Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Assurance Senior interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Assurance Senior so you can tailor your answers to impress potential employers.

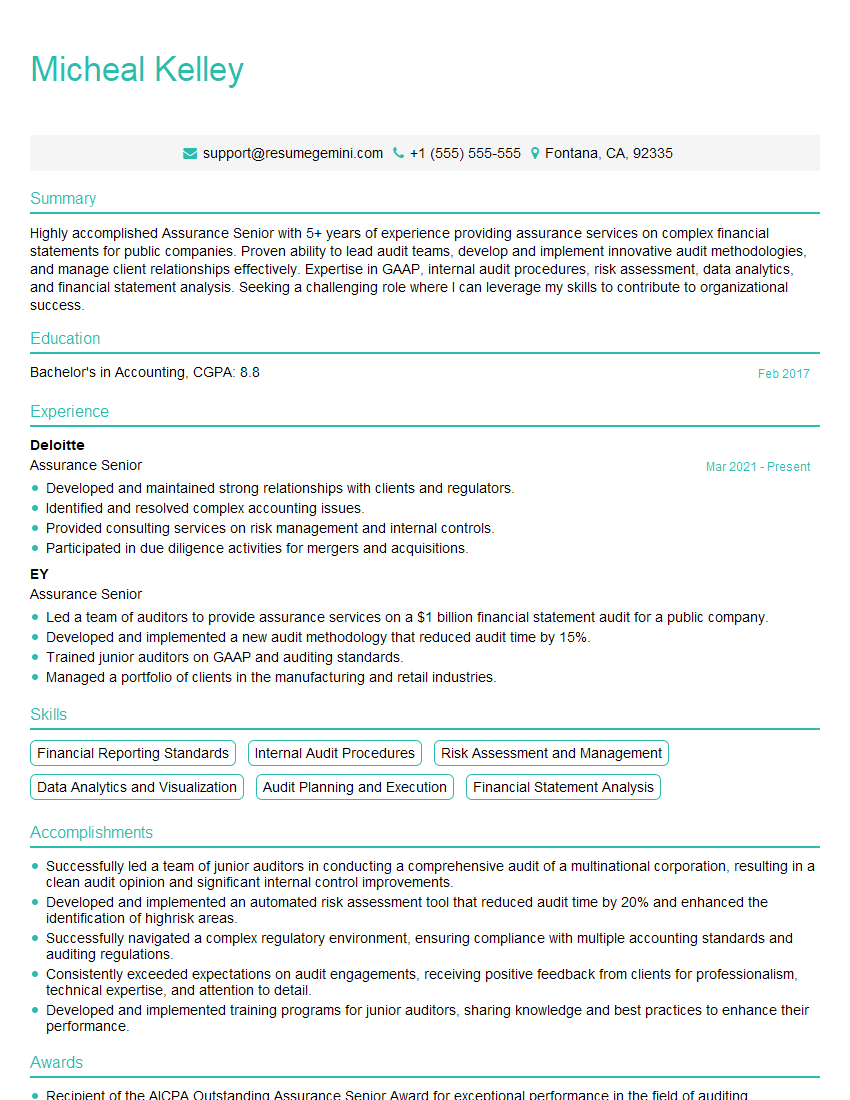

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Assurance Senior

1. Define the concept of materiality and explain its significance in the context of an audit.

- Materiality refers to the magnitude of a misstatement or omission that would influence the economic decisions of users of financial statements.

- It is important in audit as it helps determine the extent of audit procedures necessary to ensure the reliability of financial statements.

2. Describe the key elements of an internal control system and explain how they contribute to the effectiveness of financial reporting.

Key Elements of Internal Control Systems

- Control Environment

- Risk Assessment

- Control Activities

- Information and Communication

- Monitoring

Contribution to Effectiveness of Financial Reporting

- Provides reasonable assurance that financial information is accurate and reliable.

- Helps prevent and detect fraud and errors.

- Supports compliance with laws and regulations.

3. Explain the difference between analytical procedures and substantive procedures and provide examples of each.

- Analytical Procedures: Use comparisons and relationships to identify unusual fluctuations or trends in financial data.

- Substantive Procedures: Involve detailed testing of transactions, account balances, and other financial data to verify accuracy and completeness.

Examples

- Analytical: Comparing current year’s gross profit margin to industry benchmarks.

- Substantive: Vouching invoices to supporting documentation.

4. Describe the role of the audit committee in the financial reporting process.

- Oversees the financial reporting process.

- Reviews and approves financial statements.

- Ensures the independence and objectivity of external auditors.

- Provides a link between management and external auditors.

5. Explain the concept of professional skepticism and discuss how it should be applied during an audit.

- Professional skepticism involves questioning information and assumptions critically.

- Auditors should have a questioning mindset, not accepting management’s representations without sufficient evidence.

- It helps identify and mitigate risks of material misstatements.

6. Describe the key steps involved in planning an audit.

- Establish client acceptance and independence.

- Gather and review background information.

- Assess inherent and control risks.

- Develop the audit strategy and plan.

- Consider fraud risks.

- Communicate with management.

7. Explain the concept of sampling in auditing and describe the different types of sampling used.

- Sampling involves testing a portion of a population to make inferences about the entire population.

- Types of Sampling:

- Statistical Sampling: Uses statistical methods to select a sample.

- Non-Statistical Sampling: Uses judgment or other non-statistical approaches.

- Judgmental Sampling: Based on auditor’s professional judgment.

- Risk-Based Sampling: Concentrates sampling on areas with higher risks.

8. Describe the key responsibilities of an assurance senior in the audit process.

- Assists in planning and executing the audit.

- Supervises and reviews the work of junior auditors.

- Evaluates the effectiveness of internal controls.

- Prepares working papers and other audit documentation.

- Communicates with clients and management.

9. Explain the importance of audit quality and discuss the measures that can be taken to ensure it.

- Audit quality refers to the accuracy, completeness, and effectiveness of an audit.

- Measures to Ensure Quality:

- Established quality control policies and procedures.

- Continuous training and development for auditors.

- Independent peer review of audit work.

- Regular monitoring of audit performance.

10. Describe the key ethical considerations that auditors must observe during an audit.

- Integrity: Act with honesty and integrity.

- Objectivity: Be impartial and free from conflicts of interest.

- Professional Competence and Due Care: Maintain professional knowledge and skills.

- Confidentiality: Maintain the confidentiality of client information.

- Professional Behavior: Act in a respectful and ethical manner.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Assurance Senior.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Assurance Senior‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Assurance Senior plays a vital role in the assurance process, providing support and guidance to ensure the accuracy and reliability of financial statements. They work closely with clients, auditors, and other stakeholders to deliver high-quality assurance services. Here are the key responsibilities of an Assurance Senior:

1. Planning and Executing Audits

Plan and execute audit procedures in accordance with the International Standards on Auditing (ISA) and Generally Accepted Auditing Standards (GAAS).

- Develop and implement audit plans, including the scope and objectives of the audit.

- Supervise and review the work of junior auditors and assist in the training and development of staff.

- Perform risk assessments, identify and evaluate risks of material misstatement, and develop appropriate audit responses.

- Prepare audit documentation, including audit programs, risk assessments, and internal control evaluations.

2. Reporting Findings and Recommendations

Communicate audit findings and recommendations to clients and management in a clear and concise manner.

- Draft and issue audit reports, management letters, and other communications.

- Present audit findings and conclusions to clients and management, and discuss the implications of the findings.

- Recommend improvements to internal controls and financial reporting processes based on audit findings.

3. Client Management and Relationship Building

Maintain strong relationships with clients and understand their business and industry-specific risks.

- Build and maintain relationships with clients by providing excellent customer service and support.

- Understand clients’ businesses, including their industry, operations, and financial reporting requirements.

- Identify and manage potential conflicts of interest.

- Stay up-to-date on industry best practices and regulatory changes that may impact clients.

4. Professional Development and Quality Control

Continuously develop technical skills and knowledge, and maintain a high level of ethical and professional standards.

- Obtain and maintain relevant professional certifications, such as the Certified Public Accountant (CPA) or Certified Internal Auditor (CIA).

- Participate in continuing professional education to stay abreast of industry trends and developments.

- Adhere to the ethical and professional standards of the accounting profession, including independence, objectivity, and confidentiality.

- Participate in peer reviews and quality control procedures to ensure the accuracy and reliability of audit work.

Interview Tips

Preparing thoroughly for an interview is crucial to making a positive impression and increasing your chances of success. Here are some tips to help you ace your interview for an Assurance Senior position:

1. Research the Company and Position

Prior to the interview, conduct thorough research on the company and the specific Assurance Senior position. Visit the company website, study their financial statements, and familiarize yourself with their industry and recent news.

- Learn about the company’s size, structure, and financial performance.

- Understand the company’s culture, values, and commitment to quality and ethics.

- Review the job description and identify the key skills and experience required for the role.

2. Practice Your Answers to Common Interview Questions

Prepare answers to common interview questions that are tailored to the Assurance Senior position. Consider using the STAR (Situation, Task, Action, Result) method to structure your responses, providing specific examples from your past experience.

- Describe a time when you successfully planned and executed an audit.

- Share an example of how you effectively communicated audit findings and recommendations to a client.

- Explain how you maintain your technical skills and stay up-to-date on industry best practices.

3. Highlight Your Relevant Skills and Experience

Emphasize your skills and experience that are directly relevant to the Assurance Senior position. Quantify your accomplishments whenever possible, using specific metrics and data points to demonstrate your impact.

- Highlight your experience in planning, executing, and reporting on audits in accordance with ISA and GAAS.

- Showcase your ability to manage client relationships, build trust, and provide value-added insights.

- Emphasize your commitment to professional development and continuous learning.

4. Prepare Questions to Ask the Interviewer

Asking thoughtful questions at the end of the interview demonstrates your interest in the position and the company. Prepare a few questions that are specific to the role, the team, or the company’s culture.

- Inquire about the company’s approach to audit quality and risk management.

- Ask about the opportunities for professional development and advancement within the team.

- Show interest in the company’s commitment to diversity, equity, and inclusion.

Next Step:

Now that you’re armed with the knowledge of Assurance Senior interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Assurance Senior positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini