Feeling lost in a sea of interview questions? Landed that dream interview for Credit Specialist but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Credit Specialist interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

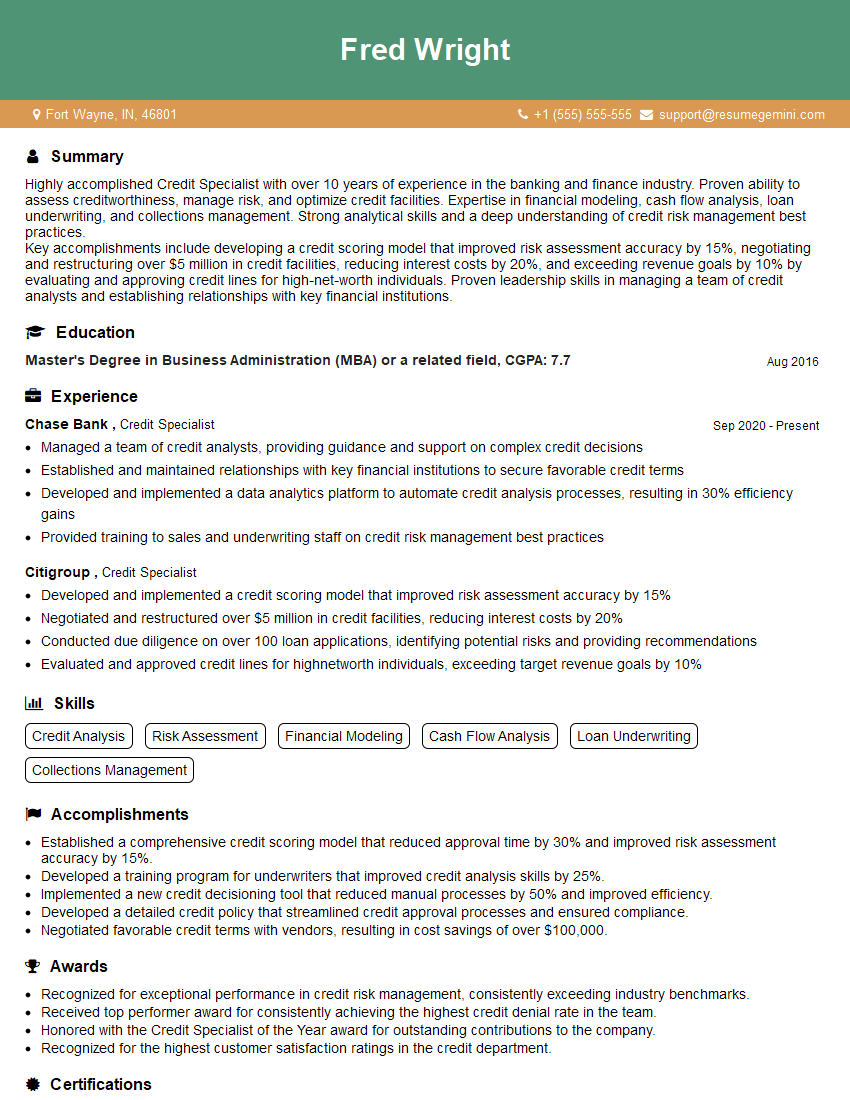

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Specialist

1. What are the key financial ratios you analyze when assessing a company’s creditworthiness?

- Liquidity ratios (e.g., current ratio, quick ratio)

- Solvency ratios (e.g., debt-to-equity ratio, times interest earned ratio)

- Profitability ratios (e.g., gross profit margin, operating profit margin)

- Efficiency ratios (e.g., inventory turnover ratio, accounts receivable turnover ratio)

- Coverage ratios (e.g., interest coverage ratio, debt service coverage ratio)

2. How do you evaluate a company’s cash flow statement?

subheading of the answer

- Review the company’s operating cash flow to assess its ability to generate cash from its core operations.

- Analyze the company’s investing cash flow to understand its capital expenditure plans and acquisitions.

- Examine the company’s financing cash flow to evaluate its debt and equity financing activities.

subheading of the answer

- Identify potential red flags, such as negative operating cash flow or a significant increase in debt.

- Use the cash flow statement to forecast the company’s future financial performance.

3. What are the different types of credit scoring models?

- Discriminant analysis models

- Logistic regression models

- Neural network models

- Decision tree models

4. How do you handle situations where there is limited or incomplete financial information?

- Request additional information from the applicant.

- Use industry benchmarks and averages to fill in missing data.

- Apply conservative assumptions when making credit decisions.

5. What are the ethical considerations in credit analysis?

- Maintain confidentiality of applicant information.

- Avoid conflicts of interest.

- Make credit decisions based on objective criteria.

- Respect the rights of applicants and borrowers.

6. How do you stay up-to-date with changes in the credit industry?

- Attend industry conferences and webinars.

- Read industry publications.

- Network with other credit professionals.

7. What is your experience with using credit scoring software?

- I have experience with using several different credit scoring software packages, including FICO, VantageScore, and Experian.

- I am proficient in using credit scoring software to evaluate credit risk and make lending decisions.

8. How do you handle high-risk credit applicants?

- I carefully review the applicant’s financial information and credit history to identify potential risks.

- I may require additional documentation or guarantors to mitigate the risk.

- I closely monitor the performance of high-risk loans and take appropriate action if necessary.

9. What is your experience with collections?

- I have experience in all aspects of collections, from pre-collections to legal action.

- I am skilled in negotiating payment arrangements and resolving disputes.

- I have a proven track record of recovering delinquent debts.

10. What are your career goals?

- I am passionate about credit analysis and collections.

- My goal is to become a leader in the credit industry.

- I am eager to take on new challenges and responsibilities.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Credit Specialist is responsible for evaluating the creditworthiness of potential borrowers and making recommendations on whether or not to approve their loan applications. They also work with existing customers to manage their credit accounts and ensure that they are meeting their financial obligations. Key job responsibilities include:

1. Assessing Credit Applications

Credit Specialists review loan applications and gather financial information from potential borrowers. They use this information to assess the applicant’s creditworthiness and determine their risk level. They consider factors such as the applicant’s income, debt-to-income ratio, and credit history.

2. Making Credit Decisions

Based on their assessment of the applicant’s creditworthiness, Credit Specialists make recommendations on whether or not to approve loan applications. They may also recommend the terms of the loan, such as the interest rate and repayment period.

3. Managing Credit Accounts

Credit Specialists work with existing customers to manage their credit accounts. They monitor customer activity and identify any potential problems. They also work with customers to develop payment plans and resolve any financial difficulties.

4. Analyzing Credit Data

Credit Specialists stay up-to-date on changes in the credit market. They analyze credit data and identify trends that may affect their company’s lending decisions.

Interview Tips

Preparing for a Credit Specialist interview requires a thorough understanding of the role and the industry. Here are some tips to help you ace your interview:

1. Research the Company and Position

Before your interview, research the company you’re applying to and the specific Credit Specialist position. This will help you understand the company’s culture and the requirements of the role. You can find information on the company’s website, LinkedIn, and Glassdoor.

2. Practice Answering Common Interview Questions

There are some common interview questions that you’re likely to be asked in a Credit Specialist interview. By practicing your answers to these questions, you can feel more confident and prepared during the interview. Some common questions include:

- “Tell me about yourself and your experience in credit analysis.”

- “What are your strengths and weaknesses as a Credit Specialist?”

- “Describe a time when you had to make a difficult credit decision.”

- “What are your thoughts on the current credit market?”

- “What are your career goals?”

3. Be Prepared to Talk About Your Skills and Experience

In your interview, you’ll need to be able to talk about your skills and experience as a Credit Specialist. Be sure to highlight your experience in credit analysis, risk assessment, and customer service. If you have any specific examples of your work, be prepared to share them.

4. Ask Questions

Asking questions at the end of your interview shows that you’re interested in the position and the company. It also gives you an opportunity to learn more about the role and the company’s culture. Some good questions to ask include:

- “What are the biggest challenges facing Credit Specialists in the current market?”

- “What is the company’s culture like?”

- “What are the opportunities for career advancement?”

5. Follow Up

After your interview, be sure to follow up with the interviewer. This shows that you’re still interested in the position and that you appreciate their time. You can send a thank-you note or an email to reiterate your interest in the role.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Credit Specialist interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.