Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Credit and Collections Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

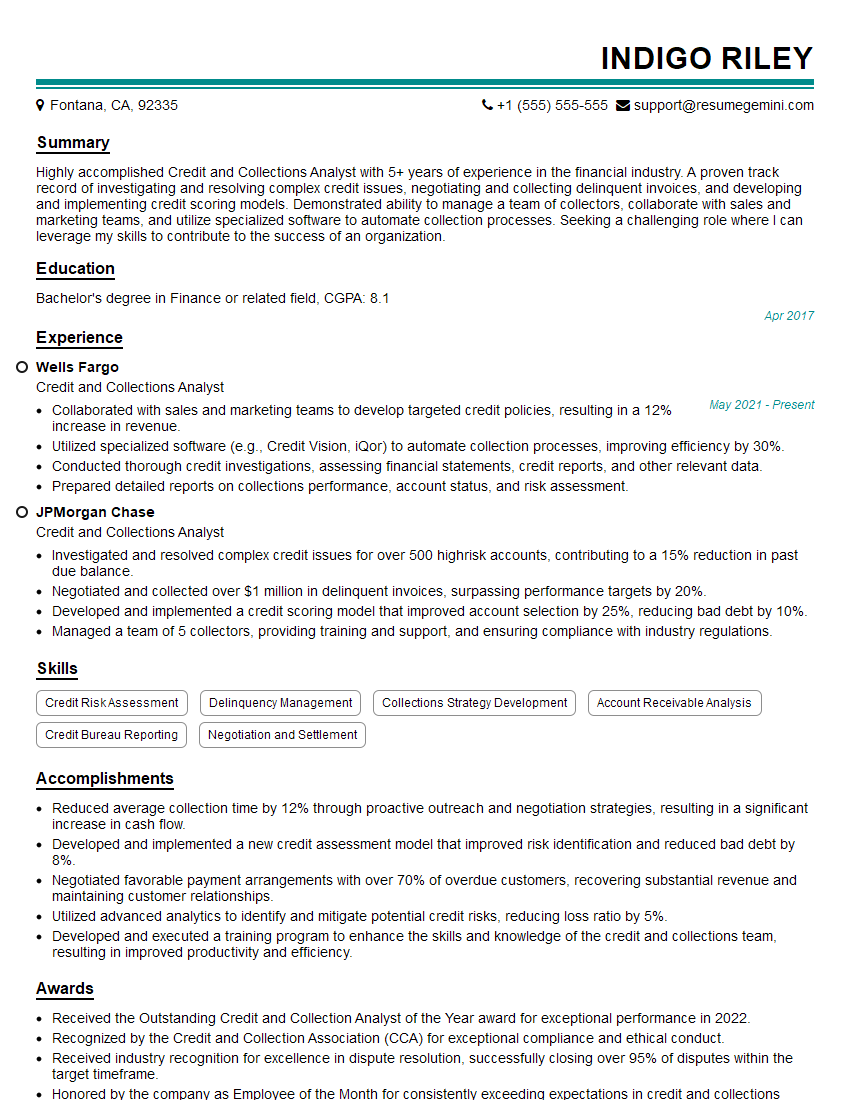

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit and Collections Analyst

1. Walk me through the process of evaluating a credit application.

Sure, here’s my process for evaluating a credit application:

- Review the applicant’s personal information. This includes their name, address, Social Security number, and date of birth. I’ll also check their employment history and income.

- Pull a credit report. This will show me the applicant’s credit history, including their credit score, payment history, and any outstanding debts.

- Analyze the applicant’s financial situation. I’ll look at their income, expenses, and assets. I’ll also consider their debt-to-income ratio.

- Make a decision. Based on all of the information I’ve gathered, I’ll make a decision on whether or not to approve the credit application.

2. What are some of the factors you consider when evaluating a credit application?

- Credit score: This is a numerical representation of the applicant’s creditworthiness. A higher credit score indicates a lower risk of default.

- Payment history: This shows how consistently the applicant has made their payments on time. A history of late payments is a red flag.

- Debt-to-income ratio: This is the percentage of the applicant’s income that goes towards paying off debt. A high debt-to-income ratio can indicate that the applicant is overextended and may have difficulty making their payments.

- Employment history: This shows the applicant’s stability and earning potential. A long history of stable employment is a positive sign.

- Income: This is the amount of money the applicant earns. A higher income indicates a greater ability to repay debt.

3. What are some of the challenges you face in the credit and collections field?

- The economy: The economy can have a significant impact on the credit market. When the economy is doing well, people are more likely to qualify for credit and make their payments on time. However, when the economy is struggling, people are more likely to lose their jobs and fall behind on their payments.

- Fraud: Fraud is a major problem in the credit and collections industry. Fraudsters often use stolen identities to apply for credit. This can make it difficult for lenders to determine the true identity of the applicant and assess their creditworthiness.

- Regulation: The credit and collections industry is heavily regulated. This regulation can be complex and burdensome, and it can make it difficult for lenders to operate efficiently.

4. What are some of the trends you’re seeing in the credit and collections industry?

- The rise of alternative data: Lenders are increasingly using alternative data, such as social media data and mobile phone data, to assess creditworthiness. This data can help lenders make more informed decisions about applicants who may not have a traditional credit history.

- The growth of online lending: Online lending is becoming increasingly popular. This makes it easier for people to apply for credit without having to go through a bank or other traditional lender.

- The increasing use of artificial intelligence (AI): AI is being used to automate many tasks in the credit and collections process. This can help lenders make decisions more quickly and efficiently.

5. What are some of the skills and qualities that are important for success in the credit and collections field?

- Analytical skills: Credit and collections analysts need to be able to analyze financial data and make sound judgments about creditworthiness.

- Communication skills: Credit and collections analysts need to be able to communicate effectively with customers, both verbally and in writing. They need to be able to explain complex financial concepts in a clear and concise way.

- Customer service skills: Credit and collections analysts need to be able to provide excellent customer service. They need to be able to handle difficult customers and resolve disputes in a professional and courteous manner.

- Attention to detail: Credit and collections analysts need to be able to pay close attention to detail. They need to be able to identify errors and inconsistencies in financial data.

- Problem-solving skills: Credit and collections analysts need to be able to solve problems. They need to be able to find creative solutions to complex problems.

6. What is your experience with using credit scoring models?

I have experience using a variety of credit scoring models, including FICO, VantageScore, and proprietary models developed by lenders. I am familiar with the factors that these models consider and how they are used to assess creditworthiness.

7. How do you stay up-to-date on the latest developments in the credit and collections industry?

I stay up-to-date on the latest developments in the credit and collections industry by reading industry publications, attending conferences, and networking with other professionals in the field. I am also a member of the National Association of Credit Management (NACM) and the American Collectors Association (ACA).

8. What are your career goals?

My career goal is to become a credit and collections manager. I am confident that I have the skills and experience necessary to be successful in this role. I am eager to take on new challenges and responsibilities, and I am committed to making a positive contribution to the credit and collections industry.

9. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your commitment to customer service. I am also impressed by your company’s reputation for being a leader in the credit and collections industry. I believe that my skills and experience would be a valuable asset to your team.

10. Do you have any questions for me?

Yes, I do have a question. What is the company’s culture like? I am interested in working for a company that is supportive and has a positive work environment.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit and Collections Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit and Collections Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Credit and Collections Analysts are responsible for evaluating and managing credit risks associated with customers and maintaining positive cash flow for their organizations. Their key job responsibilities include:

1. Credit Analysis

Assess the creditworthiness of potential and existing customers through financial statement analysis, industry research, and credit bureau reports.

- Determine appropriate credit limits and payment terms for customers based on their financial health and payment history.

- Monitor customer accounts for changes in creditworthiness and take appropriate action, such as adjusting credit limits or initiating collection procedures.

2. Collections Management

Manage delinquent accounts and collect outstanding payments from customers.

- Contact customers via phone, email, or mail to follow up on overdue payments and negotiate payment arrangements.

- Develop and implement collection strategies to maximize recovery rates while maintaining positive customer relationships.

3. Risk Management

Identify and mitigate credit risks by developing and implementing policies and procedures.

- Monitor industry trends and economic conditions to assess potential risks to the credit portfolio.

- Analyze historical data to identify patterns and develop strategies to minimize losses and improve overall credit quality.

4. Reporting and Forecasting

Provide regular reports and analysis on credit performance, collections trends, and risk exposure to management.

- Prepare and present financial statements and reports that provide insights into the credit and collections operations.

- Develop forecasts and projections to estimate future cash flow and credit risk.

Interview Tips

To ace the interview for a Credit and Collections Analyst position, candidates should consider the following tips:

1. Research the Company and Industry

Familiarize yourself with the company’s credit policies, industry best practices, and recent developments in the field.

2. Prepare for Technical Questions

Review your understanding of credit analysis techniques, collections strategies, and financial reporting. Practice answering questions related to your experience and knowledge.

3. Demonstrate Analytical Skills

Highlight your ability to analyze financial data, identify trends, and make sound credit decisions. Provide examples of successful credit evaluations or collections outcomes.

4. Emphasize Communication and Negotiation Skills

Explain how you effectively communicate with customers, build strong relationships, and negotiate payment agreements.

5. Highlight Your Problem-Solving Abilities

Describe situations where you faced challenges in managing credit risk or collecting overdue payments. Explain how you approached the problems and found solutions.

6. Research the Interviewer

If possible, learn about the interviewer and their background. This will help you understand their perspective and tailor your answers accordingly.

7. Dress Professionally and Arrive on Time

Make a positive first impression by dressing appropriately and being punctual for your interview.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Credit and Collections Analyst interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.