Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Railroad Accountant interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Railroad Accountant so you can tailor your answers to impress potential employers.

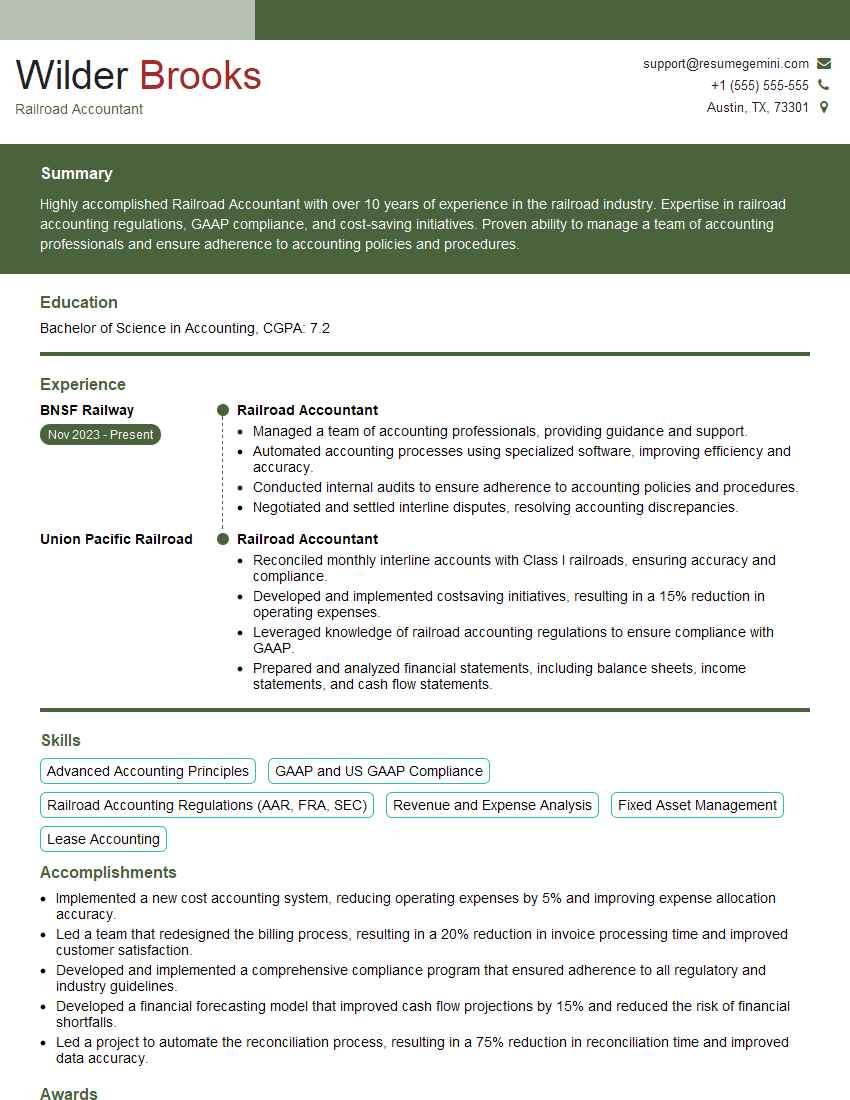

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Railroad Accountant

1. What are the key accounting principles that are specific to the railroad industry?

Key accounting principles specific to the railroad industry include:

- Uniform System of Accounts (USOA): This is a set of accounting rules developed by the Surface Transportation Board (STB) that railroads must follow.

- Fixed Asset Accounting: Railroads have significant investments in fixed assets, such as track, bridges, and locomotives. These assets must be depreciated over their useful lives.

- Revenue Recognition: Railroads recognize revenue when services are performed, not when cash is collected. This can lead to significant fluctuations in revenue from period to period.

- Interline Accounting: Railroads often work together to transport goods and passengers. This requires complex accounting procedures to track and settle interline revenues and expenses.

2. What are the different types of financial statements that a railroad company must prepare?

- Balance Sheet

- Income Statement

- Statement of Cash Flows

- Statement of Stockholders’ Equity

- Notes to Financial Statements

3. What are the key ratios that are used to evaluate the financial performance of a railroad company?

- Operating Ratio: This ratio measures the percentage of operating expenses to operating revenue. It is a key indicator of profitability.

- Return on Invested Capital (ROIC): This ratio measures the return on the company’s total invested capital. It is a key indicator of financial efficiency.

- Debt-to-Equity Ratio: This ratio measures the amount of debt relative to equity. It is a key indicator of financial risk.

- Times Interest Earned Ratio: This ratio measures the company’s ability to cover its interest expense with its operating income.

4. What are the key internal controls that are necessary for a railroad company?

- Segregation of duties

- Authorization of transactions

- Documentation of transactions

- Periodic reconciliation of accounts

- Internal audit function

5. What are the key accounting challenges that railroad companies face?

- Compliance with complex accounting regulations

- Management of large and complex assets

- Fluctuating revenues and expenses

- Interline accounting

- Capital-intensive nature of the industry

6. What are the key trends that are shaping the railroad industry?

- Increased demand for rail transportation

- Technological advancements

- Environmental regulations

- Globalization

- Mergers and acquisitions

7. What are the key skills and experience that are necessary for a successful Railroad Accountant?

- Strong understanding of accounting principles

- Experience with the Uniform System of Accounts (USOA)

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Team player

8. What are the key responsibilities of a Railroad Accountant?

- Preparing financial statements

- Analyzing financial data

- Developing and implementing accounting policies and procedures

- Maintaining accounting records

- Preparing tax returns

9. What are the key challenges that Railroad Accountants face?

- Keeping up with changing accounting regulations

- Managing large and complex accounting systems

- Meeting deadlines

- Working with a variety of stakeholders

- Balancing accuracy with timeliness

10. What are your strengths and weaknesses as a Railroad Accountant?

Here are some examples of strengths and weaknesses that you could mention:

Strengths:

- Strong understanding of accounting principles

- Experience with the Uniform System of Accounts (USOA)

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Team player

Weaknesses:

- Limited experience with certain aspects of railroad accounting

- Need to improve time management skills

- Can be too detail-oriented at times

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Railroad Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Railroad Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Railroad Accountants are responsible for managing the financial operations of railroad companies. They oversee a wide range of accounting activities, including financial reporting, budgeting, and tax compliance. Key job responsibilities include:

1. Financial Reporting

Railroad Accountants are responsible for preparing and filing financial statements in accordance with GAAP and other regulatory requirements. They work closely with other departments to collect and analyze financial data, and they prepare reports that summarize the company’s financial performance.

2. Budgeting

Railroad Accountants develop and manage budgets for the company. They work with other departments to forecast revenue and expenses, and they develop plans to allocate resources effectively.

3. Tax Compliance

Railroad Accountants are responsible for ensuring that the company complies with all applicable tax laws and regulations. They prepare tax returns and work with tax authorities to resolve any issues.

4. Internal Controls

Railroad Accountants develop and maintain internal controls to ensure the accuracy and reliability of financial reporting. They also work with auditors to assess the effectiveness of internal controls.

Interview Tips

Preparing for an interview can be daunting, but there are a few simple things you can do to increase your chances of success. Here are a few tips:

1. Research the Company

Before you go to the interview, take some time to research the company. Learn about their history, their business model, and their financial performance. This will help you understand the company’s needs and how your skills and experience can help them achieve their goals.

2. Practice Your Answers

Once you have a good understanding of the company, take some time to practice answering common interview questions. Think about your strengths and weaknesses, and how you can relate them to the job requirements. The more prepared you are, the more confident you will be during the interview.

3. Dress Professionally

First impressions matter, so make sure you dress professionally for the interview. This doesn’t mean you have to wear a suit, but you should dress in clean, pressed clothes that are appropriate for the office environment.

4. Be on Time

Punctuality is important, so make sure you arrive for your interview on time. If you’re running late, call the interviewer to let them know. This will show that you are respectful of their time.

5. Be Yourself

It’s important to be yourself during the interview. Don’t try to be someone you’re not, because the interviewer will be able to tell. Just relax and be yourself, and let the interviewer get to know the real you.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Railroad Accountant interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.