Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Tax Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

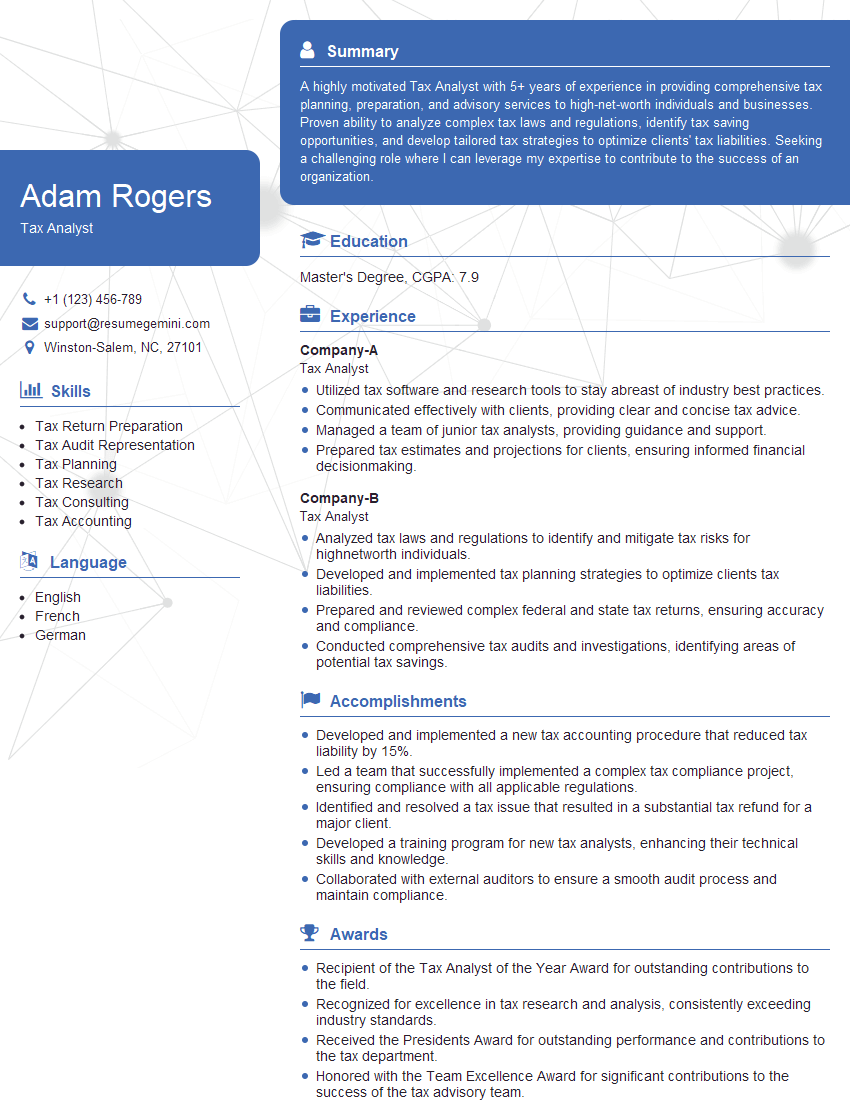

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Analyst

1. Explain the concept of transfer pricing and its importance in multinational corporations?

- Transfer pricing is a pricing strategy used by multinational corporations (MNCs) to determine the prices at which goods and services are transferred between different entities within the corporation.

- Its importance lies in optimizing the corporation’s tax burden, minimizing foreign exchange risks, and aligning the interests of different subsidiaries.

2. How are capital gains and losses treated under the tax laws?

Tax Treatment of Capital Gains

- Generally taxed at a lower rate than ordinary income.

- Different holding periods may qualify for different tax rates.

Tax Treatment of Capital Losses

- May be used to offset capital gains.

- Excess losses can be deducted against ordinary income up to certain limits.

3. Discuss the different methods for calculating depreciation and the factors that influence the choice of method?

- Straight-line method: Depreciates the asset evenly over its useful life.

- Declining-balance method: Depreciates the asset at a higher rate in the early years of its life.

- Sum-of-the-years’-digits method: Depreciates the asset at a decreasing rate over its useful life.

- Factors influencing choice of method: asset type, expected usage pattern, tax implications.

4. What are the key considerations when evaluating the tax implications of a merger or acquisition?

- Tax basis of the acquired assets.

- Tax treatment of the transaction (e.g., taxable vs. non-taxable).

- Potential tax liabilities (e.g., deferred taxes, contingent liabilities).

- Impact on the combined tax profile of the merged entity.

5. How do you stay up-to-date on the latest tax laws and regulations?

- Attend professional development courses and conferences.

- Subscribe to tax publications and newsletters.

- Utilize online resources from the IRS and other tax authorities.

- Consult with tax professionals and industry experts.

6. Describe the role of a tax analyst in a tax consulting firm?

- Analyze tax laws and regulations.

- Provide tax advice to clients.

- Prepare tax returns and other tax documents.

- Represent clients before tax authorities.

- Stay up-to-date on tax laws and regulations.

7. What are the ethical considerations that tax analysts must be aware of?

- Confidentiality of client information.

- Objectivity and independence in providing tax advice.

- Compliance with tax laws and regulations.

- Avoiding conflicts of interest.

8. How do you handle complex tax issues that you are unfamiliar with?

- Research the issue using available resources.

- Consult with colleagues or tax professionals.

- Seek expert advice from external sources (e.g., attorneys, accountants).

- Continuously educate myself on tax-related topics.

9. What are some of the challenges you have faced as a tax analyst and how did you overcome them?

Example:

- Navigating complex tax laws and regulations.

- Interpreting ambiguous or conflicting tax guidance.

- Dealing with tight deadlines and high-pressure situations.

- Communicating complex tax concepts to clients in a clear and concise manner.

10. Why are you interested in this tax analyst position with our firm?

Example:

- Interested in the firm’s reputation and specialized tax practice.

- Excited about the opportunity to work on challenging and complex tax issues.

- Value the firm’s commitment to professional development and growth.

- Eager to contribute to the firm’s success and build a successful career as a tax analyst.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities for Tax Analyst

A Tax Analyst is responsible for a wide range of tax-related tasks, including:1. Tax Research and Analysis

Conducting research on tax laws, regulations, and court cases to stay up-to-date on the latest tax developments.

- Interpreting tax laws and regulations

- Analyzing tax implications of business transactions

2. Tax Planning and Compliance

Advising clients on tax planning strategies to minimize tax liability and ensure compliance with tax laws.

- Developing tax strategies

- Preparing tax returns

- Representing clients before tax authorities

3. Tax Audit and Defense

Responding to tax audits and defending clients against tax assessments.

- Reviewing tax audit notices

- Preparing responses to tax audits

- Representing clients at tax audits

4. Tax Reporting and Disclosure

Preparing and filing tax returns, and disclosing tax information to regulatory agencies.

- Filing tax returns

- Preparing tax disclosures

- Advising clients on tax reporting requirements

Interview Tips for Tax Analyst

To ace your Tax Analyst interview, it’s important to prepare thoroughly and highlight your skills and experience. Here are some tips:1. Research the Company and Position

Familiarize yourself with the company’s business, industry, and tax-related challenges.

- Review the company’s website, financial statements, and recent news articles.

- Research the specific Tax Analyst position and its responsibilities.

2. Quantify Your Accomplishments

When describing your experience, focus on quantifying your accomplishments using specific metrics.

- Example: “Reduced tax liability for a client by $1 million through tax planning and optimization.”

- Example: “Successfully defended a client in a tax audit, resulting in a $500,000 tax refund.”

3. Highlight Your Technical Skills

Demonstrate your proficiency in tax laws and regulations, as well as tax software and databases.

- Highlight your knowledge of specific tax codes, accounting principles, and tax compliance requirements.

- Mention any certifications or training you have received in tax-related areas.

4. Emphasize Your Soft Skills

In addition to technical skills, Tax Analysts also need strong soft skills, such as communication, problem-solving, and teamwork.

- Example: “I have excellent communication skills and am able to clearly explain complex tax issues to clients and colleagues.”

- Example: “I am a detail-oriented problem-solver with a proven ability to identify and resolve tax-related issues.”

5. Be Prepared to Discuss Industry Trends

Interviewers may ask about your thoughts on current tax-related trends and developments.

- Stay up-to-date on industry news and regulations.

- Prepare to discuss your insights on how these trends might impact the company.

Next Step:

Now that you’re armed with the knowledge of Tax Analyst interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Tax Analyst positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini