Are you gearing up for a career in Fiscal Agent? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Fiscal Agent and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

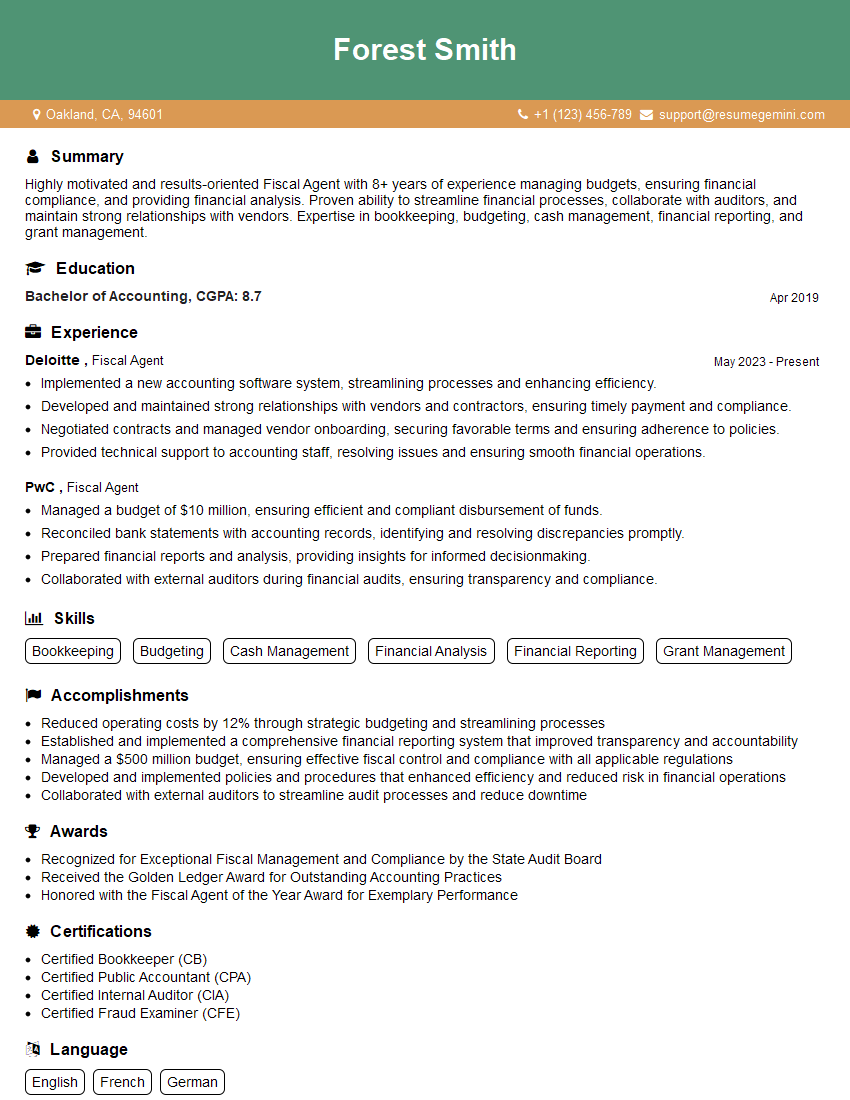

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Fiscal Agent

1. Describe the key responsibilities of a Fiscal Agent.

As a Fiscal Agent, my key responsibilities would include:

- Managing and disbursing funds according to contractual agreements and donor restrictions

- Maintaining accurate financial records and providing timely reports to donors and other stakeholders

- Ensuring compliance with all applicable laws, regulations, and donor requirements

- Providing financial advice and support to the organization’s management team

- Coordinating with external auditors during financial audits

2. What are the essential skills and qualifications required to excel as a Fiscal Agent?

Technical Skills:

- Strong understanding of financial management principles and practices

- Proficiency in accounting software (e.g., QuickBooks, NetSuite)

- Experience with grant management and reporting

- Excellent analytical and problem-solving abilities

- Strong attention to detail and accuracy

Soft skills:

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- High level of integrity and confidentiality

- Commitment to ethical and professional standards

3. How do you stay up-to-date with the latest regulations and best practices in fiscal management?

I regularly attend industry conferences, webinars, and training sessions to stay informed about the latest regulations and best practices in fiscal management. I also subscribe to industry publications and newsletters to keep up with emerging trends and developments.

4. How do you ensure accuracy and compliance in financial reporting?

I adhere to strict internal control procedures to ensure accuracy and compliance in financial reporting. This includes:

- Maintaining a system of checks and balances to verify the accuracy of financial transactions

- Reconciling bank statements and other financial records on a regular basis

- Reviewing financial reports for reasonableness and completeness before submitting them to donors and other stakeholders

- Seeking professional guidance from external auditors or consultants when necessary

5. How do you handle complex financial transactions, such as multi-currency transactions or investments?

For complex financial transactions, I follow a structured approach that involves:

- Thoroughly researching the transaction and consulting with experts if necessary

- Documenting the transaction in detail, including the rationale for any decisions made

- Obtaining appropriate approvals from authorized individuals

- Monitoring the transaction closely and taking corrective action if any issues arise

6. Can you provide an example of a time when you successfully resolved a complex financial issue?

In my previous role, I was responsible for managing a large grant that required complex financial reporting. The grant agreement stipulated specific reporting requirements that were not aligned with our organization’s standard accounting practices. To resolve this issue, I worked closely with the donor to clarify the reporting requirements and develop a customized reporting template that met both the donor’s needs and our organization’s accounting standards.

7. How do you prioritize your workload and manage multiple projects simultaneously?

I use a combination of project management tools and time management techniques to prioritize my workload and manage multiple projects simultaneously. I start by creating a detailed project plan that includes timelines, milestones, and deliverables. I then use a project management tool to track my progress and identify any potential bottlenecks. I also use time management techniques, such as the Pomodoro Technique, to stay focused and productive.

8. How do you stay organized and manage large amounts of financial data?

I follow a structured approach to organizing and managing large amounts of financial data. I use a combination of physical and digital filing systems to store and track documents. I also use accounting software and spreadsheets to organize and analyze financial data. I regularly review and purge my files to ensure that I am only retaining essential information.

9. How do you maintain confidentiality and protect sensitive financial information?

I am committed to maintaining confidentiality and protecting sensitive financial information. I adhere to strict security protocols, including:

- Using strong passwords and two-factor authentication

- Encrypting sensitive data both in transit and at rest

- Restricting access to financial information on a need-to-know basis

- Regularly reviewing and updating security measures

10. How do you stay motivated and driven in your role as a Fiscal Agent?

I am motivated and driven in my role as a Fiscal Agent because I am passionate about ensuring that financial resources are used effectively and efficiently to achieve social and environmental impact. I am also driven by the opportunity to make a positive difference in the lives of others. I believe that my work as a Fiscal Agent is essential to supporting the important work of nonprofits and social enterprises.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Fiscal Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Fiscal Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Fiscal Agent plays a crucial role in managing and disbursing funds for organizations, ensuring financial transparency and compliance. Their responsibilities encompass the following key areas:

1. Fund Management

The Fiscal Agent is responsible for:

- Receiving and disbursing funds as per the organization’s policies and procedures.

- Maintaining accurate financial records and providing timely reports to stakeholders.

2. Compliance and Reporting

The Fiscal Agent must ensure compliance with all relevant financial regulations and reporting requirements, including:

- Preparing and submitting financial statements, tax returns, and other required reports.

- Adhering to federal, state, and local laws governing the handling of funds.

3. Financial Oversight

The Fiscal Agent provides financial oversight and guidance to the organization, including:

- Developing and implementing financial policies and procedures.

- Reviewing and approving financial transactions.

4. Internal Controls

To ensure the integrity and accuracy of financial transactions, the Fiscal Agent establishes and maintains internal controls, including:

- Implementing segregation of duties.

- Conducting regular audits and reviews.

Interview Tips

Preparing for a Fiscal Agent interview requires thorough research and a clear understanding of the key responsibilities outlined above. Here are some invaluable tips to help you ace the interview:

1. Highlight Your Skills

Emphasize your expertise in fund management, including your ability to handle complex financial transactions and maintain accurate records. Showcase your knowledge of relevant regulations and your experience with internal control systems.

2. Quantify Your Accomplishments

Provide specific examples of your accomplishments in previous roles. Use numbers and metrics to quantify your results, demonstrating your ability to effectively manage funds and ensure compliance.

3. Show Your Attention to Details

Fiscal Agents must be meticulous in their work. Highlight your attention to detail by providing examples of how you have ensured accuracy and completeness in financial reporting and compliance activities.

4. Research the Organization

Thoroughly research the organization you are interviewing with. Understand their mission, funding sources, and any specific challenges or regulations they face. This knowledge will demonstrate your interest and preparedness.

5. Practice Your Answers

Prepare for common interview questions by practicing your answers aloud. Focus on clearly articulating your skills, experience, and how you can contribute to the organization as a Fiscal Agent.

6. Be Yourself

While preparation is crucial, it is equally important to be genuine and confident in the interview. Show the interviewer who you are and why you are passionate about the role of Fiscal Agent.

Next Step:

Now that you’re armed with the knowledge of Fiscal Agent interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Fiscal Agent positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini