Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Revenue Accountant interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Revenue Accountant so you can tailor your answers to impress potential employers.

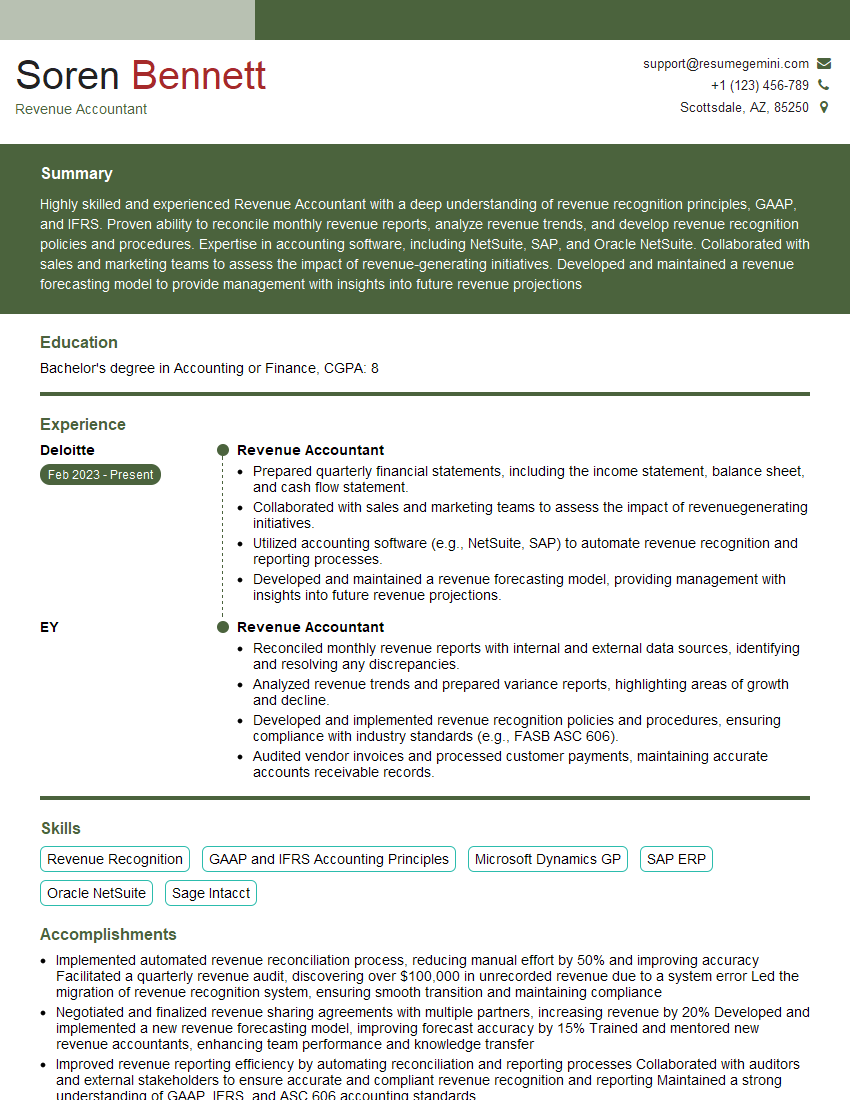

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Revenue Accountant

1. Describe the key responsibilities of a Revenue Accountant and how you have fulfilled them in your previous role?

As a Revenue Accountant, I am responsible for a wide range of tasks that contribute to the accuracy and integrity of the company’s financial records. These responsibilities include:

- Recording and processing customer invoices and payments

- Reconciling bank statements and ensuring that all transactions are accounted for

- Preparing monthly and quarterly financial reports, including the income statement and balance sheet

- Working with external auditors to ensure compliance with GAAP and other applicable accounting standards

- Analyzing financial data to identify trends and make recommendations for improving the company’s financial performance

In my previous role, I was responsible for all of these tasks and more. I developed and implemented a new system for recording and processing customer invoices, which resulted in a significant reduction in processing time. I also worked closely with the external auditors to ensure that the company’s financial statements were accurate and compliant with all applicable accounting standards.

2. What are the most important qualities of a successful Revenue Accountant?

Technical skills:

- Strong understanding of accounting principles (GAAP or IFRS)

- Proficient in accounting software (e.g., SAP, Oracle)

- Excellent analytical and problem-solving skills

- Attention to detail and accuracy

Soft skills:

- Strong communication and interpersonal skills

- Ability to work independently and as part of a team

- Commitment to continuous learning and professional development

3. What are some of the challenges that Revenue Accountants face in their day-to-day work?

- Keeping up with changes in accounting standards and regulations

- Managing large volumes of data and transactions

- Ensuring the accuracy and integrity of financial records

- Meeting deadlines and working under pressure

- Communicating complex financial information to non-financial stakeholders

4. How do you stay up-to-date on the latest accounting standards and regulations?

- Reading industry publications and attending conferences

- Taking continuing education courses

- Participating in professional organizations

- Working with a mentor or other experienced accounting professionals

5. Describe a time when you had to solve a complex accounting problem.

In my previous role, I was responsible for reconciling the company’s intercompany accounts. This was a complex and time-consuming process, but it was essential to ensure that the company’s financial records were accurate and up-to-date.

One month, I discovered a significant discrepancy between the intercompany accounts. I spent several hours investigating the issue and eventually identified the source of the error. I then worked with the accounting teams at the other companies involved to correct the error and ensure that the intercompany accounts were reconciled.

6. What are your strengths and weaknesses as a Revenue Accountant?

Strengths:

- Strong understanding of accounting principles (GAAP or IFRS)

- Proficient in accounting software (e.g., SAP, Oracle)

- Excellent analytical and problem-solving skills

- Attention to detail and accuracy

- Strong communication and interpersonal skills

Weaknesses:

- Limited experience with international accounting standards

- Not yet a CPA (but I am currently working towards my certification)

7. Why are you interested in this position?

I am interested in this position because it is a great opportunity to use my skills and experience to contribute to the success of a growing company. I am particularly interested in the company’s commitment to innovation and its focus on providing excellent customer service.

8. What are your salary expectations?

My salary expectations are in line with the market average for Revenue Accountants with my experience and qualifications. I am open to discussing a competitive salary and benefits package.

9. What is your availability to start work?

I am available to start work immediately.

10. Do you have any questions for me?

Yes, I do have a few questions:

- Can you tell me more about the company’s culture and values?

- What are the company’s plans for growth in the future?

- What are the opportunities for professional development within the company?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Revenue Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Revenue Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Revenue Accountants are responsible for managing and accounting for revenue streams within an organization. Core responsibilities of the role include:

1. Revenue Recognition

Revenue Accountants ensure proper recognition and recording of revenue in accordance with accounting standards, such as GAAP or IFRS.

- Analyze revenue sources and transactions.

- Determine the appropriate recognition criteria and timing.

2. Revenue Reporting

They prepare and provide revenue-related reports for management, auditors, and external stakeholders.

- Create and analyze financial statements, including income statements and cash flow statements.

- Provide insights and interpretations on revenue performance and trends.

3. Process Management

They develop and implement processes to ensure accurate and timely revenue recording and reporting.

- Collaborate with other departments to streamline revenue-related processes.

- Develop procedures for revenue audits and controls.

4. Compliance and Auditing

Revenue Accountants ensure compliance with relevant financial regulations and standards.

- Monitor and adhere to Sarbanes-Oxley (SOX) and other compliance requirements.

- Assist with internal and external audits, providing documentation and evidence.

Interview Tips

To ace an interview for a Revenue Accountant position, candidates should:

1. Research the Company and Position

Familiarize themselves with the company’s industry, financial performance, and specific responsibilities of the role.

- Visit the company website, read industry news, and analyze financial statements.

- Study job postings and identify key skills and qualifications sought.

2. Highlight Relevant Experience and Skills

Emphasize specific accomplishments and skills related to revenue accounting, such as:

- Expertise in revenue recognition principles (GAAP, IFRS).

- Proven ability to analyze and interpret revenue data.

- Experience in developing and implementing revenue processes.

3. Show Interest and Enthusiasm

Demonstrate genuine interest in the role and the company. Articulate why they are passionate about revenue accounting.

- Share examples of projects or initiatives that showcase their enthusiasm.

- Explain their understanding of the importance of revenue accounting in financial reporting.

4. Be Prepared for Technical Questions

Anticipate technical questions related to revenue recognition, reporting, and compliance. Consider using the STAR method to answer questions.

- Use the STAR method (Situation, Task, Action, Result) to structure their answers and highlight specific accomplishments.

- Provide clear and concise explanations of complex accounting principles.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Revenue Accountant role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.