Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Revenue Audit Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

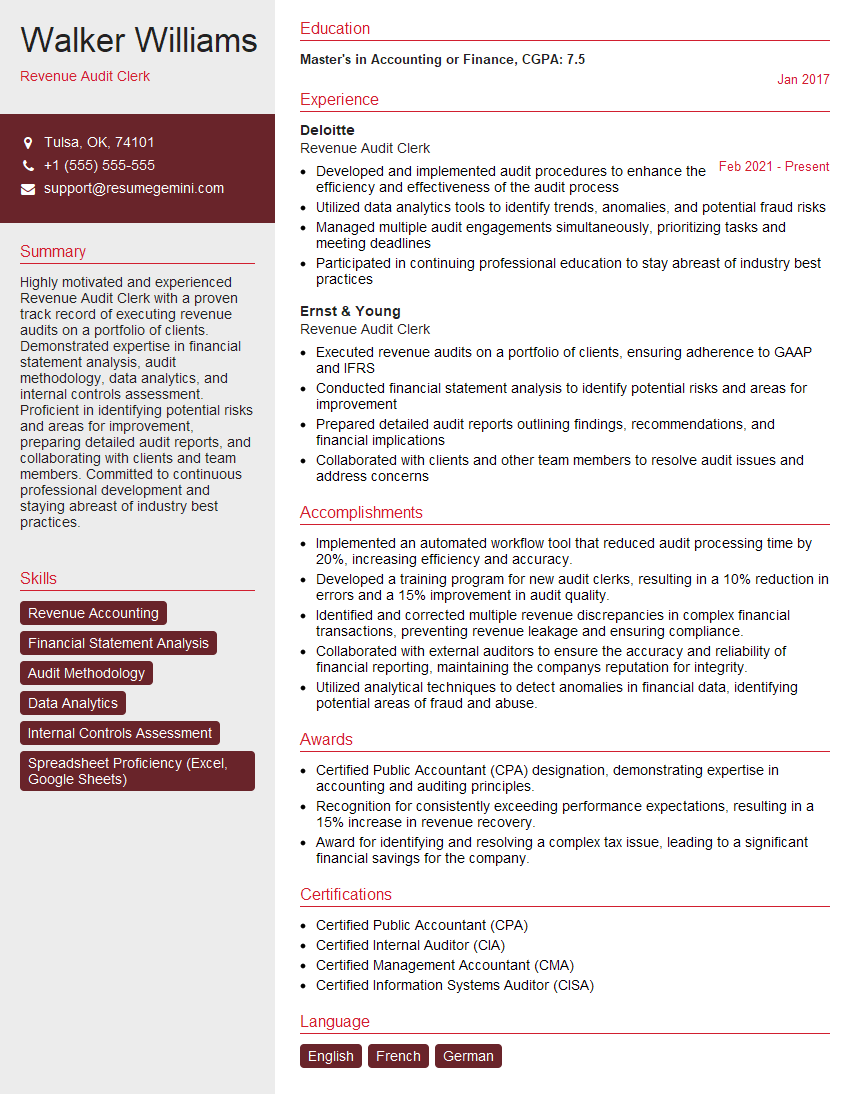

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Revenue Audit Clerk

1. Explain the key responsibilities of a Revenue Audit Clerk.

- Verifying and analyzing financial records to ensure accuracy and compliance.

- Auditing revenue accounts, including sales, cash receipts, and accounts receivable.

- Identifying and resolving discrepancies or errors in revenue transactions.

- Preparing and submitting audit reports to management and external auditors.

- Maintaining a strong understanding of accounting principles and auditing standards.

2. Describe the steps involved in revenue audit.

Planning

- Understanding the client’s business

- Determining the scope of the audit

Execution

- Analyzing key revenue transactions

- Reviewing source documentation

- Identifying potential risks and areas of concern

Reporting

- Preparing audit reports

- Communicating findings and recommendations

3. What are the common errors or issues you encounter during revenue audits?

- Incorrect recording of revenue transactions

- Overstatement or understatement of revenue

- Lack of documentation or supporting evidence

- Non-compliance with accounting standards

- Fraudulent activity

4. How do you stay updated on changes in accounting principles and auditing standards?

- Attending training and workshops

- Reading industry publications and journals

- Participating in professional organizations

- Consulting with experts in the field

- Completing continuing professional education (CPE) courses

5. How do you deal with situations where you identify discrepancies or errors in revenue transactions?

- Communicate the findings to management immediately

- Request supporting documentation or evidence

- Perform additional analysis or testing

- Document the discrepancy or error and the steps taken to resolve it

- Make recommendations to prevent similar issues in the future

6. What are your strengths and weaknesses as a Revenue Audit Clerk?

- Strong analytical and problem-solving skills

- Thorough understanding of accounting principles and auditing standards

- Excellent communication and interpersonal skills

- Proven ability to work independently and as part of a team

- Highly motivated and results-oriented

- Limited experience in a specific industry

- Need to improve time management skills

Strengths

Weaknesses

7. Why are you interested in joining this company?

- Attracted to the company’s reputation and commitment to ethical business practices

- Excited about the opportunity to contribute my skills to the team

- Believe my experience and qualifications would make me a valuable asset

- Look forward to learning and growing within the company

8. Describe a time when you successfully resolved a complex revenue audit issue.

- Explanation of the issue, including the specific transactions involved

- Steps taken to investigate the issue and identify the root cause

- Actions implemented to resolve the issue and prevent similar issues in the future

- Outcome of the audit issue, including any recommendations or improvements made

9. What are the key differences between internal and external audits?

- Internal audits are conducted by employees of the company, while external audits are conducted by independent auditors.

- Internal audits focus on improving the efficiency and effectiveness of the company’s internal controls, while external audits focus on expressing an opinion on the accuracy of the company’s financial statements.

- Internal audits are typically more frequent than external audits.

10. How do you stay organized and prioritize your workload as a Revenue Audit Clerk?

- Utilize a to-do list or task management tool

- Break down large tasks into smaller, manageable steps

- Prioritize tasks based on importance and urgency

- Delegate tasks to others when appropriate

- Take breaks throughout the day to avoid burnout

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Revenue Audit Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Revenue Audit Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Revenue Audit Clerks are responsible for examining financial records to ensure accuracy and compliance with accounting standards and regulations. Their primary duties include:

1. Revenue Verification

Analyzing revenue records, including sales invoices, cash receipts, and bank statements, to verify the accuracy and completeness of recorded revenue.

- Ensuring proper revenue recognition in accordance with generally accepted accounting principles (GAAP).

- Identifying discrepancies or irregularities in revenue transactions.

2. Accounts Reconciliation

Reconciling customer accounts with sales invoices and payments received to identify any discrepancies or errors.

- Investigating and resolving any discrepancies or differences in account balances.

- Maintaining accurate records of reconciliations and reporting any identified issues.

3. Compliance with Regulations

Ensuring compliance with relevant tax laws, regulations, and accounting standards.

- Reviewing financial records for potential areas of non-compliance.

- Reporting any identified violations or non-compliance issues to appropriate authorities.

4. Preparation of Audit Reports

Preparing and documenting audit findings, including any exceptions, recommendations, and supporting evidence.

- Communicating audit results to management and recommending necessary corrective actions.

- Maintaining audit work papers and documentation for future reference.

Interview Tips

To ace the interview for a Revenue Audit Clerk position, candidates should:

1. Research the Company and Position

Familiarize yourself with the company’s industry, size, and financial performance. Understand the specific requirements and responsibilities of the Revenue Audit Clerk role.

- Visit the company’s website, social media pages, and industry news sources.

- Study the job description carefully and identify the key skills and qualifications required.

2. Prepare for Common Interview Questions

Anticipate questions related to your revenue audit experience, accounting knowledge, and technical skills.

- Practice answering questions about your experience in verifying revenue, reconciling accounts, and ensuring compliance.

- Be prepared to discuss your proficiency in relevant accounting software and tools.

3. Showcase Your Analytical and Problem-Solving Abilities

Revenue Audit Clerks must be able to analyze financial data, identify discrepancies, and provide solutions. Highlight your analytical skills and provide examples.

- Describe a situation where you identified and resolved an accounting error.

- Explain how you use analytical techniques to assess the accuracy of financial records.

4. Emphasize Your Attention to Detail

Precision and attention to detail are crucial for Revenue Audit Clerks. Demonstrate your ability to carefully review and analyze financial information.

- Provide examples of tasks where you demonstrated a high level of accuracy and attention to detail.

- Explain how you ensure the integrity and accuracy of your audit findings.

5. Conveys Professionalism and Ethics

Revenue Audit Clerks work with sensitive financial information and must maintain high ethical standards. Emphasize your professionalism and commitment to confidentiality.

- Explain your understanding of the importance of data security and confidentiality.

- Discuss your ethical values and how they guide your work in audit and accounting.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Revenue Audit Clerk, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Revenue Audit Clerk positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.