting documentation for all disbursements, such as invoices and receipts.

- Reconciliation of monthly bank statements and canceled checks to identify any unauthorized or fraudulent disbursements.

4. Describe the process of analytical procedures in auditing?

Analytical procedures involve comparing financial and non-financial data to identify unexpected relationships or trends that may indicate potential misstatements. These procedures are performed during the planning and execution phases of an audit.

- Planning Phase: Identifying key financial ratios and trends, and comparing them to industry norms or historical data.

- Execution Phase: Investigating any significant fluctuations or anomalies identified during the planning phase.

- Evaluation: Determining whether the identified fluctuations or anomalies are reasonable or require further investigation.

5. What are the key elements of an effective internal audit function?

- Independence: The internal audit function should be independent from the operations it audits and have direct access to top management.

- Objectivity: Internal auditors should maintain an unbiased and objective approach to their work.

- Competence: Internal auditors should possess the necessary knowledge, skills, and experience to effectively perform their duties.

- Due Professional Care: Internal auditors should exercise reasonable care and diligence in conducting their work.

- Communication: Internal auditors should effectively communicate their findings, recommendations, and conclusions to management and other stakeholders.

6. What are the steps involved in preparing a tax return?

- Gather all necessary tax documents, including W-2s, 1099s, and receipts.

- Determine which tax forms are required based on income, deductions, and credits.

- Calculate income, deductions, and credits using applicable tax laws and regulations.

- Complete the tax forms, ensuring accuracy and completeness.

- File the tax return by the applicable deadline.

7. What are some common tax deductions and credits?

Deductions

- Standard deduction

- Itemized deductions (e.g., mortgage interest, charitable contributions)

- Business expenses (for self-employed individuals)

Credits

- Child tax credit

- Earned income tax credit

- Education credits

8. What are the different types of business entities?

- Sole proprietorship: One owner who has unlimited liability.

- Partnership: Two or more owners who share liability and profits.

- Limited liability company (LLC): Hybrid structure that provides limited liability to owners.

- Corporation: Separate legal entity that provides limited liability to shareholders.

9. What are the key financial statements and what do they report?

- Balance Sheet: Reports the assets, liabilities, and equity of a company at a specific point in time.

- Income Statement: Reports the revenues, expenses, and net income of a company over a period of time.

- Statement of Cash Flows: Reports the cash inflows and outflows of a company over a period of time.

10. What are some ethical considerations for accountants?

- Objectivity: Accountants should be independent and unbiased in their work.

- Confidentiality: Accountants should protect the confidentiality of client information.

- Professionalism: Accountants should maintain a high level of professionalism in their conduct.

- Integrity: Accountants should act with honesty and integrity in all their dealings.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Certified Public Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Certified Public Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Certified Public Accountants (CPAs) play a vital role in ensuring the accuracy and reliability of financial information. Their responsibilities encompass a wide range of accounting and auditing tasks that contribute to the smooth functioning of businesses and organizations.

1. Financial Statement Auditing and Attestation

CPAs conduct audits to examine and verify the accuracy of financial statements prepared by companies. They assess the effectiveness of internal controls, identify any financial irregularities, and issue reports expressing their opinions on the fairness and reliability of the financial information presented.

- Reviewing financial records and transactions

- Performing analytical procedures and risk assessments

2. Tax Planning and Compliance

CPAs provide tax advice and planning services to help businesses and individuals optimize their tax positions and minimize their tax liabilities. They stay abreast of tax laws and regulations to ensure compliance and represent clients before tax authorities.

- Preparing and filing tax returns

- Advising on tax strategies and tax planning

3. Management Consulting and Advisory Services

CPAs offer consulting and advisory services that assist businesses with improving their financial performance, optimizing operations, and mitigating risks. They provide expertise in areas such as financial modeling, business valuation, and internal audit.

- Conducting financial analysis and forecasting

- Providing recommendations for process improvements

4. Financial Reporting and Compliance

CPAs ensure that businesses prepare and disclose financial statements that comply with applicable accounting standards and regulatory requirements. They work closely with management to ensure the accuracy and completeness of financial reporting.

- Preparing and reviewing financial statements

- Attending to compliance with accounting and reporting standards

Interview Tips

Preparing for a job interview can be daunting, but with the right strategies, you can increase your chances of success. Here are some tips to help you ace your interview for a Certified Public Accountant position:

1. Research and Preparation

Before the interview, take the time to thoroughly research the company and the specific role you are applying for. Familiarize yourself with their mission, values, and current financial performance. This will demonstrate your interest and commitment to the organization.

- Visit the company’s website and social media pages

- Read recent news articles and press releases

2. Practice Your Answers

Prepare for common interview questions by writing out your answers beforehand. Practice delivering your responses aloud to improve your confidence and fluency. Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples of your skills and experiences.

- Tell me about a time you successfully audited a company’s financial statements.

- Describe a complex tax planning strategy you implemented for a client.

3. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive for your interview on time to show respect for the interviewer’s time. Your appearance and demeanor can influence the interviewer’s perception of you.

- Wear a suit or business dress

- Be punctual and respectful

4. Be Enthusiastic and Positive

Throughout the interview, maintain a positive and enthusiastic attitude. Show the interviewer that you are passionate about accounting and eager to contribute to the team. Your enthusiasm can make you stand out from other candidates.

- Express your interest in the role and the company

- Share your ideas and how you can add value

5. Follow Up

After the interview, send a thank-you note to the interviewer within 24 hours. Express your appreciation for their time and reiterate your interest in the position. You can also use this opportunity to address any questions or concerns that may have arisen during the interview.

- Thank the interviewer for their time

- Reiterate your interest in the position

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Certified Public Accountant interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.