Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Tax Assessor interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Tax Assessor so you can tailor your answers to impress potential employers.

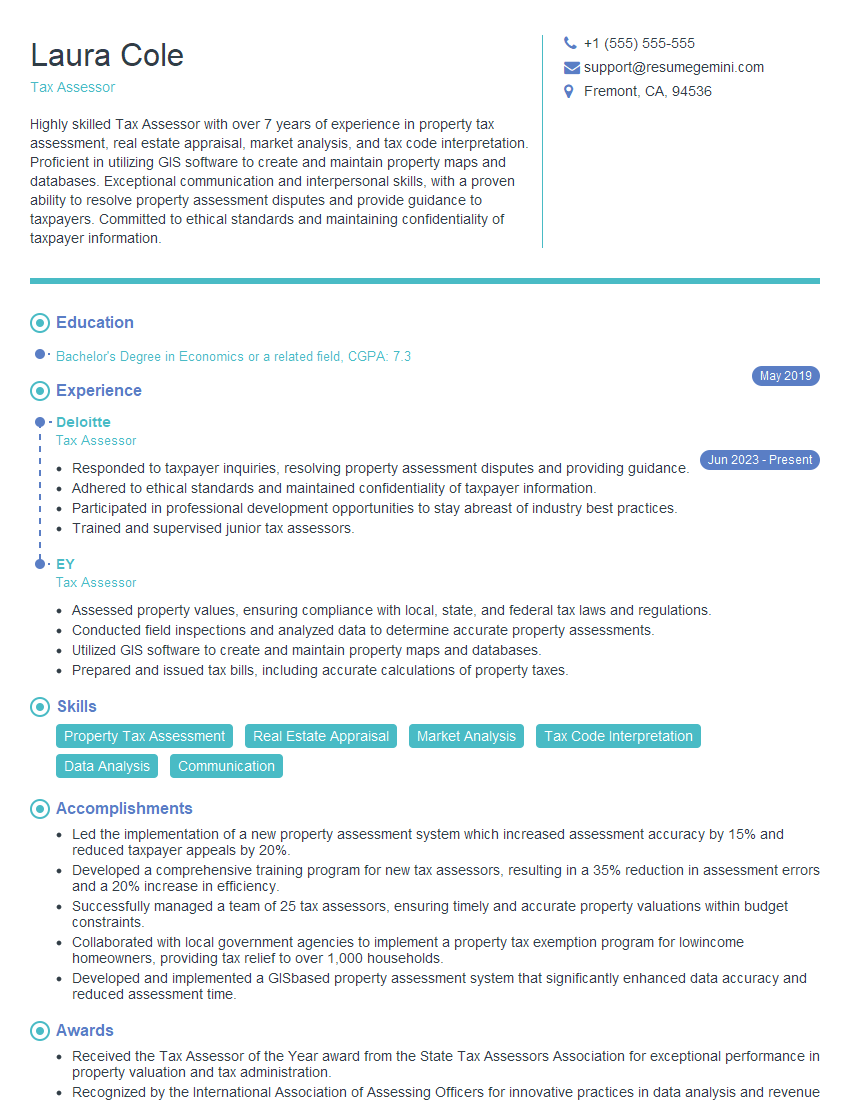

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Assessor

1. What are the key responsibilities of a Tax Assessor?

- Determining the value of taxable property within a specific jurisdiction

- Ensuring accurate and fair property assessments for tax purposes

- Maintaining and managing property records

- Investigating and resolving property tax disputes

- Providing guidance and assistance to taxpayers on property tax matters

2. What are the different types of property taxes?

- Based on the assessed value of the property

- Common type of property tax

- Based on specific characteristics of the property (e.g., number of rooms, acreage)

- Less common than ad valorem taxes

- Levied on the sale, transfer, or use of property

- Example: sales tax on real estate transactions

Ad Valorem Taxes

Specific Taxes

Excise Taxes

3. What are the methods used to value property for tax purposes?

- Comparable sales approach: Comparing the property to similar properties that have recently sold

- Cost approach: Estimating the cost of reproducing the property less depreciation

- Income approach: Capitalizing the net income generated by the property

4. How do you handle property tax appeals?

- Reviewing the taxpayer’s petition and supporting documentation

- Conducting an independent investigation of the property

- Meeting with the taxpayer to discuss their concerns

- Making a final decision on the appeal

5. What are the ethical considerations in property tax assessment?

- Maintaining fairness and equity in property valuations

- Avoiding conflicts of interest

- Protecting taxpayer confidentiality

- Adhering to legal and regulatory requirements

6. How do you stay up-to-date on changes in property tax laws and regulations?

- Attending conferences and workshops

- Reading industry publications and newsletters

- Participating in professional organizations

- Consulting with legal and financial experts

7. What is your experience with property tax software and technology?

Highlight your proficiency in relevant software and technologies used in property tax assessment, such as:

- Property appraisal software

- Geographic information systems (GIS)

- Data management and analysis tools

8. How do you manage a team of property tax assessors?

- Providing clear instructions and expectations

- Delegating tasks and responsibilities effectively

- Monitoring progress and providing feedback

- Creating a positive and supportive work environment

9. What is your understanding of the property tax exemption process?

- Eligibility criteria for various exemptions

- Documentation requirements and verification procedures

- Responsibilities of the Tax Assessor in approving and denying exemptions

10. How do you handle complex property tax issues, such as valuation of large commercial properties or historical landmarks?

- Consulting with experts and seeking external valuations

- Conducting thorough due diligence and research

- Applying sound judgment and considering all relevant factors

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Assessor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Assessor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of a Tax Assessor

1. Property Valuation and Assessment

- Conduct thorough research and analysis to determine the fair market value of real and personal property for tax purposes

- Inspect properties, collect data, and review sales records to estimate property values

2. Tax Levy and Collection

- Calculate and determine property tax rates based on the assessed values

- Create and send property tax bills to taxpayers

- Collect and record property taxes and investigate delinquent payments

3. Exemptions and Appeals

- Review and approve or deny exemption applications

- Process appeals from taxpayers who disagree with their assessment or tax liability

- Attend hearings and present evidence to support the assessment

4. Data Management and Compliance

- Maintain accurate property tax records and databases

- Ensure compliance with all state and federal tax laws and regulations

- Provide data and reports to government agencies and the public

Interview Preparation Tips for Tax Assessors

To ace the interview for a Tax Assessor position, it is essential to be well-prepared and demonstrate your knowledge, skills, and experience in the field.

1. Research the Organization and Position

- Visit the organization’s website and gather information about their mission, values, and current projects

- Review the job description carefully and highlight your qualifications that align with the requirements

2. Prepare for Technical Questions

- Brush up on your knowledge of property valuation methods, tax laws, and assessment procedures

- Practice answering questions related to specific scenarios, such as how you would handle an appeal or calculate a complex property tax

3. Showcase Your Skills and Experience

- Provide specific examples of your ability to conduct property assessments, collect and analyze data, and resolve disputes

- Quantify your accomplishments and highlight how you have contributed to the organization’s goals

4. Demonstrate Your Professionalism

- Dress professionally and arrive on time for the interview

- Maintain eye contact, listen attentively, and ask thoughtful questions

- Be prepared to discuss your work ethic, integrity, and commitment to customer service

5. Practice Common Interview Questions

- Tell me about your experience in assessing property values

- How do you ensure the accuracy and fairness of your assessments?

- What are your strengths and weaknesses as a Tax Assessor?

- Why are you interested in this position with our organization?

- Do you have any questions for us?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Tax Assessor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.