Feeling lost in a sea of interview questions? Landed that dream interview for Revenue Tax Specialist but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Revenue Tax Specialist interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

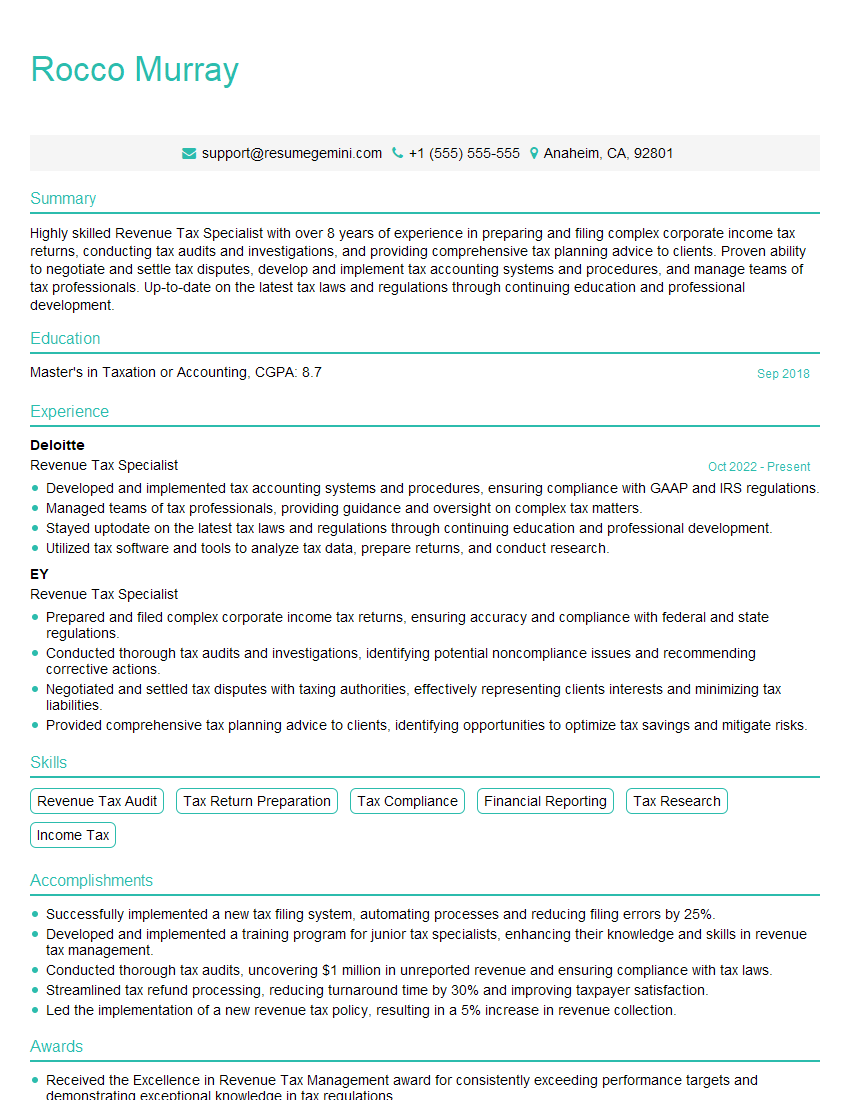

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Revenue Tax Specialist

1. Can you explain the role of a Revenue Tax Specialist?

A Revenue Tax Specialist is responsible for reviewing and auditing tax returns, determining taxpayer liabilities, and ensuring compliance with tax laws. They may also provide guidance to taxpayers on tax matters, conduct investigations, and assist in the development of tax policy.

2. What are the key skills and qualifications required for this role?

Key skills and qualifications for a Revenue Tax Specialist include:

- A bachelor’s degree in accounting, tax law, or a related field

- Knowledge of tax laws and regulations

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

3. Can you describe the different types of taxes that Revenue Tax Specialists handle?

Revenue Tax Specialists handle a wide range of taxes, including:

- Income taxes

- Sales and use taxes

- Property taxes

- Estate and gift taxes

- Excise taxes

4. What are some of the common challenges that Revenue Tax Specialists face?

Some of the common challenges that Revenue Tax Specialists face include:

- Interpreting complex tax laws and regulations

- Keeping up with changes in tax laws

- Dealing with taxpayers who are not compliant with tax laws

- Balancing the need for revenue with the need for fairness

- Working under tight deadlines

5. Can you describe the steps involved in conducting a tax audit?

The steps involved in conducting a tax audit typically include:

- Planning the audit

- Gathering evidence

- Analyzing evidence

- Preparing an audit report

- Meeting with the taxpayer

- Resolving the audit

6. What are some of the ethical considerations that Revenue Tax Specialists must be aware of?

Revenue Tax Specialists must be aware of the following ethical considerations:

- Confidentiality

- Objectivity

- Integrity

- Fairness

- Professionalism

7. How do you stay up-to-date on changes in tax laws?

I stay up-to-date on changes in tax laws by:

- Reading tax journals and newsletters

- Attending tax conferences and seminars

- Taking continuing education courses

- Consulting with other tax professionals

8. What are your career goals?

My career goals are to:

- Become a Senior Revenue Tax Specialist

- Specialize in a particular area of tax law

- Eventually manage a team of Revenue Tax Specialists

9. Why are you interested in working for our company?

I am interested in working for your company because:

- Your company has a strong reputation in the industry

- I am impressed by your company’s commitment to customer service

- I believe that my skills and experience would be a valuable asset to your team

10. Do you have any questions for me?

I do not have any questions at this time.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Revenue Tax Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Revenue Tax Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Revenue Tax Specialist shoulders the important responsibility of analyzing, researching, and interpreting tax codes, regulations, and economic data, providing expert advice and guidance on revenue issues.

1. Tax Revenue Analysis and Forecasting

- Perform complex data analysis and modeling to forecast tax revenues, identify trends, and project future income.

- Create comprehensive reports and presentations to communicate revenue projections and economic analysis to stakeholders.

2. Tax Policy Evaluation and Implementation

- Provide detailed analysis of proposed tax policies, assessing their potential impact on revenue, economic growth, and equity.

- Collaborate with policymakers to develop and implement tax policies that meet revenue targets and align with broader economic objectives.

3. Tax Law Research and Compliance

- Conduct thorough research to ensure compliance with tax laws and regulations at all levels of government.

- Provide tax planning guidance to government agencies, ensuring adherence to legal requirements and maximizing tax efficiency.

4. Stakeholder Engagement and Communication

- Communicate complex tax information to stakeholders, including elected officials, business leaders, and the public.

- Foster relationships with key stakeholders to gather feedback and inform decision-making on revenue issues.

Interview Tips

Preparation is key to acing an interview for a Revenue Tax Specialist position. Here are some helpful tips:

1. Research the Role and Organization

- Thoroughly review the job description to understand the specific responsibilities and qualifications required.

- Research the organization’s mission, values, and current revenue landscape to demonstrate your knowledge and interest.

2. Showcase Your Technical Expertise

- Highlight your proficiency in tax codes, regulations, and economic modeling techniques.

- Provide examples of complex tax analysis projects you’ve successfully completed, demonstrating your analytical and problem-solving skills.

3. Articulate Communication Skills

- Emphasize your ability to convey complex tax information clearly and effectively to both technical and non-technical audiences.

- Share examples of presentations or reports you’ve delivered that successfully influenced policy decisions.

4. Demonstrate Stakeholder Engagement

- Discuss your experience in fostering relationships with policymakers, business leaders, and the public.

- Highlight your ability to collaborate effectively and gather valuable insights from diverse stakeholders.

5. Prepare Relevant Questions

- Prepare thoughtful questions about the organization’s revenue challenges, tax policy priorities, and opportunities for collaboration.

- Ask questions that demonstrate your interest in the role and your understanding of the organization’s mission.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Revenue Tax Specialist, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Revenue Tax Specialist positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.