Are you gearing up for a career in Multi-Township Assessor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Multi-Township Assessor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

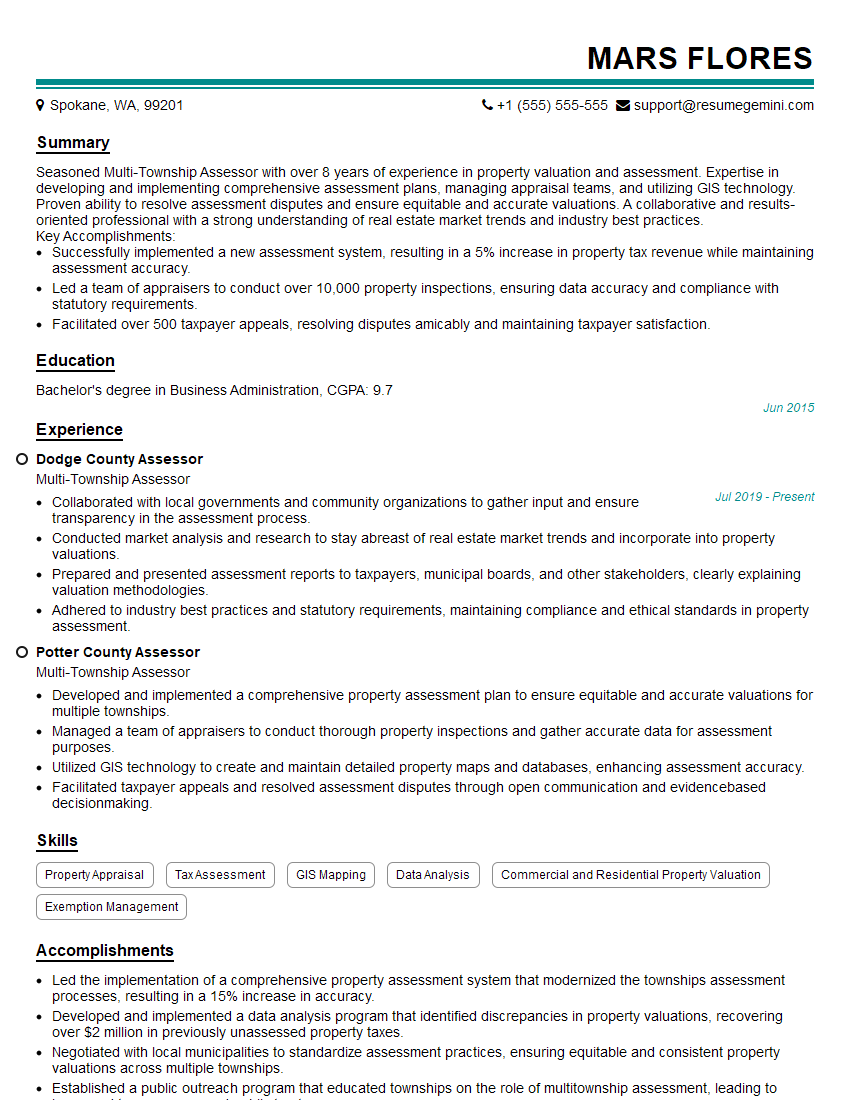

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Multi-Township Assessor

1. Explain the key responsibilities of a Multi-Township Assessor?

As a Multi-Township Assessor, I would be responsible for the following key tasks:

- Determining the fair market value of real property within multiple townships.

- Creating and maintaining property tax maps and records.

- Performing property inspections and appraisals.

- Hearing and resolving property tax appeals.

- Ensuring compliance with all applicable laws and regulations.

2. How do you ensure the accuracy and fairness of your property assessments?

Assessment Techniques

- Utilize various assessment techniques, including sales comparison, cost approach, and income approach.

- Conduct thorough property inspections to gather accurate data.

- Stay up-to-date on market trends and economic factors that may affect property values.

Equitable Treatment

- Apply assessment standards consistently across all properties within the jurisdiction.

- Provide clear and detailed explanations to property owners regarding their assessments.

- Establish a fair and impartial appeals process.

3. What are the common challenges faced by Multi-Township Assessors, and how do you overcome them?

- Rapidly changing real estate market: Use technology and market analysis tools to stay informed and adjust assessments accordingly.

- Large volume of properties to assess: Implement efficient assessment processes, including computer-assisted mass appraisal techniques.

- Property owner disputes: Maintain a transparent and responsive appeals process, resolving disputes fairly and equitably.

- Staying up-to-date with laws and regulations: Continuously attend training and educational programs to stay informed about changes in assessment practices and legal requirements.

4. How do you use technology to enhance your assessment processes?

- Utilize GIS systems for property mapping and data management.

- Employ computer-assisted mass appraisal tools for efficient property valuation.

- Implement online portals for property owners to access assessment information and file appeals.

- Use data analytics to identify trends and patterns in property values.

5. What are your strategies for improving communication and transparency with property owners?

- Host public forums and workshops to discuss assessment processes and property values.

- Create clear and accessible written materials explaining assessments and appeals.

- Maintain a dedicated website and social media presence to provide information and updates.

- Respond promptly and professionally to property owner inquiries and complaints.

6. How do you handle conflicts of interest that may arise in your role as Assessor?

- Disclose any potential conflicts of interest to the appropriate authorities.

- Recuse myself from any decisions involving properties where I have a conflict.

- Maintain a strict code of ethics and avoid any actions that could compromise my impartiality.

- Seek guidance from legal counsel or ethics experts when necessary.

7. What is your understanding of the role of the assessor in the property tax system?

- To determine fair and equitable property values for taxation purposes.

- To ensure that property taxes are distributed fairly and in accordance with the law.

- To provide accurate and transparent information about property values to the public.

- To contribute to the overall efficiency and effectiveness of the property tax system.

8. How do you stay up-to-date on changes in assessment practices and legal requirements?

- Attend conferences and workshops sponsored by professional organizations.

- Read industry publications and subscribe to newsletters.

- Consult with legal counsel and other experts as needed.

- Participate in continuing education programs and training.

9. Describe your experience in managing a team of assessors and support staff.

- Provide clear direction and set expectations.

- Delegate tasks and empower staff.

- Foster a positive and supportive work environment.

- Conduct regular performance evaluations and provide feedback.

- Recognize and reward employee achievements.

10. How do you stay informed about the latest technological advancements in property assessment?

- Attend industry events and demonstrations.

- Read trade publications and online forums.

- Network with other assessors and technology providers.

- Evaluate and implement new technologies that can improve assessment processes.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Multi-Township Assessor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Multi-Township Assessor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Multi-Township Assessor is a key financial officer responsible for managing property assessments and ensuring equitable property tax distribution among multiple townships.

1. Property Appraisal and Valuation

Conduct property appraisals to determine the fair market value of real estate and personal property.

- Inspect properties, analyze data, and estimate values using appropriate assessment techniques.

- Maintain accurate property records and ensure compliance with legal guidelines.

2. Tax Levy Calculation and Distribution

Calculate and allocate property taxes based on assessed values and tax rates established by governing bodies.

- Distribute tax bills to property owners and ensure timely collection.

- Work with township treasurers and other officials to manage tax revenue distribution.

3. Taxpayer Assistance and Dispute Resolution

Provide information and assistance to taxpayers regarding property assessments and taxes.

- Resolve assessment disputes through informal reviews and hearings, ensuring taxpayer fairness.

- Explain assessment processes and regulations to property owners.

4. Budget and Operations Management

Manage the assessment office’s budget, oversee staff, and ensure efficient operations.

- Prepare and present budget proposals to governing bodies.

- Hire, train, and supervise assessment staff, ensuring professional development.

Interview Tips

Preparing for an interview for a Multi-Township Assessor role requires a thorough understanding of the job responsibilities and the ability to effectively convey your skills and experience.

1. Research the Position and Organization

Familiarize yourself with the specific requirements and expectations of the role, including the townships involved.

- Visit the organization’s website, read job descriptions, and gather information about the townships.

- Understand the assessment process, tax laws, and regulations relevant to the jurisdiction.

2. Highlight Your Assessment Experience

Emphasize your proven skills in property appraisal, valuation, and tax administration.

- Provide specific examples of complex assessments you have successfully completed.

- Describe your experience in resolving assessment disputes and ensuring taxpayer fairness.

3. Demonstrate Financial Management Abilities

Showcase your competence in budget management, revenue collection, and financial reporting.

- Explain your experience in preparing and presenting budget proposals.

- Discuss your strategies for maximizing tax revenue collection and ensuring accurate reporting.

4. Emphasize Communication and Interpersonal Skills

Property assessment involves interacting with numerous stakeholders, including taxpayers, officials, and township boards.

- Demonstrate your ability to communicate complex information clearly and effectively.

- Highlight your experience in resolving conflicts and building consensus among diverse groups.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Multi-Township Assessor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!